Initial Report: PT Indofood Sukses Makmur Tbk (IDX: INDF), 49% 5-yr Potential Upside (EIP, Khadijah PINDARDI)

Khadijah presents a "BUY'" recommendation based on the company's strong vertical integration, expansive distribution network, and diversified product offerings.

LinkedIn: Khadijah Syahidah Pinardi

Indomie, the well-known and affordable instant noodle, has become a symbol of Indonesian food culture, found in nearly every corner of the globe. This success is driven by Indofood Consumer Brand Products (Indofood CBP), a key business arm of PT Indofood Sukses Makmur Tbk, the parent company behind a diverse range of food and beverage products.

PT Indofood Sukses Makmur Tbk is an end-to-end food solutions company covering all stages of food manufacturing, and it is one of the dominant food companies in Indonesia. The company has established a significant presence both domestically and internationally, as it exports its products to over 60 countries worldwide. They are particularly well-known for their “Indomie,” a world-famous noodle and household staple that is very affordable to many (priced at about 20 cents to 80 cents SGD, depending on geographical location).

Indofood started as a snack producer in 1990 under the name PT Panganjaya Intikusuma, grew rapidly and entered other businesses over the years through many acquisitions such as acquiring Bogasari flour mills from Indocement company a year after being listed on the Indonesian Stock Exchange (IDX) and acquiring various companies involved in plantations, distribution, and agribusinesses. Indofood continued to grow its presence in Indonesia and has also expanded its business overseas through acquisition of noodle manufacturers located in the Middle East, Africa, and Southern Europe.

Having the largest presence in Indonesia and being one of the leading companies in the country's FMCG sector, Indofood benefitted from Indonesia's economic resilience. In 2023, Indonesia recorded a 5.05% GDP growth, driven by a 4.82% increase in domestic consumption, the largest contributor to GDP. Indofood capitalized on this economic growth and secured a strong financial performance in 2023. The company achieved a 1% growth in net sales, primarily due to higher sales volumes in its CBP and distribution groups, despite the declining purchasing power of lower-income consumers in Indonesia.

I believe that Indofood is positioned well due to its constant innovation and stability as a total food solutions company, coupled with its extensive vertical integration and distribution network, economies of scale, product diversification, and strong brand loyalty in its products. These factors, I conclude, along with strong leadership and management, have resulted in Indofood having strong financials despite many economic headwinds. I also believe that Indofood still has more room to grow in Indonesia following the stable growth of Indonesia’s domestic consumption over the years.

Business Segments & Revenue Drivers

Consumer Branded Products (CBP)

Indofood’s consumer branded products (CBP) include noodles, dairy, snacks, food seasonings, nutrition products, special foods, and beverages. Major brands in this segment are Indomie, Indomilk, Chitato, and Pop Mie. One impressive thing I learned is that CBP is the biggest revenue contributor to Indofood, accounting for more than 60% of Indofood’s revenue in 2023.

Indofood CBP has had strong top-line growth over the years, increasing from IDR 46.6 trillion in 2019 to IDR 70.4 trillion in the trailing twelve months (TTM). Although their cost of revenue, operating income, and expenses have increased over the years, they have done so at a slower pace, ensuring profitability for the company.

Photo credits to Indofood Annual Report 2023

Competitors

As one of the market leaders in the FMCG sector (specifically in packaged food) in Indonesia, Indofood CBP has done a lot to maintain its dominance and presence amongst its competitors, ensuring that they are up-to-date with current industry trends and shifting consumer preference and demands. They have achieved this by enhancing and expanding their product offerings to meet what the consumer wants and needs through market and industry research. Key competitors of Indofood's CBP include Wingsfood, Unilever, Mayora, and Nestlé.

