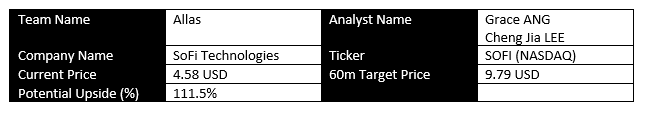

Initial Report: SoFi Technologies (SOFI), 111.5% Potential Upside (EIP Team Allas)

Let's look at their analysis

Date: 17/12/2022

LinkedIn | Grace Ang

LinkedIn | Cheng Jia Lee

Summary

SoFi Technologies, Inc., is an internet-based financial institution.

Recent Earnings have mostly been positive, earnings per share numbers while still been flat, revenue has been on the uptrend

During 2022’s third quarter, growth in overall membership and products increases the financial figures (net adjusted revenue and EBITDA) as well as guidance for the full year.

Acquired Bank Charter in 1st Quarter of 2022, which greatly increases flexibility and cross-selling opportunities.

While there are risks on pause on student payments (which is the main business model when it first started), all lending product origination was up 2% year-over-year, with personal loan gains making up for declines in student loan and mortgage volume.

SoFi Technologies (NASDAQ: SOFI) stock spiked 6.1% in 14th Dec 2022 after the financial services company's CEO, Anthony Noto, bought $5M in SOFI common shares.

Business Overview

Founded in 2011, SoFi Technologies Inc. (NASDAQ: SOFI), an all-in-one fintech that got its start in the student loan business, is one of the countless tech stocks on the market that went public via special purpose acquisition company (SPAC) during the 2021 market bubble. At the end of 2013, the company had serviced more than 2,500 students and the figure is still growing.

Once launched, the company continued to grow and to expand both the institutions it served and the services it had to offer. By 2015 the company was offering personal loans on top of student loans and by 2016 it had received the 1st ever AAA rating given by Moody’s to a digital financial institution.

In 2022 Sofi Technologies received a national bank charter when it purchased Golden Pacific Bancorp. The move allows the company to hold its own loans rather than selling them to outside investors as it had done in the past. Today, SoFi Technologies operates as a digital banking institution with three primary segments. These are Lending, Technology Platforms, and Financial Services. Consumers are able to access the platforms via mobile and desktop.

The Lending and Financial Services segments provide a range of traditional banking and lending services. These include deposit accounts and investment services along with student loans, personal loans, and mortgages. Among the many offerings are credit score monitoring, insurance products, and access to the cryptocurrency markets.

The Technology Platform segment provides technology platforms and services to businesses and institutions. Among the company’s technology platforms is Galileo, a payment processing service. This addition allows SoFi to process payments for merchants and consumers. SoFi Technologies also operates Apex, a clearing house service for investment and financial institutions, and Technisys, a cloud-based banking application.

As of 2022, the company had over 4 million active members and had paid out more than $35 million in rewards. SoFi Technologies has issued more than $73 billion in loans with roughly half that amount already repaid.

Investment Analysis

Total number of products increased over the years: Allows for a greater range of traditional banking and lending services aside from relying on student loans. The technological segment provides technology platforms and services to businesses and institutions (including Galileo), allowing

Total membership grew 61% YOY to over 4.7 million. New member adds of over 400,000 in each of the first three quarters of 2022, with explosive growth coming from the banking segment

Net adjusted revenue increased 51% to USD 419 million. And EBITDA increased by 332% YOY to USD 44 million

Company has also raised its guidance for the full year. It now expects full-year 2022 adjusted net revenue of $1.517 billion to $1.522 billion and adjusted EBITDA of $115 million to $120 million. This marks the third quarter in a row of positive revisions to full-year 2022 guidance and indicates strong optimism from the management team.

Investment Thesis:

SOFI has reported positive growth momentum despite multiple headwinds of interest rate hike and slowdown in global consumer demand, signifying resilience in business activities

SoFi’s strategy to expand its product offering and be a one-stop shop for financial services has been the right one, as the company has consistently grown its customer base over the past three years

Working towards profitability

Improvement in revenue

Strong balance sheet to weather imminent recession in 2023, edging over its peers in a similar fintech sector.

Total assets

Dec 2021: 9,176,326,000

Sep 2022: 15,834,903,000

Cash & Cash Equivalents

Dec 2021: 494,711,000

Sep 2022: 935,159,000

Saw an influx in interest-bearing deposits in 3Q22 (liabilities)

This makes a difference in the company’s business model and funding costs, considering that deposits usually have a lower cost than debt and are considered to be a stable form of funding over the long term, making SoFi more competitive against other specialty finance companies and even compared to small-sized banks. Indeed, the company says that it has achieved about 125 basis points of savings on the cost of funds through deposits, compared to other sources of debt to fund loans.

SoFi now has a banking license, following its acquisition of Golden Pacific Bancorp that was completed back in February 2022, it can now offer a wider range of products, of which deposits are probably the most important; one because it expands the company’s funding sources and two because it reduces its exposure to wholesale funding.

Monetization of its customer base and product offering is key for the sustainability of its long-term growth strategy, a situation that has clearly improved in the past few months. This is justified to some extent by its banking license and more diverse funding mix, which has improved its lending margins and its liquidity position, enhancing the sustainability of its business model.

Risks

Interest rate risk

Explanation: When interest rates increase, consumers will usually are borrowing less because cost of borrowing has risen. Since loans are a large part of SoFi’s business, this could potentially affect them

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.