Initial Report: Paypal (PYPL), 99% 5-yr Potential Upside (EIP, Xinfei TAN)

Xinfei believes PayPal's unbranded business is silently thriving, strategically countering short-term margin challenges with a focus on long-term growth.

Executive summary

Resilient Cost-Cutting and Strategic Focus:

PayPal responds to margin concerns with significant cost reductions, showcasing commitment to profitability enhancement, and focuses on optimizing user engagement.

Unprecedented Growth in Unbranded Services:

Braintree's exceptional performance drives PayPal's Total Payment Volume in 2023, with unbranded TPV projected to surpass branded TPV, reflecting the company's competitive edge.

Strategic Initiatives for Sustainable Profitability:

PayPal adopts a proactive stance to counteract lower margins in the unbranded segment, expanding into new markets, cross-selling Value-Added Services, and stabilizing net take rates through strategic initiatives.

Company overview

PayPal Holdings, Inc. operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. The company provides payment solutions under the PayPal, PayPal Credit, Braintree, Venmo, Xoom, PayPal Zettle, Hyperwallet, PayPal Honey, and Paidy names. Its payments platform allows consumers to send and receive payments in approximately 200 markets and in approximately 150 currencies, withdraw funds to their bank accounts in 56 currencies, and hold balances in their PayPal accounts in 25 currencies. The company was founded in 1998 and is headquartered in San Jose, California.

Industry: Financial Services

http://www.paypal.com/

PYPL’s share price is trading at 6-year lows…

Business segments

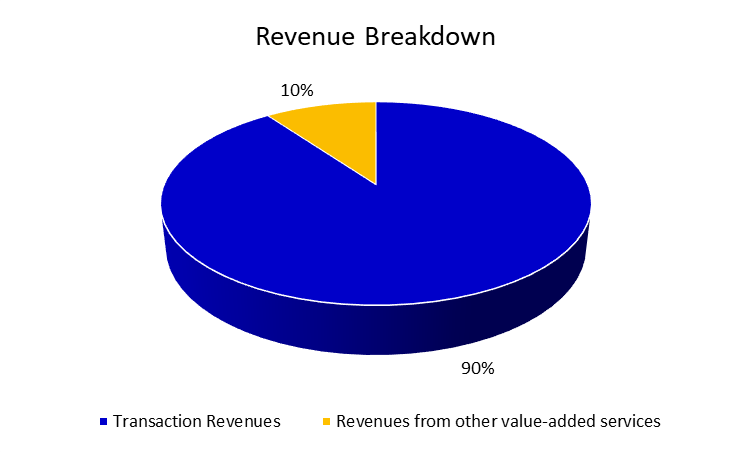

PayPal has 2 main business segments:

Transaction revenues: Net transaction fees to merchants and consumers for each transaction (Wallet & Commerce)

Revenues from other value-added services: Revenues through partnerships, referral fees, subscription fees, gateway fees, and services offered to merchants and consumers (Payments Service Provider)

Revenue drivers

Transaction Revenues:

PayPal's primary revenue driver involves net transaction fees from merchants and consumers, covering various activities like currency conversions, cross-border transactions, fund transfers, cryptocurrency transactions, and more. In Q3 FY 2023, transaction revenues surged by 7%, contributing over 90% to the company's total revenues.

Revenues From Other Added-Value Services:

Beyond transactions, PayPal diversifies its revenue streams through partnerships, referral fees, subscription fees, gateway fees, and additional services for merchants and consumers. The company also earns interest and fees from its loan receivables portfolio. In Q3 FY 2023, revenue from these value-added services marked a robust growth of 25%, constituting nearly 10% of the total revenue.

Cost drivers

PayPal's operational expenses are segregated into distinct categories, with the bulk falling under Selling, General & Administrative (SG&A) expenses (56%) and Research & Development (R&D) expenses (43%).

Transaction Costs:

Payment Network Fees: Fees remitted to card networks like Visa and Mastercard for transaction authorization (1.5% to 3.5% + fixed fee).

Fraud Prevention and Risk Management: Costs associated with anti-fraud systems, chargeback processing, and customer verification.

Technology Infrastructure: Expenses for maintaining servers, data centers, network infrastructure, and security systems.

