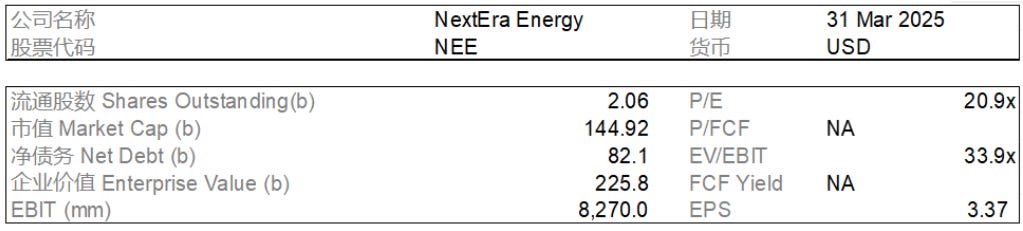

Initial Report: NextEra Energy (NYSE: NEE), 72% 5-yr Potential Upside (Kenny CHENG & Xiu Lin TEO, EIP)

Kenny CHENG & Xiu Lin TEO present a "BUY" recommendation for NextEra Energy based on its renewable energy expansion and predictable utility earnings.

Why NextEra Energy (NEE) Is a Buy?

NextEra Energy (NEE) is poised to benefit from surging electricity demand, particularly from data centers, and the shift to renewable energy. With a diverse portfolio of solar, nuclear, and ultra-efficient natural gas, NEE is well-positioned for growth. Additionally, its regulated utility, Florida Power & Light (FPL), ensures stable returns in a business-friendly, high-growth state. Florida’s population boom is driving electricity demand, while regulatory support secures financial stability. This combination of renewable energy expansion and predictable utility earnings makes NEE an attractive investment for those seeking both long-term growth and reliable returns.

Company Overview

NextEra Energy, Inc. (NYSE: NEE) is the largest utility and renewable energy company in America. It operates through Florida Power & Light (FPL) and NextEra Energy Resources (NEER).

The company focuses on renewable power generation, regulated electric utility services, and energy infrastructure, with a strong emphasis on wind, solar, and battery storage.

Together with its affiliated entities, NEE is the world's largest generator of renewable energy from the wind and sun and a world leader in battery storage.

Business Segment(s)

Florida Power & Light Company (FPL)

As the largest electric utility in Florida and one of the largest in the US, FPL provides a predictable revenue base through regulated operations. The company serves approximately 5.9 million customer accounts, covering more than 12 million people in Florida.

Its strategy is focused on investing in generation, transmission and distribution facilities to deliver on its key value proposition of making electricity affordable, reliable and clean, coupled with great customer service. FPL is currently able to provide its services at a lower cost than what many individual customers could achieve.

Revenue Model: FPL generates revenue primarily through regulated electricity rates, which ensure a stable return on invested capital, insulating the business from significant market fluctuations (base rate + cost recovery clauses).

Growth Drivers:

Population and economic growth in Florida, leading to increased electricity demand.

Ongoing grid modernization efforts, with a focus on enhancing reliability and resilience.

Investments in renewable energy projects, reducing dependence on fossil fuels.

In 2023, FPL accounted for approximately 65% of NextEra Energy’s total revenue, reinforcing its role as the company’s financial backbone.

NextEra Energy Resources (NEER)

NEER is the world’s largest generator of renewable energy from wind and solar, playing a pivotal role in global decarbonization efforts. The segment operates on a competitive, unregulated basis, allowing it to capture significant growth opportunities beyond Florida.

Its strategy focuses on investing in the development, construction and operation of long-term contracted clean energy assets in the US and Canada (renewable energy generation and transmission facilities).

Revenue Model:

Power Purchase Agreements (PPAs): Long-term contracts with utilities and corporate buyers provide revenue visibility.

Energy Trading: Participation in wholesale electricity markets.

Infrastructure Investments: Expansion into battery storage and hydrogen solutions.

Growth Drivers:

The Inflation Reduction Act (IRA) and other policy incentives supporting clean energy investments.

The increasing corporate demand for renewable energy procurement to meet sustainability targets.

Expansion into emerging technologies such as green hydrogen and energy storage.

Competitive Advantage(s)

Green attributes of NEER's generation assets

Track record of completing projects on schedule

Credit worthiness and ability to offer and manage reliable customised risk solutions to wholesale customers

In 2023, NEER contributed approximately 34% of total revenue, and its revenue mix is expected to shift favorably with the rapid deployment of renewables.

Revenue Driver(s)

Regulation and legislatives

The rate that NEE charges is set by the FPSC, to allow the utility the opportunity to recover its operating cost and earn a reasonable rate of return on invested capital.

