Initial Report: ServiceNow (NYSE:NOW), 50% 5-yr Potential Upside (VIP, Julian LEE)

Julian presents a "BUY" recommendation for based on its leadership in ITSM workflows, strong Gen AI-driven growth, and significant expansion opportunities in untapped markets.

LinkedIn: Julian Lee

Company Overview - Bringing Simplicity to Complex Business

Business Introduction - "A Platform of Platforms"

ServiceNow is an cloud computing company that provides a platform for workflow automation, digital transformation, and IT service management . It’s product portfolio—which spans our Technology, Customer and Industry, Employee, and Creator & Other Workflows is delivered on the Now Platform. The products under each of the workflows help customers connect, automate and empower work across systems and silos to enable great outcomes for businesses and great experiences for people.

1) Now Platform

The Now platform is a single platform with one data model, one code base and one architecture, enabling speed, productivity and innovation and offering a one-stop shop for automation and simplification of manual processes. It is highly flexible, scalable, and extensible and can be enhanced with additional functionality, including, depending on the product, AI (including generative AI), machine learning, robotic process automation, process mining, performance analytics, and low-code/no-code development tools. Moving forward, Now Platform is uniquely positioned to leverage the power of generative AI intelligence and offer enterprise-ready, domain-specific large language models (“LLMs”) that power generative AI experiences on the Now Platform with support customer use of third-party LLMs.

2) Technology Workflows

Unites IT, technology, risk management and security operations on a single platform to deliver modern,resilient digital services aligned to our customers’ priorities. Technology products enable IT departments to serve their customers, manage their IT infrastructure, identify and remediate security vulnerabilities and threats, gain visibility across their IT resources and asset lifecycles, optimize IT costs and reduce time spent on administrative tasks. Our technological products also drive enterprise-wide outcomes, as well as power our customer and industry, and employee workflows.

3) Customer and Industry Workflows

Customer and Industry Workflows help customers elevate their customer service with enhanced resolution efficiency and improved service quality made possible with workflows, automation, AI, and location-based work task management while reducing costs. Integrating front-end customer service capabilities with operations, order fulfillment and field service resources, help create a seamless customer experience from request to resolution through connected digital workflows that deliver fast support on a customer’s channel of choice.

4) Employee Workflows

Employee Workflows transform the employee experience by making it easier for them to work and collaborate where and how they want, improving productivity, agility and performance. Employee Workflows products also help customers unlock skills and capabilities of their workforce by being more efficient with their employee resources, staffing and delivery services, increasing customers’ ability to streamline and gain visibility into employee lifecycle events.

5) Creator & Other workflows

Creator Workflows help customers build and manage cross-enterprise workflows fast with a low-code development experience that safely delivers agile services at scale and with features such as those that allow customers to manage security and storage, especially with digital transformation, where businesses need to adapt faster with new processes and business models. This can be further supported by Now Assist for Creator, a generative AI solution. Development teams can create and scale apps more quickly on the Now Platform. Trained oncode from ServiceNow engineering, results generated with Now Assist for Creator are generally higher quality and more scalable and secure than any other code generation technology.

Business Segment and Revenue drivers

1) Subscription Revenues (97% of revenues) Subscription primarily comprises of fees that give customers access to the ordered subscription service for both self-hosted offerings and cloud-based subscription offerings, and related standard and enhanced support and updates, if any, to the subscription serviced during the subscription term.

Subscription Revenue consists of Digital Workflow Products(DWP) or ITSM and ITOM products. Digital workflow and ITOM make up 89% & 8% respectively of the total subscription revenue.

ITOM (Integrated Technology operations management) & ITSM (Integrated Technology service management)

DWP encompasses bulk of NOW's product offerings and prices per user basis

ITOMs are priced on a subscription unit basis

2) Professional Services and Other Revenues (3% of revenues)

Mainly generated through consultancy and training programs on fixed fees or actual hours and expense basis invoiced to customers on a monthly basis.

In terms of geographical diversity, the largest clients are largely in the US, with the second largest contributor in the EMEA (Europe Middle East Africa) regions.

Cost Drivers

1) Cost of Subscriptions Revenues These costs predominately are driven by hosting Now's services and providing support to its customers.This includes data centre capacity costs , interconnectivity between data centres, public cloud server , IT and customer support services which represent .

