Initial Report: Rockwell Medical, Inc (NASDAQ:RMTI), 51.6% 5-yr Potential Upside (VIP, Javier Chan)

Javier presents a "BUY" recommendation based on market not accounting for potential new contracts that management has indicated are expected to be announced in the coming weeks.

LinkedIn: Javier Chan

Executive Summary

I am initiating a BUY recommendation on Rockwell Medical Inc. (RMTI) with a one-year price target of $3.23, representing a 43.7% upside. RMTI is the second-largest manufacturer of dialysis concentrate in the U.S. The stock experienced a sharp selloff of 52% after a disappointing Q3, driven by news that its largest client, DaVita, plans to cancel $31-38 million in contracts for 2025. At its current valuation, the market appears to have fully priced in this loss. However, it has not accounted for potential new contracts that management has indicated are expected to be announced in the coming weeks. Given this, RMTI seems oversold and significantly de-risked, presenting a compelling entry point ahead of a catalyst-rich Q4 2024 and H1 2025.

Company Background

Rockwell Medical (Nasdaq: RMTI) is a healthcare company that develops, manufactures, commercializes, and distributes a portfolio of hemodialysis products for dialysis providers worldwide. Their primary focus is on creating and delivering products for patients with end-stage kidney disease (ESRD) and chronic kidney disease (CKD).

Their primary product is hemodialysis concentrates, which are used in treatments that filter waste and excess fluid from the blood in patients with kidney failure. Historically, the company's largest customer has been DaVita Inc. (NYSE: DVA), a leading healthcare provider specializing in kidney dialysis services. DVA holds approximately 37% of the U.S. dialysis market and has accounted for about 50% of RMTI's revenues.

Set-up

RMTI shares dropped 52% following the company's announcement that DVA plans to reduce contracts by an estimated $31-38 million for 2025. Under the agreement, DVA must provide RMTI with a binding 12-month forecast by December 15, 2024, which will clarify the actual impact on 2025 net sales. In response to this news, sell-side analysts have lowered their 2025 revenue forecasts from approximately $108 million to $79 million.

At current levels, the stock appears to be pricing in a worst-case scenario – a $35 million revenue decline – with no offsetting new contracts. However, I believe this reduction in DVA volumes has a limited impact on RMTI’s bottom line and free cash flow. Management has indicated that multiple high-margin contracts are in the pipeline, with announcements expected in the coming weeks. These new contracts should help bridge the revenue gap and support profitability. I anticipate consensus estimate upgrades in the near term.

Investment Thesis

1. Reaction to DVA’s cancelled contracts is overblown

According to the company, gross margins associated with DVA have historically been in the negative to low single-digit range. Management has indicated they are collaborating with DVA to focus volume reductions on the least profitable products for RMTI. DVA’s rationale for reducing volumes is to diversify its supplier base, although it remains unclear who the new supplier will be.

Assuming an average 5% gross margin on the lost DVA contracts, the revenue reduction likely results in a loss of just $1.5-2 million in profits – approximately 10% of RMTI’s annual gross profit – despite a 35% decline in revenue. With higher-margin contracts expected in the near term, RMTI should be well-positioned to recoup this profit and potentially exceed it. After adjusting for the DVA revenue and profit loss, RMTI’s non-DaVita contracts are estimated to generate gross margins of 25-30%. This suggests that securing just $5-8 million in new contracts would effectively bridge the profit gap.

During the Q3 earnings call, management disclosed that they are expecting a large domestic contract, several international contracts, and the addition of two complementary hemodialysis products to the portfolio in 2025. Furthermore, the reduction of low-margin DVA contracts could be a net positive for RMTI in the long run, as it frees up manufacturing capacity for higher-margin business. This shift is likely to result in margin expansion, with gross margins expected to improve from ~18% in 2024 to 23-25% in 2025. The enhanced profitability should support higher valuation multiples as long as RMTI can bridge the revenue gap.

Interestingly, DVA holds a small stake in RMTI (<5%), reflecting a longstanding partnership. While it is possible for tensions to arise, it seems unlikely that DVA would act in a manner overtly detrimental to RMTI. Additionally, based on my exchanges with industry insiders on Twitter/X, it appears that RMTI management may have been given advance notice of DVA’s plans, affording them time to prepare. There are also whispers that DVA’s decision to reduce volumes was not made at the executive level, leaving open the possibility that DVA could reverse course if managing multiple suppliers proves too complex. However, this remains speculative and is not factored into my base case, though it could be treated as optionality value.

