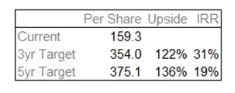

Initial Report: Spotify Technology SA (SPOT), 136% 5-yr Potential Upside (EIP, Hui Ling KOH)

Is Spotify your jam? Hui Ling did a neat memo on this one. Let's take a read together!

LinkedIn | Hui Ling KOH

Company overview

Spotify Technology SA (NYSE: SPOT) is a provider of streaming for audio on-demand. The company has presence in 184 countries, with over 515 million monthly active users (MAU), including 210 million premium subscribers. It currently offers over 100 million tracks, including more than 5 million podcast titles. Spotify operates under a freemium model under two business segments: Premium and Ad-supported. The Premium segment consists of paid streaming without ads while the Ad-supported segment consists of free streaming with ads.

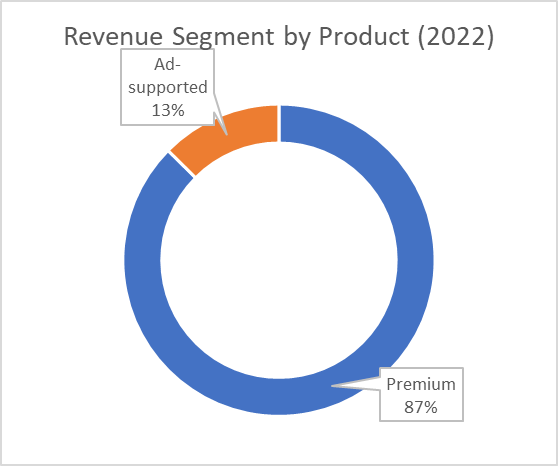

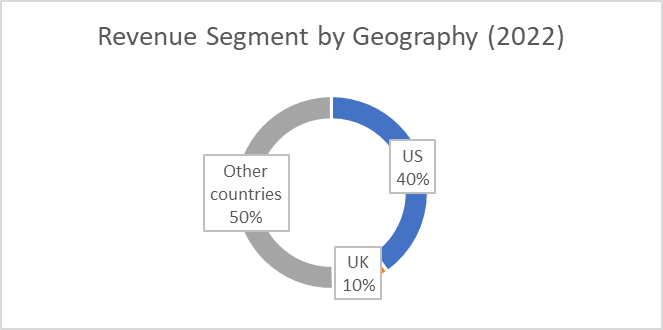

Business segments

In 2022, SPOT’s revenue was EUR 11.8 bn – 87% of its revenue is derived from the Premium segment, while 13% was derived from the ad-supported segment. Majority of SPOT’s revenue is concentrated in the US market (40%). SPOT’s gross profit margin for the year was 25%, with 28% gross margin for the premium segment and 2% gross margin for the ad-supported segment.

Revenue drivers

Spotify’s 2 main revenue drivers are MAU and Average Revenue Per User (ARPU). Spotify’s MAU is largely driven by the smartphone penetration as the nature of Spotify’s streaming product requires users to have smartphones and internet infrastructure. As its Ad-supported segment earns lower ARPU than its Premium segment, the firm’s incentive is to maximise conversion of MAU to subscribers. Spotify has managed to maintain consistent penetration of subscription with 5Y average of ~45% of MAU, through tailoring of subscription prices according to the wealth of different countries and consumer groups (eg. family plan, student plan). In regions with lower credit or digital card penetration, Spotify also partners with local telecommunication operators to allow users to purchase pre-paid premium plans with shorter period – daily or weekly.