2) Cost of professional services

These costs are linked to personnel related costs associated with NOW's professional services and training department , contracted third party partners and other adjacent overheads

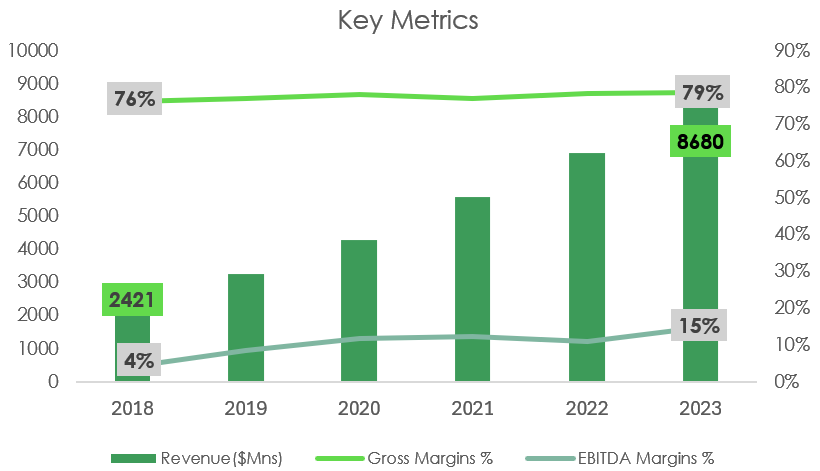

Key Financial Metrics

ServiceNow, like many fast growing software companies, started with losses and only managed to turn profitable in 2019. However, NOW's seen exponential growth in the past 6 years with a CAGR of 24% YoY and seen one of the highest gross margins amidst fierce competition in the SaaS/PaaS industry.

Industry Overview - Client Digitalisation & Workforce management a tailwind for ServiceNow

Being at the forefront of clients' digitalisation efforts

The opportunity for ServiceNow to expand its customer base remain a key growth driver for the company despite serving 85% of the Fortune 500 companies. NOW's 8100 customers as of FY 2023 was about 16% of its addressable market of 50000 large enterprises with sales exceeding $100M and a workforce of over 1000 employees. To add on, a combination of new add-on products and leveraging its consulting partners have aided large deal size with 82% of net new annual contract value (ACV) including 5 or more products vs 54% in 2019. The ITSM market could grow annually at around 10% to $16.5 billion in 2028 from about $10 billion in 2023, based on IDC data.

Market Opportunity - Huge runway for ServiceNow across all verticals

The global workflow management market size was valued at USD 9.5B billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 33.3% from 2023 to 2030.

Specifically, looking at NOW's home market in US , we see significant growth in workflow management with a CAGR of 30.7% from 2023 of $3.5B to $23.4B in 2030.

Porter 5 Forces

Investment Theses

Thesis 1 : Kingpin of higher-valued ITSM workflows supported by superior performance

Short history and reasons for rise of ServiceNow's Platform

While in the early days before 2010 , ITSM was always seen as a mere helpdesk function, a niche within ITOM , while that was successful when ServiceNow first penetrated in 2004 and acting as a system record function for enterprise customers. However, today, as the clear delination of ITSM & ITOM blurs due to new addition to ITSM , the complexity of IT infrastructure has increased with the rise of BYOD and hybrid cloud environments.

ServiceNow's differentiator?

ServiceNow has been successful in executing a land and expanding strategy.

It builds one of the best SaaS solutions for ITSM, being modular and flexible - To be able to be easy to use and offer a way to automate a wide variety of workflow while acting as the single platform to integrate all IT functions. - While on the surface it seems like just any other workflow solution , it is more easily understood as a provider of software for ITSM & ITOM which will be explained in the latter part

Why is this even important?...

NOW manages to transform itself from a core IT function which has significantly low switching costs to incorporating an extensive set of features , making them more ingrained within IT broadly , unlike ERP systems with shorter major refresh cycles.

ITSM has a longer expected major refresh cycle of 10-15 years.

Furthermore, the incorporation of a variety of other ITOM features, like IT asset management & business management integrating into one single platform, had made its solutions less one dimensional , shifting the focus from merely selling applications but focusing on solving business problems.

In other words , shifting from merely being a system of record to simplifying and automating workflows.

Operating and maintaining hardware & software is critical to ensuring business operations , and the risk of IT failure is just too high , especially in the context of a more complex cloud environment.