2. Deciphering the Large Contract

During Q3’24 earnings in Nov, management revealed that they were “in the process of negotiating a large multiyear supply agreement with the world’s largest leading provider of dialysis products and services and hope to be able to announce the execution of this agreement later this month.”

This raises 3 questions: (a) Who is the agreement with?, (b) How large is the contract? and (c) How will it be executed?

By analyzing comments made by CEO Mark Strobeck in earnings calls and conferences over the past year, we can piece together clues to identify the potential customer, estimate the size of the contract, and understand the likely execution strategy.

2a. Foes to Friends

The phrasing used by RMTI management has been very specific – “world’s largest leading provider of dialysis products and services” – strongly suggests that the potential partner is Fresenius Medical Care (ETR: FRE). Fresenius is a global healthcare conglomerate operating across multiple verticals, including dialysis products, drugs, devices, hospitals, and healthcare services.

Fresenius is by far the largest player in the dialysis concentrates market and is essentially RMTI's only credible competitor. The U.S. dialysis concentrates market is effectively a duopoly, with a 75-25 market share split between Fresenius and RMTI. Both companies are the only ones with the manufacturing capacity and distribution networks required to supply dialysis concentrates to over 12,000 dialysis centers in the U.S. However, the concentrates business is relatively insignificant for Fresenius at the company level, estimated to contribute less than 1% of its annual revenues.

To ensure that management is not just sensationalizing headlines, there are multiple signs apart from this that point towards the partner being Fresenius:

Fresenius has been actively working to exit low-margin businesses as part of its strategy to achieve an operating margin of 10-14% by 2025, up from ~8% as of Q3 2024. To meet this goal, the company has been implementing a strategic portfolio optimization program since 2023, focused on divesting non-core and underperforming assets. Over the past year, Fresenius has sold off hundreds of clinics, hospitals, and international assets as part of this effort. The concentrates business, likely dilutive to Fresenius’ bottom line, could be a candidate for divestment. Outsourcing the production of concentrates to a supplier with the scale and efficiency to provide competitive pricing would allow Fresenius to cut operating costs and improve overall margins. This aligns with their broader deleveraging and profitability-enhancement goals.

During the Q3 earnings call, RMTI management stated they were “in discussions to secure a permanent position in the West” and expected to provide more details in the coming weeks. Previously, during the Q2 earnings call, management noted that “in the West, it’s essentially a 1-player market. It’s Fresenius.” The use of the term “permanent position” is particularly noteworthy and suggests that RMTI may be preparing to take over Fresenius’ position in the region.

While RMTI’s largest customer is DVA, their second-largest customer is, interestingly, Fresenius. This relationship was only recently disclosed by RMTI in July during the Annual Kidney Virtual Conference. This indicates that RMTI and Fresenius already share a close working relationship.

Putting the pieces together: Fresenius has a clear incentive to exit the dialysis concentrates business as part of its margin improvement and portfolio optimization strategy. However, they would still require a reliable supplier for their own dialysis devices and hospitals. RMTI, meanwhile, has been actively targeting the West U.S. market – a region dominated by Fresenius – and already counts Fresenius as its second-largest customer. Combined with RMTI management’s references to a “world’s largest” provider and securing a “permanent position,” it seems highly likely that the new contract will be with Fresenius.

2b. Sizing the Opportunity

The size of a “large” contract is hard to predict, but we can again mosaic together some of management’s words to size up the opportunity.

During Q2 2024 earnings, management highlighted that the West was a “$100 million opportunity”.

During the Annual Kidney Virtual Conference in July, management highlighted that they are looking at different acquisition opportunities; “some of which are smaller and can give them access to markets that they don't currently access. Others of which are about one times the size of their current business, which today stands at about $90-94 million in revenue.”

In my view, this $90-94mn opportunity has to be Fresenius’ concentrates business in the West; there is literally no one else of that size. This statement also hints at the execution being via an acquisition, which we will explore next.

2c. Execution and Financing

The execution of the potential deal remains uncertain, and the margin of safety can only be stress-tested through scenario analysis. Based on prior precedents, it seems likely that RMTI would try to acquire Fresenius’ West U.S. concentrates business and structure the payment in phases.

RMTI’s last major acquisition occurred in November 2023 when they acquired the hemodialysis concentrates business from Evoqua Water Technologies for $11 million upfront, plus two milestone payments of $2.5 million each at 12- and 24-months post-closing, totaling $16 million. This acquisition added $18 million in annual revenues and $3.3 million in annual EBITDA, implying a 0.88x TV/Revenue valuation for Evoqua's assets.

