Initial Report: Renault SA (RNO.FP), 42% 1-yr Potential Upside (EIP, Danish ARIFIN)

Danish believes that Renault is a good investment in the short term. There is strong value proposition for near-term price action. Let's examine his analysis together.

LinkedIn | Danish ARIFIN

Executive Summary

Renault SA (EPA:RNO) is the largest French carmaker. Renault sells most of its cars in Europe as well as in the emerging markets and a rather weak presence in NorAm or China. The key brands of the group are Renault (73% of total units sold) and Dacia (23% of total units sold). In 2020, Luca de Meo joined Renault at the helm as CEO and initiated a cost restructuring program, a.k.a the "Renaulution". The program has thus far been very successful, delivering EUR 2.3 billion of R&D CapEx savings by end of FY21. I would recommend initiating a buy recommendation for Renault as they are about to embark on a model cycle uplift strategy by shifting the segment mix amidst strong volumes momentum in the market and market expectations of lowered cost of some raw materials in the coming periods. (Source: Company Domain, Annual Reports)

Company Overview

Renault SA is the 10th largest OEM globally, and designs, manufactures, sells, and distributes passenger cars, light commercial vehicles, and electric vehicles. On the services front, they are in the business of sales financing, leasing, maintenance, and services contracts. The French government holds 15% of total shares and 20% of the voting rights, and long-term strategic partner Nissan holds an additional 15% and has recently gained the right to exercise its voting rights as well.

Company History

Renault SA, commonly known as Renault, was founded in 1899 by Louis Renault and his brothers, Marcel and Fernand Renault. Initially, Renault focused on manufacturing cars with innovative features and quickly gained recognition in the early 20th century for its groundbreaking designs. During World War I, Renault produced military vehicles and became a major supplier for the French Army.

In the post-war era, Renault experienced significant growth and expanded its product line to include popular models like the Renault 4CV and the Renault Dauphine. In the 1970s, the company faced financial challenges, leading to a partnership with the French government, which acquired a majority stake. This collaboration allowed Renault to invest in new technologies and models, such as the Renault 5 and the iconic Renault Espace, a pioneering multi-purpose vehicle. In the 1990s, Renault embarked on a global expansion, forming strategic alliances with companies like Nissan and acquiring stakes in other automobile manufacturers. Today, Renault is one of the world's largest automobile companies, known for its diverse range of vehicles and its commitment to electric mobility and sustainability. (Source: Company Domain, Annual Reports)

Business Segments

Automotive - segment that encompasses the design, manufacturing, and sale of passenger cars, light commercial vehicles, and electric vehicles. Renault offers a wide range of models under different brands, including Renault, Dacia, Renault Samsung Motors, and LADA. The Automotive segment also includes related activities such as aftersales services, spare parts distribution, and vehicle financing.

Mobility Services - segment that provides mobility services for people and goods, individuals, companies, operators, and territories. Renault's mobility services focus on providing convenient, sustainable, and innovative solutions for urban transportation. Here are some examples of Renault's mobility services:

Car-Sharing: Renault offers car-sharing programs in select cities, allowing customers to access vehicles on a short-term basis. Users can reserve and unlock cars through a mobile app, paying for the time they use. This service provides an alternative to car ownership and promotes shared mobility, reducing congestion and environmental impact.

Ride-Hailing: Renault has partnered with ride-hailing platforms to integrate its electric vehicles into their fleets. This collaboration promotes the use of electric mobility for on-demand transportation, contributing to reduced emissions and improved air quality in urban areas.

Electric Vehicle Charging Infrastructure: As part of its commitment to electric mobility, Renault has been involved in the development of charging infrastructure. The company has invested in the installation of charging stations in strategic locations, making it more convenient for electric vehicle owners to recharge their cars and encouraging the adoption of electric vehicles.

Sales Financing - a dedicated division that provides financing solutions to customers and dealerships. This segment offers a range of financial products and services, including vehicle loans, leasing, and insurance. It plays a crucial role in supporting the sales of Renault vehicles and facilitates customer access to vehicle ownership.

Revenue Breakdown

Renault's revenue has grown steadily at a CAGR of 1% across the past decade. This indicates a period of soft performance, and they have been on a positive growth trajectory.

Similar to its EU Auto counterparts, the company operates across the price spectrum.

Dacia is a strong brand in the affordable segment, and Renault operates in the highly contested mid-range market, and Alpine would be their luxury offering.