This makes NOW's solutions indispensable, which gives its moat.

Supported by superior metrics... ServiceNow superiority in this aspect of automated workflows can be seen through their key metrics . 1) Rule of 50% in the Saas business, generally it is known to be the rule of 40% , which is one of the key SaaS metrics in the industry . The combined revenue growth rate + profit margins should equal or exceed 40%.The key reason behind this metric is that it gives an objective benchmark to showcase a SaaS business that is generating profit sustainably and below 40% may face cashflow or liquidity issues.

In this case, as seen from the graph above, ServiceNow compared to some of its largest and most well known competitors in the SaaS industry , ServiceNow actually outpace all its key competitors in achieving the rule of 50%, which makes it a class of its own.

2) Evidenced by high level of customer retention rates and growing CRPOs & RPOs Customer Rentention Rates

ServiceNow has one of the highest retention rates of 98% from 2019 - 2022 and 98.5% in 2023 , reflecting its strong stickness of its products and its relevance in making customers difficult to switch. It currently has a net retention rate of 125%. CRPOs and RPOs RPOs or otherwise known as remaining performance obligations are total contracted revenue from services or products yet to be delivered to customers and not yet recognised by the company. Beyond customer retention rates , now also boast an increasing CRPO and RPO numbers which further showcased the future of customer revenues.

This evidently shows NOW's strength in terms of retaining its customers and showcasing significant growth in future revenues seen from RPO growth. On whole, this reflects the strong moat that ServiceNow has in this evolving workflow automation, which is also supported by Gen AI to ensure further expansion of ServiceNow offerings , which will be explained further in thesis 2.

Thesis 2 : Reimaging the future of digital workflows with Generative AI strategy (Gen AI) to supercharge top line margins

Industrial tailwinds with GEN AI

According to IDC enterprises, worldwide enterprises are spending more then $40B on Gen AI and over $150B by 2027 as organisations realise the value of Gen AI. According to an EY survey of 1200 CEOs , they found that about 99% of them actually make or plan to invest in or develop Gen AI tools to support business efficiency and stay ahead of the curve.

This can be seen by ServiceNow's expected TAM growth with acceleration between 2025 and 2026 .

NOW is capitalising on the rapid adoption of companies leveraging AI on its Now Platform to support clientele in delivering intelligence services for employees and customers whilst boosting agent and developer productivity through 3 key pillars : Gen AI models, intelligent workflows and Pro-Plus products.

ServiceNow's Gen AI models - Why is it unique?

Domain Specific + General Purpose

Domain specific models + General Purpose Model , otherwise known as small (langauge) models which are run on NOW's cloud .

This allows NOW to build specific models through open source models and then train them to suit NOW's services

Allow for flexible data types

A knowledge based article or any specific task type article through the use of the combination of both small general purpose and domain specific to contribute to the open source market beyond just their customers.

Advantages of a small general purpose model - Allows for better user experience as opposed to large language models where there might be billions of parameters as it can be more efficient and faster for specific use cases, eg : business risks management , sales or even firms' security. - Since it runs solely on NOW's cloud, it ensures customer privacy as it does only run on NOW's cloud and more importantly, running on client's own data sources, which are both more accurate and secured.

Ran on NVDIA A100s & H100s

Allow flexibility of the best in class GEN AI chips as they are the two best in class to help ensure cost optimisation of its customers , while supporting NOW's gross margins, which is already one of the best in class among Saas peers.

Intelligent Workflow - Translating knowledge into actionable workflows

1) Knowledge graph allows one to go to your data sources across your knowledge repository that is unique to NOW's despite already having a robust suite of tools to achieve it , but NOW's take it a step further through allowing the user to get information from various third party platforms like sharepoint , one drive etc. Its open integration capabilities make it easy to connect and work seamlessly with other platforms.

2) NOW AI - Applying intelligence reasoning logic to data. Once a client retrieves it , NOW applies intelligence and act on the service request eg: process my refund , get me this laptop etc .This feature leverages the data within the platform, allowing customers to benefit from ServiceNow's comprehensive knowledge repository and automated actions across all products. Translating Gen AI into actionable insights ...

As we can see from these images, we could see significant improvement through NOW's platform for employees , customer service and developers .

Furthermore, given the rise in GenAI , one needs not to spend so much more funds to acquire more Servicenow expertise employees helping save on labour while improving productivity.

