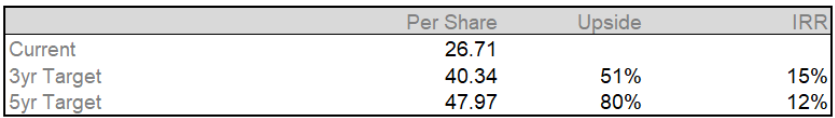

Initial Report: Progyny Inc. (NASDAQ:PGNY), 80% 5-yr Potential Upside (EIP, Leon LEONG)

Leon presents a "BUY" recommendation based on strong growth, unique model, and market expansion.

LinkedIn: Leon Leong

Company Introduction

Progyny or ("the Company") is a fertility benefits management company which operates in the United States. The Company launched its fertility benefits solution in 2016 with its first five employer clients, and has since grown its current base of clients to over 460 employer clients, providing fertility benefits solutions to almost 6.4 million lives as of March 31, 2024.

On 24 June 2024, the Company announced the acquisition of Apryl Fertility Benefits, a leading UK-based fertility benefits management provider that provides fertility benefits solutions to clients from over 100 countries globally. Due to a lack of disclosure of the transaction currently, the analysis of Progyny's business will be based solely on its United States business for now.

What are these fertility benefits solutions provided by Progyny?

An overview of Progyny's business model:

Progyny primarily provides:

Fertility Benefits Plans: Provides a unique approach to fertility benefits plans, utilizing Smart Cycles which ensures that all Members have comprehensive and equitable fertility coverage. Smart Cycles are proprietary treatment bundles designed by Progyny to include medical services required for a Member's full course of fertility treatment, including all necessary diagnostic testing and access to latest technology for whichever treatment type they wish to pursue. Most Clients opt for 3 lifetime Smart Cycles for each of their employees in their contract with Progyny. An illustration for use cases of Smart Cycles is shown below:

Progyny Rx (Its fertility pharmacy solutions): Integrated pharmacy benefits solutions which can be added on by Clients. Enables Members access to medications needed during their fertility treatment. This is crucial as it creates an efficient pharmacy solution for Members and their provider clinics by reducing dispensing and delivery times to Members, eliminating risk of missed treatment cycles and mitigating their administrative burden, which are vital for success rates of IVF treatments given its time sensitive nature

Member support services: Progyny offers a network of high quality Patient Care Advocates ("PCA"), who have necessary fertility expertise and provides end-to-end concierge support for Members, including logistical support, clinical guidance and emotional support for first-time fertility patients, all the way from pre-treatment to post-treatment

Progyny generates revenue through three main verticals:

Fertility benefits services revenue: Driven by utilization of Smart Cycles by Members as they choose their treatment types, paid out by Clients

Pharmacy benefits services revenue (Progyny Rx): Driven by Members undergoing IVF treatments via Smart Cycles that require the use of medicine (such as hormononal regulation), likewise paid out by Clients

Per Employee Per Month Fee ("PEPM"): Fixed % per employee life covered by a Client, paid out monthly by Clients and is used to compensate Progyny's network of PCAs and running essential data services used in daily operations

Industry Overview:

What is ART and IVF?

Artifical Reproductive Technology ("ART") is the broader umbrella term which includes all fertility treatments in which either eggs or embryos are handled

In-vitro fertilisation ("IVF") is a subset of ART which refers to a surgical procedure where eggs are surgically retrieved from a woman, and then combined with sperm in a laboratory setting to create embryoes, which are then either frozen to store them, donated to another woman, or surgically inserted back into the woman's uterus for a chance of pregnancy.

Genetic testing, or Preinplantation Genetic Testing ("PGT") is usually conducted before any procedures to identify sperm or eggs that are most likely to lead to a healthy baby.

Artificial insemination is conducted on patients with mild fertility issues, where sperm is surgically inserted directly into a woman's uterus for a higher pregnancy rate.

Freezing of eggs enables a woman to preserve the condition of the egg when it is retrieved and buys a woman time in situations where she is still undecided on a future partner, which can be thawed and then combined with sperm of her future spouse at a late stage.

Freezing of embryos is usually done when more than one embryo is created in the IVF process, where the fertility specialist will conduct genetic testing to identify the healthiest embryo to be inserted into a woman's uterus, with the remaining frozen which can be used in case the woman does not get pregnant in the first attempt.

Understanding the state of infertility recognition in the United States

Prevalence of infertility in the United States is high, affecting 1 in 8 couples according to the Centers for Disease Control and Prevention ("CDC"). Despite infertility being recognized by the World Health Organization ("WHO") as a disease since 2009, access to infertility treatment has previously been limited by poor insurance coverage in the United States because:

The American Medical Association did not vote in support of WHO's recognition of infertility as a disease until 2017

Legislators in the United States have not designated infertility as a condition meriting mandated health insurance coverage, with only 21 and the District of Columbia, out of 50 states, mandating insurance coverage for infertility

For the states that do mandate insurance coverage, the mandates vary greatly and often leaves patients with inadequate coverage or unable to pursue infertility care at all

What is currently lacking in conventional fertility benefits coverage?