Cost Breakdown

Competitor Analysis

SWOT Analysis:

Strengths - wide customer base and loyalty in EU markets. 1 of the largest automobile with Nissan Motors as a strategic partner. Offers a wide variety to choose from across different price ranges - sedans, SUVs, and hatchbacks, from affordable to premium. Is available in over 110 countries and actively involved in global motorsports events as teams and sponsors such as F1.

Weaknesses - despite its dominant presence and popularity in EU markets, Renault generally lacks penetration in APAC and growing EM markets where there are opportunities to be grabbed. Cases of recall of cars have slightly weakened brand image.

Opportunities - invests in hybrid and future cars such as EVs. Renault can leverage its extensive network and market leadership to develop and sustain strong partnerships with national car manufactureres, for e.g. Mahindra and Mahindra in India to penetrate these markets. Complementing this would be to extend distribution and servicing network to increase market penetration.

Threats - intensive competition that hinges on price wars. Innovative features introduced in competitive care which leads to product differentiation. Competition with national car manufacturers who enjoy increased market penetration.

Investment Thesis

Model cycle uplift - Renault's key strategy to shift up their segment mix up-market. In 2021, their C-segment cars made up roughly 25% of Renault's sales and the company has said that the absolute EBIT contribution of a C-segment is at least double that of a B-segment car. The strategic target here is to double this share and they have set itself a target to raise the EBIT contribution from C-segment cars from 15% in 2019 to 40% by 2025. The influx of newer and more expensive cars will lead to a pricing upcycle for Renault - expectations of an increase in average sales price in the upcoming models. Renault has already posted strong 1Q23 results, beating consensus on both volumes (+14% YoY) and pricing (EUR 19.7K ASP, +14% YoY). (Source: Company Financial Reports, Bloomberg)

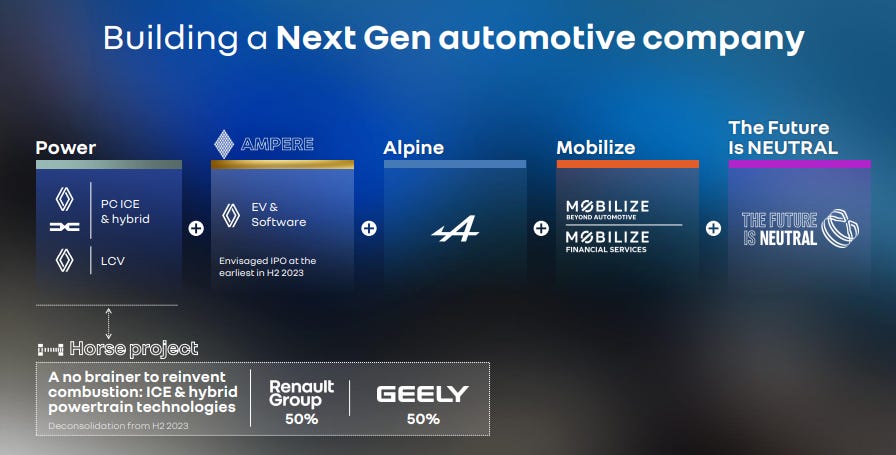

EV and ICE separation and spin-off - Renault had a capital markets day in November where they revealed details of strategic restructuring. Their industrial business would be bifurcated into 2 core divisions: (1) one focused on production of their EV lines, such as Ampere and the other; (2) one on ICE vehicles (Power). Ampere will be spun-off, and the company are thinking about the carve-out and thje IPO separately, with separate motivations, the carve-out slated for H2 of 2023 and the IPO expected to be happening some time in H1 of 2024. Meanwhile, the ICE business will transfer its drivetrain design and production assets into a JV with Geely, who will contribute their Aurobay assets to form a combined entity that will be able to leverage industry-leading scale and become the world's largest 3rd-party ICE and hybrid drivetrain supplier instantly. (Source: Company Capital Markets Day Presentation, Other Company Reports)

Electrification for the EV transition and the Alliance - Renault was one of the pioneers and the forefrunt builders of electrification in the auto space in EU, with the Renault Zoe being a top-selling BEV in 2010s and 2020. The comapny has been in plans to jointly develop 5 new platforms with their Alliance partners Nissan and Mitsubishi. By 2030, the Alliance plans to have 35 EV-only models on sale with >90% of cars built on common platforms. The 3 OEMs plan to invest a combined EUR 23 billion in electrification over the next 5 years, and Renault might likely bear a huge portion (roughly 10 billion) of that. The hope is that this can reduce Renault's CAPEX burden of simultaneously investing in EV and ICE.