ServiceNow now allows companies to focus more on the process , allowing them to use plain languages to convert that to a code, workflow or even a playbook (NOW's automated tool for allowing a structured approach to manage tasks in incident management and service management) . In other words, from text/image to something , allowing for more workflows on Servicenow with less dependency on highly skilled resources, unlike previously leading to cost savings yet improving efficiency.

Above are 3 use cases of adopting NOW's pro plus SKU which seen

A 30% mean time to resolution(MTTM) through enhanced agent productivity

More then 80% improvement via Now's intelligent services

25% increase in developer velocity, which is attributed to much faster workflow automation.

Supported with partnerships & with an actionable roadmap to ensure its products remain sticky admist competition...

Partnerships 1) With AI tech, it further enhances its value, especially to Pro Customers, as beyond the established advantages of the NOW platform infusing it with Gen AI capabilities, it makes its products more sticky as seen from the demand for those products below. Partnerships with other firms like Microsoft, Open AI for general purposes models and domain specific models ( eg: Hugging Face open source LLMs to customer data and applying it NOW's use cases such as ITSM, CSM or procurement allows for small models to run more efficiently in NOW's cloud infrastructure.

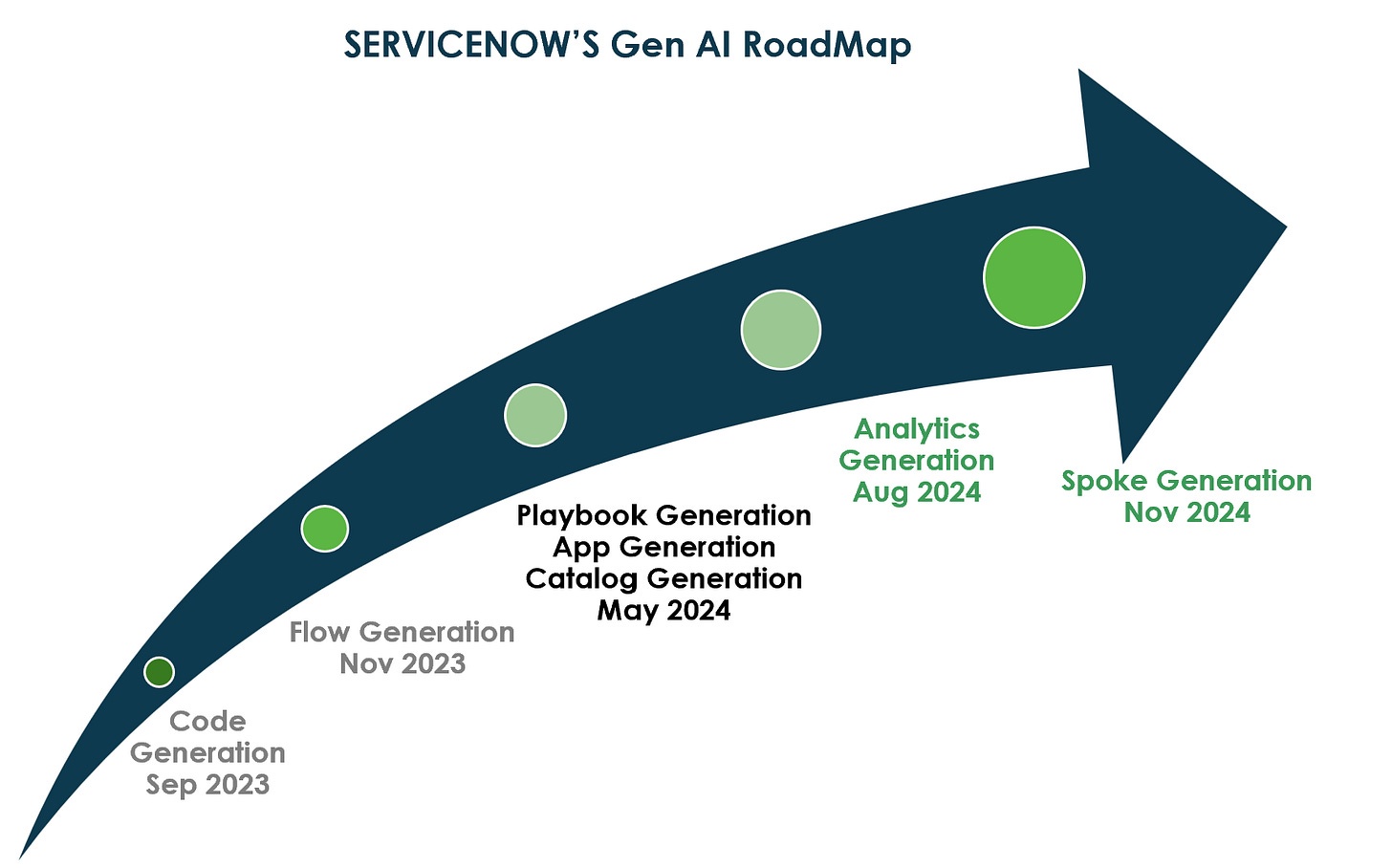

2) Future Roadmaps of ServiceNow

Moving forward , NOW's Pro Plus product roadmap gives us future insights into new tools to further help customers achieve efficiency

While delivering greater value through ServiceNow applications by making things simpler to narrow the barrier for utilising ServiceNow through low/no code creation and management of workflows

Back end perspective Knowledge graph and Raptor DB two infrastructure innovations to better enable genAI across ServiceNow Platform

Integration of Microsoft tools ( eg : MSFT Co-pilot ) and NOW assist together bring complementary benefits rather than being seen as a competitor.

Reflected by Upselling of Gen AI products in ProPlus and monetisation opportunites while supporting cost - efficiencies...

According to NOW's remarks in Q2 2024 earnings , Gen AI uptake is much stronger compared to its predecessor/adjacent products, especially for NOW's Assist, which has seen the largest net new ACV contribution of any , where about 70% of its top 10 deals in Q1 2024 consist of Gen AI products.

Furthermore, since AI incorporation in late 2018, Pro-Plus SKU has seen a 25% average selling price (ASP) uplift and has a 45% penetration rate .

Similarly, pricing has maintained even after being on the market for years and compared with PRO , PRO plus seen greater then 30% price uplift over Pro reflecting its value proposition to its customer base.* (3 Qtrs data).