Customer Support: Costs related to call centers, online chat support, email support, and dispute resolution teams.

R&D Expenses:

Substantial investments in developing innovative products, features, and technologies such as mobile payments, blockchain solutions, and AI-driven financial services.

Beyond these, external factors impacting cost drivers include shifts in the regulatory landscape, intense competition in the online payments sector pressuring PayPal to offer competitive pricing, and exposure to currency fluctuations in international operations. PayPal strategically manages costs by optimizing operational efficiency, leveraging scale for favorable supplier deals, and investing in technological solutions for process automation and reduced manual labor.

Competitor analysis

The dynamics of the Payments sector mark a notable shift from the conventional "zero-sum game" paradigm, resembling more of a "growing pie" scenario with ample opportunities for substantial growth. Under these conditions, most stakeholders have the potential to gain significantly, provided other variables remain constant.

Key Influences:

Technological Innovation (Disrupting Traditional Markets):

The advancement of technology plays a pivotal role in reshaping the conventional market landscape.

Evolving Customer Requirements (Agility and Customer Experience Focus):\

Adapting to changing customer needs and prioritizing an enhanced customer experience are crucial factors for success.

Regulatory Support (Advocacy for Financial Inclusion):

Supportive regulations, particularly those encouraging financial inclusion, contribute to the positive dynamics within the industry.

Porter's 5 Forces

Bargaining Power of Suppliers

The bargaining power of suppliers is low. For PayPal, its suppliers include global banks, cloud computing providers, data center operators that provide the scalability and reliability needed for PayPal's global operations. These suppliers offer a service that is pertinent to PayPal, but since the suppliers are concentrated, they compete to supply PayPal. Total payment volume in 2023 is $388bn in over 200 countries, which translates to millions of petabytes of data. PayPal is a valuable buyer for their products.

Industry Rivalry

The threat of rivalry is high. PayPal competes against a wide range of businesses, including banks, credit card providers, technology and ecommerce companies and traditional retailers. Competition includes major players such as Stripe, Square, Apple Pay. This leads to continual innovation and pricing pressure.

Despite stiff competition, PayPal achieves product differentiation by integrating its platform with thousands of e-commerce websites and by developing strategic partnerships. For example, PayPal has recently forged partnerships, including its collaboration with SAP, with the goal of streamlining digital payments through the PayPal Braintree Platform. Strategic partnerships like these, allow PayPal to increase their access to distribution channels, providing product differentiation.

Bargaining Power of Buyers

The bargaining power of buyers is medium. Consumers have numerous digital payment options, which moderately increases their numerous bargaining power. The existence of alternatives like Venmo, Zelle, Apple Pay, Google Pay, and bank transfers weakens PayPal's monopoly. Users can easily switch based on fees, features, or convenience. Buyers do also have alternatives like Bitcoin, but they are not widely accepted and used by the general population. Therefore, the threat of buyers is low to medium.

Threat of New Entrants

The threat of new entry into the money services industry is low. Industry is highly regulated with strict compliance requirements. Vast network of merchants to compete with. The money services industry relies heavily on advanced technological infrastructure for secure and efficient transactions. Existing firms have likely invested significantly in such technology, creating a technological barrier for new entrants. Evidently, the barriers to entry are significantly high for the money services industry. Firms wanting to enter or expand into this market must invest in technology, develop partnerships, attract diverse human capital, achieve economies of scale, and have access to distribution channels.

Threat of Substitutes

The threat of substitutes is medium. Continued innovation in the Fintech industry could lead to new, more convenient or cost-effective alternatives. While it dominates online payments, rivals like Apple Pay and Venmo woo younger users with sleek apps, while banks and cryptocurrencies lurk as future threats.

Management

PayPal has appointed Alex Chriss as its next President and CEO, effective September 27, 2023. Chriss, a seasoned business leader with a background in technology and product leadership, has served as Executive Vice President and General Manager of Intuit's Small Business and Self-Employed Group. His extensive experience includes leading a global organization responsible for delivering QuickBooks and Mailchimp to millions of users worldwide. Chriss played a pivotal role in growing Intuit's Small Business segment, achieving compound annual growth rates of 20% and 23% in customers and revenues, respectively. His leadership also contributed to the successful $12 billion acquisition of Mailchimp in 2021.

