Initial Report: Sprout Social (NASDAQ:SPT), 104% 5-yr Potential Upside (EIP, Ryan ANG)

Ryan presents a "BUY" recommendation based on strong fundamentals, experienced management and a high barrier to entry.

LinkedIn: Ryan Ang

Investment Summary

Sprout Social is a social media management solution that enables enterprises to leverage social media for research, analytics, crisis management, customer support, and marketing. There is a transformation that is happening in Sprout Social, leading to a creation of a moat that I think is underappreciated by investors today. Sprout Social, originally a small and medium enterprises (SME) solution, has transitioned into an enterprise marketing solution. This transition was ignited by an exclusive Salesforce partnership which allows Sprout Social to be natively integrated and embedded inside Salesforce platforms and products. This is crucial because it provides a seamless experience for users, while allowing users to obtain fully connected data pipes between Sprout Social and its Salesforce account.

The pivot to selling to Enterprise is already bearing fruit. Growth has re-ignited amidst weak macroeconomic environment, with RPOs and RPOs bookings growing 30 - 40% over the past 2 years since the partnership announcement. A big part of organic growth will come from the growth in annual contract value (ACV). Sprout Social’s average ACV in the past averages $12,000 per customer, as compared to an enterprise customer who typically spends $400-500k on a solution such as Sprinklr.

What is particularly enticing about this partnership is the fact that Salesforce subsidizes Sprout Social’s R&D intensity by co-developing 100+ features annually since FY2022, while internal teams’ funnels clients to Sprout Social. It is an extremely capital efficient way for Sprout to develop its product. Furthermore, through the exclusive native integration and communication between data from Sprout Social and Salesforce, this creates a distinct value proposition for clients that competitors cannot match. The customer simply does not have a better reason to choose Sprinklr or any other solutions in this space, even with better features. This is already demonstrated by the higher win-rates from Sprout.

From a number’s perspective, in Q2 2024, both companies cited macroeconomic weakness, with Sprinklr’s RPO bookings growth falling by as much as 40% and its total pipeline shrinking. Meanwhile, Sprout Social maintained its RPO bookings growth, though at a much slower 7% rate. More importantly, it achieved record pipeline value. This signals a shift in relative competitive dynamics between Sprout Social and Sprinklr, especially now that both companies are competing for the same customers.

The increasing importance of social media management for businesses, combined with Sprout Social’s value proposition, sets an interesting tailwind for Sprout. Furthermore, a combination of idiosyncratic factors in Q1 crashed the stock by 50% which I believe it to be an opportunity to buy in an expanding moat, high-growth business at a high margin of safety.

Scenario Analysis

I will run through 4 key scenarios that will likely to play out in the future. This will provide us with the logic to think about the investment case moving forward.

The first scenario (Case 1) models an extremely pessimistic outlook, capturing the potential risk in the business model transition from SMEs to large customers and enterprise customers.

In case 2, I will try and understand what needs to happen to maintain current valuation, assuming the same level of customer churn in case 1.

In case 3, I will model a situation based on management guidance, what that upside will potentially look like and what needs to happen in order to hit management guidance.

In case 4, I will model what I think is the likely scenario and what the investment case will look like.

Case 1 - SME Segment Churns at 10% with no growth in Enterprise and Large Customer Account.

You can think of Case 1 as the downside potential. Over here, we assume a certain conservative level of ARRs by backward induction for the different customer types, and assume that there will be no growth in enterprise and large customers, and a 10% churn in SMEs. This will capture the business transition risk as Sprout moves away from SMEs and into large and enterprise customers.

In this case, customer count declined by 50% by FY2028 for SMEs, while sales only declined by 16%. The implied EV at current multiple presents a 22% downside risk. What we should focus on is that any stock price reaction to poor performance of SMEs should be seen as an opportunity - SMEs represent a very small percentage of businesses and the overall investment cases. Our focus should therefore be on how the enterprise and large customer business is doing.

Case 2 - SME Churns but with growth in Enterprise and Large Customers

In case 2, what we are trying to understand is how many customers does Sprout Social needs to acquire in its enterprise customer in order to offset the decline in its SME business. From my calculation, Sprout Social will only need to acquire 490 enterprise customers by FY2028, translating to 123 customers annually in order to offset the decline in SMEs. Judging from the fact that Sprout social obtains about 150 enterprise customers on average in H1, this does not seem to be a difficult goal to achieve.

