Initial Report: Samsara Inc. (NYSE: IOT), 41% 5-yr Potential Upside (Edmund LIM, SC VIP)

Edmund LIM presents a "BUY" recommendation for Samsara Inc. based on the company's digitization efforts and expanding margins.

Executive Summary

I am issuing a “BUY” recommendation for Samsara Inc. (NYSE: IOT), with a bullish outlook projecting a 29.4% upside over the next 3 years and a 40.6% upside over 5 years. This recommendation is underpinned by Samsara’s consistent growth, expanding margins, and differentiated position within a rapidly growing $96.9B connected operations market.

Samsara operates a highly recurring business model, with 98% of revenue derived from multi-year subscriptions. The company has steadily improved its gross margins to 76% and narrowed its net income margin from -187.9% in FY2020 to -12.4% in FY2025. GAAP profitability is expected in Q1 FY26. Samsara’s AI-powered platform delivers mission-critical insights across fleet management, video safety, and equipment monitoring—making it a valuable partner for operationally intensive industries.

Company Overview

As a leader in cloud technology, Samsara Inc. (NYSE: IOT) delivers a comprehensive platform for connected operations. Founded in 2015 and headquartered in San Francisco, California, Samsara has quickly become a prominent player in the Industrial Internet of Things (IIoT) and connected operations space, serving organizations that rely on physical operations across the United States and internationally. The company’s innovative platform, Connected Operations Cloud, offers a unified suite of applications that leverages Internet of Things (IoT) data to provide actionable insights and improve various aspects of their operations, including video-based safety, vehicle telematics, and equipment monitoring, among others. While they serve a diverse range of industries, they have a strong presence in sectors such as transportation, logistics, construction, and field services.

Samsara provides an intuitive platform that leverages real-time data and analytics from physical operations. Their commitment to innovation, particularly in AI-driven video safety, and a comprehensive, integrated solution, has propelled their market success. By connecting physical assets to the cloud, Samsara empowers organizations with data-driven insights, enabling informed decisions that enhance safety, efficiency, and compliance. This technology positions Samsara as a valued partner for businesses seeking operational optimization.

Samsara excels by offering a comprehensive, integrated platform that replaces the need for multiple, separate systems for managing physical operations. Instead of dealing with fragmented data from individual telematics, camera, tracking, and compliance solutions, customers gain a unified view through Samsara's Connected Operations Cloud. This interconnectedness drives efficiency and provides deeper insights, making it difficult to revert to less integrated, single-purpose tools. The result is a deeply entrenched ecosystem within the client's core operations. While initial adoption may center on specific features like real-time GPS tracking for fleet management or AI-powered dashcam technology for enhancing driver safety, the platform's holistic approach encourages the expansion to additional modules such as equipment utilization monitoring for construction companies or temperature sensors for refrigerated logistics. Beyond its unified nature, Samsara differentiates itself through the reliability of its ruggedized hardware, the accuracy of its AI-driven analytics that provide actionable insights for driver coaching and preventative maintenance, and the scalability of its cloud infrastructure to support businesses of all sizes. As a leader in cloud technology, Samsara continues to innovate, forging strategic partnerships and expanding its platform to further empower organizations with the data they need to optimize their physical operations and achieve better business outcomes.

Source: Samsara

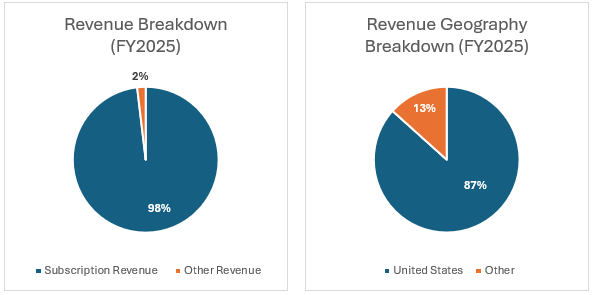

Based on FY2025, Samsara generated 98% of its revenue from subscriptions, while the remaining 2% came from product sales and maintenance services. Further, it breaks down its revenue by geography, where revenue derived from the United States accounted for 87%, while revenue derived internationally from Asia and Europe accounts for 13% of its total revenues.

