Initial Report: Sisram Medical Ltd (1696.HK), 62% 3-yr Potential Upside (EIP, Meimei WU)

Into aesthetics? Let's take a look at Meimei's insights on Sisram Medical, a unique Israeli company.

1. Executive summary

Sisram Medical is a leading international aesthetic medical company that designs, develops, manufactures, and distributes optoelectronic aesthetic medical device and aesthetic beauty equipment to medical institutions and retail customers. Sisram’s aesthetic medical devices utilize laser and RF technologies to achieve skin rejuvenation, hair removal, anti-aging, and various other beauty effects. It also produces injectables and provides dental services.

This report initiates a BUY recommendation on Sisram Medical (1696.HK) on the basis of the following theses: (a) Organic growth of aesthetic cosmetic market in the US and Asia, (b) Expanding product matrix, and (c) Stronger customer engagement through direct sales expansion. We believe that Sisram’s product advantage in providing stronger treatment effects with painless experience renders a strong economic moat for the company. Sisram has a moderately strong ESG proposition with an emphasis on product stewardship, but aspects including data privacy and information disclosure can be improved.

2. Company overview

Founded in Israel in 2013, Sisram Medical is committed to building a global ecosystem for beauty and health. The company's aesthetic product portfolio encompasses light energy-based medical devices, injectables and fillers, as well as beauty and digital dentistry. Its business spans over 90 countries and regions worldwide, enjoying a high level of brand recognition and reputation. One of its subsidiaries, Alma Lasers, is a global leader in energy-based devices, deeply involved in energy-based medical aesthetics such as comprehensive skin rejuvenation and body and facial contouring through a combination of in-house development and strategic acquisitions. In 2020 and 2021, its brand Fotona ranked first and second, respectively, in the market share of laser/intense pulsed light medical aesthetic products in China. In 2022, the company's annual revenue increased by 20.45% to $35.4 million, and its net profit increased by 28.56% to $4.017 million.

Sisram’s growth can be divided into three stages:

Founding Stage (2013-2017): Sisram Medical Technology was established in April 2013 and acquired 95.2% of Alma Lasers, a leading global energy-based medical aesthetic device supplier. In June 2016, it completed the full acquisition. During this period, the company focused on Alma Lasers as its core business, continuously enriching its Harmony and Accent series, and launching multiple energy-based products such as Beauty Fill, Opus, and Remove. In 2017, Sisram Medical Technology listed on the Hong Kong Stock Exchange, becoming the first Israeli company to be listed in Hong Kong.

Entering Injectable Market (2018-2020): Deepening global channels and expanding the injectables market. In 2018, Sisram Medical acquired a 60% stake in Nova Medical Israel, a major Israeli distributor of medical aesthetic products, to accumulate channel capabilities and lay a solid foundation for global market sales. In the same year, it signed an agency agreement for the hyaluronic acid product Profhilo with Swiss company IBSA, and officially entered the injectables and fillers business the following year. It also obtained exclusive distribution rights for the Israeli product Raziel RZL012 lipolytic injection.

Building Ecosystem (2021-Present): Expanding the product portfolio and creating an ecosystem for medical aesthetics. Since 2021, the company has successively expanded into two new business lines: dental and personal care, moving towards a comprehensive medical aesthetics framework. This includes the acquisition of full ownership of Fosun Dental and the establishment of the innovative digital dentistry service platform Copulla. The company also launched the LMNT, a home beauty device brand based on light-wave energy. Products in the injectables business line such as skin boosters, subcutaneous facial fillers, new long-lasting botulinum toxin, and lipolytic injections are all in the R&D stage. While building a diversified product portfolio, Sisram Medical actively creates a medical aesthetics platform that spans the entire industry chain, deploying direct sales channels. In April 2023, it acquired the exclusive distributor Feidun in China to accelerate channel integration and continue its global business expansion.

