Initial Report: Stride Inc (LRN), 33% 5-yr Potential Upside (EIP, Nicole TAN)

Nicole believes Stride emerges as a credible and resilient player in the EdTech industry, poised for continued success.

00 Executive Summary

Founded in 2000, Stride Inc (NYSE:LRN), is a prominent education services company offering virtual and blended learning solutions. With a comprehensive business model consisting of General Education and Career Learning segments, Stride serves diverse clientele, including public and private schools, school districts, and charter boards. The company's financials reflect a healthy position, emphasizing its potential to withstand future economic challenges. Stride's strategic focus on Career Learning, successful acquisitions, and alignment with market trends contribute to its competitive edge. Despite cybersecurity threats and regulatory complexities, the company prioritizes addressing these challenges through collaborations and proactive measures.

In the dynamic EdTech industry, where the global market is expected to reach USD 421 billion by 2032, Stride's strategic positioning stands out. The integration of cutting-edge technologies and adaptability to changing workforce paradigms contributes to its success. A competitor analysis underscores Stride's favourable financial position, marked by strong margins, positive EPS, and low net debt, indicating potential for robust future growth. The investment thesis emphasizes the successful integration of acquisitions, dominance in the Career Learning segment, and alignment with market trends as key drivers for Stride's continued success.

Valuation models project a substantial upside, signalling positive investor sentiment. However, the company faces inherent risks, notably in the form of cybersecurity threats and intricate regulatory landscapes. Stride actively addresses these challenges, leveraging collaborations and strategic planning to navigate the evolving educational compliance framework. The ESG assessment reflects the company's commitment to sustainable practices, equal access to education, and ethical governance.

In conclusion, Stride emerges as a resilient player in the EdTech industry, positioned for sustained success. Its strategic initiatives, financial strength, and commitment to responsible business practices position Stride as a credible and competitive force in the evolving landscape of virtual and blended learning solutions.

01 Company Overview

Founded in 2000, Stride Inc. (NYSE: LRN) is an education services company providing virtual and blended learning solutions to a diverse clientele. The company offers technology-based products and services that enable its clients to attract, enrol, educate, track progress, and support students. These offerings, encompassing curriculum, systems, instruction, and support services, are designed to help learners of all ages reach their full potential through inspired teaching and personalized learning. Stride's primary clients are public and private schools, school districts, and charter boards. Additionally, the company serves employers, government agencies, and consumers. Currently, more than three million students having attended schools powered by its curriculum and services since its inception.

1.1 Business Segments

Stride’s business model is comprised of 2 segments:

General Education: This segment focuses on core subjects, including math, English, science, and history, for kindergarten through twelfth-grade students. These programs offer an alternative to traditional schools and address various student needs, such as safety concerns, increased academic support, scheduling flexibility, physical/health restrictions, or advanced learning. Products and services are sold as comprehensive school-as-a-service offerings or à la carte.

Career Learning: This segment focuses on developing skills for high-demand industries like information technology, healthcare, and general business. Career Learning programs offer middle and high school students content pathways with job-ready skills and work experiences. For high school students, these programs can lead to industry certifications and/or college credits. Like General Education, Career Learning products and services are sold as comprehensive school-as-a-service offerings or à la carte. In addition, this segment also offer in-person, remote, and self-paced programs to adults in various fields, including staffing and talent development services to employers.

Majority of the revenue comes from the comprehensive school-as-a-service offering, which includes an integrated package of curriculum, technology systems, instruction, and support services administered by Stride on behalf of its customers. These agreements typically extend for more than five years, often with automatic renewals unless customers opt-out.

