Initial Report: Nike Inc.(NYSE: NKE), 127% 5-yr Upside(Leslie TAN, CC VIP)

Leslie TAN presents a "BUY" recommendation for Nike based on expectations for a turnaround under the leadership of a new CEO, driven by the revival of the product cycle.

1.Company Overview

Founded in 1964 and headquartered in Beaverton, Oregon, Nike is the world’s leading designer and marketer of athletic footwear, apparel and equipment. Its Nike Brand (including the iconic Jordan line) and Converse subsidiary are sold globally through both direct-to-consumer channels and wholesale partners. Nike reported $51.4 billion in revenue for fiscal 2024, making it the largest sportswear company worldwide. The company has a market capitalization of roughly $82.5 billion and competes with Adidas, Puma, Lululemon, and newer entrants like On and HOKA. Nike’s scale, brand portfolio, and global reach have historically delivered strong growth and high returns, though recent performance has faltered. The chairman has been Mark Parker since 2020. In late 2024, Elliott Hill succeeded John Donahoe as CEO, marking a strategic shift back to Nike’s innovation and wholesale roots. Main shareholders are institutional investors (~79%), with The Vanguard Group and BlackRock among the largest holders and Philip Knight (18%).

2.Investment Thesis

1.Undervalued due to recent missteps – a value opportunity

Nike’s valuation is near multi-year lows following a difficult 2024. The stock trades at ~18× trailing earnings, close to its 10-year low (~18×) and well below its ~32× historical median. This depressed P/E reflects investor pessimism stemming from strategic missteps under former CEO John Donahoe, whose background in technology and e-commerce (including as CEO of ServiceNow and eBay) heavily influenced his decisions at Nike. Donahoe pivoted Nike sharply toward digital direct-to-consumer, aiming to improve margins by controlling the full customer experience. However, this strategy came at the cost of pulling out from key wholesale partners, including Foot Locker, DSW, Rack Room Shoes, Amazon, and even Costco, drastically reducing Nike's physical shelf space and consumer reach.

Dick's House of Sports site visit in Boston (Apr 2025)

The shift underestimated post-COVID consumer behavior — while digital grew during the pandemic, many customers returned to in-store shopping for the convenience, breadth of selection, and immediacy it offers. By divesting from wholesale, Nike unintentionally created an opening for competitors like New Balance, HOKA, ASICS, and Puma to take over those retail spaces, especially in key channels serving cash-paying and Hispanic demographics, such as JD Sports and WSS. Meanwhile, product innovation stagnated under Donahoe’s tenure. Instead of launching breakthrough designs or new platforms, Nike leaned on repeated “bring-backs from the vault”, reissuing legacy styles like Air Force 1s and Dunks in countless colorways without material updates. Retailers noted that Nike failed to deliver new technologies or fresh silhouettes, unlike the momentum shown by newer brands offering performance and design innovation. For the first time in decades, Foot Locker's best-selling shoe in 2024 was not a Jordan, but a New Balance 9060, a striking signal of Nike’s eroding cultural relevance among youth.

New Balance, HOKA and ON's sales growth, Unit: bn USD

These compounded issues — overreliance on stale products, poor channel strategy, and lack of innovation — caused revenue growth to slow, inventory to balloon, and Nike's brand heat to fade. The resul was an inventory glut and steep discounts in 2024, causing Nike’s worst year in decades. These issues have driven Nike’s P/E to a near-historic low, presenting a contrarian entry point. With the bad news priced in, even a modest operational turnaround could spur a sharp re-rating from today’s deeply discounted valuation.

2.New CEO aligned with Nike’s heritage is catalyzing a turnaround.

The appointment of Elliott Hill as CEO (effective Oct 2024) has injected optimism and fresh strategic focus. Hill is a 32-year Nike veteran who previously led Nike’s global consumer and marketplace operations. He has a “deep connection to the consumer and Nike culture” and a passion for the brand’s sports heritage. Unlike his predecessor, Hill is refocusing the company on its core strengths – product innovation, athletic storytelling, and rebuilding wholesale partnerships.