The appointment follows a comprehensive CEO search aimed at finding a next-generation leader with global payments, product, and technology expertise. Chriss received unanimous support from PayPal's Board and CEO search committee.

John Donahoe, Chair of the PayPal Board of Directors, expressed confidence in Chriss as the ideal leader to drive PayPal's growth opportunities. He acknowledged Dan Schulman, PayPal's outgoing CEO, for his outstanding contributions over eight years, during which he laid a strong foundation for the company's future. Schulman will continue serving on the board until the next annual meeting of stockholders in May 2024.

In his statement, Chriss highlighted his dedication to championing small and medium businesses and entrepreneurs, emphasizing their importance in global economies. He expressed pride in taking the reins from Schulman and eagerness to collaborate with PayPal's team to build on the company's history and deliver outstanding products and services.

The announcement marks a significant transition for PayPal, with Chriss poised to lead the company into its next phase of growth and expansion in the digital payments landscape.

Other Key Executives:

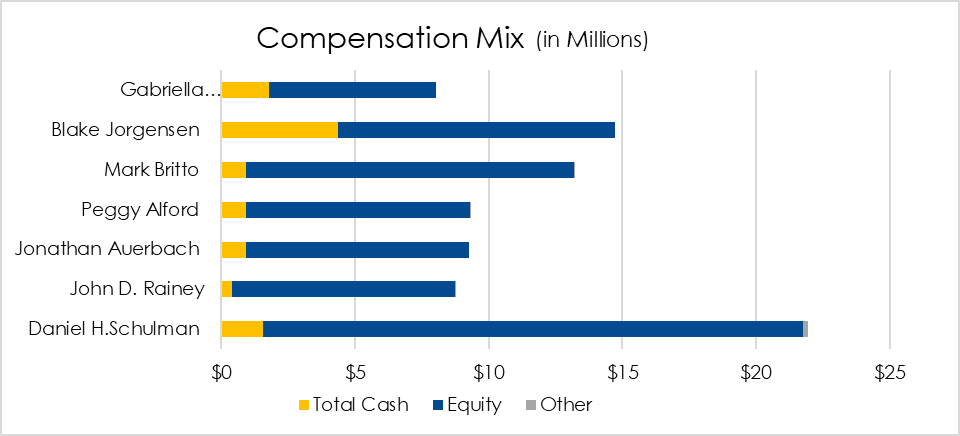

Compensation:

Industry:

Global payments revenues demonstrated robust performance, exhibiting resilience in the face of regional challenges. The year 2022 witnessed an impressive 11% surge in payments revenues, marking the second consecutive year of double-digit growth. This momentum propelled payments revenues to a historic high, surpassing the notable milestone of US$2.2 trillion.

The growth story was widespread, with North America, Latin America, and Europe, Middle East, and Africa (EMEA) all experiencing double-digit revenue growth. However, Asia-Pacific, traditionally a powerhouse for growth, encountered a slowdown in revenue expansion, primarily attributed to a 3% decline in Chinese payment revenues.

Looking ahead, the e-commerce landscape is poised for substantial expansion, with a projected annual growth rate of 9% over the next four years, reaching a staggering US$8.5 trillion globally. The United States is expected to keep pace with this growth trajectory, while emerging markets such as India and Indonesia are anticipated to emerge as leaders in this dynamic space.

Merchants and acquirers are strategically aligning their focus on augmenting online and omnichannel capabilities to capitalize on the burgeoning e-commerce market. In this evolving landscape, digital wallets are gaining prominence, impacting both online and point-of-sale transactions, potentially altering traditional card usage patterns.

Asia stands out as a frontrunner in the adoption of digital wallets, with a projected 36% penetration in e-commerce and 30% in point-of-sale transactions by 2026. In contrast, the United States is expected to trail behind with a 16% penetration rate by the same year. Europe, on the other hand, is witnessing a significant shift toward digital wallets, notably led by the United Kingdom, Italy, Spain, and Germany, where penetration rates are expected to surpass 30%. This collective industry shift underscores the evolving dynamics of the payments landscape, shaped by regional variations in adoption and technological trends.