Raising debt for this transaction is challenging due to the terms of RMTI's Securities Purchase Agreement with DVA, which restricts RMTI from taking on additional debt beyond certain limits unless DVA consents. Therefore, it is unlikely that RMTI will use significant debt financing for this deal.

RMTI has, however, entered into a controlled equity offering sales agreement that allows them to raise up to $25 million through stock issuance at market prices if needed. While management has emphasized a cautious approach to dilution, it is unlikely they will raise more than $25 million in additional capital for this deal.

Considering management’s description of the opportunity, precedent transactions, their cash position, and the potential $25 million capital raise, one plausible scenario is that RMTI acquires the $90 million in revenue from Fresenius’ West concentrates business in one transaction, with consideration paid over two equal annual installments.

While this is my “best guess”, these terms are extremely favorable for RMTI, and is probably the best outcome for them. There is no certainty that Fresenius will agree to these terms, but given that the transaction size is relatively small for Fresenius – who has $1.5 billion in cash on its balance sheet – the financing terms are unlikely to be a significant obstacle. Active negotiations will likely focus more on the pricing and markup of the concentrates that RMTI sells to Fresenius. For now, I will only consider this scenario as my bull case.

There is also a risk that the large contract may end up being completely unrelated to the $90-94 million opportunity previously discussed. It's possible that this could come from a completely different vertical, and the actual large contract could involve Fresenius merely outsourcing some of its production. As a result, my base case only assumes a $15 million large contract. This estimate is loosely based on management’s description of a one-off $4.5 million "special large order" from DVA in Q3, which would annualize to about $18 million. After factoring in a conservative haircut, I’ve adjusted this to $15 million.

Valuation

2025 Revenue Forecast Schedule (base case)

Based on current 2024 guidance and some assumptions about upcoming contracts, we can construct the bridge from 2024 to 2025 revenues. This will imply ~$82mn in revenues for 2025.

In my bull case, I assume a $90 million large contract, with consideration paid in two tranches, and an at-the-market equity raise capped at $25 million. This would result in 34% share dilution, but will be offset by the spike in revenues (and profits) by almost 100%.

In my bear case, I assume no new contracts – i.e. large contract negotiation falls through, and no international or miscellaneous contracts are announced.

There is a significant margin of safety at current levels. Even if the contract with Fresenius amounts to only $15 million in annual revenues, the base case still suggests a 28% upside. The only downside scenario would be if RMTI fails to secure any new contracts by the end of 2025, which seems highly unlikely. At current stock price, the market is essentially not factoring in any new contracts, which appears illogical. As a result, the expected returns for this stock are clearly skewed significantly to the upside.

Historical EV/Revenue (NTM):

I am valuing RMTI between 1.0-1.2x sales, which is roughly where it traded prior to Q3 earnings. This is still at a discount to peers who are trading at 1.7x sales on average.

RMTI’s multiples are currently artificially depressed, as one broker has yet to revise their 2025 sales forecast following the Q3 earnings report. Assuming the 2025 sales consensus is revised down to $79 million, in line with other brokers, the current forward EV/Sales multiple would be around 0.87x. I expect a rerating of the multiples once there is more clarity on the economics of the large contract.

Event Path

I expect multiple catalysts in the near term, with the primary one being the announcement of the large contract, which is expected by the end of November. Regardless of the contract size, this announcement is likely to trigger a rerating of the stock. Following that, we can anticipate announcements of international contracts and new complementary product verticals, all expected within the next few weeks. These developments should be sufficient to drive consensus upgrades. Additionally, 2025 guidance, set to be issued in February, is likely to exceed current estimates.

Risks

The main risk is that the large contract negotiation falls through or that unfavorable terms are reached, leading to greater-than-expected dilution without a commensurate increase in revenues or profits. However, as outlined above, unless the worst-case scenario occurs, downside risk is limited.

Due to the nature of the stock as a microcap ($75 million market cap), the stock could introduce higher volatility to our portfolio. However, I believe the risk-to-reward at current levels is highly asymmetric, and volatility will be more biased towards the upside.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

Appendix

Management Team

RMTI has a strong team with a solid track record of execution. The current CEO, Mark Strobeck, Ph.D., was appointed in 2022 to lead the turnaround of the company. Interestingly, he has a history of successfully turning around and selling businesses, which could open up strategic opportunities for RMTI down the line.

