Initial Report: NextEra Energy (NYSE:NEE), 6% 3-yr Potential Upside (EIP, Nelson WONG)

Nelson presents "HOLD" recommendation based on its exceptional cost efficiency, preferential access and pricing on key components.

LinkedIn: Nelson Wong

Company Overview

NextEra Energy, Inc. (NYSE: NEE) is one of the largest electric utility companies in the United States and a global leader in renewable energy. Some key facts about the company:

Founded: 1925

Headquarters: Juno Beach Florida, USA

CEO: John W. Ketchum

GICS Industry: Energy and Utilities

Business & Revenue Segments

NextEra Energy operates primarily through two key subsidiaries:

Florida Power & Light Company (FPL) [70%~ of assets]: This is NEE’s rate-regulated electric utility arm, providing electricity to approximately 5.6 million customer accounts in Florida. FPL has a generating capacity of about 33,276 megawatts and extensive transmission and distribution infrastructure, including 90,000 circuit miles of lines and 883 substations. [largest rate-regulated utility in U.S]

Operates a diverse fleet of power generation facilities including natural gas and solar

Revenue primarily derived from electricity sales

NextEra Energy Resources (NEER) [20%~ of assets]: This segment of their business is the world’s largest generator of renewable energy from wind and solar sources. NEER develops, constructs, and manages electric generation facilities across North America, with a total generating capacity exceeding 21,900 megawatts from renewable sources. [1# market share, 25-year track record]

Competitor Analysis

Clearly, NEE through NEER has established itself as a leader in the utility and renewable energy sector, but it faces stiff competition from several major players in the industry, namely the likes of Duke Energy, Iberdrola, Enel Green Power, Brookfield Renewable, and Orsted.

Duke Energy, for instance, competes directly with NEE in the southeastern United States, boasting a strong utility base and ambitious renewable energy plans. However, NEE maintains an edge in terms of renewable capacity and international presence. Iberdrola and Enel Green Power, both European giants, pose significant challenges on the global stage. Iberdrola's technological prowess and Enel's diverse portfolio across five continents rival NEE's international ventures. Brookfield Renewable's strength lies in its ability to acquire and optimize existing assets, allowing for rapid expansion, as demonstrated by their recent acquisition of Urban Grid.

Despite the fierce competition, I think NEE stands out in several key areas. Specifically, the company's scale and diversity are unmatched, producing more wind and solar energy than any other company worldwide. I believe this scale provides significant advantages in terms of cost efficiency and technological expertise. Furthermore,

NEE’s integrated utility model, which includes ownership of Florida Power & Light, the largest electric utility in the U.S., provides a stable cash flow to fund renewable energy projects – a key factor in a capital-intensive industry. This integrated approach sets NEE apart from pure-play run-in-the-mill renewable companies.

On a separate note, financial strength is another area where I believe NEE excels. The company's strong balance sheet and consistent profitability give it an advantage in capital-intensive renewable energy projects. With an equity-to-asset ratio of 0.27 and a net margin of 26%, their financial metrics are competitive within the industry. This financial robustness allows the company to invest heavily in innovation, particularly in integrating energy storage solutions with renewable sources and also to address the complex intermittency challenge of wind and solar power.

Also, with NEE’s operations in 49 U.S. states, the company has demonstrated skill in managing diverse regulatory landscapes, which I think is a critical factor for success in the energy sector. This expertise becomes increasingly valuable as the renewable energy market continues to grow rapidly, with technological innovation driving change and global expansion becoming a key battleground for industry dominance.

Investment Theses

NEE’s Lasting Competitive Advantage – Idiosyncratic Rationale

Cost Efficiency:

NEE's lasting competitive advantage is driven by its exceptional cost efficiency and industry leadership in renewable energy. Serving over 5.6 million customers, the company offers electricity rates 37% below the national average, leveraging economies of scale and operational efficiency to lower costs and maintain one of the industry's best reliability rates. This large customer base allows NEE to spread infrastructure and operational expenses, reducing per-customer costs and ensuring lower rates. Additionally, its heavy investments in renewable energy—being the world’s largest generator of wind and solar power—further enhance its cost advantage by minimizing reliance on fossil fuels – which can be extremely volatile in the market today. NEE also holds a dominant 20% market share in renewables and energy storage, allowing the company to excel in project development, financing, and long-term operations.