Business Model

Samsara operates a subscription-based business model centered around its Connected Operations Platform. This platform, which generated approximately 98% of revenue in the past two fiscal years, offers a suite of Applications including:

Video-Based Safety;

Vehicle Telematics;

Workforce Apps;

Equipment Monitoring;

and Site Visibility

Subscriptions include IoT data collection, cellular connectivity, access to cloud Applications, APIs, the Samsara App Marketplace, customer support, and warranty coverage.

The company primarily prices its subscriptions on a per asset, per application basis, reflecting a scalable revenue model tied to customer usage. Customers are charged a per-subscription fee for a committed term, typically ranging from three to five years. These agreements are generally non-cancelable and non-refundable, providing strong revenue visibility and predictability.

Source: Nanalyze

Financial Performance

Since going public, Samsara has demonstrated a strong growth trajectory, underscored by consistent double-digit revenue expansion and significant margin improvement across the board.

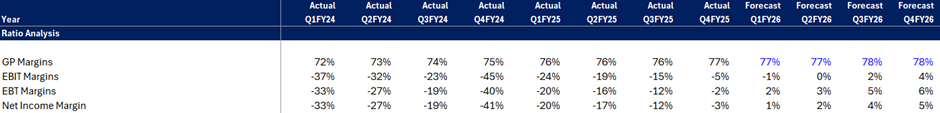

Revenue growth has been strong, though naturally decelerating from hypergrowth levels. Further, Samsara’s improving operational efficiency is yielding results, with consistent margin expansion across the board.

Business Moats

High Switching Costs

Implementing a comprehensive IoT platform like Samsara involves significant integration into a customer’s existing operations, including hardware installation in vehicles and equipment, software integration with other systems, and training of personnel.

Once a customer is deeply integrated with Samsara, switching to a competitor would involve significant time, cost, and disruption, creating high switching costs and strong customer stickiness. Furthermore, Samsara’s long contracts of 3-5 years ensure commitment from its customers for a fixed period of time, making switching out much more difficult.

Network effects and Data Advantage

Samsara’s platform processes a massive amount of operational data (14+ trillion data points annually and growing rapidly). This vast dataset, collected from a wide range of physical operations, creates a significant advantage.

As more customers use Samsara’s platform and contribute operational data, the AI and machine learning models become more sophisticated and provide increasingly valuable insights and predictions. This enhanced value proposition attracts more customers, creating a positive feedback loop or network effect. The more data they have, the better their analytics and AI, which attracts more customers, generating even more data.

Industry Analysis

Samsara operates within the Physical Connected Operations market, which is a rapidly growing segment at the intersection of the Internet of Things (IoT), cloud computing, and data analytics. This market focuses on providing solutions for businesses with physical operations, including transportation, logistics, construction, utilities, government, and manufacturing.

Based on management’s forecasts, TAM is estimated to be $96.9 billion, and based on FY2025 revenues, Samsara’s captured TAM comes up to around 1.29%. Further, Samsara’s TAM is expected to grow at a 9.91% CAGR from 2025 to 2028. Some of the key trends driving this growth is:

Increasing IoT adoption – The ongoing increase in connected devices and the data they produce will continue to drive the demand for platforms like Samsara

Continued Digital Transformation – A growing number of organizations in Samsara’s key industries are turning to digital solutions for improved efficiency and insights

Demand for Data-Driven Insights – To achieve operational optimization, enhanced safety, and regulatory compliance, businesses are increasingly turning to data analytics

Overall, the connected physical operations industry in which Samsara operates in remains highly fragmented, as most vendors offer software and/or hardware solutions that cater to niche areas like specific industry verticals, solution sets, geographies, or customer segments. Notably, despite the fragmented market, Samsara has been recognised as one of the dominant players in the industry.

Samsara’s management has identified primary competitors that compete within specific applications. However, unlike Samsara, no other competitor offers a single, unified platform that integrates connected fleets, equipment, and sites. Competitors identified by management includes “Avigilon, CalAmp, Fleet Complete, Geotab, Lytx, Masternaut, Michelin, Motive, Nauto, Netradyne, Omnitracs, Orbcomm, Platform Science, Skybitz, Spireon, TrackUnit, Verizon Connect, Webfleet, and Zonar.”