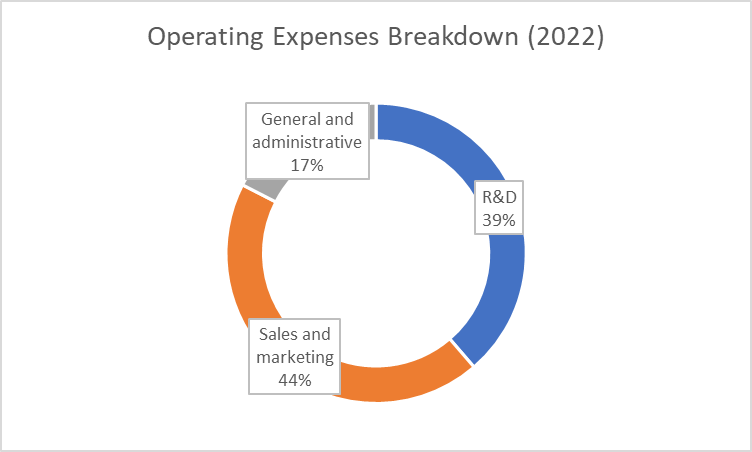

Cost drivers

Main cost drivers of the business are from sales and marketing (44%), with EUR 1.5bn expense. The company’s EBIT in 2022 was EUR -0.658bn, with a -5.6% EBIT margin (vs. its 5Y average of EBIT margin -2.0%).

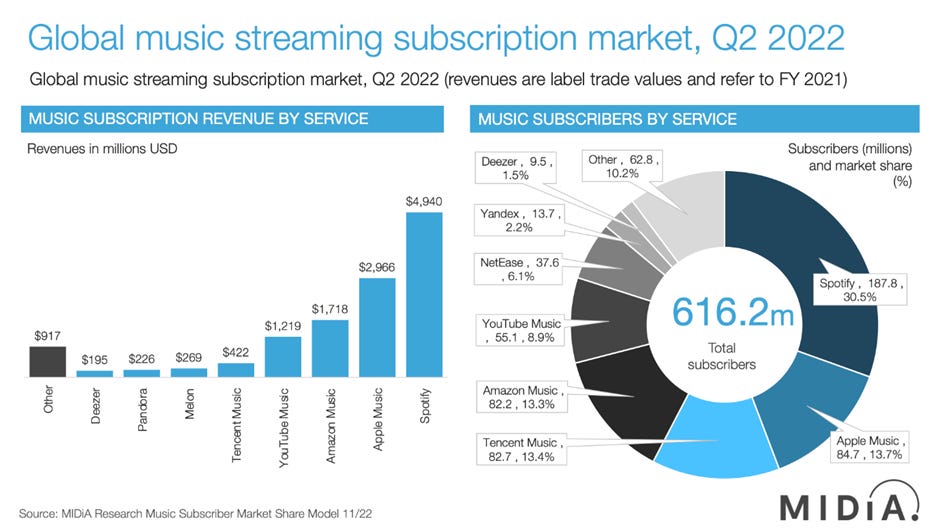

Competitive landscape

The firm faces intense competition from technology giants such as YouTube, Apple and Amazon who possess deeper pockets than Spotify and have lower customer acquisition costs (eg. through cross-selling on their platforms/bundling their products). This problem is further entrenched by the fact that these companies’ main profits are not derived from audio streaming and hence they could choose to utilise music as a loss-leader to cross-sell their higher margin products such as iPhones for Apple. However, Spotify has enjoyed higher engagement than its competitors due to its superior technological innovations and focused attention to the audio streaming market that has allowed it to stay ahead of the curve and increase consumer retention.

Investment thesis

Thesis 1: Growth of Smartphone penetration

With the growth of network infrastructure, global smartphone adoption rate is projected to continue rising steadily to 92% in 2030, from 76% in 2022. SPOT’s product of audio streaming requires users to have internet access and devices such as smartphones. With the secular tailwind of smartphone penetration growth, SPOT could acquire more MAU for its ad-supported segment which in turn is one of the main funnels for the growth in its MAU for its premium segment, where most of its margins are derived from.

