Initial Report: S&P Global Inc. (NYSE: SPGI), 98% 5-yr Potential Upside (FONG Zhi Heng, SC VIP)

FONG Zhi Heng presents a "BUY" recommendation based on macro tailwinds, S&P Global's post-acquisition synergies and diversified revenue streams.

1. Company Overview

S&P Global Inc. (NYSE: SPGI) is a leading provider of essential data, credit ratings, benchmarks, and analytics for capital and commodity markets worldwide. Headquartered in New York, the company has built a strong reputation for delivering mission-critical intelligence that powers investment decisions and financial planning for institutional and retail investors alike.

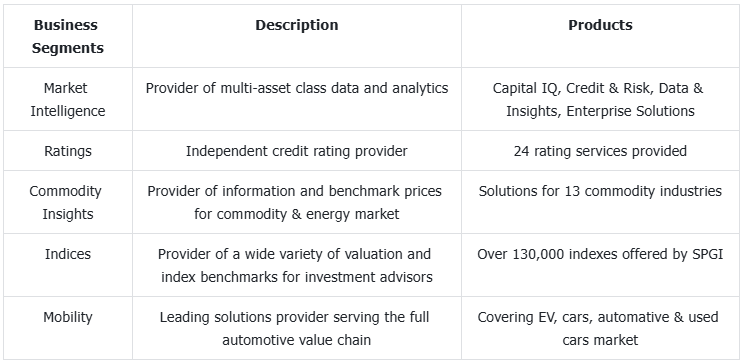

The firm operates across five primary business segments: Market Intelligence, Ratings, Commodity Insights, Indices, and Mobility. The Market Intelligence segment provides a suite of multi-asset class data and analytics products, such as Capital IQ, which cater to financial institutions, corporations, and governments. This segment is integral for delivering differentiated data sets that support credit risk analysis, private equity research, and financial modeling.

The Ratings segment is perhaps the most recognized of S&P Global’s businesses. It functions as an independent credit rating agency and is one-half of the global duopoly in this space, alongside Moody’s. SPGI provides credit assessments for a wide range of fixed-income instruments, including corporate bonds, sovereign debt, municipal bonds, and structured finance products.

Commodity Insights supplies critical price benchmarks and market information for energy and raw materials, serving stakeholders in trading, shipping, and production. The Indices segment offers over 130,000 equity and fixed income indices globally, including the iconic S&P 500, supporting the booming exchange-traded fund (ETF) market. Finally, the Mobility segment caters to the automotive ecosystem, offering data and analytics across electric vehicles, used car markets, and automotive technology, thereby supporting original equipment manufacturers (OEMs), insurers, and fleet operators.

Together, these segments allow S&P Global to generate resilient, high-margin revenues across economic cycles, making it one of the most dependable and respected names in financial data and infrastructure globally.

If revenue contributions are greater than EBIT contributions, it signals that the business segment is of lower margins.

2. Industry Overview

The broader financial information services industry has experienced rapid transformation in recent years, driven by digitalization, regulatory complexity, and the rising demand for data transparency. S&P Global stands at the forefront of this evolution, well-positioned to capitalize on long-term secular tailwinds that are reshaping global financial markets.

2.1 Rise in Global Financial Participation Post-COVID

There has been a sustained boom in financial market participation since the onset of the COVID-19 pandemic, with record inflows into equities, fixed income, and alternative asset classes. Simultaneously, the proliferation of ETFs has further entrenched the role of benchmark providers such as SPGI in the global investment landscape. Assets under management in ETFs have ballooned to over $10 trillion, reinforcing the importance of accurate, timely, and trusted indexing solutions.

Source: Statista

2.2 Expansion of Financial Data Demand by Traditional Users

Another key growth driver for the industry is the increasing reliance on high-quality data by asset managers, insurers, regulators, and fintech companies. As portfolio management becomes more algorithmic and data-driven, the demand for proprietary analytics, credit ratings, and ESG insights continues to accelerate. Notably, the financial analytics market is projected to grow at a compound annual growth rate (CAGR) of 12.5% through 2030, reaching over $21 billion in annual revenues.

