Initial Report: NVIDIA Corp (NVDA), Sell (EIP, Fernando)

If you're holding NVIDIA's stock, would you heed Fernando's advise to sell them now? Do you agree that the stock is overvalued? Let's take a look.

LinkedIn | Fernando

Company Overview

NVIDIA Corporation is a leading technology company specializing in the design, development, and manufacturing of graphics processing units (GPUs) and related technologies. Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA has become a prominent player in the fields of artificial intelligence (AI), deep learning, data centers, and gaming.

In recent years, NVIDIA has been expanding its capabilities to other technologies aside from GPUs. Some of the most recent developments include AI and deep learning, along with a range of software development.

NVIDIA’s business lines include 7 sectors: gaming, data center, professional visualization, automotive, edge computing, OEM and embedded solutions, and software and development tools. Some of the most common products of NVIDIA include:

GeForce RTX Series: High-performance graphics cards for gaming, featuring real-time ray tracing and AI-enhanced graphics capabilities.

NVIDIA Quadro Series: Professional-grade graphics solutions optimized for CAD, 3D modeling, animation, and content creation applications.

NVIDIA Tesla: Data center GPUs designed for high-performance computing (HPC), AI training, and inference workloads.

NVIDIA Jetson: Edge computing platforms specifically developed for AI at the edge, enabling AI-powered applications in robotics, autonomous vehicles, drones, and more.

NVIDIA DRIVE: A platform for autonomous vehicles, providing solutions for AI perception, mapping, and self-driving capabilities.

NVIDIA DGX Systems: Integrated AI supercomputers built for deep learning and AI research, offering a turnkey solution for training and inference tasks.

In the recent news, the company mentioned that they are going to launch a new supercomputer in Taiwan called as Taipei-1, which will feature a range of high-level GPUs to cater heavy AI workloads[1], and will expand its capabilities in the growing AI technology.

Industry Overview

The global artificial intelligence market size was valued at USD 136.55 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030[2]. Over the last few years, there has been a significant increase in global funding for AI, with the amount reaching $66.8 billion. Notably, the number of AI companies valued at $1 billion or more has also surged, reaching a record of 65, marking a remarkable 442% increase compared to the previous year[3]. This trend indicates a growing adoption of AI solutions by companies and governments around the world, with each passing year witnessing a higher uptake.

According to a report, by 2030, there is a $15.7 trillion potential contribution to the global economy from AI[4], mainly driven by:

Productivity gains from businesses automating processes (including the use of robots and autonomous vehicles)

Productivity gains from businesses augmenting their existing labor force with AI technologies (assisted and augmented intelligence)

Increased consumer demand from personalized content, that is supported by content generated by AI

That being said, the impact is not equally spread in the world. North America and China will experience the highest growth (about US$ 3.7t and US$ 7.0t, respectively). Less developed countries will experience slower effects due to less technology adoption in those countries.

Competitor. In the current market, NVIDIA has some competitors that also produce chips, such as AMD, Apple, Broadcom, and Marvell.

AMD – Although AMD has more exposure to the gaming sector due to Sony’s PlayStation 5 and Microsoft’s Xbox Series consoles as compared to NVIDIA’s dominance in Nintendo, NVIDIA has overall dominance in the GPU sector with 71% market share[5]. Moreover, the diversified capabilities of NVIDIA also positioned them to better tackle AI growth

Intel – Intel’s market share is slowly rising to compete with the rest of the industry, but it is still quite far from NVIDIA’s market dominance. They specialize in discrete GPUs, which are installed separately as compared to an in-board component of a computer

In short, NVIDIA currently dominates the current market due to its innovation in creating an even faster GPU that outperforms its competitors.