2.1 Business segments

2.2 Revenue drivers

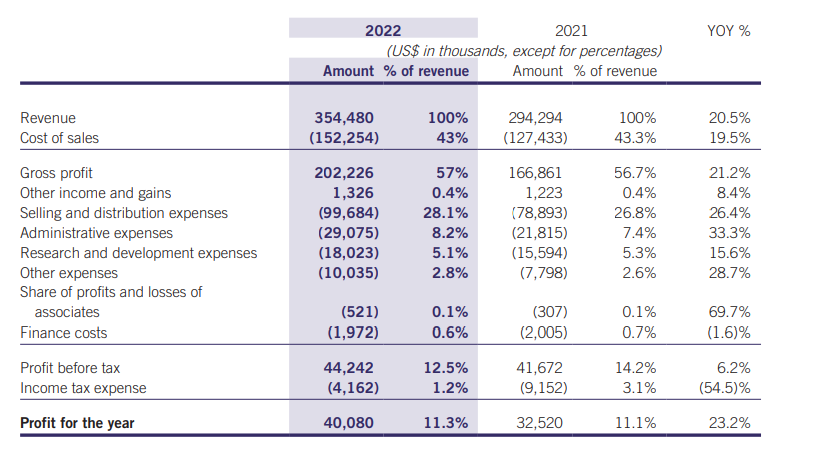

By Product Lines

86.6% of Sisram’s revenue was from medical aesthetic equipment sales. The revenue of the group increased by 20.5% compared to 2021, and 18.7% was driven by MA equipment sales. The increase was primarily attributable to the continuous growth of Sisram’s existing leading products alongside successful introduction of Alma Ted™, LMNTOne™ and CBD+ Professional Skincare Solution™.

By Geographic Regions

North America, APAC and Europe were the most important markets. The revenue derived from North America increased by 28.2%, primarily attributed to the strong position of Alma’s brand and sales operation and the successful launch of Alma Ted™. The revenue derived from APAC increased by 15.1%. The increase was mainly attributed to the integration of Foshion dental and successful launch of LMNT One™ alongside direct operation expansion (Australia, Korea, and India).

2.3 Cost drivers

43% of Sisram’s costs are attributed to the cost of material, rendering service and renumeration. The cost of sales increased by 19.5% , rising slower than the group’s revenue. R&D expenses comprise 5.1% of total sales, higher than the industry average of 2-3%, and increased by 15.6% compared to 2021, indicating more research efforts in improving the existing products and developing new lines. Selling and distribution expenses rose by 26.4% primarily due to rising sales commission and marketing expenses. The fastest growing cost is administrative cost, explained by information system investments and the creation of new corporate functions. In overall, the increase in cost is consistent with the revenue growth.

2.4 ESG considerations

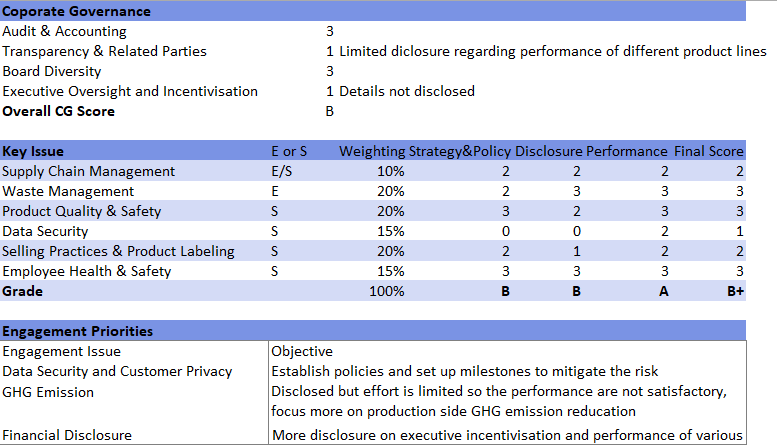

Sisram identified 17 material ESG issues that are important to its stakeholders, and devised strategies to address issues starting with the ones with more immediate and higher risk exposure. In 2022, It has included new issues including selling practices & product labelling and product design& life cycle management, which are urgently demanded by medical aesthetic companies in the environment of tightening regulation on marketing information accuracy & appropriateness and waste management. However, critical social issues regarding customer privacy and data security were not considered in the company’s ESG strategy. Information privacy is at high stake to consumers of medical aesthetic as the company are in possession of private data including photos, body measurements, medical conditions, bioinformation as well as purchase histories that they do not wish to reveal. Therefore, data leak incidents could develop into critical incident risk which damages brand value and company reputation. Sisram should address the issues immediately by including prevention features systems in the current development of its information system infrastructure.