Source: Statista

2.3 Expansion of Private Market & ESG Data

Beyond public markets, the growing sophistication of private equity, venture capital, and private credit investors has created fresh demand for specialized datasets, enterprise platforms, and benchmarking tools. S&P Global’s focus on integrating AI into its analytics platforms positions it as a critical enabler in this evolving ecosystem.

2.4 China’s Financial Liberalization as a Growth Lever

The firm is also set to benefit from the gradual reopening of China’s financial markets and the country’s push to internationalize its bond and credit markets. With the People’s Bank of China and key state agencies liberalizing bond ratings, SPGI’s presence in China could prove to be an important growth lever over the next decade.

3. Competitive Positioning

3.1 Dominant Duopoly in Credit Ratings

S&P Global operates in an industry characterized by high barriers to entry and entrenched competitive dynamics. In the Ratings segment, the firm shares a near-duopoly with Moody’s, collectively controlling approximately 80% of the global credit ratings market. This structure provides both firms with substantial pricing power and protects them from competitive disruption. Clients often seek dual ratings from both SPGI and Moody’s to meet regulatory and investor requirements, which further reduces pricing pressure and promotes high retention rates.

3.2 Defensive Niche in Market Intelligence

The Market Intelligence segment is more fragmented, with competition from Bloomberg, FactSet, Refinitiv (Eikon), and smaller data providers. However, SPGI has built a defensible niche by offering a cost-effective, enterprise-friendly alternative with deeper capabilities in private market intelligence, ESG scoring, and fundamental research. Products like Capital IQ and Credit & Risk Solutions allow SPGI to compete effectively by offering strong integration with enterprise workflows at competitive pricing.

Source: WallstreetPrep

3.3 Iconic Presence in the Indices Market

In the Indices business, S&P Global competes with FTSE Russell and MSCI. However, the firm’s role as the provider of the S&P 500 and Dow Jones indices grants it iconic brand value and enormous influence in passive investment flows. As ETFs continue to dominate fund flows globally, SPGI’s position in this space ensures a consistent and scalable revenue stream through licensing fees.

3.4 Quasi-monopoly in Commodity Benchmarks

Its Commodity Insights segment, previously Platts, remains a key player in providing price assessments for oil, gas, metals, and shipping. The segment’s benchmarks are integral to global commodities trading and procurement, giving SPGI a quasi-monopolistic presence in some verticals.

3.5 First-Mover Advantage in Automotive Data Analytics

Finally, the Mobility segment, while relatively nascent, benefits from strong legacy relationships through the IHS Markit acquisition. Its integration across supply chains and vehicle analytics gives it a head start in automotive data analytics as the industry undergoes electrification and software transformation.

4. Thesis 1: High Margins Ratings Business driven by Macro Tailwinds

4.1 Favourable Macro Conditions

While macroeconomic conditions may appear challenging on the surface, they are in fact creating a supportive environment for S&P Global’s Ratings segment — a business that already operates at industry-leading margins. Amid persistent fears of inflation and lingering memories of the 2022 bond market crash, current data suggests that the global credit landscape is in recovery mode. As the financial system normalizes post-COVID, the demand for bond issuances is rebounding, creating a strong structural tailwind for SPGI’s credit ratings revenue.

4.2 Inflation Concerns Are Overblown

Although inflation in the United States remains elevated relative to pre-pandemic levels—hovering around 2.4% to 3%—this moderate inflation does not appear to be deterring market confidence. Historical anxieties, particularly from the bond market crash in 2022 which saw a 30% reduction in investment-grade bond issuance and an 80% drop in high-yield issuances, continue to shape sentiment. The crash also led to a 13% decline in the US Aggregate Bond Index and contributed to a roughly 26% fall in SPGI’s Ratings revenue during the period.

However, these conditions are not persisting. The current environment reflects a scenario of mild inflation, narrow spreads, and increased investor confidence—a stark contrast to previous downturns. This backdrop is increasingly favorable for debt issuance, leading to a surge in demand for global bonds and, by extension, an uptick in SPGI’s Ratings services.

4.3 Recovery in Financial Markets Supports Bond Issuance

Under normal economic scenarios, rising inflation tends to elevate interest rates and lower bond prices, making bond issuance less attractive. However, in the current climate, spreads are narrowing and confidence is returning, particularly in emerging markets where economic activity is rebounding. Investors are re-engaging with fixed income as the Federal Reserve signals rate stabilization, leading to renewed issuance activity across sovereigns, corporates, and structured finance.