Bogasari Group & Agribusiness

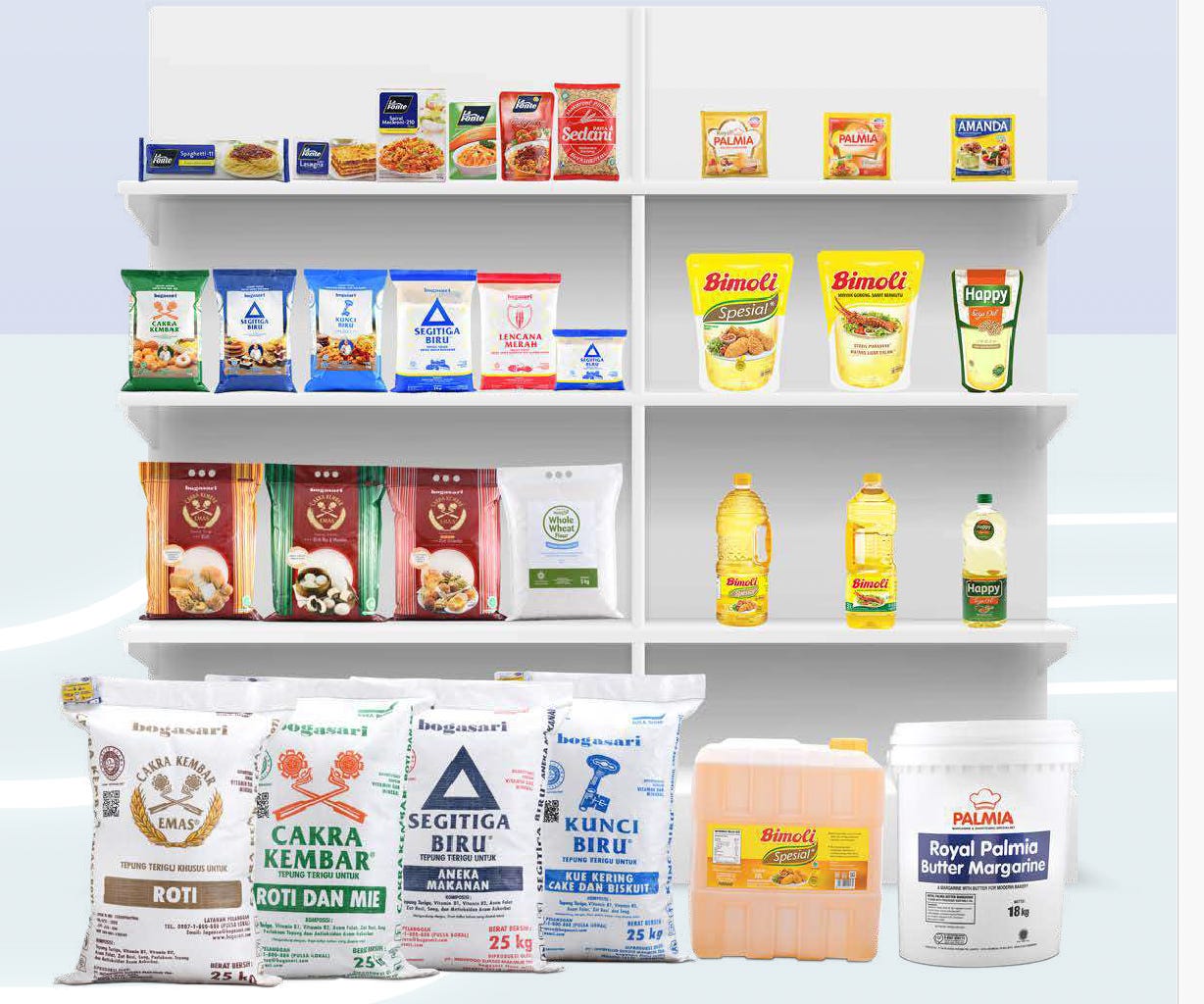

Indofood acquired the Bogasari Group, a renowned flour producer in Indonesia from Indocement company in 1995. Indofood also acquired agribusiness companies that operate large-scale plantations, including palm oil, sugar and many other crops. It is now involved in all activities of the production of cooking oils, flours, pastas, margarines, and shortenings from the research and development process to the production and marketing of many popular packaged goods products. The bogasari group & Indofood agri business is known for its premium flours, oil, and margarine brands, such as Bogasari, Bimoli and Palmia.