Valuation

Dichotomoy in auto valuations - near-term upside positioned against long-term risks. This is evident in Renault's situation. Given what is discounted in auto valuations today, the higher certainty of near-term cash flows should outweigh additional long-term risks.

Near-term upside is increasingly visible - Renault, as other OEMs alike, have benefited from the pandemic supply shortage. However, the underlying strategy, Renaulution which was initiated in 2020, remains in place and the company will start reaping the rewards in 2023 onwards. 4 years into strategy implementation and execution and the market is witnessing the company's underlying EPS grow from EUR 8.26 to an estimated EUR 14.01 by 2025. In this few-year-span, I see very little competitive risk to Renault's strategy as its battery electric vehicles (BEV) penetration remains low, Chinese entry has not occured yet, and its overlap with EV behemoths like Tesla is marginal. (Source: Bloomberg Finance, Capital IQ)

Long-term risks continue to exist for the EU sector - long-term risks for Renault are largely sector risks. Higher CAPEX from the BEV transition, Chinese entry, or a Tesla move downmarket are without a doubt concerns weighing on the whole auto sector. However, these are still uncertain, may only have a credible impact post-2025, and should be discounted in the sector multiple, as they apply equally to peers like VW or Stellantis who have similar revenue shares impacted compared to Renault. (Source: Bloomberg Finance, Capital IQ)

Capital allocation - common pushback is that investors will continue to face risks from their 'exit multiple and earnings', given the low share of distribution to shareholders in Renault. In my opinion, the best protection against long-term risks for autos is to significantly increase the distribution to shareholders. At present, it is difficult to dispel strategic fears in the upcoming quarters, and the only way to be able to increase the certainty of shareholder returns is by putting more cash on the table. Renault is doing exactly just that and are in the right direction by introducing dividends and reduction of debt. (Source: Bloomberg Finance, Capital IQ)

Market discounting unprecedent sector-wide headwinds - despite an upcycle on the horizon, it seems market sentiments point towards autos valuations today that are discounting long-term risks from electrification, Chinese competition, peak car, and more. However, it seems to me that market is valuing OEMs to go out of business which is unlikely the case. (Source: Seeking Alpha Reports, BlackRock)

Renault is trading on 9.3x EV/EBIT and 3.7x P/E, with the former showing that the company is trading well below its long-term average and even below its lower quartile, but only at a cum. 2% discount to the autos sector. This can also be said about the company's 3.7x P/E multiple, well below normal ranges, but at a cum. 30% discount to the sector which is in-line with its history. (Source: Bloomberg, Capital IQ)

I value Renault at 10.2x EV/EBIT and 4.6x P/E, which is below long-term averages, reflecting long-term outlook for OEMs' earnings power, but above today's levels, which disregard the upcoming cycle. (Own Analysis)

Risks and Mitigation

For EU Autos, the risks are macro in nature. Earnings, liquidity, and equity value could be severely tested in the event of economic contractions in major end markets like EU, US, China and EMs. Companies in the EU Autos sector are at risk of specific product and project failure, while the ability of financial services businesses to remain viable could also be tested if the global financial system deteriorates again, restricting capital markets access for enhancing liquidity. A strong move of Chinese OEMs planning to grab a piece of the pie in EU or NorAM markets could threaten companies like Renault.

Company-specific risks that would affect Renault would be that of EU's macroeconomic difficulties and the Russian geopolitical tensions and their economic difficulties. Alongside that, would be the listing of Ampere which, in the current bear market, is not favbourable for an IPO especially at the size it is being touted. EU capital markets have performed poorly relative to the US capital markets in the last decade.

ESG Assessment

Conclusion

Renault seems to me, an attractive business in a highly contested industry. They have been achieving good growth prior to the COVID-19 pandemic and their margins are healthily improving.

Their EV transition looks to be on track and at a good pace, as well as capital allocation in other areas represents opportunities for Renault's future growth.

On a valuations perspective, the stock looks absolutely mispriced. Corporate actions such as ownership of Nissan and the upcoming public listing of Ampere represent a strong value proposition for near-term price action.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.