In his first months, he met with key sports leagues, athletes, and retailers to gather insights. Hill openly acknowledged Nike “lost our obsession with sport” and vows to put the athlete and innovation back at the center of decisions. His turnaround plan (unveiled Dec 2024) emphasizes: reigniting innovation, reinvigorating marketing with athlete-centric stories, and rebuilding a “premium, integrated” marketplace bridging Nike Direct and wholesalers. Early signs of confidence include investor and analyst support – the market welcomed Hill’s appointment (Nike shares jumped on the news) and analysts predict the market will be more forgiving under new leadership. Hill’s deep Nike pedigree and clear strategic vision make him an ideal leader to restore Nike’s mojo. As his initiatives take hold, Nike’s brand momentum and investor sentiment should improve significantly.

Reignite Innovation: Hill acknowledged that Nike’s product pipeline had grown stale under the prior regime. To reverse this, Nike is doubling down on R&D and speeding up its innovation cycle, with new performance platforms slated for release in 2025–2026. The company is shifting resources to new footwear technologies, running innovation, and sports-specific performance gear, especially in high-potential franchises like basketball, training, and running.

Reinvigorate Brand Marketing: Under Hill’s leadership, Nike is re-centering its storytelling around athletes and sport, moving away from celebrity-heavy marketing. The plan includes a return to localized campaigns, athlete-driven narratives, and tighter integration between product launches and key sporting events (e.g. World Cup, Olympics). Hill himself led a listening tour across sports leagues, meeting directly with athletes and retail partners to refocus Nike’s messaging on authenticity, performance, and culture.

Rebuild a Premium, Integrated Marketplace: Recognizing that Nike had overcorrected in favor of DTC, Hill is now rebuilding trust and partnerships with key wholesale retailers (e.g. Foot Locker, JD Sports, Famous Footwear). Rather than treating DTC and wholesale as opposing strategies, Nike’s new approach is to create a “connected and premium retail ecosystem”, where both channels complement each other in storytelling, inventory flow, and consumer experience. This also includes a push to win back shelf space with innovative product and elevated in-store activations.

According to proxy statement, Hill’s compensation structure demonstrates strong incentive alignment with long-term shareholder value creation. His package includes a $1.5 million base salary, a target annual bonus equal to 200% of base, and a substantial long-term equity incentive award of $15.5 million annually, largely tied to performance metrics and stock price appreciation . This structure ensures that Hill’s personal financial success is directly tied to Nike’s turnaround progress and sustained value recovery, reinforcing investor confidence in his commitment to long-term strategic execution.

In his first months, he met with key sports leagues, athletes, and retailers to gather insights. Hill openly acknowledged Nike “lost our obsession with sport” and vows to put the athlete and innovation back at the center of decisions. His turnaround plan (unveiled Dec 2024) emphasizes: reigniting innovation, reinvigorating marketing with athlete-centric stories, and rebuilding a “premium, integrated” marketplace bridging Nike Direct and wholesalers. Early signs of confidence include investor and analyst support – the market welcomed Hill’s appointment (Nike shares jumped on the news) and analysts predict the market will be more forgiving under new leadership. Hill’s deep Nike pedigree and clear strategic vision make him an ideal leader to restore Nike’s mojo. As his initiatives take hold, Nike’s brand momentum and investor sentiment should improve significantly.

Reignite Innovation: Hill acknowledged that Nike’s product pipeline had grown stale under the prior regime. To reverse this, Nike is doubling down on R&D and speeding up its innovation cycle, with new performance platforms slated for release in 2025–2026. The company is shifting resources to new footwear technologies, running innovation, and sports-specific performance gear, especially in high-potential franchises like basketball, training, and running.

Reinvigorate Brand Marketing: Under Hill’s leadership, Nike is re-centering its storytelling around athletes and sport, moving away from celebrity-heavy marketing. The plan includes a return to localized campaigns, athlete-driven narratives, and tighter integration between product launches and key sporting events (e.g. World Cup, Olympics). Hill himself led a listening tour across sports leagues, meeting directly with athletes and retail partners to refocus Nike’s messaging on authenticity, performance, and culture.

