Initial Report: Procore Technologies Inc. (NYSE: PCOR), 169.5% 5-yr Potential Upside (Keagan Tan, Varsity Program)

Keagan Tan, a Z Club Varsity Programme member, presentsweighs in on how increasing IT use in construction and the increasing complexity of construction projects creates significant upside for Procore.

Executive Summary

I am initiating a BUY recommendation on Procore Technologies (NYSE: PCOR) with a bullish outlook, projecting a 169.5% upside potential over a five-year horizon. This recommendation is grounded in Procore’s proven strengths, including its unique business model and the accelerating adoption of construction management software across the industry. As construction firms increasingly embrace digital solutions to address labour shortages, project complexity, and efficiency challenges, Procore is well-positioned to capitalise on this trend and deliver significant value to investors.

1 | Construction

The construction industry has always been one of the largest sectors globally. In 2023, it accounted for USD 13 trillion in gross annual output, representing approximately 7% of global gross output. It is also poised for significant growth, with global construction spending projected to rise from USD 13 trillion in 2023 to an impressive USD 22 trillion by 2040, representing a CAGR of 3.2%. This is in part due to stimulus by governments, such as the $1.2 trillion Bipartisan Infrastructure Law in the United States and the €800 billion NextGenerationEU fund in Europe. This expansion is driven not only by the need to meet critical economic and societal demands for offices, housing, hospitals, and infrastructure, but also by the industry’s pivotal role in achieving net-zero goals by 2050. The construction sector will be integral in developing and executing projects focused on renewables, low-carbon technologies, and energy-efficient infrastructure.

1.1 | The issue

while the demand is obvious, it’s unclear whether the industry can meet it. Firstly, the sector is lacking capable workers, the construction workforce in US alone is already facing a significant demographic shift, with a large portion of its workers in older age brackets. By 2031, it's projected that 41% of the workforce hired before 2020 will retire. This trend can also be observed across other advanced economies, such as China, where overall workforce projections are near zero or negative due to aging. Secondly, construction productivity — the efficiency of construction projects being completed — has been stagnating. According to a study by McKinsey, construction productivity improved by only 10% between 2000 and 2022, and declined by 8% from 2020 to 2022. Contrasted against a 50% productivity improvement for the whole economy and 90% productivity improvement for the manufacturing sector, it’s clear that the construction industry faces challenges in keeping pace with other sectors in terms of efficiency and innovation.

As I dug deeper into why the construction sector struggles with low labour productivity, I discovered a few key reasons as to why this was the case. Firstly, the industry is heavily regulated and relies a lot on public-sector demand, but informality — and sometimes even corruption — can distort how the market works. Secondly, the industry is also very fragmented, contracts often don’t align risks and rewards properly, and inexperienced owners or buyers face troubles when navigating such an opaque and complex marketplace. These factors lead to poor project management, execution gaps, and a lack of skills. Thirdly, many companies still rely on manual processes and paper-based systems. While these methods are time-consuming and prone to errors, some firms stick with them because they’re familiar and feel manageable. Switching to digital solutions can be costly and overwhelming, even if it might save time and reduce mistakes in the long run. It’s a classic case of sticking with what you’re comfortable with, even if it’s not the most efficient option.

According to JBKnowledge’s 2019 Construction Technology Report, 40% of construction companies continue to rely on paper plans on the job site, while nearly 50% of construction professionals still manually prepare and process daily reports. Even among those who use software, over half (53%) manually transfer data between the different apps they use to manage projects. Considering that construction software has been available since the digital age, it’s surprising that adoption hasn’t been more widespread, especially with its appeal to boost productivity.

1.2 | Why is construction software penetration still so low?

Due to the low productivity, engineering and construction teams around the world are finding it increasingly difficult to keep pace with the growing number of projects. They’re already facing shortages in critical roles —engineers, skilled craft workers, and project managers — and there are no clear signs that the labour market will catch up to the demand anytime soon. Despite this, construction companies are not interested in improving productivity because it is not the primary metric used to measure the operational success of projects. Instead, their focus tends to be on meeting delivery deadlines, as even a single day of delay can cost the owner company significantly more than hiring additional workers to complete the project on time.

