Initial Report: Siemens Healthineers AG (ETR: SHL), 35.5% 5-yr Potential Upside (Lutfi SZE, EIP)

Lutfi SZE presents a "BUY" recommendation based on Siemens Healthineers' wide moat with established service relationships and high barriers to entry, and its fast-growing radiotherapy segment.

Company Overview

Siemens Healthineers is a global provider of healthcare products, solutions and services. Having a large geographical presence, Siemens Healthineers develops, manufactures and sells a plethora of diagnostic and therapeutic products and services to healthcare providers from over 180 countries. With an extensive array of products and services, Siemens Healthineers can support customers throughout their entire care journey, from prevention and early detection through to diagnosis, treatment and follow-up care. Siemens Healthineers operates across four segments: Imaging, Diagnostics, Varian and Advanced Therapies.

The company has demonstrated strong revenue growth, particularly in their Varian segment, benefiting from the higher demand for oncology solutions. With a robust economic moat built on long-term service contracts, multimodality partnerships and strong R&D budgets, Siemens is well-positioned for continued expansions.

Revenue Segment #1 – Imaging

Siemens Healthineers provides imaging products, services and solutions, assisting healthcare providers in creating images inside the body for diagnosis, monitoring and treatment. Siemens’ offerings include devices for magnetic resonance imaging (MRI), computed tomography (CT), X-ray, molecular imaging and ultrasound. This segment generates revenue through machinery sales and recurring revenue through their customer services business (includes services and spare parts) attributed to an established foundation of long-term client service relationships.

Revenue Segment #2 – Diagnostics

The diagnostics segment consists of in-vitro diagnostic products and services offered to healthcare providers of various fields including general laboratory, special laboratory, and point-of-care diagnostics. Siemens Healthineers also assists in improving its customers’ productivity by providing efficient workflow solutions for laboratory and informatics products. Revenue is largely generated by long-term contracts that provide instrument placement and reagent sales (chemical substances used by the machines for diagnostic tests).

Revenue Segment #3 – Varian

Varian focuses on cancer care, developing and delivering innovative technologies to support oncology departments worldwide. Varian develops integrated equipment for high-precision, image-guided radiotherapy and digital solutions for healthcare management, radiotherapy treatment planning and patient engagement. Revenue is generated through capital equipment sales, recurring revenue from services and their digital solution offerings.

Revenue Segment #4 – Advanced Therapies

The advanced therapies portfolio comprises of highly integrated products, services and solutions for the treatment of a variety of diseases. This segment offers products that are designed to support image-guided minimally invasive treatments across different clinical fields, including interventional radiology and surgery. Key products include hybrid operating rooms, angiography systems (imaging technique for blood vessels) and mobile C-arms. Like the Imaging and Varian segment, advanced therapies generate revenue through their product sales and recurring revenue from their established long-term client relationships.

Revenue Breakdown by Segment

Based on the latest FY2024’s financials, the Imaging component accounts for 55% of total revenue generated by Siemens Healthineers. Diagnostics and Varian account for 20% and 17% of total revenue, while Advanced Therapies contributes the least, providing 9% in the last fiscal year. Furthermore, on a comparable basis (excluding currency translations, IFRS revaluation and portfolio effects) all segments except Diagnostics appear to have grown sizably, with the Varian segment exhibiting the strongest growth.

Industry Overview

Siemens Healthineers competes in various industries within the healthcare sector, encompassing medical imaging, diagnostics, oncology (Varian) and advanced therapies. Every one of these markets is undergoing rapid transformation, largely driven by shifting demographics, rising incidences of chronic diseases and technological advancements led by Artificial Intelligence (AI).

General Healthcare Trends #1 – Rising Incidence of Chronic Diseases

The world is facing an aging population, placing additional stress on global healthcare systems in both emerging and developed countries. As such, non-communicable diseases such as cardiovascular disease, diabetes and chronic respiratory diseases have become more prevalent. Non-communicable disease remains the highest cause of mortality worldwide, accounting for 74% of global deaths in 2019, a staggering increase from 61% in 2000. (World Health Statistics) Early diagnosis and treatment are increasingly important, driving demand for medical imaging equipment that can detect these diseases before they worsen.