3. Competitor analysis

3.1 Beauty Optoelectronic Device Market Competitive Landscape

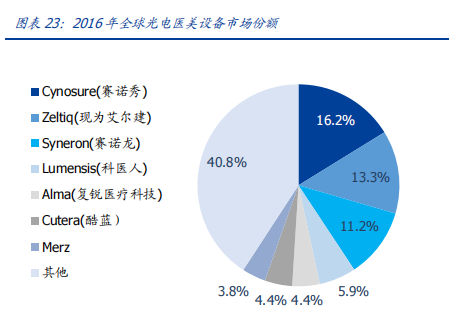

The global market has seen increasing market concentration among the top equipment. By 2016, the market share of the top 3 optoelectronic medical aesthetic device manufacturers was 40.7%, with notable acquisitions including the merger of Syneron with Hologic, the acquisition of Zeltiq by Allergan, and the acquisition of Syneron-Candela by Apax. Sisram’s Alma took up 5.9% of the global market share.

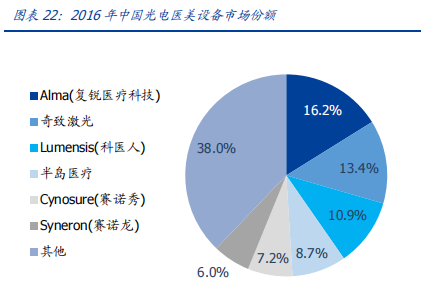

In China, 80% of optoelectronic devices are imported, primarily from United States, Israel, and Germany. In 2016, the market share of the top three optoelectronic medical aesthetic device manufacturers in China (CR3) was 40.5%, with Alma from Israel, Qizhi Laser, and Sciton from the United States. However, most domestic brands are small-scale optoelectronic medical aesthetic equipment manufacturers, and their technological capabilities are relatively weak and lagging in terms of product safety, efficacy, and the establishment of distribution networks. Alma has the highest market share of 16.2%

3.2 Segmented Markets Competitive Landscape (Laser-based and IPL Devices)

The degree of market concentration is high in the segmented market with overseas brands still occupying the majority share. In the laser-based medical aesthetic device sub-market in China, the industry's CR3 reached 65% in 2020. Among them, Alma, a subsidiary of Sisram Medical, held the largest market share at 32%, making it the market leader. Qizhi Laser and Sciton accounted for 18% and 15% respectively.

As for intense pulsed light (IPL) medical aesthetic devices, the industry's CR3 in China reached 82% in 2021. Among them, the overseas brand Sciton, with its core OPT/AOPT intense pulsed light technology and flagship product M22, captured a market share of 54%, securing the top position. Sisram Medical's subsidiary, Alma, with its flagship products such as the Black Gold DPL Super Photon, ranked second with a market share of 22%.

3.3 Sisram’s Economic Moats: Product Advantages

Sisram’s patented technology utilizes the performance differences of different energy sources to enhance device accuracy control and employs high-frequency pulse technology to improve precision, and thus enabling precise control of depth of treatment.

For energy output technology, products such as Pixel CO2 utilize dual-mode beam laser platform with multi-point focusing and scanning modes. It integrates different treatment functions into a single platform and allows for a selection of various treatment modes and combined treatments, and thus achieving targeted therapeutic effects.

While focusing on precise efficacy, Alma also prioritizes the treatment experience of users. The company is committed to reducing discomfort by implementing its In-motion technology, which involves repeatedly moving the energy release device over the treatment area. This ensures that the patient's skin can absorb an equivalent amount of energy, resulting in a relatively painless experience.

