Initial Report: SoundHound AI, 96% 5-yr Potential Upside (EIP, Brian Tang)

Brian presents a "BUY" recommendation based on its impressive order backlog, robust financial health, innovative technology, strategic partnership and market opportunity in AI voice technology.

LinkedIn: Brian Tang

Company Overview:

The company was founded in 2005 by Keyvan Mohajer, an Iranian-Canadian computer scientist who had founded several dot com ventures before starting SoundHound.

SoundHound AI, Inc. specializes in conversational intelligence, offering voice artificial intelligence (AI) solutions that enable businesses to provide conversational experiences to their customers. The company’s technology allows humans to interact with their environment in a natural, conversational manner, whether through mobile phones, cars, televisions, music speakers, coffee machines, or other devices.

SoundHound AI’s voice technology delivers fast and accurate responses in multiple languages, catering to product creators in the automotive, TV, and IoT sectors, as well as customer service industries. Key AI-driven products include Smart Answering, Smart Ordering, and Dynamic Interaction, a real-time, multimodal customer service interface.

Additionally, SoundHound Chat AI is a voice assistant integrated with Generative AI, powering a variety of products and services. The company processes numerous interactions annually for businesses and offers connectivity solutions that include edge, cloud, and hybrid (Edge+Cloud) options.

Business Model:

SoundHound AI operates with a multifaceted business model, which includes several key components:

Voice AI Developer Platform

Houndify: SoundHound provides a comprehensive voice AI developer platform called Houndify. This platform allows businesses and developers to integrate advanced voice recognition and natural language understanding capabilities into their applications and services. Houndify is essential for creating voice-enabled applications across various industries.

SoundHound Chat AI

Voice-Enabled Digital Assistant: SoundHound offers SoundHound Chat AI, a voice-enabled digital assistant. This product is designed for users seeking voice interaction capabilities for various applications, from smart home devices to mobile apps. It provides a seamless conversational experience, utilizing the company’s expertise in speech recognition and natural language processing.

Music Recognition Mobile App – SoundHound

SoundHound App: The company’s flagship product is the SoundHound mobile app, specializing in music recognition. Users can identify songs by humming, singing, or typing lyrics. The app also offers features like real-time lyrics, song recommendations, and integration with streaming services. SoundHound monetizes this app through partnerships, advertisements, and premium subscription models.

Automotive Integrations

Partnerships with Automakers: SoundHound has established partnerships with major automotive manufacturers, including Hyundai, Mercedes-Benz, and Honda. The company’s technology is integrated into vehicle systems, providing voice interaction capabilities for tasks such as music control, navigation, and hands-free communication. Revenue in this segment comes from licensing agreements and collaborations with automakers.

Partnerships and Collaborations

Strategic Partnerships: SoundHound has strategically partnered with various tech giants, including Hyundai, Mercedes-Benz, and Honda, to provide voice interaction for their products. These partnerships involve licensing agreements and collaborations to integrate SoundHound’s voice AI technology into different applications and devices, expanding the company’s reach and revenue streams.

Summary

SoundHound AI’s business model focuses on providing advanced voice AI technologies to developers, businesses, and consumers across various sectors. The company leverages strategic partnerships, licensing agreements, and product innovations to strengthen its position in the rapidly evolving landscape of voice and sound recognition.

Competitor Analysis:

Shazam and SoundHound are both music recognition apps capable of identifying songs by listening to short clips. Shazam, with over 1 billion downloads, is the more popular of the two. It is simple to use, requiring just a single button tap to identify a song. Additionally, Shazam excels at recognizing songs from TV shows and movies.

In contrast, SoundHound offers more advanced features. It can identify songs from humming or singing and understands natural language queries, such as “What song is playing?” or “Play something similar to this.” SoundHound also performs better in noisy environments. Unlike Shazam, SoundHound offers a hands-free feature, enhancing user convenience.

Google Assistant, though not a direct competitor like Shazam, poses a significant threat to SoundHound on a broader scale. Google Assistant is embedded in most Android phones and smart speakers, enabling native music recognition with the command “Hey Google, what’s this song?” This seamless integration and extensive device reach greatly impact SoundHound’s potential user base. Furthermore, Google’s extensive research and development capabilities in AI and language processing provide a competitive edge in accuracy and handling complex queries. Google's vast data resources and infrastructure allow continuous improvements in its music recognition capabilities, challenging SoundHound’s technological lead.

Both SoundHound and Nuance Communications are key players in voice technology, but their focus areas differ. SoundHound excels in conversational AI and music recognition, offering natural language understanding and the ability to identify music from humming or singing. It targets consumers through user-friendly applications like the SoundHound app and partnerships with brands like BMW and Domino’s.

Nuance Communications, on the other hand, focuses on enterprise solutions, specializing in speech recognition and voice biometrics. Their offerings cater to customer service centers, healthcare, and finance, providing automated call routing, voice authentication, and document automation. While SoundHound emphasizes natural language understanding and music recognition, Nuance prioritizes speech recognition and voice biometrics for specific industry needs.