Case 3 - Management Guidance Scenario

In case 3, we are modelling out what will happen if management guidance is achieved assuming the same level of SME churn. Over here, we see that the impact of SME churn is negligible, while the main value driver is the growth in Enterprise Customers. In order to hit ARR of $1 billion per annum, Sprout Social will need to acquire about 4,600 enterprise customers in 4 years, or about 1,150 customers per annum. This is also on a higher ARR amount of $150,000 per year, up from $100,000. This is still significantly below Sprinkr's 400k-500k annual customer spendings (Sprinklr target enterprise customers.)

This is a difficult goal, as it requires Sprout to triple its annual enterprise customer gain. However, we should be watchful on Q3/Q4's customer acquisition number as sales cycle typically gets concluded in the back-half of the year. Upcoming 2024Q3 and 2024Q4 numbers would be meaningful as it provide us a clear picture of whether this management guidance scenario is likely. Nonetheless, at such a guidance level, it means SPT will be growing sales at 30%+. At a conservative multiple (EV/Sales) of 5x, it gives us a potential EV of 5bil, reflecting 37.2% IRR.

Case 4 - Likely Scenario

In this scenario, I assume that SPT would gain about 400 enterprise customers annually (150 H1/ 250 H2), with ARR of $150,000 for enterprise customers. I also assumed a similar ratio for large customer wins, although the impact to IRR is not very significant. This translates to a topline growth of 16%. At an appropriate EV/Sales of 5x, this gives us an upside of 110% or IRR of 20.4%. I think this case is reasonably achievable, with only slight increments in customer acquisition rates. The rapid scaling of dedicated sales teams and increasing productivity per sales rep points are signs that will support this case.

I believe that as Q3/Q4 numbers come in, the narrative will start to develop for Sprout Social, with the key metric being focused on enterprise customer gains. The risk/reward of this investment case is attractive, and the fundamentals of the business case are strong.

Business

Sprout Social is a social media management solution that helps businesses manage and extract more value from their social media channels. While this might seem trivial or non-essential to retail consumers like us, who use social media for personal accounts, it’s a completely different story for a company managing 20 different brands or 10 geographic units across potentially 18 mainstream platforms (yes, there are 18 mainstream social media platforms!) and countless industry-specific blogs and platforms. This can quickly become complex. Currently, Sprout Social is integrated with only seven key platforms, with room for further growth. Sprout Social offers five key business solutions, as outlined in its 10-K: Engagement, Publishing, Analytics, Social Listening, and Influencer Marketing. All core functions are typically included in the subscription, but there are advanced features that are added on a per seat basis.

Edge

Sprout Social has several advantages over other players, including Sprinklr, in this space.

First, Sprout Social holds a significant technical edge over Sprinklr because its platform is built on a single-code base, whereas competitors typically use an acquisition bolt-on solution. This difference impacts users in subtle but important ways, particularly in terms of the seamless UX/UI experience. It is also the single-code base architecture that allows it to be natively integrated and embedded into Salesforce products, providing the same look and feel for the customer as well as the functionality that one would expect from a native product. In 2020, Salesforce announced it would retire its own product, Social Studio, and recommended Sprout Social as the preferred partner for Salesforce customers. This partnership offers exclusive integration between Salesforce’s Service and Marketing Clouds, Slack, Tableau, and more, allowing two-way communication and user action across these platforms. Customers now have the ability to achieve a full “omni-channel” view of their customers, including social media data—which is becoming increasingly relevant. Social media data is contextual and descriptive, providing insights that email, and phone records cannot. This trend is not only likely to exist in the future, but strengthen. What this does for Sprout Social is that it creates a distinct value proposition for clients that competitors cannot match. The typical enterprise customer simply does not have a better reason to choose Sprinklr or any other solutions in this space, even with better features. This is already demonstrated by the higher win-rates from Sprout Social.

Second, Sprout Social’s product is far simpler to use compared to competitors like Sprinklr. For example, Sprinklr takes 1-2 months to implement and another 6 months to train users. In contrast, Sprout Social’s solution is often described as intuitive and user-friendly, with a common phrase being “trial in the morning, use it by the afternoon.” Most users can become proficient within 1 to 2 weeks. This simplicity is so notable that Sprout Social’s sales process is “experiential,” allowing potential customers to try the product immediately while sales staff guide them through the features that might be most valuable. This kind of ease of use is not something all SaaS solution providers can claim.

Industry Empirical Barrier to Entry

High growth companies often fail over a longer period of time. To put it into context, 4 out of 5 growth companies will slowdown over the next 5 years, and 9 out of 10 would slow over the next 10 years. The reason is that high growth attracts competition, and hence, returns normalize over time. My projections indicate that Sprout Social will at least, maintain its growth for the next 5 years and more. I better have some proof or reasoning for this.