The FPSC has the right to disallow recovery of costs that it considers excessive or imprudently incurred. Hence, rates to be charged to the customers are subjected to the approval of the FPSC.

With the IRA policy, the transition toward clean energy is accelerated and utilities are likely to witness the momentum in demand for clean energy sources.

Development in AI and rising power demand from data centre growth

Power consumption driven by developments in AI will continue to grow. As generative AI training grows faster, Deloitte states that "global data center electricity consumption could roughly double to 1,065 TWh by 2030". In order to keep up with the increase in demand for energy, many companies are looking to use an innovative and energy efficient energy-mix.

Increase in demand for utilities and expansion of infrastructure driven by population growth

Urbanisation and growth in population increase demand for energy. This means the need to invest in better and a greater number of infrastructure to generate and transmit more energy. From 2020 to 2024, Florida was estimated to have gained almost 2 million new residents and it is the third largest US state. The population is forecasted to reach 27 million by 2045, driven by lower tax rates and a business-friendly environment.

Cost Driver(s)

Falling interest rates and high debt levels

Utilities companies require major debt financing due to capital intensive infrastructure projects. Thus, they are typically impacted to a greater extent when interest rates are high. As interest rates continue to hold amidst sticky inflation, the borrowing costs for utilities companies remain elevated. However, we do expect interest rates to taper down in the foreseeable future, which would reduce the borrowing cost for these capital intensive infrastructure projects.

Regulation and policies; nuclear generation risks could result in substantial penalties

The Nuclear Regulatory Commission (NRC) could impose new measures and safety requirements related to the operation and maintenance of nuclear generation facilities. Any failure in compliance could result in hefty penalties and fines and the shut down of NEE's nuclear generation facilities.

Capital expenditure in grid and renewable infrastructure

The need to meet the increasing demand for energy consumption means that NEE has to continuously innovate and upgrade its solutions for different markets. The focus on cleaner energy and renewable energy requires capital intensive investments into new infrastructure. NEE recently announced its plans for "US$120 Billion Infrastructure Investment".

Industry and Competitor Analysis

Well-positioned for a new energy paradigm with a diverse energy mix

NEE is able to generate energy from both cleaner and renewable sources of energy at a scale that its competitors are unable to do so. Based on electricity sales, it is the largest utility in the US and it is also the world's largest generator of renewable energy from wind and sun.

Exposure to regulatory risks, especially in the wind energy sector

Trump "paused federal permits and leasing for onshore and offshore wind projects and ordered a review of existing leases.". Should such regulatory challenges result in delays in wind projects and increased cost of compliance, NEE might have to turn to alternative energy sources.

Leverage on increase in demand for AI and data centres

Development of AI and increase in data centre activities would substantially increase the demand for energy consumption. For the technology sector to maintain its growth, constant supply of power is required. NEE's diverse energy mix and solutions would allow for a more stable supply with alternatives available for use.

Intense competition in the renewable energy market

Although there is intense competition in the renewable energy sector, NEE's substantial renewable energy project backlog showcases its strong market position and ability to secure huge partnerships and projects. The backlog amounts to around 25GW, taking into account a 3.3GW addition in Q4 2024.

Investment Thesis

1. The demand for more sustainable sources of energy continues to grow significantly; NEE's focus on renewable sources of energy captures this growth opportunity

The need for increased clean energy development has become even more urgent in recent years, driven by soaring electricity demand from data centers and other sectors. For the first time in decades, the U.S. is experiencing significant electricity load growth. The International Energy Agency (IEA) forecasts that global data center electricity demand could double between 2022 and 2026, with the U.S. share rising from 4% to 6% during this period. This surge is contributing to higher electricity prices in regions with dense data center concentrations, such as Santa Clara, California, and upstate New York.

With energy demand growing rapidly and prices of natural gas being sky high and volatile, renewable energy plays a critical role as an alternative energy source to meet the growing demand. According to the US Energy Information Administration, the share of new power capacity that is expected to come online this year from renewables and batteries will jump to 93%.

The diverse energy sources of NEE caters to not only the market which already consumes renewable energy, but also the segment which is transitioning toward cleaner sources of energy. This ranges from ultra-fuel efficient natural gas power plants to nuclear units and solar panels.

2. NEE provides shareholders with a fast growing and reliable return through FPL; Florida is a great business location which is expected to bring in even greater demand for energy consumption in a regulation-friendly environment

2/3 of NEE's business is taken up by FPL and it is a regulated utility in Florida. This means that NEE has great knowledge of the utility rates that it is able to charge its consumers. How well the business does is also heavily dependent on the state of Florida.