Rebuild a Premium, Integrated Marketplace: Recognizing that Nike had overcorrected in favor of DTC, Hill is now rebuilding trust and partnerships with key wholesale retailers (e.g. Foot Locker, JD Sports, Famous Footwear). Rather than treating DTC and wholesale as opposing strategies, Nike’s new approach is to create a “connected and premium retail ecosystem”, where both channels complement each other in storytelling, inventory flow, and consumer experience. This also includes a push to win back shelf space with innovative product and elevated in-store activations.

According to proxy statement, Hill’s compensation structure demonstrates strong incentive alignment with long-term shareholder value creation. His package includes a $1.5 million base salary, a target annual bonus equal to 200% of base, and a substantial long-term equity incentive award of $15.5 million annually, largely tied to performance metrics and stock price appreciation . This structure ensures that Hill’s personal financial success is directly tied to Nike’s turnaround progress and sustained value recovery, reinforcing investor confidence in his commitment to long-term strategic execution.

3.Product cycle set to revive growth by 2025–2026

Nike is on the cusp of a new product cycle that can rebuild its competitive edge over fast-growing rivals like On and HOKA. In the athletic footwear industry, major innovation cycles typically run ~18–24 months from conception to retail. Nike’s recent drought in blockbuster products (and the corresponding shift of style-conscious consumers to younger brands) is already being addressed. Hill has prioritized “driving newness and freshness” in Nike’s pipeline, with increased R&D investment at the LeBron James Innovation Center and an accelerated launch schedule across running, training, sportswear and Jordan lines. Notably, Nike is clearing old inventory to make way for upcoming 2025–26 products. Management highlighted successful recent launches (Pegasus Premium, Vomero 5/18 sneakers, “24/7” apparel) and is “excited about the Spring ’26 product line” in development. This suggests that by mid-2025 through 2026, Nike will introduce refreshed footwear platforms and high-performance styles aimed at recapturing enthusiasts. As the product cycle turns, Nike expects growth in new performance footwear to “offset declines in classic franchises” – effectively stealing back share from On, HOKA and others. Moreover, distribution is improving: Nike is reversing its over-zealous DTC strategy and actively rebuilding relationships with retailers like Foot Locker and Dick’s. By placing Nike product wherever consumers shop – and restoring a full-price, premium experience – the company can regain the shelf space and consumer mindshare it ceded. In short, Nike’s brand is set to be revitalized by a pipeline of innovative products (due in the next 12–18 months) coupled with a smarter channel strategy. This should restore Nike’s competitive dominance and drive an inflection in sales and margins heading into 2026.

One of the clearest signs of Nike’s renewed innovation engine is the launch of the Pegasus Premium, introduced in early 2025 as a performance-first evolution of its flagship Pegasus line. Unlike previous iterations, which largely relied on incremental updates, the Pegasus Premium introduces a newly sculpted, visible Zoom Air unit and a reengineered midsole for enhanced responsiveness and energy return. Designed at Nike’s LeBron James Innovation Center, the model is positioned as a premium high-performance running shoe targeted at both competitive and lifestyle runners. More than just a product refresh, Pegasus Premium represents Nike’s first major platform launch in years, signaling a shift away from retro-heavy drops and toward a technology-driven product cycle. Retail feedback and early consumer adoption suggest strong momentum, validating Nike’s decision to refocus on genuine product innovation as a pillar of its turnaround strategy.

Pegasus Premium- 2025

4.Valuation

Nike’s current valuation is attractive.The stock trades at a forward P/E in the high teens (~18–19×), which is well below its 5–10 year average (≈30×) and near the lowest level in a decade. This compressed multiple implies a significant re-rating potential as earnings stabilize. For context, Nike’s forward P/E of ~19× also looks reasonable against peers: Adidas trades at ~45× (trailing) amid its own turnaround, and premium challenger On Holding carries a lofty ~50–55× P/E. More value-oriented rivals like Puma and Deckers (owner of HOKA) trade around 15–17× earnings – levels that Nike now approaches despite its historically superior brand and margins.