General Healthcare Trends #2 – Technological Advancements

A second growth driver would be technological advancements through artificial intelligence (AI) and digitally supported solutions. The COVID-19 pandemic caused a significant strain on healthcare providers with shortages of skilled workers and increasing staff absences, resulting in increased healthcare costs for consumers. Digital solutions, including workflow automation and AI, seek to fill that gap, providing a comprehensive yet cost-effective patient experience.

AI is altering the diagnostic imaging industry considerably, not only through process automation but also improvements in disease diagnosis efficiency. AI systems can analyse medical images with greater speed and precision compared to human medical professionals, notably reducing the time needed for patient diagnosis – imperative during emergencies.

Siemens Healthineers dedicates a significant portion of its research and development (R&D) activities to the development of AI sensors and robotics. Siemens employs AI for data analysis and interpretation, decision-making and automation, aiming to integrate AI and other innovations across their revenue segments. For example, in the imaging segment, Siemens Healthineers has focused its efforts on maximising image quality while reducing scan times and integrating AI in image reconstruction and automated analysis. Siemens places a great amount of emphasis on R&D, dedicating 9% of revenue to R&D expenses (total EUR 1,918m) in 2024, far exceeding their competitors. With rising healthcare costs arising from the COVID-19 pandemic, it is crucial for companies operating in the healthcare equipment industry to advance their AI-powered offerings or risk being left behind.

Segment Breakdown – Imaging and Advanced Therapies

The medical imaging market is a cornerstone of Siemens Healthineers’ business, contributing a sizable 55% of revenue in 2024. The market operates in a highly competitive oligopolistic landscape with three main players – GE Healthcare, Philips and Siemens Healthineers. These 3 firms combined capture a significant portion of the global imaging market, leveraging technological advancements including AI, automation and workflow optimisation to maintain their competitive edge. Among the three, Siemens is the incumbent market leader, commanding an estimated 30% of market share. Furthermore, Siemens is the largest global manufacturer of MR, CT and X-ray imaging.

The imaging sector is expected to grow from USD 42.67 billion in 2024 to USD 70.19 billion in 2032, with a CAGR of 6.4%. The growth is fuelled by demographic developments particularly an aging worldwide population and technological advancements driven by artificial intelligence.

The advanced therapies segment, which offers integrated products for a variety of disease treatments. Siemens Healthineers leverages its expertise in medical imaging within this segment, notably through its hybrid operating room equipment and service solutions. These solutions include multi-modality advanced imaging equipment, staff training and customer services. Siemens is the market leader for hybrid operating room solutions and interventional radiology, and only trails Philips in cardiology and mobile C-arms.

Segment Breakdown – Varian

Siemens Healthineers entered the oncology segment with its acquisition of Varian Medical Systems in 2021. Now constituting 17% of revenue, Siemens Healthineers has successfully integrated Varian into its growing portfolio of medical offerings. Varian is committed to the field of cancer care and provides radiotherapy equipment, an integral part of cancer treatment.

Within this segment, there are only two main global providers of radiotherapy equipment – Siemens Healthineers and Elekta. These two companies have formed what is essentially a duopoly with close to no new entrants for the past decade, due to the high barriers of entry and intellectual property. Siemens dominates this segment and is the world’s largest radiotherapy manufacturer, constituting over 50% of global market share. Their market dominance is even more prevalent in the United States, where they account for over 70% of radiotherapy installations.

The Varian segment is expected to grow from a current estimated USD 7.2 billion to a USD 9.62 billion in 2029 with a CAGR of 4.9%. Siemens and Elekta are expected to consolidate most of the potential growth with both companies investing heavily into developing the market’s best offerings. With Siemens eclipsing Elekta in both size and R&D budget, combined with Elekta’s recent lacklustre financial performance, we can expect Siemens to maintain and even strengthen their market share in this segment.

Segment Breakdown – Diagnostics

Unlike the other segments, Siemens does not dominate the Diagnostics market. Formerly supported by acquisitions, Siemens has been restructuring the segment, streamlining their business by reducing the number of platforms on the market. Since the restructuring, growth has been laggard with market share losses, which are expected to reverse in the coming years. The diagnostics market is much more fragmented compared to the other segments, with many competitors including Roche and Abbott. Despite the unpromising growth, Siemens remains a major player in the market. The Diagnostics segment stands to benefit from major tailwinds, including rising demand in developing countries and increased digitalization.

