Initial Report: Sembcorp Industries (SGX:U96), 114% 5-yr Potential Upside (EIP, Elaine CHIA)

Elaine believes that Sembcorp is strategically positioned to capitalize on the global shift to clean energy and has ambitious targets.

1. Executive Summary

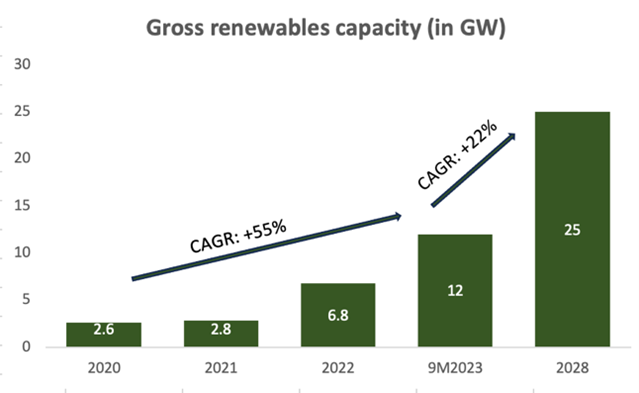

Sembcorp Industries Ltd operates as a diversified utility company headquartered in Singapore. With a strong presence across Southeast Asia, the Middle East, and the United Kingdom, the company's core business spans three segments: conventional energy, renewables, and integrated urban solutions. Embracing a visionary "Brown to Green" transformation strategy, Sembcorp aims to achieve net-zero emissions by 2050. The plan includes ambitious targets such as tripling gross installed renewable energy capacity to 25 GW by 2028, increasing the Sustainable Solutions portfolio's contribution to 70% of the Group's net profit by 2025, and tripling land sales for sustainable urban developments to 500 hectares by 2025.

While conventional energy remains the primary revenue driver, Sembcorp anticipates a shift in the sector's dynamics, with renewables poised to emerge as a critical revenue driver in the medium to long term. In 2023, the renewables portfolio exceeded the initial target of 10 GW, prompting a new goal of achieving 25 GW by 2028. Sembcorp has strategically allocated a substantial capital budget, with 75% earmarked for renewable investments from 2024 to 2028. Despite challenges, including a property market crisis affecting the Integrated Urban Solutions segment, the company is strategically positioned to capitalize on the global shift to clean energy. It aims to contribute significantly to its earnings stability.

2. Company Overview

Sembcorp Industries Ltd (Sembcorp) was founded in 1996 by merging Sembawang Corporation and Jurong Industrial Corporation. It is headquartered in Singapore with diversified operations across Southeast Asia, the Middle East, and the United Kingdom. The company mainly engages in the utilities sector with three key segments: conventional energy, renewables, and integrated urban solutions.

Brown to Green Transformation strategy

Sembcorp's “Brown to Green” transformation plan is strategically positioned for a long-term impact, with a particular focus on Asia. The overarching goal is to attain net-zero emissions by 2050. Targets include: (a) More sustainable: Sustainable Solutions portfolio to constitute 70% of the Group's net profit by 2025, up from 40% in 2020 (b) More renewables: Triple gross installed renewable energy capacity to 25 GW by 2028, up from 8.7 GW in 2023 and 2.6 GW in 2020. Sembcorp aims to do this by diversifying more across key markets and technologies (c) More sustainable urban developments: Triple land sales to 500 hectares by

2025, up from 172 hectares in 2020.

a. Business Segment

Conventional Energy

Includes sale of energy molecules such as natural gas, steam, electricity from fossil fuels and gas and related services with aim to bridge the gap between current and gradual transition to clean energy. This segment consists of gas-fired plants and gas import and retail.

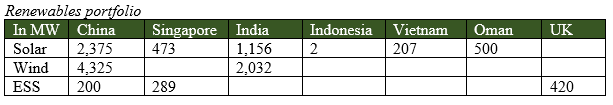

Renewables

Includes installation, operations and maintenance of wind, solar energy, energy storage system and carbon management solutions.

Integrated Urban Solutions

Includes urban, water and waste-to-resource services. Heavily dependent on regulatory approvals and property market recovery.