This resurgence directly feeds S&P Global’s high-margin Ratings business. With over 62.7% operating margins in 2024, Ratings is the most profitable segment within SPGI, surpassing even the Indices division. As bond market volumes rise, the firm can efficiently scale this segment without proportionate increases in costs, leading to operating leverage and expanded earnings.

4.4 China Expansion Presents a New Growth Frontier

A critical geographic opportunity lies in China, where S&P Global is beginning to entrench itself in the country’s rapidly maturing bond markets. In November 2024, Moody’s downgraded China’s sovereign credit outlook to "negative," which may deter global investors and drive issuers to seek alternative ratings providers. SPGI is well-positioned to fill this void. Compared to its rival, it may offer more favorable ratings treatment—without compromising credibility—at a time when Chinese companies are eager to maintain investor confidence.

China’s bond market is massive, with US$24.3 trillion in bonds outstanding and US$10.9 trillion in annual bond issuances. SPGI’s entry into this arena, supported by its global credibility and official regulatory recognition, gives it an edge over local players and even global competitors. Companies seeking dual ratings, or attempting to diversify away from Moody’s, are increasingly turning to SPGI, bolstering its international growth narrative.

4.5 Irreplaceable Role of Established Credit Agencies

One of the most defensible aspects of SPGI’s Ratings business is its entrenched position in the financial infrastructure. Obtaining a credit rating from SPGI is not just about meeting compliance standards—it materially improves issuer economics. On average, a rating from S&P Global adds only 8 basis points to bond issuance costs. In contrast, the absence of a reputable rating or reliance on lesser-known firms can inflate legal fees by 75–125 basis points and widen interest spreads by up to 300 basis points. The net cost savings of securing an SPGI rating can range from +30 to 65 basis points, making the value proposition highly compelling for issuers.

Moreover, SPGI and Moody’s effectively form a duopoly, offering dual ratings that reduce pricing pressure and ensure that both firms maintain high utilization rates. This structure enables rational competition and sustains long-term market share, which is further enhanced by the firm’s regulatory approval by the U.S. Securities and Exchange Commission (SEC) and its international counterparts.

Source: Morningstar

4.6 Conclusion: Undervalued Catalyst for Profitability

Investors may still underappreciate the strategic importance and margin profile of the Ratings business. While short-term fears about macro uncertainty persist, the long-term outlook is fundamentally bullish. As bond markets regain momentum and SPGI expands into geographies like China, the Ratings segment is poised to be a key driver of earnings growth. Its operational leverage, global trust, and market structure give it an enduring edge that supports SPGI’s overall investment case.

5. Thesis 2: Realisation of Post-Acquisition Synergies Driving Profitability

5.1 Complementary Nature of Market Intelligence Segments

The successful integration of IHS Markit into S&P Global marks a pivotal transformation in the company’s growth trajectory. While initial investor sentiment was cautious—driven by concerns about cultural misalignment, overlapping platforms, and operational redundancies—the post-merger reality has far exceeded expectations. S&P Global has strategically leveraged the complementary strengths of both firms to expand its product offering, broaden its customer base, and unlock both revenue and cost synergies across its Market Intelligence segment.

Prior to the merger, there were legitimate fears of intensified competition from incumbents such as Bloomberg and the London Stock Exchange Group (LSEG), particularly in the financial data vertical. Critics argued that such competition could erode SPGI’s pricing power and market share. However, these concerns have proven largely unfounded. Instead, the expanded suite of solutions enabled by the merger has fortified SPGI’s competitive position, allowing it to deepen client relationships and cross-sell more effectively across platforms.