The coverage and benefits design options have historically been limited and resulted in poor patient outcomes, increased costs and unintended consequences for both patients and their employers. Conventional health insurance carriers today fall short in a variety of ways, including:

Coverage structured as a limited lifetime dollar maximum benefit (the max amount of money that an insurance company or self-insured company will pay for claims), which will usually be depleted before the patient has achieved a successful pregnancy

Includes restrictive rules that limit access to treatment options and instead provides "one size fits all" clinical protocols, leading to poor patient outcomes

Does not provide adequate patient education, guidance or support struggling with their first fertility treatment journey, leading to poor treatment choices

Limits patient access to many of the nation's top reproductive endocrinologists because these fertility specialists do not broadly participate in conventional health insurance carrier networks

These adverse results translate to a myriad of negatives for all key stakeholders involved:

Members: Lower success rates of pregnancy and live births, and risks not being able to get full treatment cycle as their dollar maximum may have been exhausted mid-treatment

Clients: Higher fertility treatment costs borne by Clients and indirect costs via a reduction in employee productivity and employee retention

Fertility Specialists: Forced to follow ineffective protocols common to conventional coverage, experience lower patient volumes and lower number of patients who progress from consultation to treatment, resulting in depressed financial and operating performance

The cost of a single IVF cycle costs about US$12,000, with an additional US$3,000 - 5,000 for preinplantation genetic testing ("PGT"), putting the all in cost at US$15,000 - 18,000. However, one cycle is usually not enough for successful pregnancy, with the average cycle required for a patient to achieve pregnancy via IVF is around three cycles, thus costing a patient US$50,000 just for the IVF procedures alone.

For many patients under conventional health benefits coverage, their dollar maximums would have been exhausted before they even achieve a successful pregnancy, which leaves many devastated as a result of spending time, energy and enduring mental and physical pains to achieve nothing and be left with no choice but to rely on out-of-pocket expenses to undergo further cycles.

To make matters worse, some patients choose to insert multiple embryos as it is typically cheaper and is associated with having higher chances of a successful outcome. However, this comes with a higher multiple birth rate (the chances of conceiving twins, triplets or more children at once). The cost of childbirth for one child alone costs US$20,000, but this figure explodes upwards to US$100,000 for twins and over US$400,000 for triplets or more attributed to higher Neonatal Intensive Care Unit ("NICU") costs, putting the patient at risk in terms of finances and health.

So how does Progyny's services help bridge the gap to creating more value for all key stakeholders?

Through Progyny's fertility benefits plan, Members have a set of lifetime Smart Cycles allocated to their household (most commonly 3), which enables them to pursue amongst a list of treatments that have a specified usage of Smart Cycles instead of being based on dollar maximums, ensuring each Member has the opportunity to undergo a complete treatment cycle.

Furthermore, Smart Cycles can be utilized across all employee groups, including populations that are typically not covered in conventional health insurance carriers, such as LGBTQ+ individuals and single mothers by choice, which has exhibited an increasing trend over the years. A range of treatments with corresponding Smart Cycle Usage are shown below

The results speak for themselves, with Progyny's in-Network provider clinics utilized by Progyny Members recording the higher efficacy rates from their treatments, which leads the national average for all provider clinics by a huge margin, as shown in the table below. (Source: CDC and Progyny)

For Clients, the most tangible value is derived from savings in both unfront fertility treatment costs due to Progyny's higher live birth rates and a reduction in maternity and Neonatal Intensive Care Unit ("NICU") expenses due to Progyny's lower multiples birth rates (which is the probability of a pregnant mother conceiving more than one child).

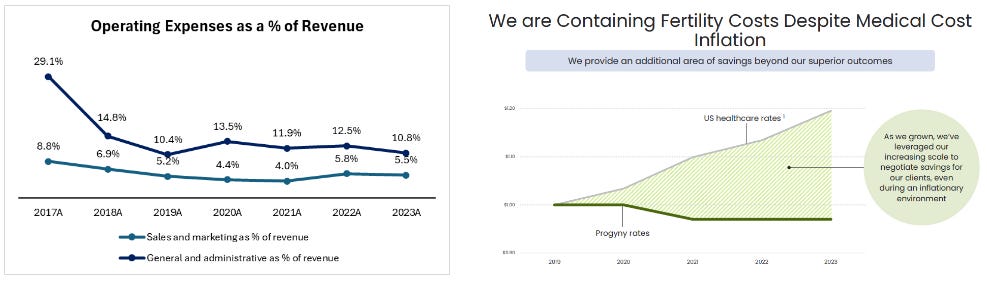

Additionally, Progyny Rx has delivered unit cost savings of between 10 - 20% for Clients for medicine dispatched to their employees / Members, as well as additional cost savings of approximately 8% through their cost containment program based on a reduction in unnecessary quantities of medicine dispensed to Members.

Aside from financial benefits, it is worth recognizing that competition to hire the best talents have intensified, and inclusive benefits granted by an employer is increasingly recognized by employees as a key factor to joining a company, with 80% of employees in CNBC's 2021 Workforce Survey voting an increase in inclination to work for a company that prioritizes inclusive benefits. The higher efficacy rates from Progyny's in-network of specialist providers remains an attractive fertility benefits management company of choice for Clients given these financial and intangible benefits.