Conventional energy remains as main revenue driver while revenue from renewables has increased from 5% to 7% of total revenue. Revenue from IUS has dropped from 8% to 6% due to the property market crisis. EBITDA from conventional energy has dropped from 68% in 2020 to 61% in 2022, losing the shares of EBITDA to renewables which increased from 17% in 2020 to 26% to 2022.

b. Revenue drivers

While conventional energy continues to serve as the primary revenue source for Sembcorp, we anticipate a normalization in the sector. Through Sembcorp's proactive efforts to expand its renewables sector in Southeast Asia, the company is a leading player in the Asian renewable energy landscape. In the medium to long term, we foresee the renewables sector emerging as a critical revenue driver for Sembcorp. In 2023, Sembcorp's renewables portfolio surpassed its initial target of 10GW capacity by 2025. Demonstrating even greater ambition, the company announced a new target of achieving 25GW gross installed renewable capacity by 2028 during the investor presentation day. Furthermore, Sembcorp has allocated a substantial capital budget to support its targets for 2024-2028, with 75% of the budget earmarked for investments in renewables.

c. Cost drivers

The cost of sales covers 84.32% of total revenue in 2022. It includes fuel and purchased power, ops & maintenance, selling & administrative expenses, depreciation, and impairments. In 2022, an impairment of S$18 million was recognized due to a more stringent emission standard expected to come into force in 2023. Another impairment of S$4 million was recognized following management’s view of the economic performance of the water plant in Qinzhou, China.

d. ESG factors

Based on the SASB Standards, we have identified the following key ESG factors:

a. Greenhouse gas emission: companies with higher emission will face earnings risk from rising carbon price.

b. Water & waste management: companies with inadequate management will face financial risk from reputational damage.

c. Waste & hazardous materials: companies with inadequate management will face financial risks from reputation damage.

d. Employee health & safety: companies with bad labour habit will face reputational risks from scandals and rumours.

3. Industry Outlook

Primary energy demand in the Asia-Pacific region is forecasted to reach 285 quadrillion British thermal units by 2030, a 12.6% increase from 2021 driven by factors such as population growth, urbanisation and rising incomes. Installed power generation capacity is set to double by 2040 to fulfil the growing demand. Conventional power from fossil fuels is expected to remain dominant, albeit with a decrease in energy share from 77% in 2016 to 63% by 2040. The sector's CAGR is projected at 6.63% from 2023 to 2028, fuelled by SEA's reliance on coal and oil. Additionally, the renewable energy sector is expected to grow at a CAGR of 7.4%, backed by supportive government policies and lower start-up costs. Wind and solar energy are projected to constitute 22% of primary energy by 2050.

4. Economic moat

Strong and Reputable brand

Sembcorp is a well-known brand name with solid consumer trust in China, India, and Southeast Asia. This gives Sembcorp the leverage to partner with leading players such as State Power Investment Corporation Limited (SPIC) to acquire 830MW of installed renewable capacity and 62MW under development. This has helped Sembcorp with its venture into emerging countries, such as building a 500MW solar project in Oman.

Leading player in Asia with “Brown to Green Transformation” strategy

Sembcorp, as an established Asian renewables player across critical segments in Southeast Asia, will be able to leverage opportunities in the region. It has one of India's highest wind portfolios under in-house asset management, is a leading solar player in Singapore, and is one of Asia’s most extensive battery operators.

5. Investment thesis

Thesis 1: Renewables segment poised to grow, driving earnings stability.

Renewables segment is poised for robust growth over the next five years, serving as a key driver for earnings stability in the Sembcorp portfolio. This is in line with Sembcorp’s “Brown to Green” strategy targets. The global shift towards clean energy presents significant opportunities in key renewable energy markets in Asia. There is strong confidence in Sembcorp’s ability to capitalise on these opportunities, given its substantial investments in R&D initiatives for renewables, strong track record, well-established presence and partnerships. Notably, Sembcorp’s strategy has played out quite well in expanding its renewables capacity as shown in its accelerated progress in meeting the 2025 goal of 10 GW, which has led to the establishment of a new target of 25 GW for 2028. Hence, we anticipate Renewables contributing to 9% of FY 2023 earnings.