Dr. Strobeck has over 20 years of leadership experience in the biotechnology and pharmaceutical industries, with expertise in product development, corporate strategy, and navigating complex healthcare markets. Most recently, he served as Managing Director at Aquilo Partners, a life sciences investment bank. Previously, he was Executive Vice President and Chief Operating Officer of Assertio Holdings, a pharmaceutical company, and Executive Vice President and COO of Zyla Life Sciences, which merged with Assertio Holdings in 2020. He also served as CEO of Corridor Pharmaceuticals, which was acquired by AstraZeneca in 2014, and as Chief Business Officer of Topaz Pharmaceuticals, acquired by Sanofi Pasteur in 2011. Dr. Strobeck has also held management roles at other major pharma companies and venture capital firms.

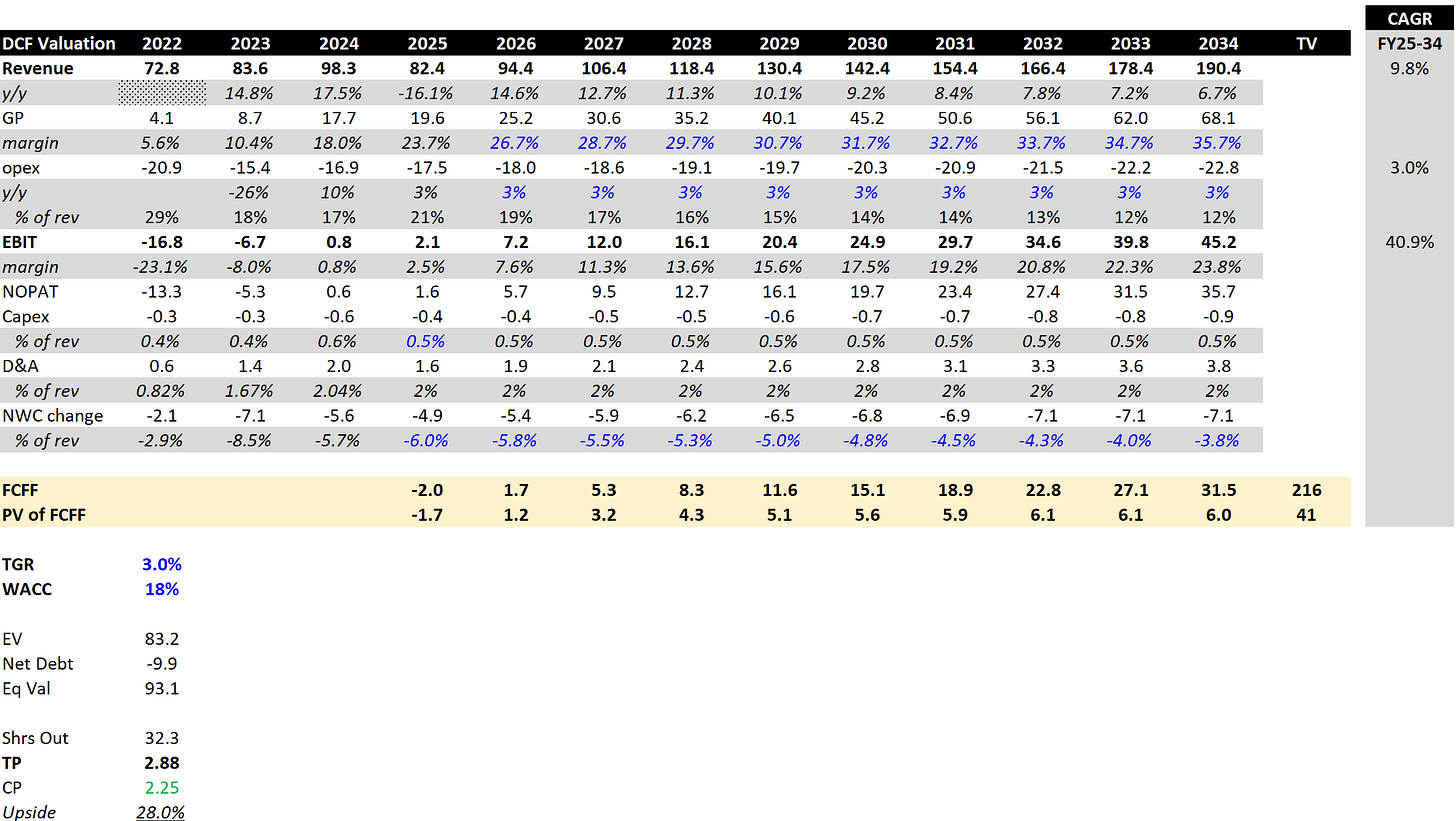

DCF (sense check)

A DCF sense check baking in 10Y revenue CAGR @ ~10%, gross margin expansion towards ~35%, operating margin expansion towards ~24%, at 3% perpetual growth and 18% WACC implies a price target of $2.88, which reconciles with my base case.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.