As a result, Progyny has grown its client base from 16 Clients from the inception of its fertility benefits solution platform to 460 clients within 7 years, with covered lives growing by a tremendous 67% CAGR from 2017 through 2023, adding a greater or equal number of lives in every sales season except in 2020 due to the Covid-19 Pandemic.

Today, Progyny's client base includes many well-known brands that we know of, including 85 out of 500 blue-chip companies in the United States, who have switched to Progyny from either a conventional health insurance carrier or a competitor (e.g. a different fertility benefits management company).

For Specialist Providers, contracting with a fertility benefits management company with a base of high quality Companies, like Progyny, is incentivizing as it means both greater potential patients and higher conversion rates from initial patient consultation to the treatment process, which benefits their operational and financial performance

The benefits to each key stakeholder elaborated on above thus translates to a powerful "Flywheel Effect", common to many platform companies that acts as a scale enabler, where an increase in participation on one side of the flywheel creates an increase on the other side of the flywheel; a virtuous cycle that ultimately brings increasing returns to every party in the flywheel. It is also worth noting that Progyny's Client retention rate has been consistent at >99% for the past 7 years since the inception of their fertility benefits solutions

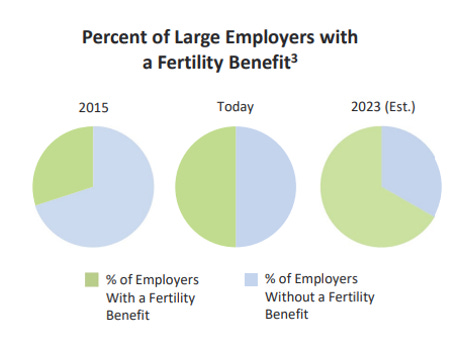

Where's the market opportunity?

Annual Artificial Reproductive Technology ("ART") cycle volume has grown at a 10.5% CAGR from 2011 through 2021, against the backdrop of increasing infertility amongst couples, prevalence of chronic conditions in women of childbearing age, a secular trend in women deferring starting families and choosing to use the majority of their prime childbearing years to build their careers, and increasing LGBTQ+ population that wish to have children and start their own families. It is difficult to refute the notion that the strong growth in ART cycle volumes is set to continue.

CDC has reported that 1 in 5 couples struggle with some form of infertility, but many are left out of existing fertility benefits coverage, and 1 in 5 women of childbearing age have 2 or more chronic conditions in the United States. ART and IVF treatments have thus gained rapid popularity as they bring hope to people that wish to start families but are not able to due to unfortunate conditions.

Aside from infertility, women shifting childbirth and delaying the start of their families due to their career means their chances of achieving natural conception per month will have decreased by the time they actually choose to do so. When natural conception attempts fail for more than twelve months, many eventually turn to IVF as a means to increase chances of pregnancy, which has likewise led to the growth in ART cycle volumes.

Progyny estimated that there are currently about 8,000 self-insured employers in the United States, with a total of 106m potential covered lives, which translates to ~13,250 average potential covered lives per employer. Since inception in 2017, Progyny has on average, increased its market share by 0.8 - 1.0% per year in both Client uptake and total lives covered. As of 2024Q1, Progyny has a total of 460 Clients and 6.38m lives covered, 5.8% and 6.0% of the Total Addressable Market ("TAM") respectively.

With that being said, it is apparent that Progyny is still in its early phase of penetrating its market opportunity, which is very attractive given its competitive benefits coverage that helps to consecutively solve pain points of all three key stakeholders. This means a huge unpenetrated market and a significant headroom for growth opportunities for Progyny. As the secular trends mentioned above continue its prevalence in the coming years, tailwinds will persist for continued adoption of Progyny's solutions by Clients as they start to switch from conventional health insurers and rival fertility management services platforms. Progyny also plans to penetrate more of the large scale Clients with a larger client base, which reasonably coincides with a higher return on incremental invested capital ("ROIIC"). We can see below that F500 companies are still underpentrated by Progyny, which presents immense growth opportunities in the most profitable Client segment to onboard

Diving into the fertility benefits competitive landscape

Industry Mapping

Mapping the fertility treatment industry allows us to observe the possible ways an individual can pursue a fertility treatment today. These three ways are 1) through out-of-pocket expenses by individuals with no fertility benefits coverage, 2) utilise a maximum dollar limit insurance coverage through conventional health insurance and benefits administrators, and 3) utilise services of fertility benefits management companies that companies have contracted with which are usually not restrained by a maximum dollar limit.

Given the increase in adoption of fertility benefits coverage by employers today, we shift our focus to conventional health insurance providers and other fertility benefits management companies as Progyny's competitors to assess the current intensity of competition in the industry and threat of new entrants / challengers in the future.

While employers have increasingly adopted some form of fertility benefit coverage for their employees, many still fall short of providing ample support for employees' fertility treatments while incurring higher than expected financial costs through unintended results of employees' treatments and intangible impacts such as a less productive workforce. Therefore, it is a lose-lose situation in many current fertility benefits coverage provided by companies as a result of contracting with conventional health insurance providers.

To that end, we further narrow the competitive forces acting on Progyny to its key competitors: Other fertility benefits management companies, including WinFertility, Carrot Fertility and Maven Clinic. Progyny is compared to these companies in the table below.

As Progyny is the only listed fertility benefits management company in the United States, there is limited disclosure to certain information pertaining to the three other fertility benefits management companies.