According to ServiceNow, it estimates that there is a $1B+ Gen AI opportunity for existing PRO customers within ITSM, CSM and HRSD which reflects strength in its ability to upsell customers.

Cost efficiencies

In terms of sales efficiencies, we can see actionable improvement in cost management, hence reflecting NOW's sales efficiencies in generating more sales per unit of marketing ahead of its key peers .

Also, in workflow costs improvement, we see better GenAI unit economics, where ServiceNow seen 20%+ improvement from mainstream GPU SKUs upgrades

Therefore NOW's capabilities and investment into Gen AI as the next phase of growth, it would be able to maintain its pricing power and market dominance in the technological workflow space.

Thesis 3 : Full throttle with multi-prong approach to drive sustained growth despite market concerns of saturation and IT budget pressures

Overall, NOW's believes it still has significant room to expand , given it small current TAM in terms of geographical pentration of just 5% across Americas Ex US , EMEA, APAC & Japan. In terms of the top 6 industries, it serves it less then 7%.

Thus NOW's aim to reaccelerate growth through its following go-to-market strategies for different regions:

1) Accelerating undertapped market expansion in other regions

2) Entrenched and Dominating Governmental Contracts Opportunities

3) Upselling and offering greater value proposition to its marque and mid-market clients

Accelerating new undertapped markets to drive future growth

ServiceNow's international market has seen significant growth, with a 16% CAGR over the last four years, now contributing about 30% of the company's total revenue.

The six key regions highlighted are the focus of ServiceNow's next billion-dollar business, where they have heavily invested in data centers, localized decision-making, and staffing.

In five additional regions, ServiceNow is driving double-digit growth, supported by new data investments in Saudi Arabia and cloud infrastructure work with Microsoft, partnering with major entities like NEOM in Saudi Arabia, São Paulo's government in Brazil, and Australia's central government.

Partnerships, such as with Hitachi Energy and NEOM, demonstrate ServiceNow's role in supporting large-scale, innovative projects, positioning the company as a leader in digital transformation across diverse global markets.

2) Embedded in governmental contracts opportunities Federal Contracts reflect runway of opportunities

ServiceNow primarily targets large-scale organizations, including significant presence in the US federal sector, where it holds 400 separate contracts across all 15 cabinet agencies, sub-agencies, and every branch of the Department of Defense (DoD)

Currently, its renewal rate with governmental organisations remains at 99%.