5.2 Complementary Capabilities Enable Seamless Integration

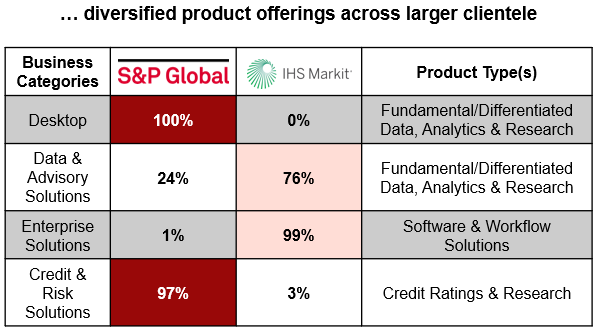

The synergy between S&P Global and IHS Markit stems from the natural complementarity of their offerings. While SPGI brought to the table a dominant presence in desktop-based solutions and credit analytics, IHS Markit had a robust footprint in enterprise software and workflow tools. The integration of these platforms has created an end-to-end data and analytics ecosystem that serves clients across asset management, ESG research, commodity trading, and private markets.

According to internal data, S&P Global contributed 100% of desktop-based data delivery, while IHS Markit brought 99% of enterprise solutions expertise. In the data and advisory category, SPGI accounted for 24% while IHS Markit contributed the remaining 76%. Such complementarity allows SPGI to serve a much broader range of client needs—from desk-level analytics and real-time dashboards to enterprise-level data integration for large institutions.

Additionally, the two companies shared expertise in core thematic areas such as ESG data, private markets, energy and commodity insights, multi-asset analytics, and credit risk management. These overlapping yet complementary capabilities significantly reduced the integration friction often seen in large-scale mergers, facilitating a smoother transition and faster synergy realization.

Source: Company Filings

5.3 Cross-Selling Opportunities Expand Total Addressable Market

Post-merger, S&P Global has identified an incremental total addressable market (TAM) of approximately $20 billion. This TAM expansion is underpinned by increasing demand for ESG metrics, private market intelligence, and energy-related analytics—domains where both legacy companies had substantial but complementary capabilities.

Importantly, the company expects average market growth exceeding 10% across its newly combined verticals. ESG and private markets are expected to grow even faster, with third-party forecasts from firms such as PwC and Deloitte projecting double-digit compound annual growth rates (CAGR) for ESG data, private equity analytics, and sustainable investment solutions through 2030. These macro tailwinds offer SPGI the opportunity to scale organically while also layering in revenue synergies through cross-selling.

The merger has enabled SPGI to integrate client workflows more holistically. Customers who previously subscribed to one set of products now gain access to an expanded ecosystem of differentiated data, research, and workflow tools—all within one seamless platform. This expansion of offerings boosts customer retention and increases share of wallet per client.

Source: Company Filings

5.4 Execution Excellence and Realisation of Synergies

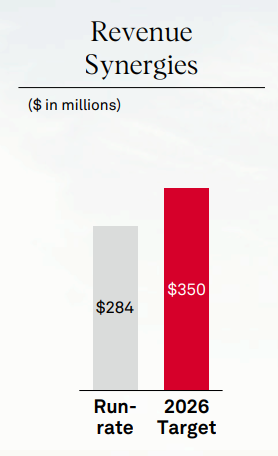

S&P Global’s management has guided toward $350 million in total revenue synergies by 2024, and as of early 2025, a significant portion of that target has already been realized. These synergies have been achieved through the rationalization of overlapping functions, consolidation of sales and service operations, and more importantly, through accelerated cross-selling to institutional clients.

Source: Q4 Earnings Call, Feb 2025

The Market Intelligence segment, in particular, has experienced notable acceleration in multi-product licensing agreements, enterprise-wide subscriptions, and custom analytics contracts. The efficient deployment of integrated solutions has not only increased revenue per client but also enhanced operational margins, as product bundling reduces incremental servicing costs.

Importantly, the success of the integration has proven SPGI’s capability to execute on large-scale strategic mergers—a capability that adds intangible value to the company’s long-term investment thesis and opens the door for future bolt-on acquisitions in adjacent data verticals.

5.5 Conclusion: A Stronger, More Scalable Market Intelligence Platform

The merger with IHS Markit has transformed S&P Global into a more comprehensive and scalable platform. The ability to offer both desktop and enterprise solutions across multiple data verticals positions the company to capture a greater share of wallet from institutional clients. With a growing addressable market, strong execution from management, and clear signs of synergy realization, the Market Intelligence segment now stands as a central pillar in SPGI’s long-term value creation strategy.