In 2023, Indofood’s Bogasari Group recorded healthy profitability due to its cost-plus pricing model, despite lower demand among lower-income households in Indonesia (sales revenue declined by 5% from IDR 31.88 trillion to IDR 30.41 trillion due to lower sales). In Agribusiness, there was lower profitability and a decline in revenue (a 10% decline from IDR 17.77 trillion to IDR 15.97 trillion) as palm oil prices and Edible Oil & Fats (EOF) prices were lower than the previous year. However, it is covered by the increased volume in sales thus I am positive that Indofood’s exposure to volatility in CPO prices will not affect its overall profitability and their profit margins.

Photo credits to Indofood Annual Report 2023

Distribution

Indofood has a robust distribution network, ensuring that its products reach even the most rural areas in Indonesia and other countries. This network contributes to its market dominance and product availability worldwide. In Indonesia, Indofood has many strategically located points that allow it to closely monitor changes in market dynamics, leading to better market intelligence and oversight in regard to market trends. Indofood sells its products through various distribution channels, including retailers (supermarkets, convenience stores, and traditional stores), wholesale distributions, partnerships with overseas partners, and e-commerce platforms.

In 2023, the distribution group showed strong performance, achieving a 12% increase in revenue from IDR 6.23 trillion to IDR 6.96 trillion.

Financial Analysis

PT Indofood has demonstrated consistent revenue growth, rising from IDR 81.73T in 2020 to IDR 112.91T in the trailing twelve months (TTM). Despite this, the pace of growth has slowed slightly since 2021. Analyzing the cost of revenue, Indofood has also effectively managed their cost of revenue, which declined from IDR 76.85T in 2021 to IDR 74.36T (TTM), leading to higher gross profits and a more favorable gross margin. We can see that their gross profit improved steadily from IDR 26.75T in 2020 to IDR 38.55T (TTM).

Indofood’s operating expenses grew moderately, allowing Indofood to increase its operating income from IDR 12.95T in 2020 to IDR 21.95T (TTM). This reflects the company’s ability to scale operations without a significant rise in overhead costs.

Indofood's net income has been a little volatile, peaking at IDR 7.66T in 2020 and fluctuating in subsequent years, recovering to IDR 6.43T (TTM). This volatility could be linked to fluctuating costs and high borrowing expenses. Indofood remains cash-generative, with EBITDA increasing from IDR 15.05T in 2020 to IDR 18.01T (TTM), highlighting strong operational performance and resilience in its core business segments.

Investment Thesis

Leading Total Food Solutions with Strong Vertical Integration and Distribution Network in Indonesia

Indofood’s unique distribution model spans the entire value chain—from the production of raw materials to the distribution of finished food products. This vertical integration gives the company significant control over its operational costs across its product portfolio. For example, Indofood’s Bogasari mills benefit from the support of its own maritime and packaging teams, driving efficiencies throughout the supply chain.

Large Economies of Scale with Product Diversification

Indofood’s competitive advantage is built over time through its ability to leverage large economies of scale, ensuring cost efficiency across its products. Economies of scale occur when a company reduces its per-unit cost as it increases its production output. Indofood has achieved this through strategic expansion, such as the acquisition of Pinehill, a leading instant noodle producer with a presence in the Middle East, Africa, and Southern Europe. This acquisition allows Indofood to expand its noodle production capacity and reduce export costs from its Indonesian factories. Indofood’s economies of scale not only enhance its cost position but also help to drive competitors out of the market by increasing its capacity further.

The company’s wide product range ensures it meets the needs of various consumer segments, from packaging design to pricing strategies. Indofood’s ability to adjust wheat flour prices based on global market conditions—such as the spike in wheat prices following the Russia-Ukraine conflict—illustrates its adaptability in managing external pressures.

Strong Brand Loyalty and Effective Management

Indofood has developed deep brand loyalty, particularly with its flagship product, Indomie, through consistent product quality and innovation. Over the years, Indomie has become a staple in Indonesia, supported by a leadership team that continuously pushes for product innovation. Indomie has built a strong, differentiated brand that has not been easily replicated by competitors. With Indonesia being the fourth most populous country in the world, Indofood is well-positioned for continued growth. The brand’s international success—accounting for approximately 23% of total sales—further strengthens its market leadership.