Thus, making the case for spending on software is tough for construction companies, especially when there is limited capacity for investment. The industry has low margins and faces increasing economic headwinds, including materials cost inflation. With such thin margins, firms are hesitant to take risks or invest in improvements, especially when returns on investment are uncertain. Low margins have also pushed companies toward a capital-light approach, focusing on minimising expenses rather than making bold moves. When earnings are already slim, the idea of investing in productivity improvements — even if they could pay off in the long term — is a gamble many aren’t willing to take. Moreover, the typical IT spend for these companies is 1% to 2% of the revenue, compared with the 3% to 5% average across industries. Against this backdrop, software solutions must come with a business case. Although ROI can be high, players have not been effective at quantifying benefits.

1.3 | Industry – Construction Software

There are different types of construction software for different needs. One popular category is BIM (Building Information Modelling), which focuses on design and planning, it utilises 3D models to manage a building’s details throughout its life, BIM is typically used by architects and engineers. The other type of construction software is Construction Management Software (CMS) is geared toward the administrative and operational aspects of construction, such as project coordination, scheduling, and budgeting. CMS’ key customers are general contractors and subcontractors. In this memo, I will be focusing specifically on CMS.

Before going further, I feel it’s necessary to lay the groundwork for understanding how the different stakeholders (users of CMS) are involved in the construction process. Starting with a simple example of you purchasing a home: You (Owner) bought a house but want to renovate it completely. To do so, you’ll hire a general contractor (GC) to coordinate and execute the entire renovation process. Supposing you have some unique requests that the GC is unable to fulfil with his team; the GC would then hire a specialist/sub-contractor (SC) to help with specific tasks, such as plumbing, or flooring. The GC takes on the primary responsibility of overseeing and coordinating all parties involved, playing the most crucial role throughout the entire process.

For commercial developments, it becomes a lot more complex. It involves a developer (Owner) who may be a business or individual that purchased a plot of land and wants to build a shopping centre. Based on the price they paid for that land; the Owner would then put out an Invitation to Bid (ITB). GC would submit bids based on several factors, such as how much GC’s think it will cost and the duration of the project. The Owner would then select the bid — sometimes selecting the lowest GC bid to minimise costs and improve margins — and the GC with the winning bid would proceed to hire the SC and get started on the project.

It’s worth noting that CMS typically offers solutions that span the entire life cycle of a construction project. Additionally, many companies that provide construction software often offer multiple solutions, including both CMS and BIM, allowing users to address both the operational and design aspects of their projects within a single ecosystem.