Preferential access and pricing on key components:

Exclusive agreements such as with General Electric (GE) for advanced wind turbines, significantly enhance its operational efficiency and competitive edge in the renewable energy market.

This partnership is centred around the deployment of GE's 1.7-100 wind turbines, which are recognized as the most efficient in their class. These turbines feature a 6% increase in power output compared to previous models, thanks to their advanced design and technology that allows for better energy capture and production. The turbines are equipped with innovative capabilities harnessing the Industrial Internet, enabling them to analyse vast amounts of data in real-time to optimize performance and manage the variability inherent in wind energy generation – a prevailing industry challenge.

Beyond the wind turbines, recent deals include:

Supply of up to 4 gigawatts (GW) of onshore wind turbines to NEE annually

Access to GE's latest 3 MW onshore wind platform

Notably, this agreement is one of the largest in the industry's history and secures NEE’s access to up to 4 GW of cutting-edge wind turbines annually, including exclusive rights to GE's latest 3 MW platform in the U.S. market. I believe that this deal not only ensures a stable supply chain for the company’s ambitious expansion plans but also reinforces its position as a leader in renewable energy innovation and deployment.

Long Term Electricity and Energy Demand from AI Advancements – Industry Rationale

The demand for energy is rising rapidly, with U.S. power consumption projected to grow by 4.7% in the next five years and by 38% over the next two decades—a rate four times higher than that of the previous two decades.

Demand is supported by drivers such as higher data centre growth rates and the lack of near-term capacity in which case would most definitely keep pricing elevated. According to McKinsey data, energy demand from data centers is set to grow at a high single-digit rate through 2030, potentially reaching 35 gigawatts by that year.

Data centers, which have consistently driven renewable energy demand, are poised to see even greater growth due to the acceleration of AI technologies. The shortage of available grid connections, expected to remain constrained, has led to customers paying a premium for assets with existing connections. I believe this is a significant tailwind for NEE, which has a strong data center backlog and the capacity to scale up to meet increasing demand.

For example, NEE is set to double its battery storage capacity from 2 gigawatts (GW) to 4 GW over the next ten years, with a $1.5 billion investment in battery storage planned over the next four years. Total battery capacity is projected to grow by 25% annually through 2033. This expansion ensures that solar energy can be efficiently stored and used during non-sunny periods, addressing a key limitation of solar power.

Moreover, it can be seen that NEE is already addressing the growing demand for renewable energy from tech companies, exemplified by its agreement to supply Google with 860 MW of renewable energy to power its expanding AI operations.

On a different note, AI also enhances NEE’s operational efficiency. The company has already launched over 100 AI projects, including proprietary AI applications, to optimize site selection, development, and operations. With more than 50 GW in its operating portfolio and 34 GW of standalone interconnection queue spots, I think that NEE is well-positioned to meet future demand.

Tailwinds from Shift in Interest Rate Environment – Macro Rationale

The recent shift in the interest rate environment has created favorable conditions for the U.S. renewable energy sector. Previously, elevated interest rates posed a significant challenge for the industry, as renewable energy projects are capital- intensive and rely heavily on financing. The higher cost of borrowing made it more difficult for developers to fund long-term projects.

However, as interest rates begin to fall, with further rate cuts projected, the cost of capital is expected to decrease. This reduction in borrowing costs acts as a significant tailwind for NEE and the renewable energy sector, enabling developers to finance projects more affordably. In turn, this boosts the value of long-duration assets such as wind and solar farms.

This shift in the macroeconomic environment not only lowers financing costs but also enhances the profitability and scalability of renewable energy projects. As the cost of capital declines, it opens the door for increased project development and expansion, positioning NEE and the U.S. renewable energy sector for stronger growth in the coming years and to effectively match the growing renewable energy needs.

