Initial Report: Palantir Technologies (PLTR), 162% 5-yr Potential Upside (EIP, Kenny CHENG)

Kenny recommends a “buy” on PLTR for a short term investment horizon of about 3 - 5 years.

Executive Summary

Palantir Technologies (American Software Company) is focused on big data analytics and develops data fusion platforms. It has developed rapidly and raked in more than 1.5 billion USD in revenue in 2021. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions.

Its product platform includes Palantir Gotham, Palantir Apollo and Palantir Foundry [1].

Foundry is Palantir’s enterprise data platform. Through Foundry, companies can build pipelines, clean and transform data, and run analytics. Foundry operates at an enterprise level, allowing companies to efficiently maximise their assets and data within a secure environment customised for their needs.

Gotham is Palantir’s offering to the government. Palantir Gotham is a big data analysis platform that can process, store, and analyse large data sets from multiple data sources. The U.S. government uses the Gotham platform for counterterrorism, anti-fraud, and law enforcement.

Lastly, to use applications of the Gotham platform with the Foundry system, Apollo is needed. Apollo is a continuous data delivery platform that allows organisations to move data between the two software platforms.

Company Overview

Business Segments

Palantir serves two customer segments [1]:

1. Government Agencies

They include the military, intelligence and law enforcement agencies

2. Commercial Businesses

They include financial institutions, healthcare organisations and other enterprises

Palantir is seeing increased success diversifying away from government contracts, which comprised around 55% of its total revenue in the third quarter of 2023 [2]. Government revenue grew 12% year over year last quarter to $308 million, while commercial revenue grew 23% to $251 million.

Revenue Drivers [1]

The company offers contracts with terms ranging from one to five years. There are also clients who enter into contracts with terms less than a year. Pricing is dependent on the needs of the clients as some just require the software, while others need maintenance, support and training. Palantir offers subscription based plans and sells subscription access to its hosted environment (Palantir Cloud), software subscriptions for on-premise software and other professional services.

1. Palantir Cloud: The Palantir Cloud allows organizations to use Palantir software without installing and maintaining it on their servers. The subscription plan also includes operating and maintenance services throughout the contract period.

2. On-premise services: These are for organizations that prefer to install and maintain the Palantir software on their servers. It provides access to software licenses and maintenance services for the duration of the contract. Customers can also install the software on their cloud infrastructure.

3. Professional services: Palantir offers professional services to help customers get the most out. These service contracts include the needed support to implement, operate, and optimize the software. It also consists of the on-demand provision of expertise when needed.

Cost Drivers

Cost of Revenue

Cost of revenue mainly includes employee wages, shared based compensation expense, employee benefits and third party services overhead costs.

R&D Cost

As a software company, Palantir requires continuous research and development to solidify its platforms and services as it expects its consumer base to increase further. Palantir must be able to successfully build a software solution that is superior to those that its customers could build, so they would not opt to build their own proprietary solutions.

Sales and Marketing Expense [3]

Its business model is built around 3 stages: Acquire, expand and scale, to identify new customers and expand on existing partnerships. Sales and marketing expense has continuously been the highest operational expense, compared to G&A and R&D. This reduced margins previously and made Palantir a loss-making business.

However, marketing strategy is critical for the success of Palantir. Palantir announced boot camps for prospective customers, during which they can test the company's software. Since its commercial launch, Palantir's management claims that over 100 enterprises are currently using AIP and that the backlog of prospective customers is "unlike anything we have seen in the past twenty years."

Competitor Analysis [4]

Palantir competes in an industry with many large and well-established players and several startups. Its competitive advantage lies in its strong financial position, extensive investment in research and development, and innovative products.

- Cognizant [5]: Headquartered in Teaneck, New Jersey, United States. In 2022 the company recorded revenue of $19.4 billion, an increase from $18.5 billion in 2021 (5% growth YOY). Cognizant and Palantir compete in the domain of consulting and application development. Both offer big data analytics solutions, but Cognizant’s solutions are more traditional and do not have the same capabilities as Palantir’s Gotham platform.

- Alteryx: headquartered in Irvine, California, United States. Alteryx expects $957 million in revenue for 2023 (12% growth YOY). With its Alteryx Intelligence Suite, the company competes directly with Palantir Foundry. However, Palantir offers better data preparation capabilities and a more comprehensive solution.