ServiceNow extends beyond IT workflows into mission-critical applications, including an IL5 DoD-regulated cloud (specialised cloud services), and is positioned to integrate Gen AI for use by military personnel, employees, and taxpayers in the near future.

This unique contractual negotiations anchors ServiceNow's competitive advantage in the government space, ensuring a sustainable revenue stream due to high security and secrecy requirements, which limits new competitors.

Federal Risk and Authorization Management Program (FedRAMP(®)) provides a standardized approach to security authorizations for Cloud Service Offerings.

Currently, there are only approximately 25 firms attaining high sensitivity for software companies that have acquired that level and only about half of those have attained the L5 certification of DOD security clearance, which is where ServiceNow is in.

The federal business operates across multiple verticals, such as finance, healthcare, logistics, and DoD, presenting opportunities for cross-selling products within the US federal government, the single largest employer, offering a $5 billion market opportunity.

ServiceNow's role is crucial in projects like addressing the fentanyl crisis by coordinating across multiple federal agencies, acting as an engagement layer to ensure interoperability between people, systems, data, and organizations.

ServiceNow's embedded role in federal government services enhances its growth potential, with a current $1.5 billion Annual Contract Value (ACV) growing at 30% YoY, and expansion into the UK Ministry of Defence (MOD) is underway.

3) Broadening Existing Customer Base through go to market strategy

Servicenow aims to broaden its product offering beyond the popular technology workflows to diversify its deal ACV mix . With current tech workflow contributes 55% and non tech workflow such as customer, employee and creator workflows make up the remaining 45%

ServiceNow's platform strength is evident in its growth of Net New Annual Contract Value (NNACV). In 2019, just over half of its customers had five or more ServiceNow products. By 2023, about 82% of customers had more than five products, highlighting the ecosystem's value and the increased benefits of integrating more workflows within ServiceNow.

In the latest Q3 2024 , NOW seen NNACV doubling QoQ with 11 new deals >$1M ACV

Given NOW's platform of platform strength, it has reflected in the huge growth in NOW 5+ product sales to its clients, which further illustrate its strength in upselling customer new products to drive higher NNACV.

Digitalising Go to Market Team opens opportunity to efficiently target new mid-market client s beyond its marqee logos

In Jan 2024 NOW made its platform available as a SaaS offering in the AWS marketplace .

Key benefits for customers from ServiceNow-AWS collaboration:

Enhanced Innovation & Agility: By combining AWS's global reach, data capabilities, and cloud infrastructure with ServiceNow's platform and AI, customers can accelerate digital transformation with greater flexibility and innovation.

Improved Performance & Scalability: The integration ensures streamlined workflows, IT services management, and enhanced customer experiences with higher performance and scalability.

Robust Infrastructure & Security: Leveraging AWS’s trusted global infrastructure, customers benefit from top-tier security, data protection, and compliance standards.

Simplified Deployment & Management: ServiceNow on AWS Marketplace allows for faster procurement, simplified billing, and easy deployment, enabling customers to focus on innovation rather than administrative tasks.

Cost Efficiency: By using dedicated AWS spend and optimized operations, customers can manage costs more effectively while scaling their digital initiatives.

While not immediately obvious, this collaboration positions ServiceNow to attract upper mid-market customers, serving as a growth catalyst.

Historical data indicates that scaling clients right from the start often presents significant upselling opportunities.

Although the initial revenue impact may be modest, this partnership is likely to drive substantial growth over the next 3-5 years as these companies expand and adopt more of ServiceNow's offerings, creating a strong tailwind for future revenue.