As financial markets continue to embrace digitization and demand for real-time, decision-critical information grows, SPGI is well-positioned to meet these needs with unmatched breadth and depth. The company has not only reinforced its competitive advantage but has also created a new growth runway in a fast-evolving industry.

6. Thesis 3: Diversified Revenue Streams Drive Sustained Revenue Growth

6.1 A Stable Foundation with High Visibility and Operating Leverage

A key strength of S&P Global’s business model lies in its diversified and resilient revenue streams, which provide a strong foundation for sustained growth, even amid market volatility. Across its five core operating segments—Market Intelligence, Ratings, Commodity Insights, Mobility, and Indices—the company generates income from a balanced mix of subscription, transaction-based, non-transaction, and asset-linked sources. This revenue composition enhances both predictability and scalability, while offering protection against cyclical downturns in any single business vertical.

In FY2023, SPGI generated US$14.2 billion in total revenue. Of this, 52% came from subscription revenue, ensuring high visibility and recurring cash flows. Transaction revenue contributed 21%, non-transaction revenue accounted for 14%, and asset-linked fees—primarily from index licensing—made up 7%. The company also earned royalties and usage-based fees, bringing in an additional US$393 million.

6.2 Subscription Model Anchors Predictable Revenue

Subscription-based revenue remains the cornerstone of SPGI’s top line, particularly within the Market Intelligence and Commodity Insights segments. These divisions generated 84% and 87% of their revenue, respectively, from subscriptions. Such a model improves client stickiness, fosters long-term customer relationships, and enables better forecasting for both internal planning and investor communication.

For instance, S&P Capital IQ and other Market Intelligence platforms are deeply integrated into clients' daily workflows, making switching costs extremely high. In the Mobility segment, recurring subscription contracts with OEMs, fleet managers, and insurers ensure a reliable revenue baseline despite automotive industry cyclicality.

This recurring structure has proven especially valuable in recent years, as macroeconomic uncertainty and inflationary pressure affected capital markets. Whereas competitors with predominantly transactional models faced top-line contractions, SPGI’s subscription-driven model provided revenue stability and margin protection.

6.3 Transaction-Based Revenue Enables Cyclical Upside

Although comprising a smaller portion of the revenue base, transaction revenue offers significant operating leverage during periods of heightened financial activity. This stream is most prominent in the Ratings business, which earned 53% of its 2023 revenue from transactions related to bond issuances.

As debt markets recovered following the 2022 bond market rout, SPGI benefited directly from an increase in corporate and sovereign bond activity. The company’s Ratings segment is uniquely positioned to capitalize on future tailwinds such as refinancing waves, interest rate normalization, and global bond issuance—particularly in emerging markets like China and India.

The transaction-based model also provides SPGI with agility. Unlike fixed contracts, transaction volumes can scale quickly during bullish cycles, allowing the company to grow revenue with minimal incremental cost—leading to margin expansion during upswings.

6.4 Non-Transaction Revenue Provides Long-Term Certainty

Another notable feature of SPGI’s revenue composition is its non-transaction revenue, amounting to over US$2.04 billion in FY2023. This includes long-term contracts for data delivery, custom analytics, regulatory feeds, and research. Clients typically engage SPGI for multiyear deals, particularly in sectors like energy trading, banking, and regulatory compliance, where data continuity is mission-critical.

This revenue type anchors long-term visibility, even when market conditions are volatile. It ensures that SPGI can continue generating cash flow regardless of market cycles or near-term issuance slowdowns, adding a layer of business continuity that is often underappreciated in financial data firms.

6.5 Index Licensing and Asset-Linked Fees Drive Scalable Growth

S&P Dow Jones Indices (a joint venture with CME Group) is one of the most valuable yet often overlooked contributors to SPGI’s growth story. In FY2023, the Indices segment generated over US$1.6 billion in revenue, of which US$1.05 billion came from asset-linked fees tied to ETF and index fund assets under management (AUM). These fees are inherently scalable and benefit directly from the long-term secular trend of passive investing, which now represents over 45% of U.S. fund assets according to Morningstar.

As the global ETF market surpasses US$10 trillion in AUM and continues to expand into thematic and ESG strategies, SPGI’s index-linked revenues will continue to scale with market appreciation and new product launches. These fees require no additional servicing cost and are typically calculated as a percentage of AUM—allowing revenue to grow organically with global financial markets.