Investment Thesis I – Growth of AI in the Near Future

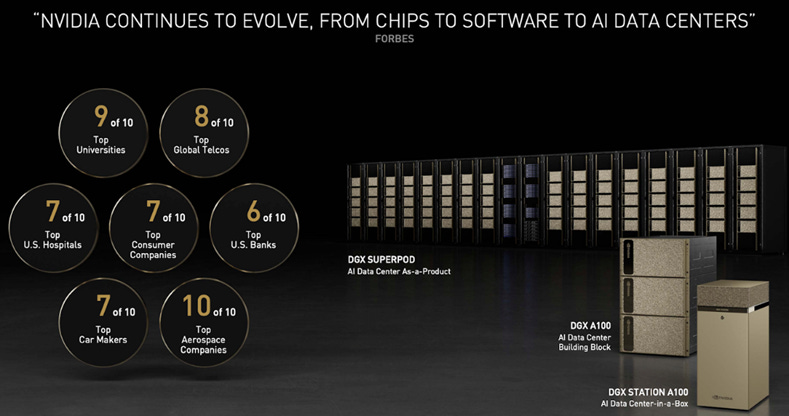

As mentioned in the previous sections, AI is facing a huge growth in all business sectors across different industries. Although high-performance computing companies (HPC) have the technical competencies to capitalize the AI growth, they will still be heavily dependent on suppliers such as NVIDIA. For example, AI companies will require the services from data centers, and almost ~90% of data centers in the world use NVIDIA’s products[6]. In Q1 2023, the company recorded a record high in its data center business with revenue reaching US$ 4bn. The company’s technology has been used in some of the most popular AI models such as OpenAI’s GPT-4[7], and will only grow in the future.

With this, we can observe that there are two moats that NVIDIA has in terms of AI growth – a full-suite offerings competitive edge as compared to its competitors and its ability to deploy economy of scale.

First, as compared to its competitors, NVIDIA is the only company that is available to provide end-to-end technology solutions, from the hardware (processors) to networking components to the software that drives all the processes. By engaging NVIDIA, businesses would have the all-in-one access to all AI solutions that they need. Some use cases would include conversational AI, autonomous devices, and optimized manufacturing.

According to the MLPerf benchmark, a consortium of AI leaders from academia, research lab, and industry to evaluate the performance of hardware, and software and services, NVIDIA consistently tops other companies in almost all categories. In the training section, NVIDIA resulted in 20x better performance growth in just three years, showing a huge dedication in creating state-of-the-art processors to train AI data.

With its expertise in the software section, NVIDIA has an even greater competitive edge. Through its NVIDIA AI Enterprise, it enables end-to-end workflow of AI in companies, suitable for those companies that would like to adopt AI but do not have the capability to start from scratch. NVIDIA’s combination of cloud supercomputer (NVIDIA DGX Cloud), AI platform software, and AI model enables accessible AI for everyone.

Second, NVIDIA’s enormous scale makes it really hard for the competitor to get a share of the pie from NVIDIA. The level of R&D expenditure for the company is simply too high for other companies to catch up. In FY2023 alone, NVIDIA spent US$ 7.39b on research, while AMD was stuck at US$ 5.3b for the same period. Moreover, its scale in patents and technologies is one of the most advanced in the industry. For example, in 2006, NVIDIA invented CUDA, an API that enables users to conduct parallel computing. Till today, the API has been downloaded over 30 million times, whereas the industry, due to its advanced implementation, has only about 3 million developers.

Investment Thesis II – Transition Towards Greener Future

Due to the massive push for climate change measures, energy transition is one of the most important trends to observe. Energy transition refers to the global energy sector’s shift from fossil-based systems of energy production and consumption — including oil, natural gas, and coal — to renewable energy sources like wind and solar, as well as lithium-ion batteries[8]. In 2022, the global investment in the low-carbon energy transition totaled US$ 1.1t, a new record fueled by the intense energy crisis and policy action that push for higher adoption of clean energy. The investment is expected to grow even further nearing the global traditional stocktake of 2030.

Therefore, in this context, NVIDIA is well suited to complement the energy transition to even higher efficiency. By building software-defined smart features, NVIDIA could improve resiliency in extreme weather events, improve electricity affordability and reliability through real-time optimization, and integrate different facilities together. With the deployment of AI, companies can modernize current infrastructures even further.

Some of the use cases of AI technologies in energy transition include:

Grid management: NVIDIA’s Edge AI helps dynamically manage distributed energy resources such as solar panels, wind farms, electric vehicles, and home batteries. Powered by a software-defined smart grid chip based on the NVIDIA Jetson Edge AI platform, NVIDIA can integrate the ecosystem with sensors, SDKs, and various services, including a cloud-based workflow system

Grid modeling: as the energy transition is dependent on a reliable grid system, high-performance computing can be deployed to quickly model networks at scale. The model can then be used to predict outage scheduling and the balance of demand and supply of electricity. Moreover, AI-enhanced intelligent video analytics and cybersecurity secure grid infrastructure from unauthorized access

Predictive management: in the US alone, utility companies own 185 million poles and spend billions of dollars to track the status of such facilities. As the energy transition drives even more infrastructure construction, NVIDIA’s Jetson Edge AI can automate the process of facility maintenance through AI-powered data collection and analysis, that can identify needed repairs and vegetation management.