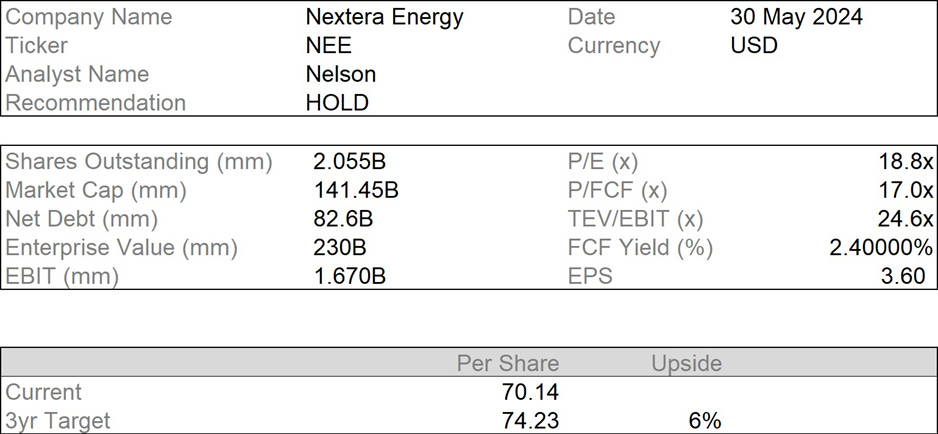

Valuations

Based on the P/E ratio comparison, NEE appears to be undervalued relative to its peers. With a current P/E of 18.76, compared to an average P/E of 20.5 for similar companies such as Iberdrola, Southern Co, Duke Energy Corp, NextEra’s stock is trading at a small discount. Using the peer average P/E ratio of 20.5 and EPS of $3.6, the implied fair value of the stock would be approximately $73.80. Given that NEE’s current stock price is $70.14 (May’24), this implies a upside of about 5.2%. With this modest upside, combined with NextEra's industry leadership and focus on clean energy solutions, I recommend holding current positions and monitor future earnings reports and industry trends as any significant changes could alter this assessment.

Risk 1:

The Inflation Reduction Act (IRA), introduced under the Biden administration, has been a key driver of investment in U.S. renewables, benefiting companies like NextEra Energy through tax credits. However, the upcoming 2024 election presents political risk. A shift in power to the Republicans, who have criticized the IRA due to concerns over its cost and stance on fossil fuels, could lead to changes or repeal of the act. This would reduce financial incentives, potentially impacting NextEra’s project pipeline and profitability.

Mitigation 1:

NEE can mitigate this risk through its diversified business model, which includes focussing on wind and solar production tax credits alongside renewables. Considering wind and solar are cost competitive and also creates jobs, it is unlikely it would be targeted. Based on commentary from republican party candidates, EV tax credits and support for uneconomical technologies will more likely be targeted. Additionally, state- level clean energy mandates, strong corporate demand for renewables with the rise in AI, and global trends towards decarbonization would likely sustain the sector's growth. As a market leader, NEE is well-positioned to adapt and maintain profitability even if federal policies shift.

Risk 2:

NEE faces significant risks from interest rate fluctuations due to the capital-intensive nature of its operations, particularly in the renewable energy sector. Higher interest rates could increase borrowing costs, potentially impacting the company's ability to finance new projects at favorable terms and slowing the expansion of its renewable energy portfolio.

Mitigation 2:

Notably, NEE utilizes substantial interest rate hedges for near-term protection and maintains a diversified funding mix, including equity, tax equity, and project debt. NEE's strong credit profile allows favorable access to capital markets, while its ability to sell tax credits under the Inflation Reduction Act provides an additional, less interest- rate-sensitive funding source. The company's regulated utility base offers stable cash flows, and long-term power purchase agreements for many renewable projects provide revenue stability. This comprehensive approach helps NEE to navigate interest rate challenges while maintaining its growth trajectory in the evolving energy landscape.

ESG Assessment

NEE’s environmental leadership is central to its AAA MSCI rating, driven by its large- scale investments in renewable energy, especially wind and solar. As the largest wind energy producer in the U.S. and a major solar energy player, the company is actively reducing reliance on fossil fuels, leading to a substantial decrease in greenhouse gas emissions. NEE's decarbonization plan targets near-zero carbon emissions by 2035, which aligns with global climate goals.