- Tableau: headquartered in Seattle, Washington, United States. Both companies offer data visualization and analysis tools. Tableau’s advantage lies in its ease of use—its drag-and-drop interface makes it simple to create complex visualizations without coding skills. The company’s desktop and server products are available in different editions, making it flexible for different users.

- IBM Watson Studio: IBM Watson Studio is a comprehensive platform that offers capabilities similar to Palantir Foundry. However, Foundry is more user-friendly and rovides better integrations. Moreover, Foundry’s artificial intelligence (AI) capabilities are more advanced. Unlike Foundry, Watson Studio is optimized for the IBM Cloud and is available as a cloud-based or on-premises solution.

- Splunk: enables organizations to search, monitor, and analyze machine-generated data. In 2022, the company’s revenue was $2.67 billion, a 20% increase from 2021. The company has been investing heavily in research and development (R&D), which has resulted in new product launches and expansions into new markets. Splunk competes directly with Palantir Foundry in the data analysis market. While Splunk solely relies on machine-generated data, Palantir ingests all data types, making it a more comprehensive solution.

Moat [6]:

Proprietary Software

The company’s software is based on a platform called Gotham, which is designed to help organisations integrate and analyse large amounts of data. Gotham is not available to Palantir’s competitors, which gives the company a significant advantage.

Strong Relationship with Governments

Palantir is its strong relationships with government agencies. The company has contracts with the US Department of Defense, the CIA, and other government agencies. These relationships give Palantir access to a large and growing market.

Stick Product and High Barrier to Exit

Palantir’s software is difficult to switch. Once an organisation has invested in Palantir’s software, it is difficult and costly to switch to a different platform. This encourages Palantir to keep its customers happy.

Investment Theses

Generative AI to Become a $1.3 Trillion Market by 2032, Research Finds

The market size in the Generative AI market is projected to reach US$44.89bn in 2023 [7]. The market size is expected to show an annual growth rate (CAGR 2023-2030) of 24.40%, resulting in a market volume of US$207.00bn by 2030.

Bloomberg Intelligence: New Report Finds That the Emerging Industry Could Grow at a CAGR of 42% Over the Next 10 Years [8]

Rising demand for generative AI products could add about $280 billion of new software revenue

Palantir announced its newest offering, the "Artificial Intelligence Platform," early this year. As of mid-September, Palantir says the AIP now has 150 users, up 50% within the last month [9].

The company is seeing strong interest in the "bootcamps" it launched in October to give clients access to its AI platform for one to five days, in a positive sign for future demand [10].

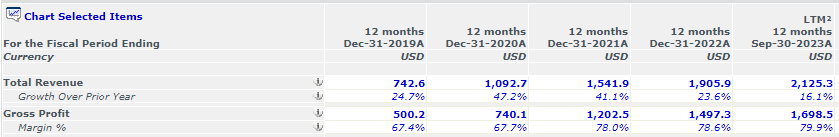

Palantir has Strong Financials Despite Slowing Growth [11]

In 2022, revenue growth slowed to 24% from 40% in 2021 and 47% in 2020.

Palantir earnings for the quarter ending Sept. 30 were 7 cents on an adjusted basis, vs. 1 cent a year earlier. Revenue rose 17% to $558 million.

Government revenue rose 12% to $308 million, missing estimates for $321 million. But commercial market revenue climbed 23% to $251 million vs. estimates of $234 million.

Despite slowing revenue growth, gross profit margins have still increased from 78.6% to 80% (by the third quarter of 2023). This shows that there is improving cost savings.

GAAP net income of $72 million, representing a 13% margin. Fourth consecutive quarter of GAAP profitability

Cash from operations of $133 million, representing a 24% margin

Adjusted free cash flow of $141 million, representing a 25% margin

Announcement of Share Buyback

The company has announced a $1 billion buyback for PLTR stock. But no shares were repurchased in the September quarter.

The main goal of any share repurchase program is to deliver a higher share price. This buyback announcement could signify that the board may feel that the company's shares are undervalued, making it a good time to buy them. Meanwhile, the announcement could also be perceived as an expression of confidence by the management.

Changing Revenue Mix toward the Commercial Segment

In Palantir's most recent quarterly results, the company's government revenue totaled a little under $308 million, which was 23% (compared to 25% in 2021) more than the $251 million in revenue its commercial clients brought in.