However, a few key observations from the comparison are:

Progyny is the only fertility benefits management company that does not utilize a lifetime maximum dollar benefit for fertility treatments utilized by patients, which as explained above is usually insufficient for a patient to achieve a successful pregnancy. It is a pioneer in developing its proprietary Smart Cycle approach.

Progyny and WinFertility operate only in the United States, while Carrot Fertility and Maven Clinic provide fertility benefits management services to Clients from more than a 100 countries. Despite this, Carrot Fertility contracted clients and Maven Clinic's covered lives are underwhelming, as compared to Progyny's 460 clients contracted and 6.4 million lives covered, bearing in mind that Progyny only operates in the United States.

Between Progyny and WinFertility, one can deduce that Progyny has a greater appeal to employers as its clients contracted has increased at a more rapid pace since inception, as compared to WinFertility, which has been around for over 25 years but has only contracted around twice the number of clients of Progyny. Progyny also appears to have contracted a greater number of large employers, given its higher average lives covered per client of 13,900 compared to WinFertility's 9,400. This is advantageous to Progyny if we reasonably assume that contracting larger employers provides more attractive returns on incremental invested capital, given the spread of a set investments spread towards a larger covered lives base. Progyny's growth trajectory since inception has been significantly stronger compared to other fertility benefits management companies

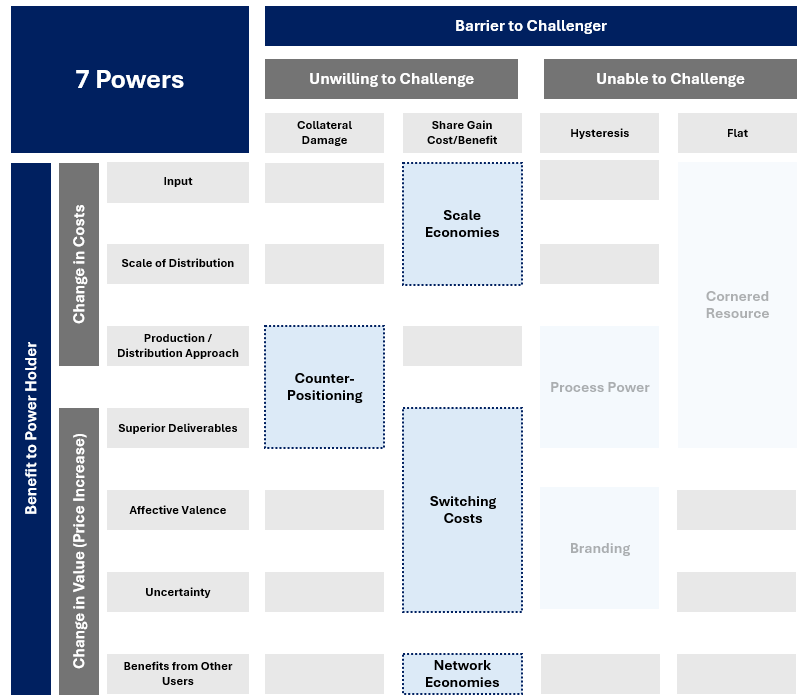

Analyzing the Powers possessed by Progyny

Power refers to a set of conditions creating the potential for persistent differential returns for a company, and must fulfill the conditions of generating a benefit to the Power holder and a barrier to a challenger. It is only with the existence of powers that allows a company to create value from growth as incremental returns exceed its cost of capital over a prolonged period of time. I believe Progyny currently possesses 4 out of 7 powers: Counter-positioning; Switching costs; Scale economies; and Network economies

1. Counter-Positioning

Progyny is the only benefits management company today that does not utilize a dollar maximum benefit model, and instead relies on its Smart Cycle model for its Clients and Members. This is a key differentiator and one that creates superior deliverables to Clients through higher efficacy rates for its employees' fertility treatments and cost advantages for the employers. For fertility benefits providers that utililize a dollar maximum benefit approach, the average lifetime dollar maximum is ~US$25,000. While the average cost of Progyny's Smart Cycle charged to its Clients is undisclosed, it is reasonable to assume that its Clients would pay more for each employee they have under Progyny's benefits solutions plan (which usually offers 2 to 3 lifetime Smart Cycles per employee / household) compared to a provider that utilizes a lifetime dollar maximum. Despite the higher costs, Progyny has rapidly amassed its Client base, proving its Smart Cycle model's superior value to employers.

Existing competitors cannot compete effectively with Progyny's Smart Cycle model without a turnaround of its dollar maximum reimbursement approach, which has likely been developed for an extended period of time and changing it risks disruption to its current business model, as well as potential impacts to all its key relevant stakeholders, especially patients that are undergoing an iVF cycle or have already utilized a % of their max dollar benefit. We can collectively term these as "Collateral Damage" to existing competitors.

For conventional health benefits insurers, a change is even more unlikely given that they operate other types of insurance coverage other than fertility benefits, where a dollar maximum benefit approach makes more sense for their entire organization as a whole.