Competition and Key Players:

With the digital payments landscape surging and digital wallets becoming king, payment giants like PayPal have a golden opportunity to capitalize on this evolution. Here's how:

Global Gateway:

PayPal's established network lets it crack emerging markets like India and Indonesia, poised for e-commerce explosions. Local partnerships can ease entry and bridge cultural gaps.

Omnichannel Oasis:

Seamless payment solutions across online and offline worlds are the future. Companies mastering both, from tap-and-pay coffee to one-click checkouts, will win hearts (and wallets).

Wallet Wonderland:

Digital wallets need to be more than money holders. Think loyalty programs, instant discounts, and unique features that make users ditch their plastic forever.

Merchant Marvels:

Businesses need tools to conquer the online shopping universe. Data insights, fraud shields, and customizable payment options are their secret weapons.

Regional Rhythms:

Payment preferences dance to different tunes around the globe. Understanding these rhythms and tailoring offerings to local beats is key to a harmonious global symphony.

E-commerce Alliances:

Teaming up with online giants, retailers, and even fintech startups can supercharge everyone's game. Together, they can build an irresistible e-commerce ecosystem.

Competitor analysis:

Economic moat

PYPL derived economic moats from two sources: (a) Expansive Network Effects and (b) Cost Advantage

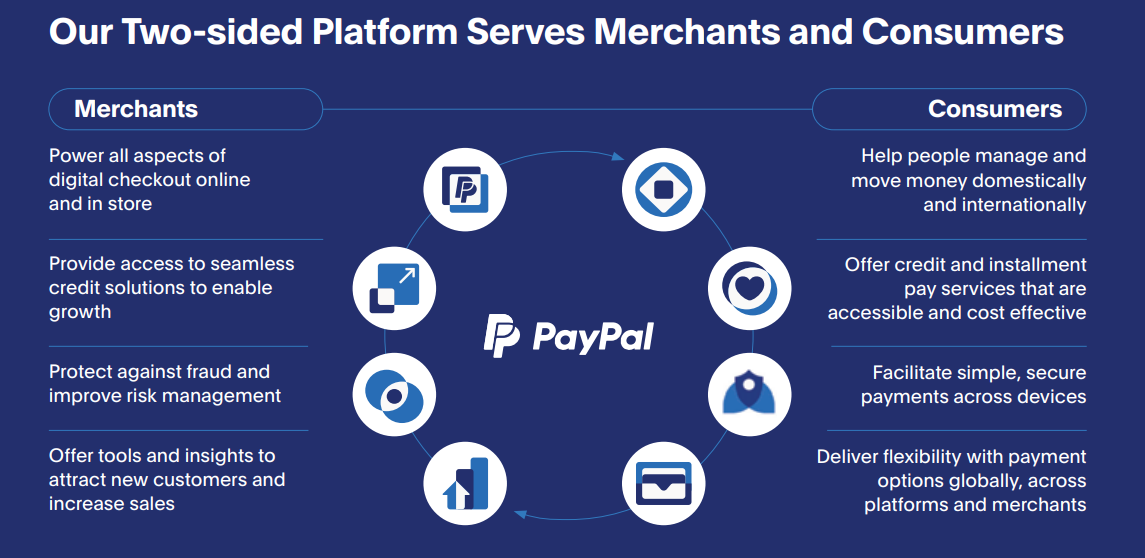

Interaction Points Between Consumers and Businesses Under PayPal’s Two-Sided Payment Network

Expansive Network Effects:

PayPal, a digital payment pioneer, processed nearly $1.4 trillion in payments in 2022, boasting 433 million active accounts, including 35 million merchants. At a high level, PayPal operates a two-sided platform that thrives by connecting merchants and consumers, creating powerful network effects that serve as the main source of the company's economic moat. This interdependence between both sides of the network establishes a mutually reinforcing cycle.

The fact that PayPal has a vast number of consumers on its network makes it a preferred choice for businesses to accept this form of payment. Having information on both sides of the transaction gives PayPal a substantial edge in combating fraud. With acceptance at approximately 80% of the top 1,500 retailers in North America and Europe, PayPal's dominance poses a significant barrier to potential competitors. Additionally, Venmo, PayPal's peer-to-peer service with over 80 million users, exhibits its own network effect, as increased users enhance the service's overall value.