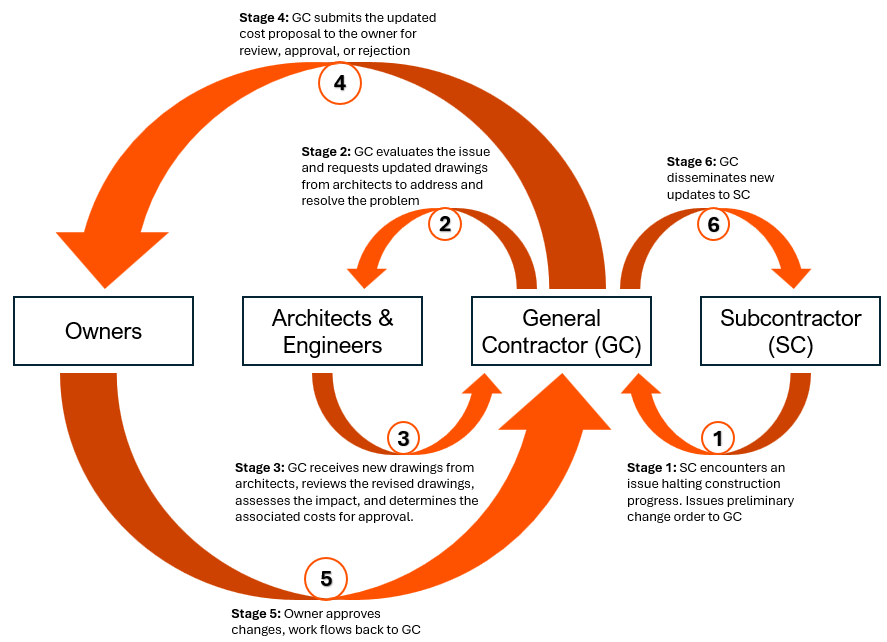

While the construction process may seem relatively straightforward, complications can arise extremely easily. Just for the sake of illustration, imagine if the GC uses Google Drive while the SC uses Microsoft OneDrive; or if the GC used WeChat and the SC uses WhatsApp. The key stakeholders would not be able to communicate effectively or share important documents such as blueprints or floorplans. The complexities in the construction workflow are best illustrated by a change order, which is typically kicked off by the SC when they run into an issue that forces them to pause construction.

Change orders occur regularly throughout the lifecycle of a construction project. They are complex and time-consuming process due to the need for constant updates, approvals, and communication across multiple stakeholders; frequently causing bottlenecks and delays. This is where CMS comes into play, it bridges the divide between stakeholders and enhances work productivity by acting as a single source of truth. Aside from providing a channel for communication and documentation sharing, these applications are designed to address the full range of issues faced by stakeholders as shown below