1.2 Company Financials

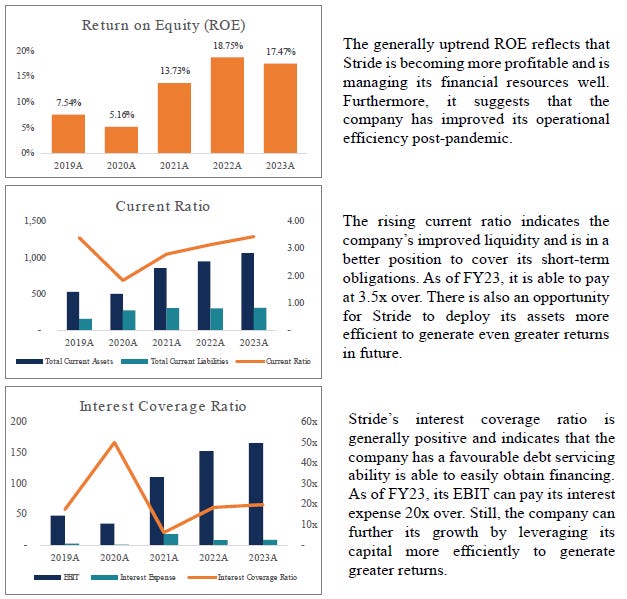

A breakdown of the Stride’s financials has been generated to enable a more comprehensive understanding of its financial position.

Overall, Stride’s financial position looks very healthy and the company seems to be in a favourable position to stand against any future economic challenges. Moving forward, there are opportunities for the company to optimize asset deployment for even greater returns, presenting a potential avenue for future growth. Efficient capital leverage could further enhance the company's financial performance and contribute to sustained success.

02 Industry Overview

Education Technology (‘edtech’) uses information and communication technology systems to create more engaging, inclusive, and individualized learning experiences for students.

2.1 Market Size

In 2022, the global edtech industry was valued at USD129 billion and is expected to grow at CAGR of 12.9% from 2022 to 2032, and potentially reaching USD421 Billion in 2032. At 48%, the North American market takes up a significant share of the edtech market.

2.2 Growth Drivers

This unprecedented growth of the edtech industry in recent has been driven by a confluence of technological advancements and changing workforce paradigms.

2.2.1 Technological. Advancements

The integration of cutting-edge technologies such as AI and Machine Learning not only enhances the educational experience through personalized learning and data analytics but also positions EdTech companies as pioneers in the evolving learning landscape, thus attracting a burgeoning user base. Furthermore, the surge in demand for consumer electronics, fuelled by significant economic progress and smartphone proliferations, plays a pivotal role in democratizing education. This expanded accessibility not only transforms individual learning experiences but also contributes substantively to the overall growth and diversification of the EdTech industry.

2.2.2 Changing Workforce Paradigms

The edtech sector’s robust growth has also been propelled by dynamic workforce shifts. In 2020 alone, 48% of venture investments targeted workforce education. The evolving job market sees a surge in individuals transitioning to high-demand sectors like IT. For instance, the U.S. Bureau of Labour Statistics anticipates a 22.2% growth in software development job openings by the end of the decade. Online programming courses and EdTech tools are pivotal in facilitating this shift. Corporate giants, including Amazon, Walmart, Target, and Google, recognize the importance of workforce education. Major investments are being made to address skill gaps and retain talent. Walmart, for instance, integrates such programs into diversity, equity, and inclusion (DEI) initiatives. The evidential societal shift towards skills upgrading and relevant lifelong learning experiences has managed to successfully poised the edtech industry for sustained growth.

2.3 Competitor Analysis

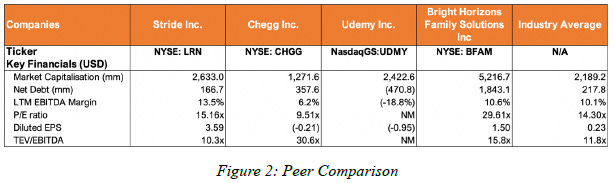

The following competitor analysis enables a more comprehensive understanding of Strive’s competitiveness and relative overall financial positioning.

Market Capitalisation: Despite not being the largest, Stride’s market capitalisation of USD 2,633.0 million suggests that the company has immense opportunities for growth potential.

Net Debt: In comparison to many of its competitors, Stride has a relatively lower net debt of USD 166.7 million, indicating stronger liquidity. This stronger financial positions can provide financial flexibility for the company to have more ample resources for future growth.