Investment Thesis

Thesis 1: Well-Positioned to Capitalize on the Digitization of Physical Operations

Currently, there is a trend of moving towards digitalisation across various industries that rely on physical operations. Companies are increasingly recognising the advantages of data-driven decision-making, hence accelerating this trend – a shift underscored by projections that the global digital transformation market will reach approximately $3.29 trillion by 2030, growing at a compound annual growth rate (CAGR) of 23.9% from 2024 to 2030.

Additionally, investment in this space continues to grow – global spending on digital transformation is projected to reach $2.8 trillion by 2025 and rise to $3.4 trillion by 2026 – driven in part by widespread adoption, with 93% of organizations having already adopted or planning to adopt a digital-first approach.

Samsara is well-placed to seize this momentum, as its platform is specifically designed to digitise physical operations. By integrating hardware such as sensors, cameras, and gateways with powerful software, Samsara enables organisations to collect and analyse data from traditionally analogue assets – turning real-world operations into actionable insights that drive efficiency and performance.

Samsara’s all-in-one unified platform, paired with its industry-leading AI-driven video safety and scalable, reliable infrastructure, makes it an attractive choice – particularly for larger customers – by addressing a broad range of physical operations needs with advanced technology and a clear focus on delivering tangible business value.

Thesis 2: Path to Multiple Expansion Through Profitability

Since going public, Samsara has been achieving high double digits revenue growth every year, combined with expanding margins across all levels – with gross margin expanding from 59.7% in FY2020 to 76.2% in FY2025, while net income margins have narrowed from -187.9% in FY2020 to -12.40% in FY2025.

From a quarter-by-quarter basis, as of its most recent quarter (Q4FY2025), Samsara has narrowed down its net income margin to -3%, showing a clear line to profitability in its upcoming quarter (Q1FY26) based on current trends in improvements of operational efficiency. Based on my forecast, Samsara is expected to achieve profitability in the upcoming quarter of FY2026.

Source: Samsara Q4FY25 Investor Presentation

With Samsara expected to achieve GAAP profitability in the upcoming quarter, the company will transition from being valued solely on revenue multiples to being eligible for earnings-based valuation metrics such as P/E and EV/EBITDA. This shift not only expands its potential investor base – including institutions that screen for positive earnings – but also unlocks the possibility of valuation multiple expansion, especially as the company demonstrates operating leverage and sustainable margin growth, allowing for a possible re-rating of the stock.

Valuation

In order to value Samsara, industry wide EV/Sales multiple benchmarks for IoT and AI companies will be utilised, using the average of both multiples. Given Samsara’s relatively new and unprofitable business as of yet, combined with its competitors which are mostly privately owned, a DCF analysis and market multiple approach is not as feasible in valuing Samsara.

Using current publicly available information on current multiples of AI companies and IoT companies has yielded us with 25.8x and 36.84x respectively, giving us an average of 21.5x. Working backwards with the 1-year 21.5x exit multiple to derive the share value gives us an implied share price of $47.12, representing a 21% upside from the current value of $38.93. The same steps were applied with a 3-year 23x exit multiple and 5-year 25x exit multiple, which gives an implied share price of $50.36 and $54.75, representing a 29% and 41% upside respectively.

Risks

High Competition: Samsara operates in a highly competitive and fragmented market, contending with both long-established telematics providers with substantial resources and newer, more specialised technology firms offering innovative solutions. This high level of competition poses several challenges, including the risk of price wars that could squeeze profit margins, as well as the ongoing difficulty of gaining and retaining market share in an increasingly crowded field.

Macroeconomic Sensitivity: Samsara’s customer base is heavily concentrated in industries tied to physical operations – e.g., transportation, logistics, field services, and construction – which collectively account for a significant portion of U.S. GDP and accounts for 87% of Samsara’s revenues. With the ongoing tariffs and global economic uncertainty, Samsara’s business may significantly impact Samsara.

The reoccurring revenue is a great strength, especially as they continue to improve their numbers