Given that Florida's population has been growing significantly over the last few years, with about 2 million new residents from 2020 to 2024, it has become the third largest state in the US and is a great business destination for a utility company. The demand for energy consumption is expected to grow with the increase in Florida's population.

The long standing partnership with Florida's regulators is also a good sign of a regulation friendly environment for FPL's operational expenses to be approved and recognised for the base rates charged to consumers. This ensures that the utility company breaks even at the very least for operating its facilities and assets.

Valuation

Price (NTM) - Comparable Company Analysis

Share Price (High) = High P/E * EPS = 22.13 * 3.37 = $74.58 (5.86% upside)

Share Price (Median) = Median P/E * EPS = 16.06 * 3.37 = $54.12

Share Price (Low)= Low P/E * EPS = 9.79 * 3.37 = $33.60

DCF Model

ESG Assessment (Material Topics)

Sustainalytics ESG Risk Rating: Medium Risk (25.0)

Environmental Factors

NEE is a leader in renewable energy, with a strong commitment to reducing GHG emissions. The company has set an ambitious goal to achieve net-zero emissions by 2045, supported by substantial investments in solar, wind, and battery storage technologies. However, natural gas dependence remains a key challenge, particularly in FPL, where 73% of the energy mix still comes from natural gas. This reliance could impact the company’s long-term transition to 100% clean energy.

Beyond decarbonization, water & wastewater management is a material issue for NEE. The company has implemented strategies to mitigate water availability risks and optimize water consumption across its operations. Additionally, NEE has taken steps to simplify waste streams and enforce consistent hazardous waste management practices to minimize environmental risks.

Social Factors

NEE faces operational safety risks, particularly in its natural gas operations and transmission line work. The company proactively mitigates these risks through comprehensive safety protocols in wind and solar projects and a dedicated safety committee and an executive safety council to monitor and address workplace hazards.

In terms of human capital management, NEE fosters a diverse and inclusive workforce, ensuring equitable opportunities across the organization. The company maintains strong employee engagement and training programs, further reinforcing its commitment to workplace health and safety.

Governance Factors

NEE has established robust governance structures to oversee its sustainability initiatives. A key governance challenge is exposure to hurricanes and extreme weather events in Florida, which pose operational and financial risks. In response, FPL continues to invest in grid resilience, implementing storm-hardening infrastructure to minimize service disruptions and enhance reliability.

Risk(s) and Mitigation Measure(s)

Risk 1: Changes in federal, state, or local regulations could impact NEE’s operations, particularly its renewable energy projects and regulated utility business.

Recent political developments have introduced uncertainties. The Trump administration's reelection has led to policy shifts, including the freezing of funds allocated for climate initiatives under the previous administration. For instance, the Environmental Protection Agency (EPA) and Citibank have withheld $7 billion in federal funds earmarked for climate and housing projects, prompting legal action from affected coalitions. The current administration's stance on climate change has led to the rollback of federal climate efforts and regulations aimed at limiting pollution, favoring the fossil fuel industry instead. This shift includes abandoning initiatives to reduce global warming, even as record heat levels, largely driven by fossil fuel consumption, are observed. Additionally, actions such as freezing funding and threatening to overturn key policies, such as the Inflation Reduction Act and the Bipartisan Infrastructure Law pose further challenges to renewable energy development.

Mitigation 1: NEE’s combination of regulated utility operations (FPL) and competitive renewable energy development (NEER) reduces reliance on any single regulatory framework. In addition, I posit that it is very unlikely for a full repeal of the IRA as it destroys jobs for Americans and will cause a surge in energy prices for consumers. The Republicans are also supportive of the IRA and hence, it would be difficult for Trump to completely reverse the policy.

Risk 2: Approximately 2/3 of NextEra Energy’s net income in 2023 came from the Florida Power & Light company. Florida seasonally experiences natural disasters, such as hurricanes, which pose a threat to the infrastructure established by FPL. Changes in weather can also affect the production of electricity at power generation facilities, including but not limited to NEER's wind and solar facilities.

Mitigation 2: Diversify income streams. Reduce the reliance on FPL as a key source of revenue and derive a greater proportion of income from NEER over the long term.

Conclusion: NextEra Energy (NEE) Remains a Buy

Despite regulatory and climate risks, NEE’s diversified model ensures resilience. Its mix of regulated utility (FPL) and renewable energy (NEER) reduces reliance on any single policy or revenue source. While political shifts may impact renewables, a full repeal of key incentives like the Inflation Reduction Act is unlikely. Additionally, NEE’s strategy to expand NEER mitigates risks from Florida’s natural disasters. With stable utility cash flows and high-growth renewable investments, NEE remains well-positioned for long-term success, making it a compelling buy for investors seeking both reliability and growth.