For instance, Alma’s DPL Super photon device is currently the only device that can deliver precise and targeted painless treatment. Moreover, the treatment time is the shortest and duration of treatment effect is the longest compared to competing products. Due to product advantages, Sisram DPL’s treatment price is 2980RMB per treatment, 2 to 3 times the price of other comparable treatment offered. As for hair removal devices, Sisram’s Soprano series offers shorter treatment courses and lower levels of discomfort, targeting the mid-to-high-end hair removal market in China. In terms of treatment courses, Sisram’s treatment device requires 3-5 sessions, which is fewer than the 3-6 sessions required by other brands such as SciMedic. The total duration of the treatment course is 3-5 months, significantly shorter than the 12-18 months required by devices like the Cynosure GentleLase Pro-U.

During the treatment process, it can maintain a continuous temperature of 45-50℃ in the hair follicle area while keeping the skin surface temperature at 25℃, providing a virtually painless experience for patients. Additionally, it has minimal occurrences of redness, swelling, or blistering. The price of Sisram’s device treatment is 3 to 5 times of the market average price.

4.Investment thesis

4.1 Growth of aesthetic cosmetic market (Global, US and Asia)

According to Medical Insight, the market size of energy-based medical aesthetic devices and consumables was $2.67 billion in 2016, with a compound annual growth rate (CAGR) of 14.6% from 2014 to 2016. It is projected to reach $4.48 billion in 2021, with a CAGR of 10.4% from 2016 to 2021, indicating steady double-digit growth in the global energy-based medical aesthetics market. North America and Asia have significant market potential. According to Medical Insight, in 2016, North America, Asia, and Europe were the top three energy-based medical aesthetics markets globally, with market sizes of $1.39 billion, $570 million, and $540 million, respectively. It is projected that by 2021, these markets will grow at compound annual growth rates of 11.1%, 11.5%, and 7.6%.

China's energy-based market demand continues to grow at a double-digit rate. According to Medical Insight, the market size of energy-based medical aesthetic devices in China was $160 million in 2016, and it is projected to reach $330 million by 2021, growing at a compound annual growth rate of 16% from 2016 to 2021. According to Frost & Sullivan, the non-surgical market size in China was 97.7 billion yuan in 2021, with a compound annual growth rate of 25% from 2017 to 2021. While skin rejuvenation and hair removal continued to growth steadily within China, anti-aging treatments have also gained popularity in recent years and are highly sought after by individuals seeking aesthetic enhancements. Skin tightening projects have been highly sought after in recent years. Sisram’s Accent thermal face-lifting treatment device has the potential to achieve exceptional growth as it offers much more comfortable treatment experience and much lower price compared to Thermage, Ultherapy, and Thermi.

4.2 Expanding the product matrix.

The company launched its home beauty device product, LMNT One. In March 2022, the company introduced the LMNT brand for home beauty devices, and in May, they launched their first product, LMNT One. The product is sold in China and Italy through distribution and e-commerce models. The company has already established a presence on various platforms such as Tmall, Douyin (TikTok), Xiaohongshu (RED), laying a solid foundation for future online channel expansion.

LMNT One, the home beauty device, utilizes a combination of three technologies to achieve multiple effects such as skin brightening and collagen regeneration. The device features a single setting design and one-button operation, making it easy to use for home spa treatments, business trips, and travel. In 2021 the market size of home beauty devices reached 9.8 billion RMB, with a year-on-year growth of 19.9%. The compound annual growth rate from 2017 to 2021 was approximately 26.4%, indicating a period of rapid growth in the industry. The emphasis on high-end products and increasing average spend per customer have become major drivers of home beauty industry growth in recent years, benefiting the sales of high-quality and high-end products like Alma.

Compared to markets like the United States and Japan, the penetration rate of home beauty devices in China is low, indicating significant growth potential. In 2020, the penetration rate of home beauty devices in China was 2.1%, while during the same period, the penetration rates in the United States and Japan were 20.0% and 11.0% respectively. When benchmarked against overseas markets, China's home beauty device market still has a relatively low penetration rate, indicating ample room for improvement in the future.