6.6 Multi-Segment Structure Adds Resilience

S&P Global’s multi-segment structure also insulates the company from idiosyncratic risk in any one business line. Each segment has distinct end-market exposures—ranging from automotive and energy to sovereign credit and investment management—providing sectoral diversification. When bond issuance is low, Mobility and Commodity Insights may outperform. When equity markets are volatile, the recurring data and regulatory analytics from Market Intelligence offer consistency.

6.7 Conclusion: A Balanced Model for Scalable and Resilient Growth

S&P Global’s diversified revenue model is a strategic asset in its own right. The combination of high-margin, recurring subscription revenue with opportunistic transaction and indexing income allows SPGI to balance stability with growth. This hybrid structure positions the company to outperform peers across market cycles, while continuing to generate robust free cash flow to reinvest in innovation, M&A, or return to shareholders.

As institutional demand for trusted data intensifies and the financial landscape becomes increasingly digital and passive, SPGI is uniquely placed to monetize these trends through its balanced, global platform. The strength of this diversified model reinforces our conviction in SPGI’s ability to compound value over the long term.

7. Catalyst

7.1 Positive Quarterly Earnings Release (Q2 2025)

One of the near-term catalysts for S&P Global’s stock performance is the expectation of a strong quarterly earnings report in Q2 2025. The company is anticipated to deliver improved financial guidance, signaling stronger operating performance and revenue growth across its business segments. Such an outcome would reinforce investor confidence in the firm’s operational execution post-merger and validate management's forward-looking projections. Improved guidance, particularly when backed by tangible margin expansion, tends to be a powerful share price driver—especially in high-quality, earnings-consistent companies like SPGI. Investors are likely to reward upward revisions in guidance and accelerating earnings with a multiple expansion, particularly in a macro environment that increasingly favors companies with reliable cash flows and pricing power.

7.2 Exceeding Revenue & Cost Synergy Targets (Q4 2025 / Q1 2026)

A key structural catalyst for SPGI lies in the realization—and potential over-delivery—of post-acquisition revenue and cost synergies from the IHS Markit merger. Management has committed to achieving US$350 million in revenue synergies by 2024, and there are increasing signs that this target may be surpassed by late 2025 or early 2026. These synergies are being driven by successful cross-selling of products across the combined client base, the rollout of new data-driven products, and increased upselling to existing customers. Additionally, operational efficiencies are being realized through consolidated platforms and harmonized infrastructure, contributing to steady margin expansion. From a valuation standpoint, exceeding synergy targets would support faster top-line growth and higher utilization rates, leading to stronger EBITDA margins—thereby justifying a higher valuation multiple.

7.3 Equity and Bond Market Exuberance (2025–2026)

The macro environment between 2025 and 2026 is expected to further support SPGI’s business model, particularly in its Indices and Ratings segments. A continued bull market in global equities will naturally increase revenue derived from index-linked assets such as ETFs and passive funds—especially as SPGI is the provider of the S&P 500 and other widely used benchmarks. Concurrently, a backdrop of declining interest rates would reignite demand in fixed income markets, spurring a new wave of bond issuances. This would benefit SPGI’s Ratings segment, which earns significant transaction-based revenue from new credit ratings. These dual tailwinds—strong equity performance and revived bond issuance—could lead to a material uplift in revenues from both high-margin businesses, driving free cash flow growth and supporting upward revisions in price targets.

8. Risk

8.1 Slowdown in Global Financial Markets

The most significant risk to S&P Global’s topline stems from a potential slowdown in global financial markets. A sharp spike in interest rates, prolonged inflation, or an unexpected economic downturn could reduce market liquidity and investor activity. In such an environment, new bond issuance tends to decline significantly, directly impacting SPGI’s Ratings segment—which relies in part on transactional revenue from newly issued credit ratings. Historical precedent highlights this risk: during the 2022 bond market downturn, investment-grade bond issuance declined by over 30% while high-yield issuance plummeted by more than 80%, leading to a material drop in SPGI’s Ratings revenue.