2. Switching Costs

Switching costs are generally high for Clients that have contracted with a benefits management company, given that fertility treatments are time-sensitive procedures and switching from one provider to another disrupts their employees' treatment cycle, from a change in specialist clinics, pricing methodology, fertility expert consultants, etc, which will not be well-received by employees of a company. This can be attributed to Progyny's near 100% Client retention since its inception (7 years record). Switching makes sense only if another benefits management company can deliver superior value to both employers and employees where a disruption will be worthwhile. An instance of this is the trend of employers switching from conventional health benefits insurers to fertility benefits management companies, where Progyny has reported that >66% of its client base has switched over from these conventional health benefits insurers. This means that retention rate of Progyny's Clients will likely remain at the same level as new entrants and existing competitors will face difficulties trying to convince them to switch to their platform.

3. Network Economies

There exists a "Flywheel Effect" for fertility benefits management companies as elaborated on earlier, where the network contains the Clients, Members and Specialist Clinic partners. Progyny's differentiated Smart Cycle approach has contributed to a ramp up in Clients contracted, which has accelerated its member base (61x increase in 2024 compared to 2016), generating incremental value for Specialist Clinic partners with a higher patient consultation-to-treatment conversion rate, which increases specialist clinic partners onboarded, contributing to Progyny's increasingly broader network access and scale, which in turn further incentivizes existing Clients to stay on and uncontracted employers to switch to Progyny's platform.

New industry entrants / fertility benefits management companies entering the market will face increasing difficulties in taking market share as the Flywheel sets into motion, including incurring larger costs and having to provide better pricing terms to onboard clients, which could very well end up destroying value as their returns on incremental invested capital fall below their cost of capital. In anticipation of this, potential new entrants will be unwilling to participate / challenge for market share in this industry altogether.

Progyny's covered lives in the United States

4. Scale Economies

Being a first-mover in this industry is crucial, given high switching costs from one fertility benefits management provider to another. The low hanging fruit for fertility benefits management providers lies in contracting with employers that currently have some form of fertility benefits coverage with a conventional health benefit insurer. Once these low hanging fruits diminish, it becomes reasonable to assume that a provider's ability to onboard new clients will slow drastically due to switching costs, or at least require substantial incremental expenses and investments to convince them to switch to their platform.

Progyny has managed to rapidly scale its business with around 0.8% of incremental market share per year in terms of Clients onboarded since 2017, which has effectively reinforced its network economies and switching costs for its existing client base. Scale economies are apparent from a reduction in operating expenses as a % of revenue for Progyny across the years, where such expenses are spread over an increasing number of covered lives and Client base.

Additionally, increasing scale has allowed Progyny to negotiate cost savings with its Specialist Clinic partners for its Clients while still ensuring a win-win situation for both parties, which new entrants will find impossible to execute without incurring substantial costs. The barriers to a potential entrant or challenger are especially high with Progyny's first-mover advantage via its differentiated approach and rapid scaling, which may help to deter potential entrants.

Evidently, the existence of these powers and an underpenetrated market for Progyny have translated into a 6-year average ROIC of 41%, well in excess of any reasonable estimate of the Company's cost of capital in that period. NOPAT used in the calculation of ROIC is calculated using EBITA * (1 - Operating Cash Tax Rate)

*Note: (1) 2022's decline in ROIC was attributed to an increase of over 300% in stock-based compensation paid out to employees which depressed NOPAT. Stock-based compensation is included as an operating expense which reflects the economic reality of a company paying its employee salaries in stock options, which is still part of operating expenses

The recent slump in share price performance

From end 2021, Progyny's share price performance has been deteriorating up till today. In April 2022 after the Company's 1Q2022 earnings release showed a doubling of operating expenses (mainly from a spike in stock-based compensation), which produced an operating loss compared to ~S$11m of operating profit in 1Q2022, its share price tumbled. Naturally, given the rapid increase in contracted Clients and covered lives, the Company had to hire and spend more on employee compensation, which drove operating and net profit margins down, though these have recovered slightly in 2023.

Since then, its share price has remained largely stagnant up until February 2024, when an Alabama State IVF Court Ruling sent the share price down by 19% (from 40.30 on 21 Feb 2024 to 32.50 on 9 May 2024), which was made worse when Progyny released its 1Q24 earnings and announced a lowering of FY2024 full year results guidance, sending the stock down another 17% (from 32.50 on 9 May 2024 to 26.98 on 14 Jun 2024). The revised guidance indicated a 3.8% and 3.1% decline in full year FY24 revenue and adjusted EBITDA respectively, from what Management had set out earlier in the Company's 4Q23 earnings call.

No mans' land for the United States' IVF market

On 16 February 2024, The Alabama Supreme Court issued a ruling that declared embryos created through IVF should be considered children, as a result of a lawsuit by families against someone who had accidentally destroyed their frozen embryos in negligence. As a result, three IVF clinics in Alabama promptly suspended all services due to fear of criminal prosecution, which led to patients undergoing IVF treatment in Alabama being stuck without access to their stored eggs and embryos in those clinics. This led to the nationwide uproar.

As mentioned earlier, woman undergoing IVF treatment may opt to extract multiple eggs and have them combined with sperm to create multiple embryos as backup. However, if the first embryo inserted into the woman results in a successful pregnancy, the leftover embryos in the IVF clinic can be handled in three main ways: 1) Kept forever, where patient incurs storage costs for life; 2) Destroyed; 3) Donated for medical research. Of course, with the new ruling in Alabama, options 2 and 3 are no longer possible if one does not wish to be prosecuted for wrongful death, given that embryos are now human and technically possess equal human rights.