Customer count grew 34% year-over-year. US commercial customer count grew 37% year-over-year, from 132 customers in Q3 2022 to 181 customers in Q3 2023.

Commercial revenue grew 23% year-over-year to $251 million. US commercial revenue grew 33% year-over-year to $116 million. Government revenue grew 12% year-over-year to $308 million.

With the diversification toward the commercial segment, Palantir is able to seize opportunities from a recurring and consistent source of revenue from the public sector and also tap on increasing demand for AI amongst enterprises.

Valuation [12]

PLTR’s Forecasted EPS and P/E

1Y: Upside of 20% in 2023

2Y: Upside of 36% in 2024

3Y: Upside of 19% in 2025

Analysts’ estimated that PLTR share price is trading 30.6% below its fair value of $24.73 [13].

Risks and Mitigation [14]

Risk(s)

Palantir has a significant revenue concentration.

Majority of the company’s revenue is derived from the public sector with its early success in helping the US government. Hence, the company is highly dependent on the public sector and this might limit Palantir’s growth in the future. With rising tensions between different countries and worsening geo-political climates, Palantir’s access to governments around the world might be restrained due to national security issues.

Palantir's top three and top twenty customers accounted for 17% and 52% of its revenue in 2022. While these relationships are reasonably stable due to high software switching costs, having too much revenue concentrated within a few clients could be problematic. The sustainability of such revenue streams is heavily dependent on the renewal of the contracts. Hence, Palantir needs to have a strategy to drive at high client retention rates to ensure continuous revenue streams.

Palantir’s valuation might not be reasonable.

The stock trades at price-to-sales (/PS) and price-to-earnings (P/E) ratios of 18.7 and 303, respectively. This valuation could be justified to some as Palantir stands to benefit tremendously from the increased AI demand, as Generative AI is forecasted to be a $1.3 Trillion market by 2032.

However, the very high valuations still might deter investors from investing in the company as it provides no safety margin, in the event that the good prospects change.

Privacy concerns around clients’ information

Patient privacy fears as US spy tech firm Palantir wins £330m NHS contract.

Doctors’ organisations and human rights charities have expressed concerns about the contract and Palantir, including whether patient data would be suitably protected.

Privacy concerns have also been raised, by groups including the British Medical Association, about whether confidential data will be seen by Palantir and other organisations outside of the NHS.

Mitigation(s)

Palantir is trying to diversify revenue streams toward the commercial segment.

The top 20 customer revenue concentration was high at 52% in 2022, it declined from 67% in 2019 as Palantir grew its client base.

Since the start of 2023, it is clear that the commercial business has been doing much better, with at least 8% quarter-over-quarter revenue growth in two of the past three quarters.

Palantir has recently launched AI bootcamps in a bid to help businesses find use cases for AI by trying out Palantir's software and this is a trend that would very well continue into the future. Such business strategies could help Palantir rapidly expand its commercial client customer base.

Palantir can justify its valuation

With a forward price-to-earnings multiple of 61, the company trades at a substantial premium to the S&P 500's average of 26. This valuation could be justified by the company’s solid bottom-line momentum as the third-quarter net income jumped from a loss of $123.9 million to a gain of $80 million. This is also Palantir’s first four consecutive quarters of profitability under generally accepted accounting principles (GAAP).

Commitment to law and regulation [15]

Palantir is committed to complying with data protection legislation, including the data protection regime introduced by the General Data Protection Regulation (EU Regulation 2016/679, the “GDPR”), California Consumer Privacy Act of 2018 (the “CCPA”) as amended by the California Privacy Rights Act of 2020, and other applicable US consumer privacy laws. There are a limited number of circumstances where Palantir may share its clients’ information with third parties (for example, pursuant to a court order, for our marketing purposes, if we are part of a merger, or with our business partners and service providers who support our business or collaborate with us).