Hence all in all with the combination of upselling customers new products , expansion in new markets and Gen AI we should see continued sustainable growth of ServiceNow over the next 5 years

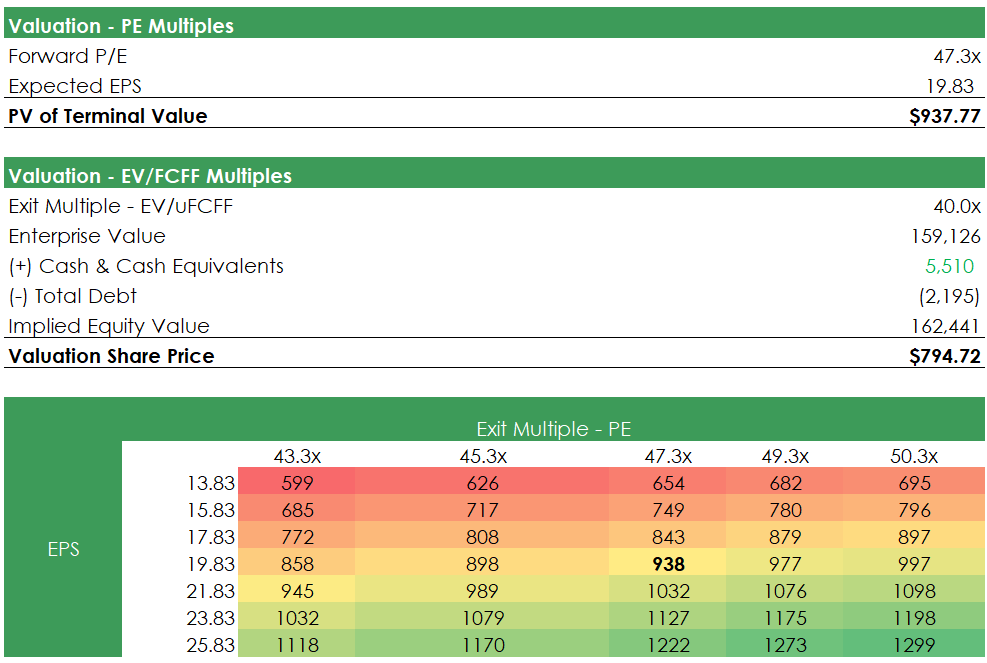

Valuation - Priced for perfection

Using a combination of EV/Sales , EV/FCFF and PE Ratio

Hence, with a blended valuation using EV/Sales, EV/FCFF and PE Ratio , we can derive a share price of $1216 for a 5 Year Target Price which represents an upside of 50%. That said, in the short term, the current valuations are trading at a very high premium compared to other Saas peers while further cementing itself as the enterprise workflow software leader.

Risks and Mitigations

Risks

1) Maturity of IT workflows - ITSM, which is currently NOW's flagship product is generally considered a relatively mature product with significant pentration.While NOW's has considerably improved within the IT workflows , which include 4 other products with $250M+ ACV , growth in IT workflows may moderate. However, if it starts slowing down significantly, it will hurt NOW's core growth drivers. 2) Failure to execute employees and customers and create workflows amidst circling competition - To continue its strong topline growth , NOW will need to innovate and rely on non-IT workflows to further diversify and grow, especially in light of circling competition from cloud native solutions. 3) Valuation Risks --> Given NOW's already very rich multiples any blemishes to its guidance may cause a huge drawdown as seen from its key peers like SalesForce , Adobe , Veeva , hence as investors we need to be aware of such drawdowns.

Mitigations 1) Maturity of IT workflows - ServiceNow has always relied on new ways to innovate, such as leveraging GenAI and expanding its TAM across new industries and upselling customers , giving them new avenues for monetisation and as well as limiting the saturation of its core business . 2) Failure to execute employees and customers and create workflows amidst circling competition - According to industry partners, it reflects that NOW's execution has been relatively well received and seeing increasing pick up among customers and coupled with their relentless pursuit of innovation and dual upgrades per year on its platform for its clients would allow them to stay ahead of its competition.

3) Despite valuation concerns, ServiceNow's 20% YoY revenue growth, rising free cash flow, growing EPS, and consistent deal wins set it apart from peers. Its strong execution and market leadership justify the higher valuation, making it well-positioned for continued growth.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

References ServiceNow Investor Presentations https://www.servicenow.com/content/dam/servicenow-assets/public/en-us/doc-type/other-document/servicenow-financial-analyst-day-2023.pdf EY Global Gen AI Survey https://technologymagazine.com/articles/ey-study-ceos-bet-big-on-gen-ai-to-gain-competitive-edge Global Enterprise Software market size https://www.grandviewresearch.com/industry-analysis/enterprise-software-market CapIQ - Financials & Comps Analysis of ServiceNow

https://www.capitaliq.com/CIQDotNet/Financial/KeyStats.aspx?companyId=22967487&statekey=1d156f78da1149ef845d8d1d8f998d20