1.4 | Competitive Positioning

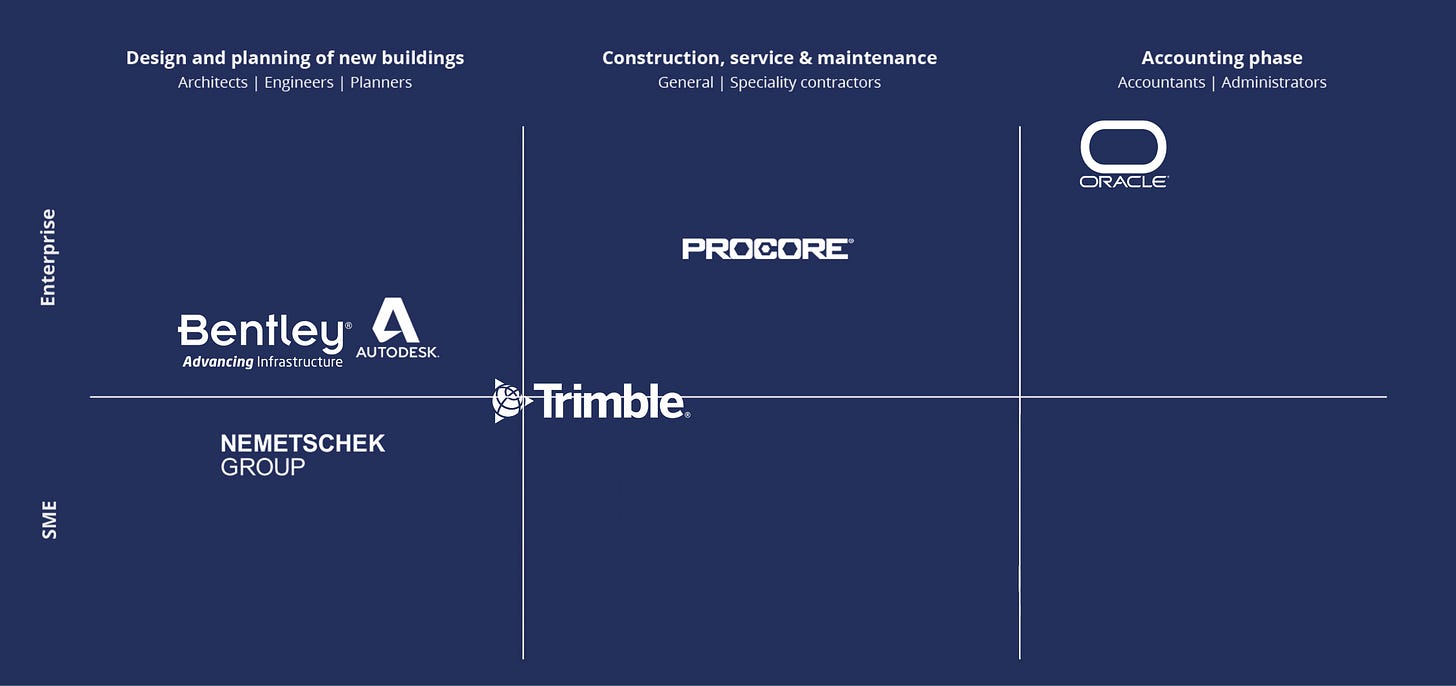

Source: Apps Run The World

The top 10 CMS vendors command 45.6% of the total market globally. Autodesk was the leader, with a 6.9% market share, followed by Procore with 6.8% and then Oracle with 6.6%. The CMS space is extremely competitive, particularly at the top. Incumbents resort to competing through go-to-market strategies or sales and marketing strategies due to marginal differences in product offerings and technology.

Within this chart are the companies are who I believe are the key players leading the CMS market, it can be segmented into three distinct categories of offers, each catering to unique stakeholders. Although these companies offer extremely similar products, like workforce management tools, they were scattered based on the focus and popularity of their primary offerings within the industry. With this chart, I would also like to emphasise that Procore is the only vertical construction management software. It is also the youngest amongst the rest — going public in 2021 while the other 5 were founded and listed well before 2000. How was Procore able to steal market share from competitors and position itself at where it is today?

2 | Business Overview - The History of Procore

Procore Technologies was founded in 2002 by current CEO Tooey Courtemanche, Tooey was very familiar with the construction industry, having worked as a carpenter through junior and high school summer breaks and as a real estate developer after college. During his mid-twenties, he founded a technology company at Silicon Valley which focused on front-end (UI/UX) implementation for companies. The idea of a construction management software came to him as he was building a home for his family, after encountering many setbacks throughout the construction process with no clear lines of communication. Tooey observed that the construction industry then was still heavily dependent on manual, pen and paper processes and realised that there was a market opportunity for a construction management software. Procore started off as a simple app, tracking the activities of workers onsite. Just 2 years after its inception, Procore raised a $950,000 seed round led by current board member Kevin O’Connor. With an initial pricing model of $195 per month, they successfully onboarded contractors for several celebrities like Eddie Murphy and Ben Stiller to monitor their home renovations with Procore. Their business model adopted a simple and focused approach — serving custom home builders concentrating on a specific customer segment (high-net-worth individuals). Procore helped to facilitate the coordination between homeowners who were constantly on the move and a scattered builder team.

Its 2006, Wi-Fi was scarce, and smartphones lacked the capabilities they have today. To keep Procore running, Tooey and his team had to travel constantly, setting up hot spots for clients at a loss. He faced rejection from Silicon Valley venture capitalists when seeking funding, with some dismissing his industry-focused approach. The situation worsened with the 2008 financial crisis, residential construction came to a halt overnight; Tooey to mortgage his house, cut his salary to zero, and lay off nearly his entire team. Residential building companies either scaled down or went bankrupt, forcing Procore to pivot toward commercial projects with mixed-use and commercial builders. Tooey remained optimistic that the construction industry would inevitably embrace IT — it was only a matter of time. He ensured that Procore was ready for this shift by expanding and serving multiple stakeholders instead of just the construction project manager. Sure enough, the tides began to turn in Procore’s favour as a new generation of construction workers started integrating software into their workflows. New devices like the iPad, combined with advancements in internet infrastructure, enabled Procore to be used directly in the field and further accelerating its growth. As adoption surged, Silicon Valley took notice, Bessemer Venture Partners led a $15 million investment round in 2014, followed by an additional $30 million with Iconiq Capital just 10 months later.

It wasn’t until 2016 that Procore expanded its platform beyond construction management software by introducing new products. While some might view this as a late move, this delay allowed Procore to establish a solid foundation prior to expanding their product line. Their customer-centric approach ensured that new solutions were only developed in direct response to customer demands. Over time, this disciplined strategy proved especially effective in the construction industry, which was largely non-digitised and faced clear challenges. By letting customer needs shape their product roadmap, Procore ensured that each new addition gained immediate market traction.