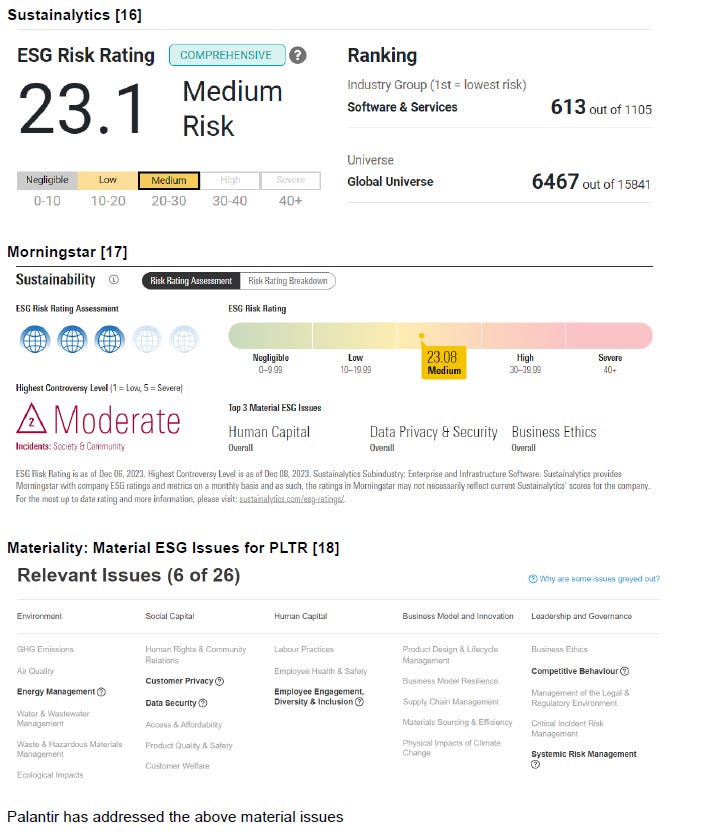

ESG Assessment

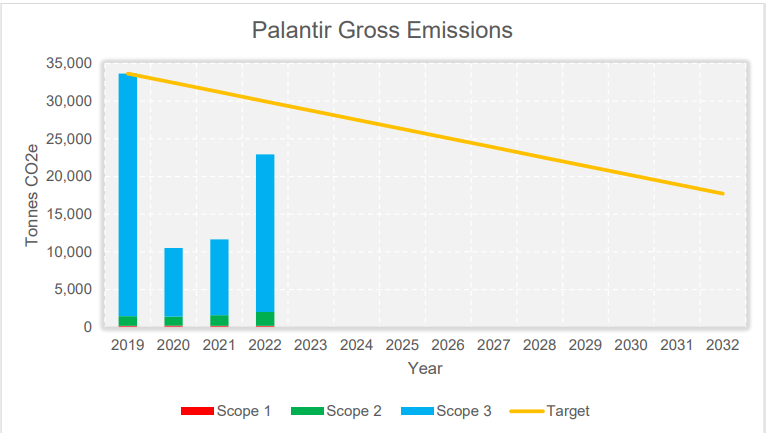

Energy Management [19]

Palantir achieved carbon neutrality across its global operations in 2022 and sought to reduce or eliminate greenhouse gas (carbon) emissions across Scopes 1, 2, and 3, as defined by the Greenhouse Gas Protocol. Where emissions cannot be reduced or eliminated, it purchases credible, scientifically-verified carbon offsets to achieve carbon neutrality each year

.

There was a 57% decrease in emissions intensity per employee in 2022 compared to its baseline year of 2019. This is a significant sustainability advancement for 2022, as Palantir grew its global headcount by 31% relative to 2021.

In 2022 as in prior years, PLTR took additional step of disclosure and transparency by including carbon emissions tabulations for hotels and lodging, which are not required by the Greenhouse Gas Protocol Corporate Accounting Standard (achieves signalling effect).

As seen, Palantir Global Emissions is well below its SBTi aligned targets for 4.2% YoY linear reduction in emissions. These are emissions excluding offsets.

DEI [20]

Unfortunately, there remains a pay and bonus gap between men and women at Palantir.

However, the percentage of employees who received a bonus is almost identical for both men and women. PLTR also made a lot of progress in closing the gender gap in our hiring, and as a result of our continued progress, had more women than men new UK hires during the bonus period of 2022.

PLTR has put measures in place to ensure equal wages and inclusivity for employees across different demographics (Equitable hiring process, key partnerships, scholarships for women in tech etc.). Global compensation data is generally reviewed on a biannual basis to ensure that employees are paid appropriately based on their role, experience, and performance, regardless of gender.