Investment Thesis #1 – Wide Economic Moat across revenue segments through established service relationships and high barriers to entry

Siemens Healthineers enjoys a wide economic moat across its revenue segments, most notably in Imaging, Advanced Therapies and Varian. Siemens has established long-term value partnerships with healthcare providers across the world, offering not only their latest medical equipment but also consulting services to improve their partners’ operational efficiency.

Siemens promises to replace more than half of a value partner’s devices within the first 5 years, providing new devices with advanced technologies that improve diagnostic accuracy and streamline treatment delivery. Siemens also benefits from recurring revenue through spare part sales and staff training on the utilisation of their clinical equipment. Operational efficiencies of their partners are improved through Siemens’ assistance in workflow optimisation via staff management and resource allocation. Many hospital networks have benefited from improved operational efficiencies via these value partnerships.

These partnerships further entrench Siemens’ economic moat. Existing clients rely on Siemens’ technology ecosystem, including software updates, AI-enhanced diagnostics and integrated workflows, while staff are highly familiar with Siemens’ systems. In the imaging segment, where Siemens commands greater than 30% market share, machines have a long shelf life which could be prolonged through hardware and software upgrades, further hindering vendor switching. For the advanced therapies segment, Siemens offers hybrid operating room solutions, allowing hospitals to customise their equipment based on their required specifications. Producing highly customised hybrid operation room equipment involves long lead times and high costs of manufacturing.

Thus, hospitals are reluctant to switch vendors due to high upfront costs, long-term service contracts and familiarity with Siemens’ systems. Customers tend to be sticky, with hospitals preferring multimodality partnerships, working with a single vendor across imaging modalities (CT, MRI, X-Ray) instead of relying on different vendors for each modality. With many hospitals belonging to a wider network, these single-vendor partnerships proliferate across the entire network, broadening Siemens’ market share. Single-vendor partnerships benefit not just Siemens but also its customers. Hospitals gain improved costs and operational efficiencies through improved pricing negotiations, reduced maintenance complexities and system interoperability.

Furthermore, with the acquisition of Varian in 2021, Siemens has successfully integrated the oncology care company into their business model. Siemens now boasts a more comprehensive product portfolio, providing imaging, surgical and radiotherapy solutions, benefiting hospital networks who seek to consolidate their number of vendors.

Other barriers to entry also exist that are advantageous to Siemens. Costs are significant – these long-term partnerships require companies to have the capital and operational capability to manufacture and service equipment at scale. Furthermore, innovation is especially important within the industry, with companies seeking to improve their equipment through technological advancements.

With this trend in mind, we can expect Siemens to maintain their market share against their current and future potential competitors. Looking at the chart above, the big three of the imaging industry (Siemens, GE Healthcare and Philips) spend large amounts on R&D with an average of EUR 1.6b of R&D spending in FY2024. Additionally, Siemens has the greatest R&D expense in absolute terms, with only Philips spending more as a percentage of total revenue. Against Elekta, their main competitor in the Varian segment, Siemens eclipses their R&D spending by a significant margin. Siemens’ R&D leadership not only deters new entrants but also ensures continuous advancements in its medical technologies, reinforcing its dominant market position. Should their dedication to innovation bear fruit, we can expect Siemens to not just maintain but also expand their market share against their peers.

Aside from costs, healthcare equipment producers are bound by stringent regulatory standards. The U.S Food and Drug Administration (FDA) subjects imaging and radiotherapy devices via the Electronic Product Radiation Control to ensure radiation-emitting products are safe for use. In other markets, other regulations exist, including the EU Medical Device Regulation, which enforces strict clinical trial evidence and post-market surveillance.

Overall, due to the existing value partnerships established by Siemens, alongside the significant barriers to entry arising from high costs and regulatory approvals, Siemens has a wide economic moat. Siemens’ entrenched market position, combined with its industry-leading R&D and regulatory expertise, ensures that it will not only defend but also expand its dominance in imaging, advanced therapies and oncology solutions.

Investment Thesis #2 – Strong growth potential in the Varian segment

Following Varian’s acquisition, Siemens has integrated the oncology care company into their portfolio of medical equipment. Varian is Siemens’ fastest growing segment with comparable revenue growth exceeding the other segments. The radiotherapy-focused segment exhibited outstanding growth of 9.5% in 2024, with the second fastest growing segment, Advanced Therapies, only expanding by 5.1%. Siemens Healthineers expects the Varian segment to continue its strong growth trajectory due to increasing customer demand and the further development of cancer treatments and solutions in developed markets. Varian is also expected to benefit from a larger total addressable market through increased access to developing markets, further augmenting growth.