Mitigant: SPGI’s subscription-based revenue, which comprised 52% of total revenue in FY2023, acts as a stabilizer during cyclical downturns. The Market Intelligence and Commodity Insights segments, in particular, generate over 80% of their income from recurring contracts, ensuring predictable cash flows even when transactional volumes decline. This recurring revenue structure enables the company to weather financial storms better than peers with less diversified revenue models.

8.2 AI Reducing the Need for Financial Data and Solutions

As artificial intelligence becomes increasingly sophisticated, there is a growing risk that automated data generation and analysis tools may reduce demand for traditional financial data providers. Fintech startups and large technology firms are developing AI models capable of parsing alternative data, generating real-time forecasts, and building risk models—potentially reducing dependence on firms like SPGI.

Mitigant: SPGI is not standing still. The firm has proactively integrated AI capabilities into its own product offerings, embedding intelligent features into platforms like Capital IQ Pro and its ESG solutions. Through natural language processing (NLP), automated credit monitoring, and predictive analytics, SPGI continues to deliver differentiated value that increases customer stickiness. Moreover, its AI-enhanced products are designed not to replace human analysts, but to augment enterprise workflows, helping clients make faster, more informed decisions. These innovations are also central to SPGI’s efforts to maintain pricing power and defend against commoditization in the data analytics space. According to a 2023 report by McKinsey, over 75% of financial institutions are investing in AI to enhance operations, yet many continue to rely on external data providers for source accuracy, integrity, and compliance purposes SPGI’s focus on trust, regulatory alignment, and structured data keeps it essential in enterprise decision-making.

8.3 Regulatory and Compliance Risk

With its growing scale and influence across financial markets, S&P Global faces increasing scrutiny from global regulators, particularly in the areas of anti-trust, data privacy, and market dominance. Governments have raised concerns that financial data oligopolies—particularly in ratings, indexing, and benchmarks—may be engaging in anti-competitive behavior. The European Commission and U.S. regulators have both reviewed mergers in the financial data space with growing intensity, reflecting a wider global shift toward data governance and corporate accountability.

Mitigant: SPGI has taken a proactive stance to divest non-core or overlapping assets as part of its compliance strategy. For instance, to complete the IHS Markit acquisition, the firm agreed to sell several business units—such as CUSIP Global Services—to address regulatory concerns. By streamlining its operations and focusing on core competencies, SPGI has both maintained regulator goodwill and sharpened its strategic positioning. Furthermore, the company continues to engage with policymakers and investors transparently, highlighting its role in supporting market transparency, not obstructing it.

9. Valuation

To determine my price targets, I used EPS and P/E as my key valuation methodology. P/E ratios eventually reverted back to SPGI’s 5-year average of around 39x.

To further stress-test the valuation, a sensitivity analysis was conducted using a range of EPS and P/E scenarios to assess the potential upside and downside to SPGI’s stock price. The table plots implied share prices across various combinations of forward EPS (from $11.20 to $17.20) and P/E multiples (from 36.5x to 44.5x). This matrix highlights how the stock performs under both optimistic and conservative assumptions.

At the high end of the range, an EPS of $17.20 with a 44.5x P/E yields an implied share price of $765.40, while the downside case of $11.20 EPS and a 36.5x P/E results in $408.80. Based on the current share price of $502, this results in a favorable risk-reward ratio of approximately 0.35, meaning investors are risking $1 for the opportunity to gain $2.85—supporting the argument for a compelling margin of safety.

Thanks for the write-up! SPGI seems like a great business, but my concern revolves around valuation. The current 40PE implies steady growth of 10%-15% in earnings. However, in case of a recessionary environment, there could be a few quarters of muted growth or even de-growth. In that scenario, i see a de-rating to around 20-25 PE, which will lead to a large draw-down. Anyway, will add this to the tracking list and wait for a buy price which affords higher margin of safety!

I think a de-rating of 20-25 PE might be possible. This took place from May - Oct 2022, with the stock plummeting from $379 (25x PE) to $292 (22x PE). Over the past 5 years, the PE has dropped below 25x around 5% of the time. Peak to trough (36x P/E to 22x P/E) in 2022 lasted around 9 months, with recovery taking another 10 months.

However, SPGI's 5-year historical median P/E sits at around 37x. At today's valuation (Apr 2025), we are close to 37x P/E.