Initial Report: NexGen Energy (TSX:NXE), 218% 5-yr Potential Upside (Chelsea CHEW, EIP)

Chelsea CHEW presents a "BUY" recommendation based on its leadership in setting new standards for uranium mining, volume-based contracting strategy, and industry growth potential.

Company Overview

NexGen Energy is an exploration and development stage company that develops Uranium properties in Canada. It holds a 100% interest in the world-class Rook 1 Project, consisting of 32 contiguous mineral claims totaling an area of approximately 35, 065 hectares in the uranium resource rich, Athabasca Basin of Saskatchewan. Rook 1 is the first and only project to discover over 100 million pounds of uranium in the Athabasca Basin for a small cost per pound.

Rook 1 is making progress toward commencing operations at its mine, towards a late 2025 to early 2026 hearing with the Canadian Nuclear Safety Commission. With mine operations making headway, management has been building out NexGen’s market by securing offtake agreements with various utilities in the US. Once developed, it is capable of being the largest supplier of high quality uranium to meet the world’s growing demand for clean nuclear energy.

Riding on positive momentum, I issue a BUY recommendation for NexGen Energy with a target price of $14.90.

“Even when the uranium price was so low, NexGen is focused on optimising the outcome, daily focus on discipline around good decision making while upholding quality standards irrespective of where the market was going.”

- CEO, Leigh Curyer

Industry Overview

The world faces a growing energy crisis, with demand outpacing secure supply. Nuclear energy is critical to addressing this gap, yet over 80% of global uranium supply is exposed to high sovereign or technical risk—particularly from Russia and its allies, who currently produce 45% of the world’s uranium. In 2022, the U.S. imported a similar percentage of its nuclear fuel from these regions.

To mitigate this risk, uranium production must shift to stable jurisdictions like Canada, the U.S., and Australia. NexGen Energy’s Rook 1 project in Canada is a key solution. When it is in production, it is expected to deliver 28.8 million pounds annually in its first five years—equivalent to 23–25% of global supply, which is projected at 135–140 million pounds.

This output would significantly diversify the uranium supply chain. For context, the UAE accounts for 12% of global oil production—Rook 1 could double that share in uranium. Strong interest from utilities and advanced offtake discussions further validate the project’s commercial strength. With declining output from aging mines and rising demand, NexGen is well-positioned to become a cornerstone supplier in the nuclear energy sector.

ROOK 1 project will significantly diversify sovereign and technical risk and provide a reliable source of 30 million pounds of uranium annually accounting for a large portion of 25% of global production. To put things into perspective, UAE currently accounts for 12% of global oil production.

Reflected by enormous interest in utilities for ROOK 1 production, some offtake discussions are more advanced than others. Market signals that current production of Uranium is very fragile, positioning NexGen better to serve the demand due to their market capitalisation.

Investment Thesis

Proven Track Record Potential to Generate Phenomenon Returns

Creating contracts for local communities, royalties to provincial and federal government

NexGen Energy is positioned to generate exceptional returns with a strong track record of delivering value and a clear path to significant production growth. The company’s operations are set to benefit local communities through job creation and provide royalties to both provincial and federal governments.|

The Rook 1 uranium project is expected to produce 30 million pounds of uranium annually, which is enough to power 46 million homes in the U.S. or eliminate the CO2 emissions of 70 million vehicles off the road annually. The mine will process 1,300 tonnes of uranium per day, a volume equivalent to the weight of 1.5 double-decker buses daily.

Despite being one of the world’s smallest underground mines, Rook 1 will contribute 25% of global uranium production. The project has an impressive Net Present Value (NPV) of $5.8 billion, assuming a uranium price of $75 per pound. Should uranium prices rise to over $100 per pound, NexGen is poised to become one of the top 10 mining companies globally (excluding gold).

The economic viability of the Rook 1 project is remarkable, with an IRR of 81.6%, making it an incredibly attractive opportunity. The project's location in a stable, sovereign jurisdiction further reduces risk. Notably, the project’s capital expenditures (CAPEX) are expected to increase, but this will not impact the NPV or IRR, underlining the project's resilience to cost inflation.