SoundHound and Deepgram both focus on speech recognition and AI, but their approaches and target markets are distinct. SoundHound is known for its consumer-facing applications and music recognition capabilities. It excels at understanding natural language queries and has established partnerships with brands like BMW and Domino’s.

Deepgram, however, targets developers and businesses with its deep learning-based speech recognition technology. Known for high accuracy and customization options, Deepgram’s technology is ideal for building voice-powered applications in diverse fields like healthcare, education, and media. Unlike SoundHound, Deepgram does not offer pre-built consumer apps.

Fano Labs and SoundHound both leverage conversational AI but focus on different markets. SoundHound excels in music recognition and conversational AI, targeting consumers with applications that understand natural language, humming, and singing. It partners with brands like BMW and Domino’s to offer intuitive voice control experiences.

Fano Labs specializes in creating custom voice-powered solutions for people with disabilities and diverse communication needs

Economic Moat Analysis using SWOT:

Strengths

User-Friendly Interface: Displays the top 25 most popular songs, providing inspiration for users unsure of what to listen to.

Comprehensive Song Information: Users can access details about the song, singer, release date, and similar music.

High User Satisfaction: The app has a large user base with predominantly positive feedback and high ratings on the Apple Store.

Efficient and Versatile Music Search: Allows users to search for songs by typing, singing, or humming, with quick results and access to Live Lyrics. Users can also bookmark favorite songs and playlists for later reference.

Music Exploration and Offline Support: Highlights charts clearly and supports offline usage, enabling users to save searches for later use and automatically add identified songs to playlists in their preferred streaming app.

Weaknesses

Negative Net Income: The company has been experiencing significant losses since 2020, raising concerns about profitability.

High Debt-to-Assets Ratio: The ratio increased from 5.34 in 2020 to 7.98 in 2021, indicating high debt and bankruptcy risk.

Accuracy and Usability Issues: The app sometimes fails to identify the correct song when users sing or hum, and there is a learning curve due to its many features. The free version contains ads and is not effective in event recording and mixing.

Opportunities

Expansion into Voice Interactive AI: Potential growth similar to Amazon's Alexa, with a focus on expanding business and diversifying services.

Strategic Partnerships: Collaborations with companies like Hyundai (seven-year agreement for in-car voice experience) and Square (voice ordering service).

Integration with VIZIO: Advanced voice AI technology integrated into VIZIO's voice-enabled remote and mobile apps, enhancing user experience.

Voice Commerce Potential: The extensive library of content domains opens significant opportunities for voice commerce.

Merger with Archimedes Tech SPAC: Expected to list shares on Nasdaq under the ticker symbol SOUN upon closing.

Threats

Strong Competitors: Faces fierce competition from Shazam, Soundcloud, Midomi, and Gracenote in the music recognition market.

MarketBeat Ratings: Competitors like Materialize received higher user ratings and outperformed SoundHound AI in net margin and return on equity.

Key Ratios and Margins: All values updated annually at fiscal year-end

TTM = Trailing Twelve Months 5YA = 5-Year Average MRQ = Most Recent Quarter

SoundHound AI significantly underperforms compared to its industry peers across multiple financial metrics. The company faces substantial challenges with profitability, as indicated by its negative P/E ratio, pretax margin, and net profit margin, all of which are much lower than the industry averages. Despite a strong gross margin, which suggests effective cost management, SoundHound AI struggles with high operating losses.

Liquidity ratios, such as the quick and current ratios, are significantly higher for SoundHound AI compared to industry, indicating strong short-term financial health. However, efficiency ratios such as asset turnover and revenue per employee are lower, showing less effective use of assets and human resources.

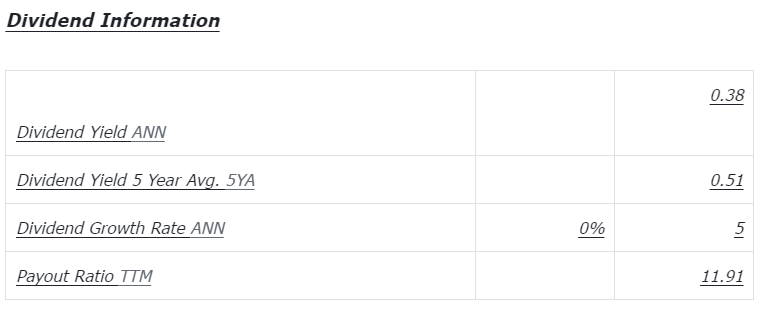

In terms of dividends, SoundHound AI does not provide a dividend yield, which may be less attractive to income-focused investors. While SoundHound AI shows potential in specific areas like gross margin and liquidity, it faces significant challenges in profitability, efficiency, and overall financial health compared to industry standards.

Investment Theses:

Strong Order Backlog and Market Opportunity

SoundHound AI boasts an impressive order backlog of nearly $700 million as of Q1 2024, up from $336 million the previous year. This backlog reflects committed client contracts and realistic adoption estimates for its subscription services, indicating a solid foundation for future revenue. The significant increase in the backlog suggests rising customer demand for SoundHound AI's services. As this backlog converts into revenue over time, it positions the company for substantial growth, making it an attractive investment opportunity. Furthermore, the AI voice technology market is projected to grow from $2.5 billion to over $15 billion by 2032, offering substantial growth potential for SoundHound AI.