It’s interesting that, despite the massive under-penetration and significant total addressable market (TAM) opportunity in this space, we do not see many competitors beyond a few additional private players and Sprinklr. Management notes that there has been only one new entrant in the past seven years. There are 2 logical arguments from this – 1: Sector is not attractive enough to new players. This is definitely untrue because players like Salesforce and Adobe tried entering. The large TAM, proven SaaS business model and under-penetration is definitely attractive from an economics perspective. The second reason is that there is an actual barrier of entry which restricts new competition from entering. From my analysis, the high barriers to entry stem from social media platforms downsizing the number of vendors they are willing to share data with due to privacy and GDPR regulations. This makes it challenging for newcomers to gain similar access levels as the current incumbents—a genuine high barrier to entry.

So, why did Salesforce and Adobe fail when they attempted to enter this space?

Firstly, the technology stack used in their operations is not compatible with social media. For example, Salesforce’s CRM and email marketing systems rely on unique identifiers like email addresses or phone numbers, resulting in static data that is relatively easy to manage. In contrast, social media data for the same individual can differ significantly across platforms like LinkedIn, Facebook, Twitter, and Pinterest. This disparity means that companies like Salesforce need to develop ways to ingest all this new data from various APIs from the ground up, without benefiting from economies of scale based on the systems they have already built.

Another challenge is the rate and unpredictability of API changes. An expert mentioned that companies like Meta and X often provide less than 10 days’ notice for API updates, making it difficult for companies like Salesforce to allocate sufficient resources and time to manage such a small aspect of their overall business. Further complicating matters is the constant introduction of new platforms and the need to keep up with competitor’s pace of innovation. More on this later on Pushbacks.

What happened to Stock Price?

Sprout Social was previously traded at 40x EV/Sales back in 2021 but was sold off alongside other high-multiple software companies. The stock remained flat for the next two years until Q1 of 2024, when it crashed another 46%. Why did this happen?

Firstly, the company missed its sales target by 1% and subsequently reduced its revenue growth guidance by 5%. Then, the company announced the surprise departure of CEO and Founder Justyn, along with the appointment of Ryan Barretto as his replacement. While this might have been shocking to investors, insiders at Sprout Social indicated they were not at all surprised by this move and had been anticipating the announcement.

As a side note, a similar culture of smooth transition from founder to new executives was evident in December 2023, when then-CTO and Co-Founder Aaron Rankin stepped down to focus on supporting the team, while Alan Boyce, the first platform engineer he hired, was promoted to the next CTO.

The kicker for investors was the sudden removal of key metrics like ARR and customer count especially in a quarter they missed where they missed expectations. This likely created investor anxiety, leading to a kind of lollapalooza effect as investors rushed to sell the stock. But if you think about it, this move made a lot of sense.

Firstly, Sprout Social’s revenue mix has shifted from 70% month-to-month and 30% annual and multi-year contracts to 30% month-to-month and 70% annual and multi-year contracts. This shift is largely due to the increasing focus on enterprise customers. ARR can inflate revenues if customers pay upfront, but it doesn’t account for churn. RPOs, on the other hand, provide a much clearer view of revenue stability. It is not perfect – Sprout social still has 30% month-to-month, but we expect that to decrease moving forward.

Secondly, the promotion of Ryan Barretto to CEO, despite the timing, seems to be a strong choice. Given the significant opportunity for Sprout Social to capitalize on untapped Salesforce Service Cloud customers, execution would be key. Ryan's 10+ years of experience at Salesforce will be a considerable asset.

Lastly, regarding revenue guidance, I found it amusing when management explained that they reduced guidance to set more conservative targets so that "we can beat it later." Not much else needs to be said about that.

Management and Capital Allocation and Culture

Stacked. That’s the word to describe Sprout Social’s management team. Despite the small market cap, it is filled with seasoned executives from enterprise companies who were previously holding key executive roles in Salesforce, Google, Atlassian and ZenDesk. The alignment of skill sets toward the next chapter of enterprise focus is particularly noteworthy, especially with the recent addition of new Chief Product Officer Erika Trautman, who previously served as Product Director for Google Drive and Editors (Docs, Sheets, Slides, Forms) and more recently at Atlassian (Trello, Jira, Confluence). Additionally, Mike Wolf, who most recently served as the Chief Revenue Officer for Salesforce, has joined as the new Chief Revenue Officer. These seasoned executives left companies that are 200 times the size of Sprout Social—perhaps a sign of confidence in the company despite its share price being down 80% since its peak.