PLTR also standardised their offer packages for interns and new grads to help reduce pay gaps that historically impact members of underrepresented communities, levelling the playing field more.

Customer Privacy and Data Security [16]

Palantir currently offers the following data protection modules, which were specifically developed to help our customers comply with data subject rights requests under the EU General Data Protection Regulation (GDPR) and comparable privacy laws in other jurisdictions (e.g., Brazil’s Lei Geral de Proteção de Dados Pessoais (LGPD), the California Consumer Privacy Act (CCPA) and its recent amendments through the California Privacy Rights Act (CPRA), the Virginia Consumer Data Protection Act (VCDPA), etc.

As a company, it does not collect data, sell data, or facilitate unauthorized sharing of data among customers or any other parties.

Measures which have been implemented to ensure customer privacy and data security would include:

1. Targeted Search and Discovery

2. Granular Access Controls & Dynamic Data Minimization

3. Data Provenance Tracking

4. Audit Logging and Analysis

5. Data Retention and Deletion

Conclusion

All in all, this report recommends a “buy” on PLTR for a short term investment horizon of about 3 - 5 years. With expected increase in demand for AI as interests around AI and technology continues to grow stronger, PLTR, which has established itself in the AI software space should be able to ride on this wave of opportunity. As PLTR continues to roll out initiatives and smart business strategies to capture new potential clients and convert them into customers, PLTR commercial revenue streams are expected to rise and continue in the coming years. Not forgetting its sticky revenue streams from the public sector, PLTR’s strong economic moat of long standing relationship with the US government should continue to play out well as new contracts are still being signed. With increasing clients and greater economies of scale, PLTR should ideally be able to increase its cost savings and increase its net income, after achieving its first four consecutive quarters of GAAP net income, suggesting that its business model actually works. The 3Y target is an upside of about 20 - 30%. Considering ESG, PLTR has addressed most of its material ESG issues and has committed to making good progress in the coming years. Justifications have been made for poor performance and should PLTR demonstrate that it is enroute to reaching its targets, I think PLTR is still a worthy investment.

[1] https://businesschronicler.com/business-strategy/palantir-business-model-explained/

[2]https://www.fool.com/investing/2023/12/07/could-this-news-derail-palantirs-incredible-rally/#:~ext=Palantir%20is%20also%20seeing%20increased,grew%2023%25%20to%20%24251%20 illion.

[3] https://www.fool.com/investing/2023/10/22/palantirs-artificial-intelligence-ai-strategy-is/

[4]

[5]https://bstrategyhub.com/palantir-competitors-alternatives/

[6]https://www.linkedin.com/pulse/palantir-competitive-advantages-make-excellent-long-charleschoi

[7]https://www.statista.com/outlook/tmo/artificial-intelligence/generative-ai/worldwide

[8]https://www.bloomberg.com/company/press/generative-ai-to-become-a-1-3-trillion-market-by-

2032-research-finds/

[9]https://www.investors.com/news/technology/pltr-stock-buy-now/

[10]https://www.reuters.com/technology/palantir-projects-revenue-above-estimates-demand-ai-p

latform-2023-11-02/

[11]https://investors.palantir.com/news-details/2023/Palantir-Reports-Its-Fourth-Consecutive-Qu

arter-of-GAAP-Profitability-GAAP-EPS-of-0.03

[12]https://www.nasdaq.com/market-activity/stocks/pltr/earnings

[13]https://simplywall.st/stocks/us/software/nyse-pltr/palantir-technologies/valuation

[14]https://finance.yahoo.com/news/2-major-risks-investors-know-223000157.html

[15]https://www.palantir.com/pcl/technologies/

[16]https://www.sustainalytics.com/esg-rating/palantir-technologies-inc/2000116302

[17]https://www.morningstar.com/stocks/xnys/pltr/sustainability

[18]https://sasb.org/standards/materiality-finder/find/?company[0]=US69608A1088

[19]https://www.palantir.com/assets/xrfr7uokpv1b/6hm9hUVtO9lix0FxvtGnX/fd20c452191dd578

040592e0f833b018/2022_Carbon_Report_-_Update__12.2023_.pdf

[20]https://www.palantir.com/assets/xrfr7uokpv1b/7aVRewJdzPeZmWLgOGpNtW/bccebb3021464486d16ba26baf877c42/UK_GenderPayGap_2022_2023_R3.pdf

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.