The global oncology market is expected to grow significantly, driven by an aging population and growing incidence of cancer cases. The World Health Organization expects new cancer cases to reach 35 million in 2050, a staggering increase from 20 million cases in 2022. Demand for radiotherapy and oncology solutions will subsequently expand, placing Varian in an advantageous position as the leading provider of radiotherapy equipment and oncology software.

Varian benefits greatly from Siemens’ acquisition – being part of the larger Siemens base provides access to cross-selling opportunities across hospital networks. With Siemens’ established multimodality partnerships, hospitals can procure various medical devices from a single producer. For example, Varian’s linear accelerators can be packaged together with Siemens’ X-ray and CT solutions. Siemens’ expertise in imaging further enhances Varian’s radiotherapy precision, compelling increased adoption from healthcare providers.

In developing markets without the infrastructure and human capital to handle the rising cancer burden, cost-effective and high-quality cancer care modalities are paramount. Operational efficiency and cost minimization are imperative in these markets owing to the lack of experienced clinical staff. Radiotherapy adoption in developing markets significantly lags their developed peers, posing as an attractive potential marketplace. Varian is well-positioned to serve this growing market, through their digital solutions and applications that can treat a variety of cases while reducing treatment time and increasing patient throughput.

The radiotherapy and radiosurgery markets are highly consolidated, consisting only of Varian, Elekta and Accuray. Varian and Elekta account for most new installations, while Accuray is a much smaller competitor whose scale pales in comparison to the other former two. Within this duopoly, Varian is expected to outpace their main competitor Elekta. Elekta has been struggling lately, with lower-than-expected revenues and mediocre demand culminating in the firing of CEO Gustaf Salford last month. Furthermore, without access to the larger R&D budget of the wider Siemens network that Varian enjoys, Elekta is forced to consolidate its investments on singular bets, reducing its margin for error. Another advantage of Varian is the ability to leverage Siemens’ expertise in imaging, enhancing radiotherapy precision and the attractiveness of their radiotherapy offerings over Elekta’s. Overall, Varian integration with Siemens places it in an advantageous position against their peers, with market share expected to move in their favour in the coming years.

Overall, with growing demand for oncology products and a competitive advantage over their peers through established client relationships, greater R&D budgets and technological know-how, the Varian segment is bound to lead growth for Siemens.

Valuation

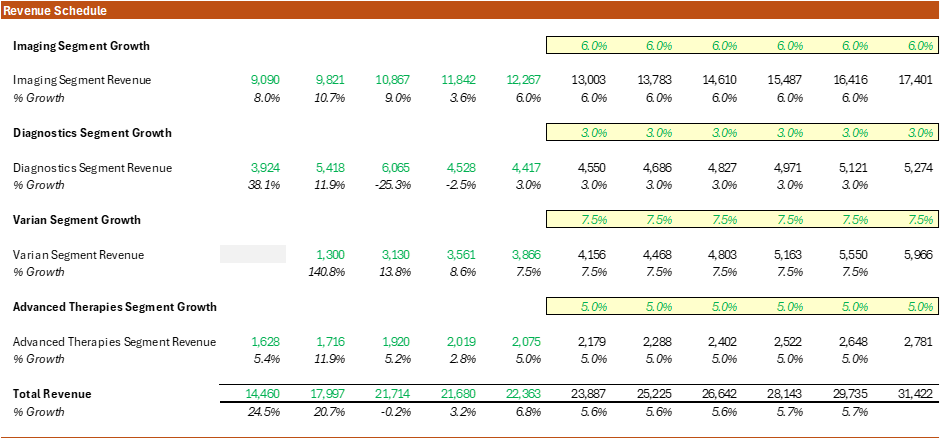

I constructed a discounted cash flow model to assess Siemens’ intrinsic valuation. I projected revenue for the four different segments separately, as I expect the Imaging and Varian segments to grow quicker than the other segments. Under my base case, the Imaging and the Varian segment are poised for stronger growth at 6.0% and 7.5% respectively. Advanced Therapies is projected to grow at 5% while Diagnostics is expected to experience slower growth at 3.0%. Furthermore, with the streamlining of the Diagnostics business and digital transformations alleviating cost pressures, I forecast EBIT margins to grow steadily from the current 14.0%.