In many ways, I believe the culture at Sprout Social will continue to be product-first. Co-founders Justyn Howard and Aaron Rankin created a laser focus on product quality, and even though both co-founders are now taking a back seat, they are still supporting the team in areas where they can provide the most value (Product Development). This embedded culture is evidenced by recent achievements and awards, with G2 ranking Sprout Social #1 in all software categories in the recent summer 2024 software report. Glassdoor reviews show Sprout Social ratings at 4/5, with 79% of employees willing to recommend it to a friend. In contrast, Sprinklr scores 3.3/5, with only 50% willing to recommend it. While such statistics should be taken with a grain of salt, as they can often be skewed, some patterns are emerging.

Lastly, capital allocation. The company is investing heavily in R&D, doing so efficiently through the co-development of over 100 new features with Salesforce. Essentially, Salesforce is subsidizing a portion of R&D for Sprout Social. Moreover, the company is not shy about using acquisitions to enhance its capabilities, as evidenced by its past acquisitions of Tagger, Repustate, and Simply Measured. All acquisitions were small percentages of market capitalization, with the largest being Tagger at $140 million. These acquisitions are now playing a significant role in Sprout Social's offerings, particularly in sentiment analysis, social listening capabilities, and influencer marketing.

Some Pushbacks

Firstly, much of the promotion surrounding the partnership is done by Sprout Social, with minimal announcements from Salesforce. This may be by design, but when companies look to add Sprout Social, they still have to sift through hundreds of add-ons on Salesforce AppExchange, making Sprout Social one of many options. It is also uncertain whether Salesforce's sales reps are indeed pushing customers to Sprout Social actively. This raises questions about the strength of the partnership and whether Salesforce is truly incentivized to direct customers towards Sprout Social. Nonetheless, I argue that the native integration between the two platforms, along with the co-development of over 100 annual features, offers a significant value differentiation for companies seeking social media management tools.

Secondly, the new CEO,Ryan Baretto, though aligned with Sprout’s needs, remains unproven as a CEO. A big chunk of success is contingent on the management team’s ability to capture the larger untapped Service Cloud customers. Despite this, I would argue that Ryan Baretto, though new as a CEO, is a veteran of Sprout Social, serving over the past 8 years as President and SVP of Sales. There is no new "ramp" or learning curve that a new external CEO might have.

Thirdly, although the partnership with Salesforce is valuable, the failure of Salesforce’s own product underscores the high R&D demands in this space, making scale essential for Sprout Social’s long-term success. While this is true, one also need to consider the larger context at hand - Social Studio represents a very small % of Marketing Cloud, which represents a further smaller % of overall Salesforce Revenues. It did not make economic sense for Salesforce to invest heavily into it. This is not the case for Sprout Social. But this is also the risk for Sprout Social, it's identity as a singular product and tool. As the rate of disruption is high in tech sectors, we need to pay attention to Sprout Social plans and product roadmaps, and whether it is able to capture adjacent sectors to diversify its revenue base.

Lastly, disruption risks from AI, while unlikely to fully replace social media management, pose a potential threat as innovative tools may emerge. For now, AI serves as a tailwind, aiding in auto-generated replies and data analytics, which allows for further up-selling and cross-selling of tools. There are equally strong arguments from both sides, but to me, A.I. is an optionality that is not yet priced into the growth potential.

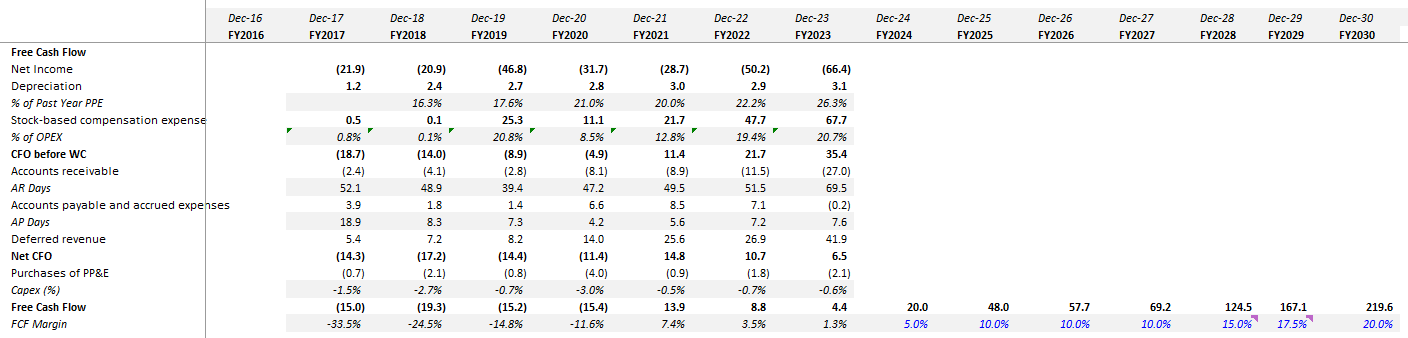

Financials

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.