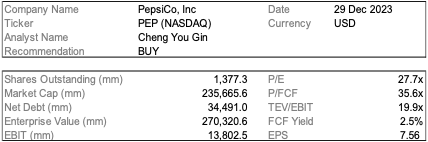

Initial Report: PepsiCo (PEP), 50% 5-Year Potential Upside (Yougin CHENG, VIP SEA)

Yougin believes that the further price hikes, concerns of weight loss and global shift are the reasons that Pepsi revenue will grow.

Linkedin | Yougin CHENG

PepsiCo(PEP) is a global food and beverage leader with a diverse product portfolio that includes a wide range of snack foods and beverages. PEP had been experiencing steady revenue and earnings growth with revenue set to grow by 6% and earnings by 11% in 2023. This growth can be attributed to strong brand portfolios, diversified product lines, and a focus on innovation and market expansion. With an integrated distribution network and vast product mix, the company is set to grow consistently in the near future. I believe the company is undervalued as macro and fundamental headwinds such as the development of weight loss drugs are overblown. My thesis for this stock consists of:

1) Further price hikes to drive revenue will continually sustain profits enabled by strong brand and pricing power.

2) Fundamental Headwinds are overblown - effects of weight loss drugs like Ozempic are unlikely to have material impact on PEP’s business

3) PEP stands to benefit from a temporary global macro shift

Business Segments:

PEP has seven business segments:

(1) PEP Beverages North America (PBNA)

(2) Frito-Lay North America (FLNA)

(3) Europe

(4) Quaker Foods North America, (5) Africa, Middle East, and South Asia, (6) Latin America, and (7) Asia Pacific, Australia, New Zealand, and China.

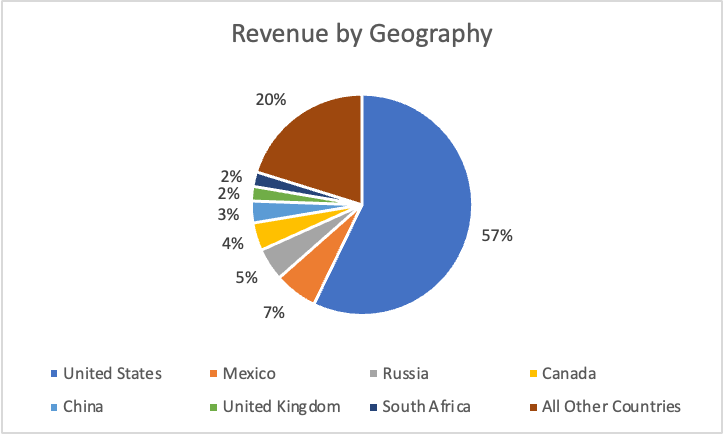

Revenue Segments:

PBNA constitutes all beverages (including product and endorsed brands) business across the U.S. and Canada and constitutes 30% of all revenue.

FLNA focuses on potato chips brands in the North American markets of the U.S. and Canada and constitutes 25% of all revenue.

Europe operates a full range of beverages, food, and snack products and contributes about 15% of all revenue.

Further price hikes to drive revenue will continually sustain profits enabled by strong brand and pricing power.

PEP has a strong foothold in the snacks and beverages segment enabled by its wide product mix.

Products Brands:

PEP has a wide range of product brands in different categories, including snacks (Lay’s, Doritos, Cheetos, etc), beverages (Pepsi, Mountain Dew, Gatorade, etc) and nutrition (Quaker Oats, etc). PEP’s wide variety of products appeal to a diverse range of consumers with different tastes and preferences.[1]

Endorsed Brands:

PEP engages in partnerships with various brands to market and distribute products under the PEP brand allowing it to expand into various competitive markets by leveraging on the strong brand of its partners to promote and sell the product.

Examples include exclusive agreement with Starbucks to distribute and market Starbucks bottled coffee beverages, including Frappuccinos and cold brew, under the PEP brand.

Its partners focus on the production of the product while PEP focuses on marketing and distribution by leveraging its strong brand reputation and marketing channels.By partnering with these companies, PEP has been able to expand its product line and enter new markets without having to invest in the development and production of new products.

PEP has a strong brand reputation and a wide reach to consumers. Its products touch 94% of households and every zip code in America. [2]

PEP raised its prices by approximately 11% and this is the 7th consecutive quarter that it has raised its prices. Despite this, earnings increased by 14% indicating its strong pricing power. Going into 2024, PEP also plans for a "modest" price hike as demand held up this year despite the multiple increases.

Its strong brand and product mix is reflected in its growth. PEP is a mature and stable company and is able to protect and increase its market share relative to its peers in the beverages segment [3]. Despite being approximately twice the size, PEP is able to maintain a similar 6% organic growth. For a comparison, Coca-cola’s(KO) growth was driven by a price contribution of 5% and a volume contribution of 1%, whereas PEP had a 12% price increase offset by negative 6% growth. This fall in volume was due to the aggressiveness and size of the price hike as PEP raised its prices later than KO. Both companies raised prices at pretty much a similar rate but KO over a longer period which began earlier.