2.1 | Procore’s business model

Today, Procore has 5 integrated product categories: 1. Preconstruction, 2. Project Execution, 3. Workforce Management, 4. Financial Management, and 5. Construction Intelligence. Project Execution is the most popular product amongst users and has the highest attach rate. Procore employs a land and expand strategy, using Workforce Management as the initial entry point due to its high ASP. Once a customer is onboarded, Procore expands its relationship by increasing project volume on the platform and then cross-selling additional products across multiple contract cycles. Growth is primarily driven by volume expansion, as customers manage more projects on the platform. Over time, customers adopt complementary products like Quality & Safety and Financial Management, which, despite having lower ASPs than Project Execution, play a crucial role in expanding total committed construction volume. This deeper integration not only strengthens Procore’s foothold within customer operations but also enhances platform stickiness, making it more indispensable to their workflows. As companies rely on multiple Procore solutions across various project phases, switching costs increase, further reinforcing long-term customer retention.

Source: Procore FY24 Investor Day Presentation

Procore had since updated their pricing model, basing it instead on the Annual Construction Volume (ACV) managed on its platform. ACV refers to the total value of construction projects that customers have committed to running on Procore's platform each year, and customers pay in proportion to their construction activity. It is also designed to scale with the volume of construction managed on their platform. Price estimates are not publicly listed on their websites as it depends on the specific needs of the company or project. From my own research however, I found that Procore could charge about 0.1%-0.175% of ACV. Customers also enjoy more favourable rates with higher volume commitments, as the basis points decrease with increased usage. However, if a customer's volume decreases, the basis points may increase accordingly — indicating that Procore is more suitable for much large enterprise customers rather than SME customers. Since customers are not charged on a per-seat basis, Procore allows unlimited users onto the platform during a project; enhancing its appeal to larger firms.

On top of their stickiness, Procore cultivates platform virality by effectively encouraging adoption through firsthand experience. Non-users are allowed to experience the full range of its features when working with a Procore customer. As these new users engage with the platform’s tools (without the need for any sign-ups or commitments), they experience Procore’s value in its ability to enhance project efficiency and collaboration. This approach also allows the new users to familiarise themselves with the program, increasing the likelihood of them adopting it for their own future projects. Project managers who are Procore users also bring the software with them as they move between companies, expanding the platform's reach and reinforcing its position within the construction industry. This strategy was responsible for carrying Procore upmarket, enabling it to scale and compete with established SaaS giants like Autodesk.

In summary, Procore’s subscription model and vertical focus positioned them as a leader in CMS, giving them a competitive edge over broader SaaS providers. As the industry gradually embraced digital transformation, Procore’s tailored solutions found strong product-market fit, driving adoption across both SME and larger enterprises.

2.2 | Moat

Remember the example of the SC and GC using different applications? Procore is able to address this disconnect by seamlessly integrating these disparate systems into its platform. Why is this important? Picture yourself as a SC who has never used Procore before and was recently hired by a GC who introduced you to the platform.

The SC unfamiliarity with the platform could initially slow down the efficiency of the project. However, Procore addresses this challenge by integrating a wide range of third-party applications that subcontractors may already be familiar with. For example, while the GC might use Procore’s in-house field scheduling feature to plan worker schedules, the SC could continue using Microsoft Project for their scheduling needs. By integrating Microsoft Project with Procore, both parties can seamlessly share and view each other’s schedules, ensuring better coordination and collaboration without disrupting existing workflows. This flexibility helps bridge the gap between different tools and teams, ultimately enhancing project efficiency.

Procore Marketplace is an ecosystem of third-party applications and integrations designed to extend the functionality of Procore's construction management software. As of February 2025, there are over 550 different applications from various categories that users can integrate into their workflow.

*Oracle’s Construction software

**Autodesk entered into an interoperability agreement with Nemetschek, sharing their API and ecosystem

The moat initially seems shallow because APIs allow app developers to create custom integrations, so what if Procore offers so much more integrations than everyone else? There are some key considerations you should note: Since Procore only focuses on construction management, their partner apps covers everything from drones to safety compliance, allowing construction companies more flexibility to tailor solutions. On the other hand, third-party apps found on Autodesk or Trimble may not even be related to construction, thus the true number of integrated CMS apps may be even lower. Secondly, construction firms — with their low IT spend — are unlikely to hire a software developer to create an app to be integrated into their construction software. Hence, they are likely to just use Procore and its full range of third-party app offerings.