Thesis 2: Superior Technological Innovation Drives Customer Retention

Spotify’s superior technological innovation and dedication to on-demand audio streaming allows it to keep ahead of the Red Queen Race and increases customer retention. With SPOT’s incumbent dominant market share of ~31% with 515 million MAU that allows it to strengthen its core proposition of discovery and customisation. Broadly, the company enjoys higher engagement compared to its peers that allow it to effectively scale and personalise its discovery function. For instance, Spotify has ~3 times the premium subscription base of Apple Music and a wider global presence, allowing the firm to exploit the data gap and compound its discovery competency by feeding its recommendation algorithm more data. Given the vast number of music that is readily available in the market with the rise of both indie and label artists, the high degree of personalisation over time makes Spotify very sticky and allows it to be well-positioned against its peers. Discovery tailors Spotify playlist recommendations to allow users to discover new songs catered to their tastes. Alongside the difficulty in transferring albums between platforms (often created with Spotify’s recommendation algorithm), this drives the high switching cost of Spotify. Ease of usage with integration with third party platforms such as Instagram and TikTok also increase switching cost and increases MAU. Spotify also has highly integrated systems for advertisers such as Spotify Audience Network that allows advertisers to target their advertising in podcasts.

Thesis 3: Strategic Acquisitions That Further Drives Core Competencies

As Spotify operates on a cost structure that is largely variable costs, which means its costs scale with their revenue growth, Spotify has a margin expansion ceiling. Nonetheless, its gross margins have been growing steadily for its Premium segment from 26.8% in 2018 to 28.3% in 2022. Furthermore, the nature of the music industry dictates that artists generate majority of their income from the likes of concerts, and minimal income from streaming. This is explained well by Sleepwell Capital:

“Let’s say Spotify has 60 users in the country of Sleepyland and each user pays $10 a month for a total of $600 monthly revenue. Sleepylanders only listen to two artists: Drake and Taylor. During the month of April, users streamed Drake’s songs 75 times and Taylor’s songs 25 times for a total of 100 streams.

From the total revenue pie of $600 for the month, Spotify will take a cut of ~$200 and the other ~$400 will be distributed to rights-holders in accordance with the stream-count share calculation. Drake’s songs will receive $300 (75%) and Taylor’s songs will receive $100 (25%). Notice that I said their songs, meaning Spotify doesn’t pay artists directly (a huge misconception) but rather the intermediaries which are labels, distributors and collection societies. These intermediaries will take their cut and then distribute the money further down the funnel to artists, songwriters and other parties involved according to the contracts they signed.”

This is illustrated in the diagram below.

This means that exclusive deals are unlikely as artists prioritise maximum reach on streaming platforms. Hence, to strengthen its position, Spotify has conducted numerous strategic acquisitions over the years to diversify strengthen its revenue potential into the podcast and audiobook industries. In the podcast industry, most of their revenue stems from advertisements during podcasts. This means that Spotify can obtain exclusive content for podcasts and convert these into more MAU for its premium subscription. In tackling a key pain point of podcasts of inserting ads that allow advertisers to target relevant audiences, Spotify acquired Megaphone which is an integrated platform that has a crucial ad-insertion tool that capitalises on Spotify’s algorithm to allow advertisers to reach their target audience. On the consumer front, Spotify acquired Podz, a podcast discovery platform that creates a key value proposition by helping audiences discover podcasts that are catered to their preferences. This is crucial as podcasts episodes are longer, and hence the discovery function simplifies users’ discovery process, driving up its MAU and ARPU.