Between 2023 and 2028, key markets are expected to witness a new build capacity of over 1,300 GW, accompanied by a market average CAGR growth in gross installed renewables capacity of 17%. Sembcorp is strategically positioned to harness this growth, thus we maintain our expectation that the segment will achieve 60% growth (from FY 2023 to FY 2024) and 50% growth from (FY 2025 to FY 2027), securing a renewables revenue share of 25% by FY 2027. The increasing share of revenue from the Renewables segment will drive stability in earnings quality when energy prices fluctuate.

Thesis 2: Integrated urban solutions expected gradual pickup in momentum with property market recovery.

The Integrated Urban Solutions segment is anticipated to experience subdued growth in the near-term, followed by a gradual uptick in momentum. Sembcorp aims for its Sustainable Solutions portfolio, which includes the Integrated Urban Solutions segment, to contribute 70% to the Group's net profit by 2025. However, growth in this segment hinges on regulatory approvals and property market recovery in targeted regions such as Vietnam, China, and Indonesia. The segment's 2022 performance was hampered by Chinese market slowdown due to China’s zero-COVID policy, dampening the property market. Hence, considering the ongoing recovery in property markets and demand for land, a conservative outlook is maintained.

However, with a committed S$700 million investment to the segment under the 2024 to 2028 Investment Plan, Sembcorp is actively building its land bank. As China's property market gradually rebounds, Sembcorp is well-prepared to seize these opportunities, leveraging its past experiences with large-scale developments in China, such as the Wuxi-Singapore Industrial Park. Consequently, we anticipate a notable uptick in growth.

6. Risks & Mitigation

Physical risks

Sembcorp’s assets are exposed to acute and chronic physical risks. These risks may arise from increased severity and frequency of extreme weather conditions, rising sea levels, and temperatures. This exposes Sembcorp to financial risks from operational disruptions.

Sembcorp mitigates these risks by conducting physical risk assessments of critical assets every five years and annually reviewing the effectiveness of mitigation and adaptation plans based on local market intelligence.

Foreign exchange risks

Sembcorp has extensive operations beyond Singapore, which exposes Sembcorp to currency translation risks. This resulted in a S$558 million forex translation loss in 2022.

Sembcorp limits its exposure through forward foreign exchange contracts and cross-currency interest rate swaps. Additionally, significant foreign currency-denominated transactions are managed case by case.

7. ESG Assessments

Based on the material ESG issues identified by the SASB Standards:

a. Greenhouse gas emission (GHG emission)

Sembcorp scope 1,2 and 3 emission intensity has improved since 2020 due to efforts to decarbonise the energy sectors. An example would be the sale of SEIL, which operates two coal-fired plants in January 2023. This has shown the management level’s commitment to sustainability and indicate positive sentiment for Sembcorp.

b. Water management

Water intensity has improved since 2020. However, percentage of water use from stressed areas has increased from 41% in 2020 to 47%. This might pose a moderate concern for Sembcorp if the case evolve into a scandal which might damage its reputation.

c. Waste and hazardous waste management

Waste management has deteriorated since 2020. There is an increasing non-hazardous and hazardous waste produced by Sembcorp. This might pose a significant risks on Sembcorp in terms of reputational damage and financial loss.

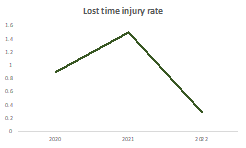

d. Employee health and safety

Lost time injury rate peaked in 2021 at 1.5 employees per million man-hours. However, it recovered to 0.3 employees per million man-hours in 2022. There is also no work-related fatalities and high-consequence injury cases. Hence, risks from health and safety is moderately low.

8. Valuation

Based on the multiples method and given the capital intensive nature of Sembcorp’s operation, EV/EBITDA is used. EV/EBITDA is currently trading at an average of 9.35x resulting in an 3-year implied share price of S$7.68 and 5-year implied share price of S$10.45.

9. Conclusion

To recommend a buy on Sembcorp Industries Ltd with a 3-year target share price of S$7.68 and 5-year target share price of S$10.45.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.