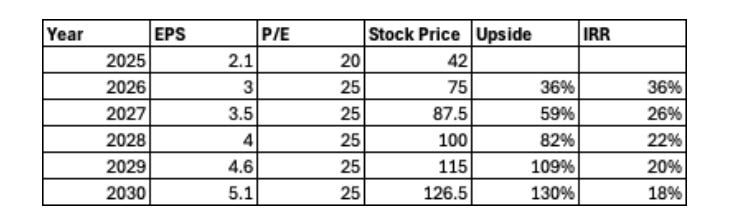

Earnings outlook: FY2025 is a tough year – consensus expects around $2.1 EPS (down ~45% YoY) as the company works through inventory and resets its channels. Beyond this bottom, we anticipate a strong rebound. Nike’s EPS is projected to recover in FY2026 as the turnaround gains traction (one early estimate pegged FY2026 EPS at $3.5, +13% YoY, although recent consensus may be more conservative). We estimate Nike can deliver $2.5–3.00 in EPS by FY2026, still below its FY2024 peak ($3.95) but reflecting a return to growth.

Even applying a below-average P/E of ~25× to a FY2026 EPS of ~$3 yields a stock price of about $75. This is ~40% above the current share price. If Nike restores investor confidence and approaches its historical valuation norms (e.g. ~30× forward earnings), the upside would be higher. For example, 30× a $3 EPS = $90 (nearly double today’s price).

5.Risks and Mitigation

Tariff headwinds: Ongoing trade tensions pose a risk to Nike’s cost structure. New U.S. tariffs on footwear/apparel imports from China and Mexico are expected to pressure margins in the near term.

Mitigation: Nike has a diversified supply chain (sourcing from Vietnam, Southeast Asia, etc.) and can adjust production locations over time to reduce tariff impact. The company is also lobbying and working on tariff exclusions where possible. In the interim, strong pricing power on hot products may help offset some duty costs, and Nike is streamlining expenses to preserve profitability.

Competition from new entrants: Innovative younger brands like On Running and HOKA (Deckers) have been gaining market share at Nike’s expense. These rivals capitalize on trends in running and athleisure, and their popularity, if sustained, could limit Nike’s sales recovery.

Mitigation: Nike still owns deep advantages – a richer product portfolio, huge marketing scale, and decades of athlete endorsements. Under the new CEO, Nike is responding aggressively: refocusing on performance innovation (to match rivals’ product buzz) and rekindling “heat” around its franchises via limited releases and athlete storytelling. The company’s recent moves (e.g. partnering with high-profile influencers and launching fresh campaigns) demonstrate its resolve to “reassert the brand” and outcompete the upstarts. Nike’s strong brand equity and financial resources should enable it to eventually reclaim any lost ground in key categories.

Product innovation or marketing execution falters: The turnaround thesis relies on Nike delivering compelling new products and reinvigorated marketing. There is a risk that product development could disappoint or be delayed, or that marketing investments (athlete partnerships, campaigns) won’t resonate with consumers. Such failures would prolong Nike’s slump.

Mitigation: Nike is making significant investments in innovation – for example, its Nike Sport Research Lab is driving advanced R&D for the next generation of footwear. The pipeline for 2025–26 is robust, with multiple new shoe lines and apparel collections planned. Additionally, Elliott Hill’s strategy to put sport back at the center is already restoring focus internally. Nike is reallocating spend towards high-impact storytelling (leveraging its unparalleled roster of athletes and iconic swoosh branding). Early feedback from retailers and athletes has been positive, suggesting the messaging is on point. While execution risk remains, Nike’s management is keenly aware of past shortcomings in innovation and marketing – and has a clear roadmap (and the talent) to correct them. The company’s track record prior to the recent missteps gives confidence that it can once again create hit products and campaigns. In short, Nike’s own renewed efforts, combined with its enduring brand loyalty, should help mitigate the risk of an innovation or marketing shortfall in this crucial turnaround phase.