LTM EBITDA Margin: Amongst its peers, Stride has the highest positive EBITDA margin of 13.5%, indicating efficient operating profitability and suggests that a good portion of its revenue is translated into earnings, which is a positive sign for future growth.

P/E ratio: The company has a relatively moderate P/E ratio of 15.16x, suggesting that investors are willing to pay a moderate premium for its earnings. This ratio is deemed to be reasonable due to expectations that the company is going to continue growing in future, as highlighted by its positive margins and EPS metrics.

Diluted EPS: At US$3.59, Stride has the highest positive diluted EPS figure, indicating that the company is currently generating earnings on a per-share basis and is poised for future growth.

TEV/EBITDA: Stride’s TEV/EBITDA ratio of 10.3x is lower than the industry average of 11.8x, suggesting the company’s valuation may be lower in relation to its earnings. The TEV/EBITDA financial metric was used as edtech is a capital intensive business and requires substantial funding for their research and development needs.

Overall, coupled with their low net debt position, Stride’s positive margins, EPS and P/E ratio suggest an excellent foundation for strong future growth.

03 Investment Thesis

3.1 Successful Integration of Acquisitions

Stride Inc. strategically acquired Galvanize, Medcerts and Tech Elevator in 2020, investing approximately $260 million. The subsequent shift to selling software, healthcare, and IT coursework to high schools following these acquisitions has proven successful. In the year following the acquisitions, Stride generated approximately $706 million in revenue and around $50 million in net income from new enrolments. This significant return on investment indicates that Stride has successfully extracted substantial value from its strategic acquisitions, diversifying its offerings and expanding its reach to high schools. The total acquisition cost is only ~5x current earnings, demonstrating the company's ability to generate considerable value from these investments.

3.2 Dominance in the Career Learning Segment

Stride's focus on the Career Learning segment is supported by strong data:

• Enrolments in the Career Learning segment increased by 57% to around 66,000 students.

• Revenues in this segment grew more than 70%, highlighting exceptional growth.

A recent survey mentioned in Stride's Q3 earnings call revealed that only 30% of respondents felt their schools have satisfactorily prepared students for their careers. Stride's Career Learning solution addresses this gap, providing industry-focused coursework to high schoolers and positioning the company as a leader in a segment with strong demand.

3.3 Alignment with Market Trends and Legislative Support

Stride experienced an 8% rise in fall enrolments, reaching nearly 188,000 students, indicating increasing demand for online education following the growth in home-schooled children. The legislative trend toward school choice, driven by increasing dissatisfaction with conventional K-12 education, supports Stride's mission. In addition, Stride's strategic move to embrace AI capabilities is highlighted positively, in contrast to negative market reactions observed for peer companies such as Chegg. The company's application volumes are stronger than the previous year, supporting anticipated enrolment growth.

04 Valuation

A discounted cash flow (DCF) valuation model was used to value the business. Using conservative financial estimates and valuation multiples to forecast for the next 5 years, a 32.77% upside was derived.

05 Risks

5.1 Cybersecurity Threats

Stride confronts a notable cybersecurity risk due to the substantial volume of sensitive data processed on its educational platforms. The potential for data breaches or privacy issues poses a threat to user trust, impeding the broad adoption of its solutions and posing a risk to overall growth. In 2020, the company detected a cyberattack on its network that exposed certain student and employee information. Although complete elimination of such risks is challenging for any company, Stride has prioritized addressing these concerns and is actively collaborating with industry-leading third-party forensic firms to mitigate future threats effectively.

5.2 Regulatory Complexities

Stride grapples with intricate regulatory landscapes across diverse regions. The complexity of educational regulations presents a multifaceted challenge, potentially leading to compliance issues and legal ramifications. As a non-traditional form of public education, virtual public school operators like Stride face scrutiny that may surpass that applied to traditional institutions. The nuanced nature of these regulations requires meticulous consideration and strategic planning to ensure adherence to various educational standards and policies. These regulatory hurdles serve as a substantial barrier to market entry and success, underscoring the need for proactive measures and a comprehensive understanding of the evolving educational compliance framework.