[5]

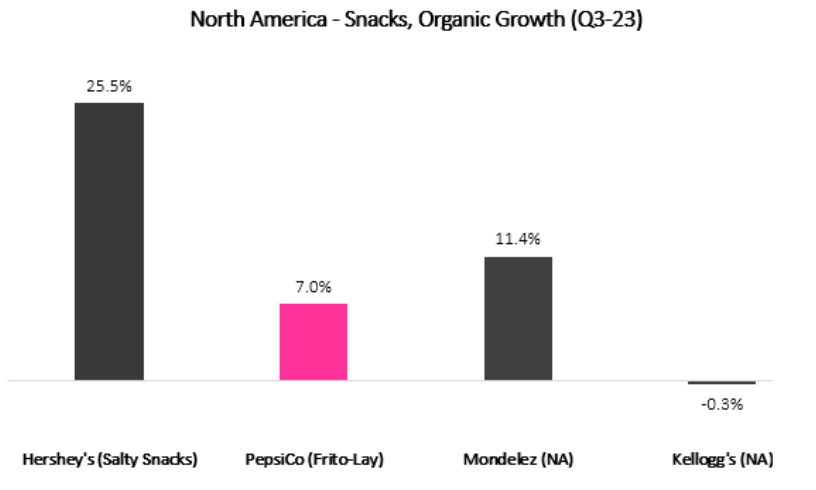

Looking at its snacks segment, its 7.0% organic growth is made up of 7.5% in price hikes offset by 0.5% negative volume. This growth in sales is strong taking into consideration its size vs its peers. PEP sales of $5.95B in the quarter, compared to Mondelez with $2.85B and Hershey's with a much smaller $0.34B.

With its strong foothold in the beverage and snacks market, it will be able to drive revenue with price hikes despite smaller reduction in volume.

Concerns of weight loss drugs are overblown causing the decline in price in Q3 to be unjustified:

Walmart Inc executive John Furner told Bloomberg that a new generation of weight loss drugs are causing consumers to cut back on groceries and beverages that are high in calories causing shares of both PEP and KO to collapse. These drugs reduce appetite and cravings, therefore altering the physiology that goes on within the body.

45% of the U.S. population is deemed as obese with as much as 70% categorized as overweight.

More than 9 million prescriptions for these kinds of drugs were written in the U.S. Q4 2022, with the number of patients taking such drugs reaching an estimated 24 million, or nearly 7% of the U.S. population, by 2035.

However, such concerns the uptake of the drug will be slow. Drugs like Wegovy and Ozempic are expensive, with a list price of roughly $1,000 a month making it unaffordable to the average consumer. [4] Additionally many of the consumers who snack likely won’t be able to afford Wegovy or Ozempic as such snacks often considered as ‘junk food’ generally over-indexes toward lower-income individuals, who are unlikely to be these drugs’ primary users.

It takes time for the drugs to become more affordable and snack companies like PEP will have adjusted to the shifting consumer behavior. As such the impact of weight loss drugs in the near term is extremely limited and there is an overreaction in the share price movement.

Snacking as a consumer trend is also growing [6] where snacks have grown to become entire meals rather than for just munching. Almost half of US consumers have 3 or more snacks daily - up 8% in the last 2 years driven by Millenials and Gen Zs.

There is a growth from more indulgent salty snacks towards health-forward snacks and PEP is able to capture this market with its deep portfolio of other snacks such as Grandma's cookies, Funyuns, PopCorners, Bare baked fruit and coconut snacks, Cracker Jack and Off the Eaten Path vegetable crisps.

Despite such concerns, earnings have been beating forecasts consistently for the past 3 quarters and for 2023, Pepsi now expects constant currency earnings per share growth of 13%, up from its prior forecast of 12%, its 3rd hike in its 2023 forecast.

Global shift in sectors towards consumer staples due to business cycle giving PEP’s shares a boost

Consumer staples are essential products that people consume on a daily basis and are considered as a necessity. As such people continue to buy them regardless of their financial situation. This makes it a defensive sector during economic downturns where a mild recession is expected to occur in 2024.

Additionally, treasury yield has fallen from a high of 5% making PEP’s 3% dividend yield more attractive than before.

Competitors:

[7]

Overall, the U.S. snacking marketing is valued at $115 billion, according to PEP, giving the company roughly 20% ownership of the segment. The segment is expected to grow annually by approximately 5% [6]

Coca-Cola, Pepsi and Dr Pepper dominate the beverage market taking approximately 40%, 28% and 25% of the market share respectively .

Currently, PEP has lower valuation multiples compared to its peers.

Why not Coca-Cola:

KO is a fully beverage company and does not own any snacks or chips brand whereas PEP has diversified its portfolio by competing in both the beverage and snack markets. With its diversified portfolio, it can better capture changing consumer trends such as healthy snacking. PEP has more flexibility to adapt as it has in the past due to its different business strategy. Eg. PEP continuously innovates by introducing new flavors, brand extensions such as dips.

Fundamentally, both companies are great and generate good cash flows but looking at a technical perspective in share price movement, PEP seems more attractive.

KO’s stock price has been going sideways for the past 1-2 years whereas PEP has been trending nicely less the recent pull backs due to developments in the weight-loss drugs. PEP’s stock has also not rebounded as much since its recent lows.

[8]

PEP’s market capitalisation is growing at a faster rate than KO’s and is set to overtake KO’s soon due to snack’s segment outperformance against other segments.

Valuation:

PEP is currently trading at a PE of 27.7x and has a forward P/E of 20.5x. I expect PEP’s revenue growth to be high-single-digit due to a combination of revenue growth, driven by higher prices.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

[1]https://thebrandhopper.com/2023/03/28/exploring-brand-architecture-of-PEP/

[3]https://fortune.com/2023/05/15/millennials-gen-z-snacking-spawned-181-billion-industry-food-meals/

[4]https://www.cnbc.com/2023/10/01/kellanova-bets-on-snacking-as-ozempic-wegovy-take-off.html

[5]https://seekingalpha.com/article/4652754-PEP-should-investors-be-concerned-over-declining-volumes

[7]https://www.cnbc.com/2023/10/01/kellanova-bets-on-snacking-as-ozempic-wegovy-take-off.html

[8]https://www.netcials.com/financial-marketcap-comparison-usa/KO-PEP/