Cost Advantage:

Over time, PayPal's advantageous unit economics are reinforcing its competitive edge, primarily driven by key costs such as transaction expenses (38% of revenues) and transaction and loan losses (8%), both of which are variable in nature. Non-transaction expenses (39% of revenue) are predominantly fixed, with 75% considered as such. As PayPal increases its Total Payment Volume (TPV), unit transaction costs proportionally decrease. The substantial growth in TPV, exemplified by a 15.1% increase in the third quarter of 2023 compared to the same period the previous year, underscores PayPal's scale and brand strength, manifested through over six billion processed transactions.

This continuous widening of PayPal's moat over time, especially relative to smaller players or new entrants, renders the expected economics of new entrants unfavorable, given PayPal's position as the absolute low-cost provider.

Financial statement analysis:

PYPL Ratio

In 2022, PayPal's revenues increased by 8.5% to $27.5 billion, marking a slowdown from previous years' double-digit growth. This year saw the first single-digit growth for the company in the last five years. The slowdown was due to lower total payment volume, transactions, and active accounts.

Despite these challenges, PayPal proved otherwise in 2023 and managed a total payment volume of $1.36 trillion, up from $1.25 trillion the previous year. Q3 2023 showed a positive trend with a 15% growth in total payment volume, outperforming previous quarters.

Peer-to-Peer Total Payment Volume (P2P TPV), including PayPal, Venmo, and Xoom, increased by 4% to $97 billion, constituting 25% of the total payment volume. This highlights the strength of Venmo within the company's payment ecosystem.

PayPal has experienced a lack of Free Cash Flow (FCF) growth since 2020, attributed to a diminishing transaction margin resulting from unbranded activities and challenges in achieving sustained reductions in non-transaction expenses. In the subsequent discussion, I will delve into the positive aspects of unbranded charges and the management's effectiveness in enforcing discipline regarding non-transaction expenses.

I advocate for a focus on the anticipated FCF yield, which strongly correlates with the buyback yield, to foster a more informed assessment of the investment's potential merits. For instance, in its most recent quarter ending on September 30, the company generated $1.1 billion in FCF, constituting 14.9% of its $7.4 billion in net revenue for the quarter. Applying a 15% FCF margin to this revenue projection implies that FCF could approach $5 billion (i.e., $32.17 billion x 0.15 = $4.83 billion). In essence, there is an expectation that the company will generate a substantial amount of FCF, providing opportunities for activities such as dividend payouts or stock buybacks.

In June 2022, PayPal's Board approved a substantial $15 billion stock buyback plan without a specified expiration date. Since its initiation, the company has pursued an aggressive share buyback strategy, deploying $4.5 billion in 2022 alone and a cumulative $11.1 billion over the past three years. Over the preceding five years, PayPal has allocated a total of $17 billion to share repurchases.

Throughout 2022, approximately 41 million shares of common stock were repurchased, amounting to a $4.2 billion investment. This figure increased to $4.4 billion in 2023. It's crucial to note that the management justifies these share repurchases as a means to counteract the dilution resulting from equity compensation programs. Additionally, management may opportunistically repurchase common stock based on market conditions and other factors.

Despite the ongoing share buyback efforts, the reduction in shares outstanding has been gradual, indicating a methodical approach. One positive thing that must be noted, however, is that of these $20.5bn of buybacks, $10.6bn were used on repurchases with the stock price above $100. Moving forward, I think that we can experience a more marked effect of share count reduction going forward. In the Q3 2023 earnings call, management presented the following statement: “On a trailing 12-month basis, PayPal returned $5.4B to stockholders by repurchasing ~75M shares, reducing weighted average shares by 5% y/y.” This shows that in the past year alone, they managed to accomplish a share reduction equivalent to half of what was achieved from 2016 until now.

As of now, the share buyback program still holds a substantial amount, suggesting the potential for further share repurchases in the future. It is worth noting that this may be partially offset by share-based employee compensation.