However, this was quickly rectified by Alabama's republican governor on 7 March 2024, who signed a bill into law aimed at protecting IVF patients and specialist providers from legal liabilities imposed on them after the widespread uproar and urgent demand for lawmakers to provide a fix to their ruling. There was a divided view on this "quick fix" by the State, given the uncertainties regarding IVF treatments and whether embryos should be classified as human remain stuck at a blurred line. Some abortion opponents who have opposed IVF also called for reference to Louisiana, which bans the destruction of frozen embryos, meaning they must be used, stored indefinitely, or donated to a married couple. Being stored indefinitely will likely be the outcome for most patients, which will jack prices of IVF cycles up tremendously (which is already restrictive enough), putting it out of reach for many more potential patients that require it for family building. This would also mean serious disruptions and changes to the way specialist clinics operate, the pricing and costs incurred by fertility benefits management companies (like Progyny), and whether certain employers can continue to provide such benefits at significantly higher costs for their employees.

This incident has also invoked re-newed interest in "fetal personhood" laws, which give fetuses and in some cases embryos the legal rights of a person. 1/3 of the states in the United States have already implemented fetal personhood laws though most did not explicitly target IVF patients and specialist clinics, but gave legal human rights to fetuses after the Dobbs decision overruled Roe v.Wade (which was a constitutional right which eliminated all restrictions on abortions in every state) in June 2022.

Under the Dobbs decision, individual states can now set their own policies protecting or banning abortion, which led to 22 States banning abortion right after, creating an uproar as women were robbed of their rights to make decisions about their healthcare and bodies. The Dobbs' decision was also feared to eventually put IVF and other ART at risk.

Is the pessimism justified?

As a result, the market has probably priced in these uncertainties and potential catastrophe to the entire fertility market into the future cash flow generating potential of Progyny.

While understandably concerning, the degree of pessimism priced into Progyny is unwarranted for due to a couple of reasons:

86% of Americans, including 78% of self-reported "pro-life advocates" have supported IVF in a recent poll. This means it is highly unlikely for State Courts to pursue any action that could restrict or deter people from pursuing IVF procedures. The possibilities of long-term operational and financial impacts on Progyny remains low.

The market has overreacted to Progyny's downward revision in its full year FY24 financial results guidance. While the first quarter results indicated a lower utilization rate of Smart Cycles, I believe it is a temporary disruption due to increased wariness of patients due to fears of being criminalized for having a miscarriage through IVF treatments, and were afraid to be involved with embryos that could be classified as humans that could expose them to future financial and prosecution risks, given the uncertainties and confusion in the first quarter of 2024. However, patients that have to rely on IVF will eventually need to undergo the procedures if they wish to start their families, hence I believe the growth story for Progyny remains intact.

In fact, I will argue that the recent slump in price performance for Progyny since Feb 2024 presents an opportunity where price and sentiments have diverged excessively from fundamentals. The secular trend towards increasing adoption of IVF procedures, the nascent fertility benefits management industry, a large underpentrated TAM for Progyny, and the existence of Powers accrued to Progyny will provide it a fertile period to generate differential returns.

How high has the bar been set for Progyny?

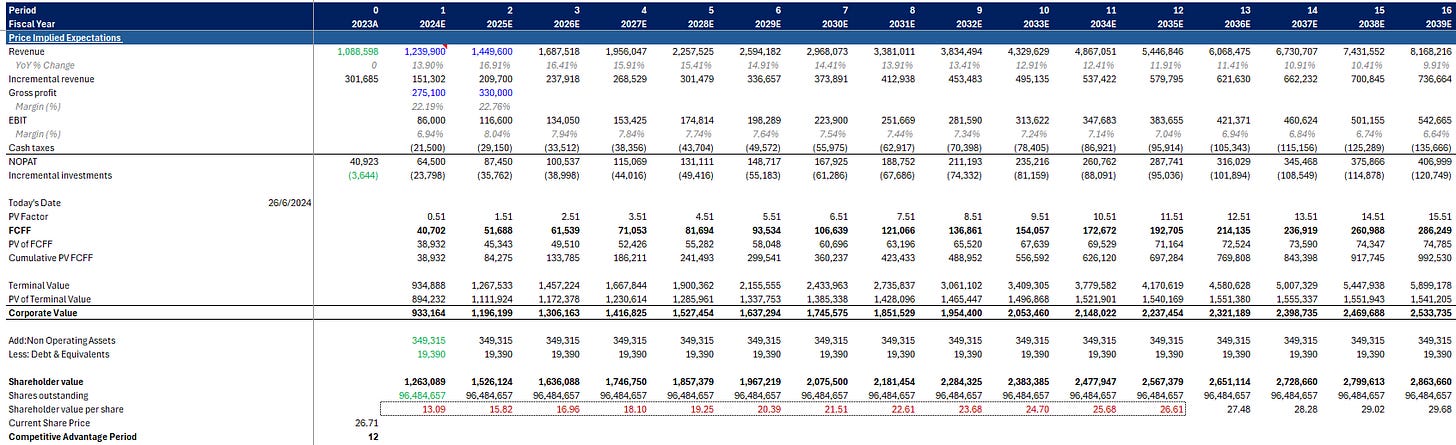

Estimating Price-Implied Market Expectations

Using Progyny's Research Analysts' consensus estimates for the 2024E and 2025E as a proxy for market expectations, we will estimate the market implied competitive advantage period ("CAP") for Progyny, which is the period of time the market expects Progyny to continue generating returns above its cost of capital.