Notably, NEE relies heavily on natural gas for energy generation which limits its full transition to a zero-carbon footprint. However, the company is actively mitigating this by expanding its renewable energy portfolio, including large-scale investments in wind, solar, and energy storage technologies. Additionally, NEE is exploring green hydrogen and carbon capture solutions to reduce emissions from its remaining natural gas operations. Despite this dependency, the company’s proactive strategies ensure that

its overall ESG risk remains low, as recognized by its strong ratings from MSCI and Sustainalytics.

From a social perspective, NEE excels in managing its stakeholder relationships, community engagement, and workforce development. The company supports numerous programs aimed at benefiting the communities where it operates, particularly in areas affected by energy transitions. Moreover, NEE's commitment to a diverse and inclusive workforce has been recognized, further enhancing its social responsibility profile. By prioritizing local employment and minimizing environmental impact, NEE contributes positively to the regions it serves.

In terms of governance, NEE has implemented strong leadership and oversight mechanisms to ensure its long-term sustainability goals are met. The company’s board includes a committee dedicated to overseeing ESG initiatives, and its transparency in reporting is consistently rated highly. These governance practices reduce risk and enhance investor confidence, contributing to the company’s positive ESG rating.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

NextEra Energy, Inc. (2024). Annual report 2023. https://www.investor.nexteraenergy.com/~/media/Files/N/NEE-IR/reports-and- fillings/annual-reports/2023/2023_Annual%20Report_NEE.pdf

The Brand Hopper. (2024, September 2). Top NextEra Energy competitors: A comprehensive analysis. https://thebrandhopper.com/2024/09/02/top-nextera- energy-competitors-a-comprehensive-analysis/

Macroaxis. (n.d.). NEP competitors. Retrieved October 3, 2024, from https://www.macroaxis.com/competition/NEP

Yahoo Finance. (n.d.). Competitive solar market analysis: NextEra. Retrieved October 3, 2024, from https://finance.yahoo.com/news/competitive-solar-market-analysis- nextera-140001032.html

ESG Dive. (n.d.). NextEra Energy Resources, Entergy strike 4.5 GW solar, storage development. Retrieved October 3, 2024, from https://www.esgdive.com/news/nextera-energy-resources-entergy-strike-45-gw- solar-storage-development/718815/

PR Newswire. (n.d.). Entergy and NextEra Energy Resources announce agreement to develop up to 4.5 GW of new solar and energy storage projects. Retrieved October 3, 2024, from https://www.prnewswire.com/news-releases/entergy-and-nextera- energy-resources-announce-agreement-to-develop-up-to-4-5-gw-of-new-solar-and- energy-storage-projects-302166991.html

Portland General Electric. (n.d.). PGE's and NextEra Energy Resources' leading-edge renewable energy project reaches commercial operation. Retrieved October 3, 2024, from https://investors.portlandgeneral.com/news-releases/news-release-

details/pges-and-nextera-energy-resources-leading-edge-renewable-energy

Investing.com. (n.d.). NextEra Energy's SWOT analysis: Renewable giant's stock faces market shifts. Retrieved October 3, 2024, from https://www.investing.com/news/company-news/nextera-energys-swot-analysis- renewable-giants-stock-faces-market-shifts-93CH-3638926

NextEra Energy. (2023, October 24). Third quarter 2023 financial results. https://www.investor.nexteraenergy.com/~/media/Files/N/NEE-IR/news-and- events/events-and-presentations/2023/10-24- 23/3Q%202023%20Slides%20v%20%20F.pdf

Christie55. (2024, July). The next US energy crisis: Electric power. https://christie55.com/news/2024/07/the-next-us-energy-crisis-electric-power/

Seeking Alpha. (n.d.). NextEra Energy stock: Sustainable powerhouse fuelling future AI. Retrieved October 3, 2024, from https://seekingalpha.com/article/4704190- nextera-energy-stock-sustainable-powerhouse-fuelling-future-ai