Investment thesis

The market has been incorrectly punishing PYPL for short term headwinds: In the face of recent challenges leading to a decline in PayPal's stock value, the company's resilience and strategic initiatives provide a robust foundation for sustained profitability and growth. PayPal's proactive measures to address transient headwinds are evident in its focused efforts on cost control. The last quarter witnessed a slump in shares following a cautionary note on slower margin growth. However, the subsequent decrease in non-transaction operating expenses, such as sales and marketing (-23%), customer support and operations (-13%), general and administrative (8%), and technology and development (9%), signals a positive shift. This reduction underscores PayPal's commitment to improving profitability and controlling costs.

A key indicator of PayPal's strength lies in its ability to adapt and thrive despite a decline in active accounts (0.6% drop by 2.8M). The company's strategic move to remove inactive accounts emphasizes its dedication to optimizing the user base and ensuring an unparalleled experience for its active users. Notably, PayPal's user growth may have declined, but the simultaneous growth in transaction volume and average value per account suggests a more engaged and active existing user base. This can be seen from the 13% rise in transactions per active account.

Furthermore, PayPal's geographical distribution of total payment volume (TPV), with approximately 63% in the U.S. and 37% internationally, offers insights into its market exposure. The impact of elevated U.S. interest rates and a stronger USD on FX-neutral growth has been notable since 1Q22. As these headwinds diminish, PayPal anticipates a potential tailwind in FY24, with reported TPV surpassing FX-neutral TPV growth. The convergence of constant-currency TPV growth with reported TPV growth by 2Q23 indicates a positive trend. The expected weakening of the USD and diminishing FX headwinds in FY24 could contribute significantly to PayPal's reported TPV, potentially recovering approximately $10 billion lost in 2Q23 due to FX headwinds.

With unbranded businesses taking the lead, investors have to look past the immediate margin concerns and embrace the vision for long term growth

PayPal's unbranded business is silently thriving, strategically countering short-term margin challenges with a focus on long-term growth. Despite the temporary decline in margins, the unbranded segment, driven by Braintree's robust performance, is anticipated to grow significantly, reaching an estimated $520 billion in 2023, while the branded segment is expected to achieve $430 billion in the same period.

The key driver behind the unbranded segment's success is the strategic partnerships and initiatives undertaken by PayPal. The collaboration with Booking.com and meta has been instrumental in fueling growth. For instance, Braintree's role in international card processing for Booking.com has not only facilitated a seamless transition but also significantly boosted authorization rates in partnered regions. The partnership with meta extends to powering end-to-end payments for sellers on Instagram and Facebook Shops, with PayPal Hyperwallet handling payouts to the creator community.

Furthermore, PayPal's complete payments (PPCP) strategy plays a crucial role in offsetting margin pressures in the unbranded segment. By migrating businesses to PPCP and enhancing the checkout experience with mobile in-app integrations, PayPal aims to target the SMB market, expand into new geographies, and cross-sell value-added services. The anticipated impact on revenue and take rate is substantial, potentially ranging from 2.00% to 4.00%, according to management projections.

PayPal is actively addressing the challenge of lower margins in the unbranded segment through strategic initiatives. Their expansion into new geographies with favorable pricing dynamics not only strengthens take rates but also diversifies revenue streams. Furthermore, cross-selling value-added services is a pivotal approach to optimizing profitability and generating additional revenue streams with the potential for higher margins.

A key strategic move for PayPal involves the introduction of passkeys in the US and Europe, streamlining the checkout login process and boosting authorization rates. This initiative solidifies PayPal's lead over competitors and sets the stage for sustained growth. Presently, around 70% of checkouts are passwordless, and this figure is expected to rise with the upcoming EU rollout of Passkeys in the next 12 months (currently implemented in the UK and Germany). This holds particular significance in easing conversions affected by Strong Customer Authentication (SCA) requirements.

PayPal's overarching goal is to continually narrow the gap in user login and checkout experiences each quarter, aiming to surpass or align with competitors within the next year. Concurrently, PayPal is dedicated to delivering distinct digital wallet experiences across both PayPal and Venmo platforms. They firmly believe that companies with unique and expansive datasets will fully leverage AI's potential, translating it into actionable insights and delivering distinct value propositions for their customers.

Looking ahead to FY24, the unbranded segment is expected to outpace the branded business in terms of growth. The strategic initiatives undertaken by PayPal, including geographic expansion and value-added services, are anticipated to moderate the degradation in net take rates, highlighting the company's commitment to navigating short-term challenges in pursuit of sustainable long-term success.