Procore has cemented itself as the leading construction management software, becoming so integral to the industry that many construction firms now consider proficiency in Procore a key requirement in their hiring process.

3 | Key operating metrics

Procore’s revenue has grown at 30.8% CAGR from FY21-24, this was mainly driven by customer growth (11.9%) as well as an increase in production adoption; the number of customers contributing more than $100,000 in ARR increased by 20% yoy and the number of customers contributing more than $1,000,000 in ARR increased 39% yoy. They have also had a Net Revenue Retention rate (NRR) of 106% as of 2024. Furthermore, despite the intense competition in the CMS space, Procore continues to outperform its competitors in non-GAAP operating margin growth.

4 | Thesis: Topline growth as construction spending on IT increases

I expect construction spend in IT to increase to around 5% due to the younger generation of workers adopting software over traditional methods and the growing complexity of projects driving the need for advanced management tools. CMS companies such as Procore are especially experiencing a surge in adoption, compared to other types of construction software like BIM. A contractor survey by L.E.K. Consulting’s found that use of cloud-based construction management software among contractors jumped significantly, from 14% in 2022 to 51% in 2023 — with a growth rate more than double that of any other technology in the industry.

4.1 | Construction software are increasingly being used in schools with construction-related programs.

Similar to how data analytics students in school use Tableau or Power BI in classes, AEC (Architecture, Engineering, Construction) programs are beginning to implement construction software into their teaching curriculum as they prepare the future generation of builders. Procore further leverages on this by donating their software and training to construction professors, as well as offering resources for teaching Procore in the classroom. After graduation, the younger generation of workers are more likely to embrace technology for efficiency, collaboration, and project management, aligning perfectly with the capabilities of construction software. As a result, younger construction workers drive faster technology adoption compared to older individuals in the industry, especially as more baby boomers retire.

4.2 | Increase in complexity of construction projects

Construction projects are becoming more complex, with intricate designs and advanced requirements. To tackle these challenges, an increased number of professionals are starting to turn towards construction software. These tools streamline planning, coordination, and execution, helping projects stay on track and within budget. With features like real-time collaboration, centralized data management, and tools for complex workflows, construction software meets the demands of modern projects. As a result, its use is expected to grow significantly, becoming essential for managing complexity and ensuring success.

5 | Valuation

Procore currently trades at a 9.6x EV/Revenue and a 61.52x forward P/E.

5.1 | Bull Case

In my bull case, the construction industry accelerates its adoption of technology, driven by labor shortages, increasing project complexity, and a growing number of younger workers integrating construction software into their workflows. Procore continues to capture market share in the rapidly expanding construction software industry. I estimate revenue growing at a 15% CAGR, with the EV/Revenue multiple expanding to 13x.

5.2 | Bear case

In my bear case, a recession or slowdown in the construction industry reduces demand for Procore’s software, as contractors cut back on discretionary spending. Intense competition forces Procore to lower prices or offer discounts, squeezing margins and slowing revenue growth. As a result, the EV/Revenue multiple de-rates to 7x, and revenue growth declines to a 5% CAGR.

6 | Risks

Macro Risk: Procore’s revenue is completely tied to the performance of the construction industry. Any downturn in the industry — such as economic recessions, reduced infrastructure spending, or delays in construction activity — could directly impact its growth and customer retention. This makes Procore vulnerable to cyclical fluctuations in the construction sector.

Good read, thanks Kegan. Some questions from me:

1. Regarding the competitor landscape, I think the main competitor in this pure-play construction software is Autodesk with its Autodesk Construction Cloud. What is the likelihood for Procore to win Autodesk, especially when Autodesk has scalability?

2. You mentioned that $PCOR uses a land and expand strategy: "Once a customer is onboarded, Procore expands its relationship by increasing project volume on the platform and then cross-selling additional products across multiple contract cycles". Just curious whether the company is on track with their roadmap and what type of products are they expecting to xsell in the next few years?