With more than $450 million in cash, NexGen is well-financed for the next 2.5 years of construction, ensuring smooth project execution. In addition, the company has raised $1.3 billion CAD for feasibility studies and development. While inflation may affect costs, NexGen is well-positioned to benefit from rising uranium prices, which are expected to increase from $50 per pound in 2023 to $106 per pound in 2024, and potentially as high as $150 per pound in the coming years.

NexGen Energy has seen growing interest from international investors, particularly in Asia. Notably, Li Ka-Shing was an early supporter, entering at a low average price of $2 per share, and remains a long-term shareholder with a 4% stake. In 2023, NexGen raised $300 million on the Australian Stock Exchange from prominent investors like Sol Patterson and large pension funds, at a 1.5% discount to spot price, providing a non-dilutive entry with an average price of $9.50 per share.

Unique Contracting Strategy

Leaving it to market prices at the time of delivery

NexGen is utilising a volume-based contracting approach, referencing spot prices at time of delivery. Production will be tailored to market conditions at the time of delivery and enable optimal leverage for future uranium prices.

This approach will provide customers with reliable, flexible supply with the added knowledge that it has been sourced in an elite ESG manner. 100% leveraged to uranium price, a modern contracting approach for the resiliency of the industry. As fundamentals of Uranium improve, NexGen has terrific leverage to rising Uranium prices while offering natural downside protection with a low cost base of OPEX $9.98/ pound.

For ROOK 1 Project to make money, uranium prices are going down to $25 / pound uranium. Average cost production from western world producers ~50 – 60, don’t see scenario for uranium price for many decades heading back to those levels in last decades, see it going higher from today.

3. Strategic Clean Energy / Decarbonisation Industry Positioning

Embracing nuclear energy, a low-carbon power source as complementary to the current burgeoning trend installing renewables to further slash emissions and combat climate change. According to the International Energy Agency (IEA), nuclear power produces just under 10% of global generation and is the second-largest source of low-emissions electricity today after hydropower. 1 In 2025, nuclear energy generation is expected to hit record high levels from 420 reactors globally. This is reflected in nuclear fuel, as uranium prices skyrocketed to a record high on Jan 14 2025, amid an AI energy demand frenzy.

Despite the negative reputation caused by rare accidents, nuclear energy is one of the safest, most efficient and cleanest energy sources in the world. Compared to fossil fuels, nuclear energy is much more efficient energy, generating as much energy with 200 tonnes of uranium as is made with 3,500,000 tonnes of coal. Nuclear energy has much lower human causality rate than fossil fuels, as WHO estimates 4.2m people die from burning fossil fuel pollution annually. But compared to solar energy, it’s still less safe.

Valuation

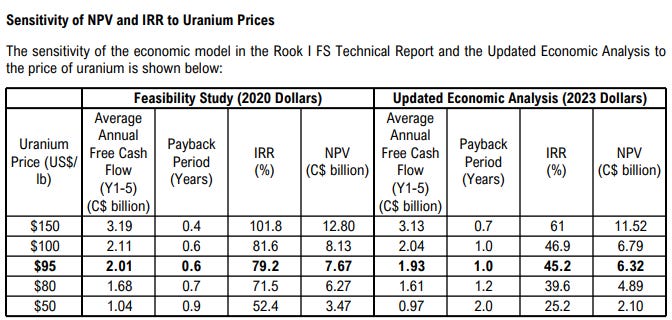

I value NexGen Energy using a single-stage DCF model, with implied EBIT and EPS based on margins of mature peer, Cameco, a global uranium mining company that has already achieved profitability. In its filings, NexGen shares the following technical report, which estimates average annual FCF at Y1-5 of CAD 0.97-3.13b based on Uranium prices between US$50-150/lb.