Valuation

This report employs the DCF model as its primary valuation methodology. Based on the DCF model, a target price of US$125.22 suggests a potential upside of 98.52% from current share price.

Beta: I used a beta of 1.34 for the DCF model. I utilized the historical beta calculation method to determine the beta of my stock. This involved conducting a regression analysis, specifically by regressing the historical excess returns of the market (S&P 500) against the historical excess returns of PYPL. Through this statistical analysis, I assessed the sensitivity of my stock to market movements over a specific historical timeframe. I then used a blended figure by taking the average of 5-year levered beta from Bloomberg and the 5-year levered beta calculated using historical regression.

Cost of Equity: I derived a figure of 10.53% based on the CAPM model. The risk free rate was 3.82% based on the US 10yr yield figure on 12/28/2023. The equity risk premium was derived from Damodaran Country Default Spread & Risk Premiums which is 5.00%

Cost of Debt: To calculate the after-tax cost of debt, you used the Interest Coverage Ratio (ICR) approach. The Interest Coverage Ratio is determined by dividing the company's Operating Income by its Interest Expense. In this case, the Interest Coverage Ratio is 12.6 times. Given the Synthetic Rating of AAA, which represents a very low default risk, and a Default Spread of 0.00%. SOFR (Secured Overnight Financing Rate) is used as a proxy for the risk-free rate and is provided at 5.35%. The pre-tax cost of debt is then calculated as the sum of the SOFR and the Default Spread, resulting in 5.35%. Applying the Marginal Tax Rate of 15.00% to this pre-tax cost of debt accounts for the tax shield on interest payments. This is done by multiplying the pre-tax cost of debt by (1 - Tax Rate). The after-tax cost of debt is thus calculated as 4.55%.

Weighted average cost of capital: Computed a figure of 8.01% by using the formula:

Projected Revenue Growth:

In my projection, I anticipate a dynamic revenue growth trajectory from 2023 to 2025, marked by accelerated rates attributed to the integration efforts aimed at achieving annualized synergies. Subsequently, from 2025 to 2027, my growth rates align with the Compound Annual Growth Rates (CAGRs) specific to the markets of the respective components.

The foundation of my revenue projection lies in taking a percentage of the total payment volume (TPV). The TPV growth exhibits a smoothing pattern, gradually increasing from 12% to approximately 15%. This aligns with my estimation based on the global e-commerce market's anticipated CAGR, which is expected to grow steadily from an estimated USD 7.60 trillion in 2023 to reach USD 16.24 trillion by 2028. The forecast period spans from 2023 to 2028, projecting an impressive CAGR of ~ 15.80%.

Terminal Growth rate:

I have incorporated a terminal/perpetuity growth rate of 2.1% into my projection, drawing this figure from the International Monetary Fund's data on the real GDP growth rate for the United States.

Relative Valuation Method:

Employing the exit EV/EBITDA multiple method, I determined the median EV/EBITDA of PayPal's peers through a Comparable Company Analysis, resulting in a figure of 16.5x. The outcomes of this analysis are noteworthy. The implied share price stands at 161.59, indicating an implied upside of 156%. Additionally, the 5-year implied EV/EBITDA is projected to be 38.5x.

Risks and mitigation

Cryptocurrency Risks:

PayPal introduced its own stablecoin (PSYUSD) in the absence of a comprehensive Federal framework for regulating and enforcing such assets. This move has faced political scrutiny, with figures like Maxine Waters emphasizing the necessity for Federal oversight and enforcement.

Mitigation:

PayPal has a positive track record of collaboration with regulators. Additionally, PayPal, alongside its stablecoin custodian Paxos, has implemented essential precautions, such as Anti-Money Laundering (AML) checks and the suspension of tokens associated with sanctioned entities.