Robust Financial Health and Recent Stock Performance

Despite its current unprofitability, SoundHound AI maintains a solid financial foundation with a cash balance of $180 million and only $85.5 million in long-term debt. This financial stability enables the company to sustain its operations and continue its growth trajectory even while incurring short-term losses. The strong cash position provides SoundHound AI with the flexibility to invest in its innovative technology and strategic initiatives, supporting its long-term growth prospects. Additionally, SoundHound AI's stock has nearly doubled over the past six months, reflecting growing investor confidence and interest in its AI technology.

Innovative Technology, Strategic Partnerships, and Acquisition Potential

SoundHound AI's cutting-edge voice recognition technology has attracted notable clients such as Honda, Netflix, and Mastercard. These strategic partnerships and an investment from Nvidia bolster the company's credibility and market presence. Despite competition from tech giants like Apple, Amazon, and Alphabet, SoundHound AI's unique offerings and growing market presence highlight its potential for long-term success. The company's innovative approach and strategic alliances position it well in the competitive landscape of voice recognition technology. Moreover, given major tech companies' growing interest in AI voice technology, SoundHound AI could become an attractive acquisition target, further enhancing its investment appeal.

SoundHound AI is Considered Undervalued

SoundHound AI is regarded as undervalued due to its significant long-term growth potential that is not fully reflected in its current valuation. Despite recent stock fluctuations, SoundHound AI's fundamentals paint a promising picture. The company’s stock is valued at approximately 1.9 times its substantial order backlog, indicating that the market may not be fully appreciating the future revenue potential embedded in these committed contracts.

Additionally, SoundHound AI's market cap of around $1.3 billion is relatively modest compared to the potential size of the AI voice technology market, which is expected to grow significantly over the next decade. With over 270 patents and an early lead in securing major clients, SoundHound AI is well-positioned to capture a sizable share of this expanding market. Furthermore, the company's ability to maintain high growth rates in revenue, coupled with its robust financial health, supports the case for its undervaluation.

Considering recent industry acquisitions, such as Microsoft's purchase of Nuance for nearly $20 billion, SoundHound AI's current valuation appears palatable. The company's innovative technology, strong order backlog, and strategic partnerships provide a compelling investment opportunity for those willing to bet on the lucrative rise of AI voice technology. SoundHound AI's potential for significant revenue growth and long-term success positions it as a promising investment in the AI technology sector.

Risk Analysis

Lack of a Competitive Moat

SoundHound has managed to attract a notable list of clients, including Honda, Netflix, and Mastercard. Additionally, an investment from Nvidia has likely bolstered the company's credibility. However, these achievements may not be enough to alleviate concerns about competition from some of the world's largest tech companies. SoundHound faces formidable rivals such as Nvidia (also an investor), Apple, Amazon, Alphabet, and OpenAI, all of whom are developing voice recognition software.

Furthermore, these competitors, except for OpenAI, have significantly larger cash reserves compared to SoundHound's $1.7 billion market cap. This disparity in financial resources puts SoundHound at a considerable disadvantage.

Staggering Financial Losses

SoundHound's substantial financial losses pose a threat to its viability and its ability to compete with trillion-dollar companies. In the first quarter of 2024, SoundHound generated nearly $12 million in revenue, a 73% increase from the previous year. While this growth seems impressive, it is overshadowed by the company's costs and expenses totaling $40 million. Consequently, the comprehensive loss attributable to shareholders rose to $33 million, up from $27 million in the first quarter of 2023.

Although investors generally do not expect start-ups to be profitable immediately, SoundHound's situation is precarious. With $212 million in cash and equivalents, the company can sustain its current rate of losses for about six more quarters. However, this indicates that SoundHound will need to raise additional funds shortly, which is a cause of concern for shareholders.

Potential for Shareholder Dilution

To raise funds, SoundHound may consider issuing more shares, a strategy it has used extensively. At the time of its IPO two years ago, the company had fewer than 200 million shares available. Today, that number has increased to just over 329 million.

Moreover, SoundHound has around $85 million in long-term debt. While this debt level is manageable, it is relatively high given the company's $155 million in stockholders' equity, making it an unlikely source of significant new funding.

Ironically, if SoundHound's stock performs well, the company might be more inclined to issue additional shares. Investors recently witnessed how GameStop's stock rally reversed after the company announced a new share issuance. Therefore, achieving a "meme stock" status could benefit the company but might not be favorable for its shareholders.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

References:

https://www.fool.com/investing/2024/06/27/is-soundhound-stock-a-buy/

Du, J. S., Li, J., & Zhao, Y. (n.d.). Business analysis for SoundHound based on financial study and SWOT model. United World College South East Asia Dover Campus; Wuhan Britain-China School; Metropolitan Preparatory Academy. Retrieved from https://aemps.ewapublishing.org/media/1c728ab4e1cc421db9112a072e674c72.pdf