Valuation

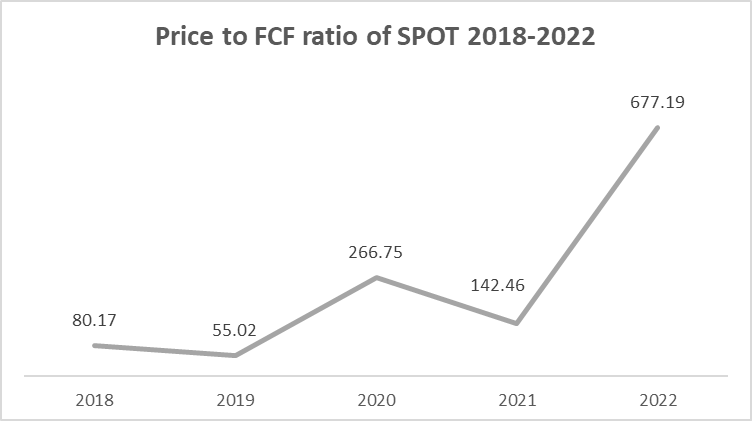

With Spotify’s strong market leadership in audio streaming but with the consolidation of the industry, I estimate a 3Y revenue CAGR of 12% and a 5Y revenue CAGR of 10% (vs 5Y average of 17%). With an average of 2019-2021 price to FCF ratio of 136x, the 5Y implied share price = $375.13 (136% upside).

Risks and mitigation

Key risks to Spotify

Competitive landscape may intensify over time. Spotify risks losing of market share to competitors such as Apple Music and YouTube Music if they choose to focus on music as a product and utilise their algorithms from their other services to aid their catch-up with Spotify’s music algorithm. This would allow the competitors to integrate music into their ecosystems.

Unlikely because 1) music is not the highest margin product for these players, they would rather focus on products such as Apple Iphone for APPL 2) due to the nature of the music industry, where the top 3 labels hold a significant market share of the western music industry: UMG (32%), Sony (20%), WMG (16%), it is inconducive to have many market players in the field (elaborated in the next point).

Labels disputes with Spotify and eventual withdrawal of labels from the platform

Unlikely. As seen from the chart below, the market share of annual Spotify music streams held by the big four music labels have been on the downtrend. The significant market shares of the labels translate into higher bargaining power for them currently with Spotify. However, as Spotify diversifies further into the podcast and audiobook segment, with its strategic M&A activities to fortify its ecosystem, as well as the rise of indie creators with Spotify’s supportive ecosystem, the bargaining power of the big four labels have been falling. This implies: 1) in the long run, Spotify would be able to earn a higher gross margin. Presently, Spotify does not pro-rate its revenue (podcast + music) according to music and non-music consumption, which implies that the labels are entitled to the entire revenue pool as per their deals. However, as Spotify’s podcast segment grows, this gives Spotify a greater bargaining chip to pro-rate the revenue according to music and non-music segments. 2) Spotify is likely to be the leading music streaming platform in the long run, and it would be difficult for the labels to leave the platform as they would lose an essential distribution network, amidst the headwind of physical music sales.

ESG assessment

On the environmental front, Spotify targets to achieve net-zero status by 2030. To effectively carry this out, the company has taken actionable steps such as utilising a streaming-emissions data model through their work with DIMPACT.

On the social front, some key highlights include 1) Launch of disability inclusion plan 2) Establishment of Creator Equity Fund that aims to uplift under-represented creators, which may aid the increase in the market share of indie creators on the platform 3) Commitment of $10million to Spotify Gives Back programme.

On the governance front, its founders Daniel Ek and Martin Lorentzon each hold a significant shareholding of 16.5% and 11.1% respectively, which necessitates that they act in the interest of shareholders due to their high stakes in the firm. Additionally, Daniel has received no base salary since July 2017, and has warrants to acquire 800,000 shares, with an exercise price for US$281.63, exercisable any time through 23 Aug 2024.

Conclusion

Although Spotify share prices have been on the downturn recently, I believe that the numbers do not reflect its potential and were likely driven by many shock factors in 2022, such as the exit from the Russian market due to regulations related to restrictions on free expression that may incur huge legal costs. The global nature of the internet industry necessitates that Spotify incur short-term falling ARPU from tailored prices from penetration into lower wealth regions, to optimise its consumer lock-in while consumers are still exploring different platforms, which will drive monetisation in the long run.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

References

https://investors.spotify.com/home/default.aspx

https://moiglobal.com/spotify-case-study-202008/

https://midiaresearch.com/blog/music-subscriber-market-shares-2022

https://www.gsma.com/mobileeconomy/wp-content/uploads/2023/03/270223-The-Mobile-Economy-2023.pdf