Macro Pressures on Consumer Spending: In the face of inflationary pressures, discretionary spending has taken a hit, impacting various industries, including PayPal. Evolving post-pandemic spending patterns add further complexity. This necessitates strategic adjustments from PayPal to align with new market dynamics and consumer behaviors. Their ability to effectively navigate these multifaceted challenges will determine their future success. Mitigation:

Despite inflationary headwinds and rising interest rates, PayPal displayed remarkable resilience in Q2, achieving an 11% increase in Total Payment Volume (TPV) to $376.5 billion. Notably, Year-to-Date (YTD) Earnings Per Share (EPS) grew by a robust 25%. This sustained double-digit TPV growth trajectory, initiated in Q2 2022, underscores PayPal's ability to navigate complex macroeconomic environments and achieve continued success.

Fierce & Growing Competition:

PayPal's historically advantageous competitive standing is facing erosion due to intense rivalry from Apple Pay, Stripe, Ayden, and a perceived decline in market share to alternative e-commerce checkout solutions. Furthermore, Google and Amazon are expressing a keen interest in venturing into this sector, with the latter leveraging its established expertise in the domain

Mitigation: PayPal's introduction of its stable coin and crypto wallet is a strategic maneuver aimed at reigniting the expansion of its user base. Recognizing the swift growth and appeal of Apple Pay, especially among younger consumers, PayPal has collaborated with Apple to seamlessly integrate its payment solutions into the Apple ecosystem. The establishment of robust partnerships with prominent entities such as Etsy, Shopify, eBay, Adobe, and Booking.com reflects the company's commitment to fostering enduring relationships that withstand the test of time.

ESG assessment

ESG Rating overview

Sustainalytics → Sustainalytics is a leading independent ESG and corporate governance research, ratings and analytics firm that supports investors around the world with the development and implementation of responsible investment strategies

Refinitv → LSEG recognizes the increasingly critical importance of transparent, accurate and comparable environmental, social and governance (ESG) data and analytics for the financial industry. We strive to be the trusted and preferred partner in the transition to sustainable finance and are committed to bringing to the market an array of best-in-class data, analytics and workflow solutions, which allow customers to use LSEG data as the backbone of their investment processes.

MSCI ESG → ESG methodology documents describe the calculations, data inputs, and processes followed by MSCI ESG Research to maintain ESG methodologies.

In 2019, PayPal engaged in its inaugural Environmental, Social, and Governance (ESG) Materiality and Prioritization Assessment with SustainAbility. The comprehensive three-phase approach began with a Research & Landscape Assessment, analyzing existing programs, peer performance, and global ESG trends. Utilizing inputs from SASB, GRI, TCFD, U.N. SDGs, and others, PayPal identified 19 key ESG topics.

The Stakeholder Mapping & Engagement phase involved 130 stakeholders, including senior leadership and a global employee survey. External engagements included discussions with NGOs, peer companies, financial health experts, and investors, providing valuable insights.

The Topic Analysis & Prioritization phase categorized ESG topics based on impact, stakeholder concern, perceived performance, influence, and societal/environmental impact. The materiality matrix emphasized the centrality of PayPal's mission and values, guiding its ESG strategy.

Aligned with the U.N. Sustainable Development Goals (SDGs), PayPal makes a direct, positive contribution to 10 of the 17 SDGs, emphasizing goals related to economic rights, employment, financial access, transaction cost reduction, and effective partnerships. This assessment underscores PayPal's commitment to responsible business practices, social innovation, employee well-being, and environmental sustainability, forming the basis for its ESG strategy.

PYPL ESG Materiality Matrix

Sources

https://s201.q4cdn.com/231198771/files/doc_financials/2023/q3/PYPL-Q3-23-Investor-Update.pdf

https://investor.pypl.com/financials/quarterly-results/default.aspx

https://s201.q4cdn.com/231198771/files/doc_financials/2023/q2/PYPL-Q2-23-Investor-Update.pdf

https://app.tikr.com/

https://www.imf.org/en/Countries/USA

https://investor.pypl.com/esg-strategy/default.aspx

https://www.morningstar.com/stocks/xnas/pypl/sustainability

https://www.sustainalytics.com/esg-rating/paypal-holdings-inc/1007990978

https://financefeeds.com/paypal-stock-rises-after-revealing-its-own-cryptocurrency-paypalusd/

https://ecommercenews.eu/paypal-introduces-passkeys-in-germany-and-the-uk/

https://www.bankingday.com/paypal-introduces-passkeys-in-australia

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.