Uranium spot price is currently US$72/lb, declining from 2022 peaks due to the winding up of Kazakh-based National Atomic Company, Trump tariffs and geopolitical tension with Russia. In my base case, I have assumed a uranium price of US$80-150/lb to estimate my FCF.

Employing a single-stage DCF, I assume a WACC of 20%, which is typical for high-risk mining projects that have yet to begin production, and a TGR of 3% in-line with global GDP growth. NexGen has negligible net debt. Based on these assumptions, the implied fair value per share is CAD 14.9-28.3, implying a 67-218% premium to current market price of CAD 8.9/sh.

Cameco, the world's largest uranium company, has reached profitability with FY24 FCF/EBIT/Net margin of 22%/16%/8%. Applying these on the average FCF of CAD 2.4b, the implied EV/EBIT and P/E by my DCF valuation is 4.7-9.0x and 10.1x-19.3x respectively.

Risk & Mitigation

A key risk for NexGen Energy is the macroeconomic headwinds the uranium market faces with competition from natural gas becoming more favorable for powering large-scale AI data centers. Russia's dominance in uranium enrichment and potential supply chain bottlenecks pose significant risks, making natural gas a more viable power source for data centers.

NXE also faces risks imposing tariffs on uranium imports into the US, potentially making nuclear power generation less desirable.

Another key risk for NexGen Energy is permitting risk from the Federal government. They are pending Federal approval for Rook 1 mine construction but are currently making progress toward commencing operations with the expectation of hearing back from the Canadian Nuclear Safety Commission in late 2025 or early 2026.

A good mitigation and positive sign towards approval is the full support and advocacy from local Indigenous Nations in the Local Priority Area. Before the first exploration drilling started, CEO Leigh Curyer introduced himself to all the communities. NexGen has signed industry-leading benefit agreements with four local Indigenous communities namely, the Clearwater River Dene Nation, Birch Narrows Dene Nation, Buffalo River Dene Nation and Metis Nation. Another positive momentum as mine operations make headway, management has been building out NexGen’s market by securing offtake agreements with various utilities in the US.

ESG

Extracting uranium can be harmful to the environment. It often contaminates the environment with radioactive dust, water-borne toxins, and increased levels of background radiation. However, Rook 1 Uranium has been sourced in an elite ESG manner, it is also one of the world’s tiniest underground mines with benign impact on the environment.

Recommendation

NexGen Energy is a key player in a rapidly growing industry that has distinct advantages over its peers. I believe this enables it to deliver superior performance for investors in the longer term. I believe the company is currently mispriced/undervalued relative to its assets for a few key reasons:

Generational Expansion Potential with exploration projects

Market cap of this company is significantly below the true value of this company. It is being valued at NPV of Rook 1 Project, without considering the addition 30,000m drill program. (which signals future growth)

Market is not worried NexGen is issuing massive amount of stock (see potential of this massive mine)

Clean Balance Sheet, Super solvent and liquid

As of end 2023, they have total assets of $1B and liabilities $187M. Despite the cashflow from continuous stock issuances, price action of stock has not slowed down. The market is rewarding for this company over the long term.

If NexGen passes permitting, Rook 1 is going to be one of the biggest and highest quality Uranium mines on the planet with incredible economics and free cashflow.

Everything is done setting an elite level for the resources sector for every aspect of the organisation, NexGen is well recognised for the efficiency of the discovery. From a meters drilled perspective, they employ new technologies never used before , resulting in faster definition of project and more validated data points.

I issue a BUY recommendation for NexGen Energy with a target price of $14.90.

References

https://www.iea.org/reports/the-path-to-a-new-era-for-nuclear-energy/executive-summary

https://www.fairplanet.org/story/what-is-nuclear-energy-and-can-it-help-stop-climate-change/

NexGen Energy - Largest & Highest Grade Uranium Deposit:

https://tradingeconomics.com/commodity/uranium

https://tradingeconomics.com/world/full-year-gdp-growth

https://stockanalysis.com/quote/tsx/CCO/financials/