Estimates for 2024E and 2025E key value drivers are taken from research analysts' consensus estimates, with a gradual fade rate for certain key value drivers applied beyond 2025E

Revenue growth: 13.9% in 2024E, 16.9% in 2025E, with a gradual fade rate of 0.5% per year until a minimum of 2.0% revenue growth per year

Operating margin: 6.9% in 2024E, 8.0% in 2025E, with a gradual fade rate of 0.1% per year, until a minimum of 6.5%

Incremental re-investment rate: 15.7% of incremental revenue in 2024E, 17.1% in 2025E, with a constant incremental re-investment rate of 16.4% thereafter

Operating cash tax rate: 25.0% for all years

WACC: 9.04%

We derive an estimated market implied CAP of 12 years, where the market expects no further value creation beyond 2035E (or put another way, the ROIC converges to the WACC beyond year 12 from increasing competitive forces, and any incremental investment or growth creates no additional corporate value).

With revenue growth fade rate of 0.5% annually and key value drivers kept the same, a market revision of CAP to 16 years by the market from a more optimistic view on a reduction in intensity of competitive forces would increase shareholder value per share by 11.5% to US$29.68.

Given all that has been discussed above, an implied CAP of 12 years appears overly pessimistic for Progyny from a nascent industry with only a moderate number of true competitors in the United States (most are private and backed by PE sponsors that utilise a max dollar benefit model).

Investment Thesis

1. Secular trend in increasing ART Cycles in the United States + Growing and underpenetrated TAM underpins Progyny's growth story

As mentioned previously, I believe the many secular trends provide massive tailwinds for the fertility market, and disruptions to ART and IVF services in the United States is unlikely to happen as it would upend the lives of many couples and is generally not what State Governors would do for their people. Though Progyny has only been on the market for 7 years, much lower than its peers, it has proven its capability to scale and grow much faster than competitors while sustaining high differential returns.

Progyny currently holds 5.8% of its TAM, equivalent to 460 employers contracted out of 8,000 total employers in the United States, and 6.4m covered lives (6.1% penetration).

Assuming the number of employers and average potential employee per employer remains the same for the next 11 years, which is fairly conservative, I projected a base case gradual increase in employers contracted to 1,395 in 2034 (17.4% penetration) and number of lives covered to ~20m (18.8% penetration). This assumes Progyny adds 1.0 - 1.2% incremental market share on average for the next 11 years, which is a fairly reasonable assumption as Progyny remains the only fertility benefits provider in the United States that can solve all its key stakeholders' pain points consecutively, its competitive position with a unique Smart Cycle approach, combined with the fact that it is only at its early phase of growth and scaling up.

With reference to the current Market Price-Implied expectations, the backed-out assumption for incremental Clients contracted and incremental covered lives appear too pessimistic and unaligned with Progyny's strong growth thus far. With no revolutionary competitor at the moment, the plausible explanation for the decline in expectations of future incremental clients contracted can be attributed to the fear and uncertainty regarding the future of the United States' IVF market. Just looking at past performance, such a drastic decline in incremental market penetration is unjustified, even if one wants to argue for a gradual decline in market penetration rate. As shown below, the price implied expectations estimates 874 employers contracted in 2034 (10.9% penetration). A potential near term catalyst for market expectations revision would be greater reassurance by States on protection towards IVF patients and specialist providers, and clear guidelines and rules regarding the treatment of embryos created in IVF procedures. However, as it looks right now, there is a clear divergence between the market price and fundamentals of the business.

2. Durable Powers to sustain an enduring period of differential returns, Smart Cycle model will continue to differentiate Progyny from competitors

Currently, Progyny is the only fertility benefits management company in the United States that does not utilize a max dollar benefit model for its fertility benefits solution, meaning Members or patients under Progyny's platform do not have to worry about hitting their benefits limit before achieving a successful pregnancy. Existing competitors will find it difficult to switch from a max-dollar benefit model to a model similar to Progyny's due to potential disruptions to their business. Even if they do change their models towards something similar to Progyny's Smart Cycles, which will probably involve recontracting their existing clients with new contractual terms, their existing clients can simply save themselves the hassle and switch to an entirely new provider instead (like Progyny). New entrants will also face increasingly higher barriers to compete in the industry given high switching costs for employers and thus the importance of being a first mover in the industry. A near 100% client retention rate for Progyny since 2017 is a clear testament to this. New entrants will be left with a much smaller TAM by the time they can actually begin scaling their business. In anticipation of this and the diminished opportunity for value creation, new entrants would have to think twice before entering the market, which will make them unwilling to challenge incumbents in the market.

With that said, I do not foresee Progyny losing its competitive position in the fertility market anytime soon, which means opportunity for differential returns (ROIC - Cost of capital) will be enduring for a sustained period of time.