Indofood’s management team is highly resilient in the face of economic challenges. During downturns, both locally and internationally, the company adapts by strengthening its balance sheet—boosting cash reserves, reducing bank debt, and minimizing currency exposure. They also continue to innovate to meet shifting market demands. This approach has allowed Indofood to not only survive but thrive amid uncertainty, securing a stable path for future growth.

Risks & Mitigation

Weakening consumers’ Purchasing Power, Price Fluctuations, and Possible Indonesian Rupiah Depreciation against USD

There has been a weakening of consumer purchasing power in Indonesia, specifically the consumers under the lower income bracket as the size of middle-class Indonesian has shrunk from 21.4% in 2019 to 17.1% in 2024 according to Indonesian Statistics Bureau (BPS) data. These people fall into the bracket of “aspiring middle class” who earn between 874,398 Rupiah and 2.04 Million Rupiah which is equal to roughly between 73.3 SGD and 171 SGD. And the number of people under this bracket has increased from 128.85 million in 2019 to 137.5 million (close to 50% of total Indonesian households) in 2024. Indofood tried to address this by offering products at different price points to cater to lower-income consumers’ decreasing purchasing power, together with implementing product portfolio optimization where they assess, manage, and enhance their products to maximize profitability and minimize risks, while also aligning with market demand. This helps Indofood to expand and sustain its market share and volume sales for its products, specifically in their key segment of Consumer Branded Products (CBP) and distribution groups.

Indofood is also exposed to the risk of commodity price fluctuations. In 2023, an example would be how there was a decline in soybean oil prices due to an unforeseen spike in Brazilian soybean crops, which resulted in downward pressure on the price of its oil substitutes, palm oil, globally. To mitigate and offset these risks, Indofood has significantly increased its sales volume of palm oil products and capitalized on its inventories to enhance sales when price was down. Additionally, it has also maintained tight cost-control measures to reduce expenses, which helps to cushion the price declines in palm oils. In another business segment, Indofood’s Bogasari responded to decreasing global wheat prices by reducing flour prices and was still able to maintain healthy profitability due to their cost-plus pricing model.

Lastly, Indofood is also exposed to the risk of Indonesian rupiah depreciation against USD as its export sales and import purchase are mainly denominated in the USD. Currently, Indofood does not hedge or use any financial instruments to protect itself against foreign exchange exposure. However, indofood tries to apply natural hedging whenever possible through the matching of its liabilities against its assets in the same currency. For example, whenever it has expenses in USD, it tries to have revenue or assets in USD as well. This helps to ensure that exchange rate fluctuations will not impact its financials as much.

ESG

Indofood recognizes the climate crisis as both a risk and an opportunity, and it has implemented a range of strategies to mitigate its impacts. In 2022, its agricultural arm adopted the TCFD framework and conducted qualitative climate scenario analyses. To address ESG risks and seize opportunities, Indofood has made significant improvements to its infrastructure, including measures to reduce flooding risks at its plantations and factories, enhance energy efficiency, and lower greenhouse gas (GHG) emissions. The company has been reporting its environmental impact and emissions since 2021, aligning its disclosures with the Global Reporting Initiative (GRI) standards. Additionally, Indofood has introduced key ESG metrics to address both stakeholder concerns and the company's environmental impacts.

Photo credits to Indofood Sustainability Report 2023

Conclusion

In conclusion, I believe that PT Indofood Sukses Makmur Tbk remains a leading player in Indonesia's FMCG sector, driven by its strong vertical integration, expansive distribution network, and diversified product offerings. While the company faces challenges such as commodity price fluctuations and rising consumer price sensitivity, it has consistently demonstrated resilience through strategic pricing, innovative products, and effective cost management. With iconic brands like Indomie and a proven track record of financial stability, I believe Indofood is well-positioned to capitalize on the growing Indonesian middle class and global demand. Its focus on innovation and sustainability will continue to fuel long-term growth and strengthen its leadership as a dominant player in the market.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.