Based on my base case, my target price is €68.71, representing a 35.5% upside over the current price of €50.70.

Risks

Being a company that operates in multiple countries, Siemens could be negatively impacted by increased protectionism and trade conflicts. Protectionist measures such as import and export controls, tariffs, local ownership and shareholder regulations could adversely affect Siemens’ business and operations. The United States and China are essential markets for Siemens, and a heightening trade conflict between the two countries could hamper Siemens’ growth prospects. Furthermore, global macroeconomic slowdown could cause Siemens to face increased costs for materials, eroding their cost advantage, especially in emerging markets.

A second risk would be the competitive environment Siemens operates in. Despite being a major or even dominant player in its many revenue segments, innovative technologies from their competitors may disrupt Siemens’ existing market shares. If Siemens fails to produce cost-effective and high-quality products, it stands to lose out to their competitors. However, market share losses due to disruptive technologies are unlikely to be felt instantly by Siemens due to its established long-term service contracts and the sticky nature of its customers. Furthermore, with Siemens’ R&D capabilities, they would likely be able to stay ahead of their less resource-rich competitors.

Environmental, Social and Governance

Siemens has outlined their ESG targets across three core pillars – Healthcare Access, Resource Preservation and Diverse and Engaged Healthineers.

On the environmental aspect, Siemens aligns itself with the universal goal of net zero emissions by 2050, specifically targeting a 90 percent reduction in Scope 1 and 2 emissions and a 28 percent reduction of Scope 3 emissions by 2030. Siemens has made inroads towards that target, reducing Scope 1 and 2 emissions by 40% compared to their benchmark year 2019. Siemens’ Scope 1 and 2 emissions largely stem from energy consumption from operating facilities, its vehicle fleet and fugitive gases. By reducing fossil fuel consumption and switching to an electric fleet, Siemens has reached this milestone a year ahead of schedule and is on track towards their 2030 target.

Siemens conducted multiple energy-saving projects in FY2024, replacing equipment such as boilers, pumps, cooling systems and lighting systems with more energy-efficient substitutes. Renewable energy usage increased to account for 89% of the company’s electrical needs. For vehicle fleets, Siemens is embracing electric vehicle adoption through increased charging infrastructure at their locations.

Scope 3 emissions are more challenging to reduce for Siemens as they account for the lion’s share of Siemens’ yearly emissions. In FY 2024, Siemens reduced emissions by 2% through reductions from purchased goods and services. Through active supplier engagement, Siemens has reduced Scope 3 emissions from Category 1 Purchased Goods and Services by 3% compared to FY2023, however, emissions from this category remain above FY2019 levels. Siemens has its work cut out for it in reducing Scope 3 emissions, and significant progress needs to be made in the coming years to hit its 2030 targets.

On the social aspect, Siemens is committed to diversity, equity and inclusion. However, women’s representation in senior management roles remains low at 17%. The company aims to increase women’s representation in senior management to 30% in 2024. Siemens also aims to tackle healthcare disparities in developing countries and improve healthcare access. Siemens has provided 4 million hours of training to healthcare personnel in developing countries who tend to lack human capital. For example, dedicated academies were constructed in Cario, Egypt, in 2024, providing learning opportunities for healthcare experts across EMEA.

Conclusion

Siemens Healthineers exhibits strong fundamentals with dominant market positions, strong recurring revenue and innovation-driven growth. While macroeconomic and competitive risks exist, the company’s strategic positioning and expansion into emerging markets may provide substantial upside. I recommend a buy for Siemens Healthineers with a price target of €68.71.

Appendix

Assumptions and Drivers

Cost of Debt Schedule

Equity and Country Risk Premium Schedule

WACC Schedule

Revenue Schedule

Unlevered Free Cash Flow Schedule

Discounted Cash Flow Schedule

Sensitivity Analysis

Notes: Historical Periods from 2020 – 2024, Estimates from 2025 – 2029

Other Sources

https://www.marketsandmarkets.com/ResearchInsight/radiotherapy-monitoring-devices-market.asp

https://www.fda.gov/radiation-emitting-products/medical-imaging/medical-x-ray-imaging

https://www.regdesk.co/eu-mdr-overview-an-update-to-european-medical-device-regulations/

https://www.mddionline.com/ivd/siemens-healthineers-to-overhaul-diagnostics-division