With the list above being non-exhaustive, it can be observed that there is an endless possibility to integrate AI in this sector. Coupled with NVIDIA’s capabilities, the company is well-positioned to capture the growth of the industry.

Valuation

By doing a simple DCF analysis, we observed that the company is currently overvalued. Some assumptions taken in this analysis include:

WACC of 8.5%

Revenue projection based on the assumption that NVIDIA can keep its market share amidst the growing AI industry

Perpetuity growth of 3.0%

The analysis led us to the implied share price of US$ 287/share, which represents -32.0% of the current share price of US$ 422.1/share. Further analysis of the comparable metrics is shown below.

The data shows that NVIDIA is currently trading at a very high P/E value (26x as compared to the median of 9.8x), a sign of overvalued stock. We can therefore conclude that the overvaluation might be caused by the fact that the hype of AI and its recent announcements – while its revenue currently doesn’t justify its stock, it has a good story of the integration of AI and GPU. It can be therefore concluded that there is a SELL recommendation on NVIDIA stock.

That being said, NVIDIA is still well positioned with its advantage to capture the growth of the industry – it is just that currently the stock is trading at a very high value due to market sentiment and is overvalued. It is recommended to hold the buy for this stock, and close monitoring of the market movement is essential.

Catalyst

There are few catalysts that need to be tracked in investing in NVIDIA:

Deployment of new GPU, CPU, DPU, and robotics processor: as the industry is highly driven by intellectual properties, the competition is intense on who could make the most efficient and high-speed processor. It is therefore important to observe how advanced the company compared to the competitors

Breakthroughs in AI: gaming was once the main driver of NVIDIA, but moving forward, we would see that NVIDIA’s stock is driven even greater by the advancement of AI. One great example is the announcement of ChatGPT which took off earlier this year, which fueled the company’s stock price significantly. The rise of ChatGPT has sparked increased competition for NLP-based adoption in the industry

NVIDIA’s bet in other business: so far, NVIDIA has placed a lot of investment in some of the still developing sectors, such as Arm-based server processors earlier this year. Although these industries often have high growth rates (e.g., the Arm-based processor is targetted to be triple in size over the next decade), it gambles highly on how effective are such investments and whether they would realize into meaningful revenue to the firm.

ESG

NVIDIA is committed to sustainability and has made a number of efforts to reduce its environmental impact. These efforts include:

Purchasing renewable energy: NVIDIA has a goal of purchasing or generating enough renewable energy to match 100% of its global electricity usage by 2025. In 2022, the company purchased 1.2 gigawatts of renewable energy, which accounted for 50% of its electricity usage.

Improving energy efficiency: NVIDIA's products are becoming more energy efficient over time. For example, the company's H100 GPUs are 26x more energy efficient than CPUs when measured across inferencing benchmarks.

Reducing waste: NVIDIA is working to reduce the amount of waste it produces. For example, the company has a program that recycles all of its end-of-life electronics.

Supporting sustainable communities: NVIDIA is committed to supporting sustainable communities. For example, the company has a program that provides grants to organizations that are working to address climate change.

In 2022, the company was named to the Dow Jones Sustainability Index and the Carbon Disclosure Leadership Index. In DJSI, it was even included as part of the “best green company” and “100 best companies to work for.”

Risks

Some risks associated with an investment to NVIDIA right now are:

High valuation: currently, the stock is trading at a very high valuation due to the market’s bullish view of the growth of AI, and there is a huge risk of the falling price if the company could not meet the expectation of the investors. In the light of this risk, it is advisable to closely observe any announcements made by the company, as the slightest of short-term underperformance will put the stock price at stake.

Geopolitical risks: as a NVIDIA’s supply chain is based on a global network of suppliers, it poses a huge risk in the case of major disruption, such as seen in the war between Russia and Ukraine. Moreover, the company relies much on the semiconductors from Taiwan, which in turn poses a risk depending on how the situation develops between China and USA in the future.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

[1] Company’s disclosure, National Taiwan University

[2] Grand View Research

[3] USA International Trade Administration

[4] PwC’s Global Artificial Intelligence Study

[5] John Peddie Research

[6] Network World

[7] https://techmonitor.ai/technology/ai-and-automation/gpt-4-openai-multimodal-chatgpt

[8] S&P Global