Sisram also ventures into various other beauty sub-industries including injectables and aesthetic dentistry. Sisram’s Hyaluronic Acid and Lipolytic Injection products were launched in Hongkong and India and are currently going through clinical research stage in China. A recently acquired subsidiary of Sisram is also carrying out bio-degradable silhouette protein face-lifting thread research and development. Sisram strategizes to further expand its product portfolio, and it has the potential to ultimately integrate all product lines into one-stop beauty treatment centers that directly reaches out to end-users.

4.3 Stronger customer engagement through direct sales expansion

Since its listing in 2018, the company has been focusing on expanding its direct sales channels as an important factor for sustainable growth. It has established nine major direct sales centers worldwide and has transitioned from distribution to direct sales in markets such as Mainland China, Hong Kong, South Korea, the United Kingdom, Australia, and Israel. As of 2022, the proportion of revenue from direct sales channels has increased from 37.6% in 2017 to 66%. The compound annual growth rate (CAGR) of direct sales channel revenue from 2017 to 2021 was 28.8%, surpassing the average revenue CAGR of 21.09% during the same period.

Direct sales enable more refined operations in mature markets and result in higher gross profit margins. In the initial stage of foreign brands entering the domestic market, they can quickly cover the end market through distributors to establish a presence. However, as projects mature, major brands should rely more on internal operations to maintain relationships with institutional clients and communicate product features. The company's direct sales channels have higher gross profit margins compared to distribution channels, and the trend towards direct operation is expected to drive higher-quality growth in the future.

Fig: Sales share by distribution channels, 2022 (Red: Direct Sales | Yellow: Distributor Sales)

5. Valuation

We predict that the company will achieve revenues of 445/561/701 million USD and a year-on-year growth of 25.4%/26.1%/25.1% during the period of 2023-2025. The net profit attributable to the parent company is projected to be 50/64/82 million USD, with a year-on-year growth of 24.7%/27.1%/28.2%. The current stock price corresponds to a PE ratio of 11 for the year 2023.

When comparing Sisram with upstream medical aesthetic and medical equipment consumables manufacturers such as Imeik, Huadong Medicine, Giant BioGene, and Angelalign Tech, we believe that there is still room for the company's valuation to increase. Therefore, I will initiate coverage on the company with a "Buy" rating.

6. Risks and mitigation

Weak end-user demand: A recession induced decline in orders and demand could negatively impact on the company's revenue growth. In viewing the development of aesthetic beauty market in the United States during the 2008 financial crisis, we predict that short-term demand will be adversely affected by economic and consumer sentiments. However, in the long term, returning to work has made more consumers recognize the benefits of medical aesthetic procedures and are willing to invest in these services to enhance their appearance and confidence.

Intensified industry competition: Increased competition can lead to a decline in the company's profitability as competitors strive to gain market share. The Hyaluronic Acid and Botox market may not perform up to expectation due to the high volume of market entry.

Research and development risks: There is a risk of failure or delays in obtaining certifications or approvals for the company's ongoing research and development projects. This can impact product launches and the ability to bring new innovations to the market.

7. ESG assessment

In overall, Sisram Medical has a comprehensive ESG strategy and data-driven disclosure, and satisfactory ESG performance. The highlight of Sisram’s ESG strategy is its product stewardship which encompasses various aspects including product health & safety, IP management, product design& lifecycle management, selling and labelling practices. The company’s strong emphasis on product and resilient business model forms the bedrock for Sisram’s sustainable development. While the effort on product stewardship is commendable, the company should focus more on including more metrics like data security into its ESG evaluation and increase disclosure on executive incentivization and detailed product sales performance to shareholders.

8. Conclusion

In conclusion, Sisram medical has the potential to capture the tailwind of a high-growth industry, its product matrix expansion plans, healthy financial profile, and emphasis on product stewardship will help the company to grow sustainably and resiliently. Therefore, the report initiates a BUY recommendation for Sisram Medical [1696.HK] with a target price of HKD 15.16, subject to adjustment depending on the recovery situation of the end-user consumer market.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.