This is contributed by a competitive advantage from its unique Smart Cycle model, underpenetrated TAM, barriers for competitors to challenge, and increasing demand for ART and IVF treatments. As the market implied CAP for Progyny is 12 years, I've forecasted ROIC 12 years out (5 years explicitly based on granular operating drivers + 7 years based on simplified key value driver assumptions), which hits a peak at 35% before declining to 24%. With a 6-year historical average ROIC of 41%, I find the peak and taper-off of future ROIC projections reasonable given the tailwinds mentioned above and accounting for gradual decrease in TAM opportunity for Progyny as it continues to onboard more United States self-insured employers. This translates to a ~20% 12-year average differential return on invested capital by Progyny through 2035.

3. Addition of new services with potentially more favorable margins + going global to diversify risks inherent in the United States' IVF market

In Progyny's 1Q24 Earnings Call, management indicated the company's rollout of additional maternity services, including menopause, postpartum, etc, and indicated that while revenue contribution per utilization will be lower than that of fertility benefits and pharmacy, margins will be more favorable due to high efficiencies from relying on the Company's existing infrastructure. Note that this is a different line of service compared to what Progyny has previously provided (only fertility benefits services), and also the fact that most of Progyny's competitors are already offering these maternity services on their benefits platform.

While Progyny previously lacked its competitors in this aspect, it seems reasonable enough to assume that prospective employers looking to switch providers would be more inclined to switch to Progyny's platform given its unique Smart Cycle model and new maternity services, which combined together could provide greater value to both employers and their employees as compared to competitors' max dollar benefit model + maternity services. The introduction of maternity services also allows Progyny to diversify some of the risks of solely offering fertility services, which is filled with uncertainties in the United States due to potential regulations and laws that could incrementally restrict IVF services.

Additionally, Progyny very recently announced the acquisition of Apryl, a UK-based fertility benefits company with services in over 100 countries. This effectively allows Progyny to tap into markets globally and further diversify risks associated with the United States' fertility market. Without disclosure to the transaction and historical operational and financial performance of Apryl, it is currently difficult to assess whether the acquisition was a good capital allocation strategy by Progyny's management. For now, I assume that fair value was paid on the acquisition of Apryl and it neither contributes nor destroys value for Progyny. The focus will be on the underlying trajectory of reduced risks + potential margin expansion from new maternity services introduced by Progyny, which I believe could lead to revised market expectations on future shareholder value creation (less pessimistic).

Valuation

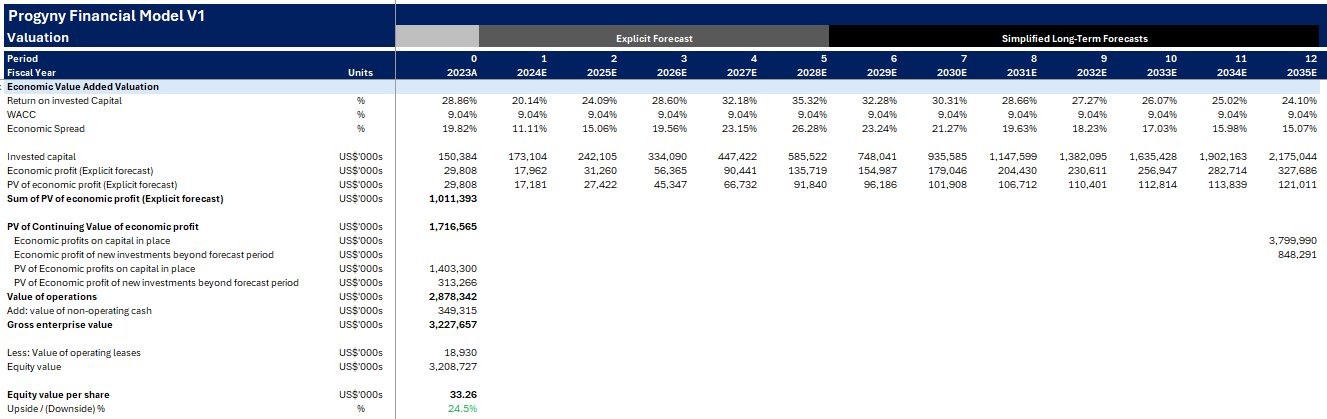

To value Progyny, DCF and EVA valuations are done with a 5-year granular forecast of operating drivers and a further 7-year simplified forecast on key value drivers.

Base Case Discounted Cash Flow ("DCF") Valuation:

Base Case Economic Value-Added ("EVA") Valuation:

Probability Weighted Valuations:

Using three scenarios with varying assumptions for certain material operating drivers (Incremental market penetration by employers, Fertility benefits service revenue per ART Cycle % growth, and ART cycles utilized per Progyny Member % growth) and assigning a probability to each scenario, I derived a probability weighted value of US$29.54 and US$30.71 for the DCF and EVA probability-weighted values respectively. This translates to a 16.5 - 20.7% divergence from Progyny's intrinsic value and the market price.

Conclusion

To ensure a sufficient margin of safety, I would target a 30% upside potential w.r.t probability weighted value derived from the DCF valuation, which implies waiting for the price to drop to ~24.00 before taking a position in Progyny. (Which translates to an entry P/E of 37.7x and entry EV/EBITDA of 29.0x).

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.