06 ESG Assessment

6.1 Environmental Assessment

Goal: Stride aims to achieve United Nations Sustainable Development Goal (SDG) 12 of ensuring sustainable consumption and production patterns through the use of natural resources.

Assessment:

Stride has made numerous efforts to reduce carbon emission and use alternative energy resources.

• Partnered with AWS, which infrastructure is 3.6 times more energy efficient than the median of surveyed US enterprise data centres, to tackle their carbon emission related to their online activities.

• Partnered with delivery partner UPS, which uses 10,000 alternative energy delivery trucks, reducing the carbon impact of 1 million miles driven every day.

However, there has been a lack of data of the company historical energy consumption levels, which makes it difficult to assess if the company has truly become more energy efficient.

6.2 Social Assessment

Goal: Stride aims to achieve SDG 4 of quality education, and target by 2030, to ensure equal access for all men and women to attend affordable quality technical, vacation and tertiary education. In addition, by the same year, they aim to increase the number of youth and adults with relevant skills for employment and decent jobs.

Assessment:

The company has taken numerous steps to improve gender and racial inequities through its online education programs, with comparable proportions of both female and male, and white and non-white students respectively enrolled in its program. While efforts can be taken to address socioeconomic inequities, it is understandable that these challenges would require time due to the underlying complexities making education more accessible to students in rural communities

6.3 Governance Assessment

The company emphasizes ethical and responsible business practices in alignment with the highest standards of business ethics, as outlined in its Code of Business Conduct and Ethics. The company ensures governance transparency through extensive training on insider trading compliance for new employees and maintains a 24/7 Ethics Point Helpline for confidential reporting of misconduct. Stride's commitment to anonymity, protection against retaliation, and addressing various whistle-blower complaints further underscores its dedication to robust governance practices.

07 Conclusion

In conclusion, Stride Inc. demonstrates robust performance and promising growth prospects. With a solid financial position, the company appears well-prepared for potential economic challenges. Strategic focus on the Career Learning segment, successful acquisitions, and alignment with market trends positions the company favourably. Despite challenges like cybersecurity threats and regulatory complexities, ongoing efforts to address these concerns underscore the company's resilience. In addition, the ESG assessment highlights positive strides in sustainability and equal access to education, reinforcing Stride's commitment to responsible practices. Overall, Stride emerges as a credible and resilient player in the EdTech industry, poised for continued success.

08 References

1. Stride, I. (2023). Stride 2023 Annual Report. https://s26.q4cdn.com/126400783/files/doc_financials/2023/ar/stride_annualreport_2023_fnl.pdf

2. Stride, I. (2021). Stride 2021 ESG Report. Stride 2021 Sustainability Report. https://s26.q4cdn.com/126400783/files/doc_downloads/2021/Stride_ESG2021_November-Supplement_vFINAL.pdf

3. Market.us. (2023, November 20). Edtech market statistics, size, share. Market.us Report. https://market.us/report/edtech-market/

4. (Micra Solution), M. L. (2023, June 27). The Rise of Education Technology. LinkedIn. https://www.linkedin.com/pulse/rise-education-technology-micra-solution

5. Rivero, V. (2020, November 19). Edtech Market Size 2016-2027. EdTech Digest. https://www.edtechdigest.com/2020/11/19/edtech-market-size-2016-2027/

6. Yelenevych, A. (2022, December 27). Council post: The future of EdTech. Forbes. https://www.forbes.com/sites/forbesbusinesscouncil/2022/12/26/the-future-of-edtech/?sh=220d2ac26c2f

7. Sanghvi, S., & Westhoff, M. (2022, November 14). Five trends to watch in the edtech industry. McKinsey & Company. https://www.mckinsey.com/industries/education/our-insights/five-trends-to-watch-in-the-edtech-industry

8. Jimenez, K. (2023, August 28). Why parents who moved kids to alternative schools amid pandemic are keeping them there. USA Today. https://www.usatoday.com/story/news/education/2023/08/28/parents-choosing-alternative-over-public-schools/70552129007/?gnt-cfr=1

9. HERNDON, V. (2020, November 30). Stride identifies a cyberattack on its systems and Network. Business Wire. https://www.businesswire.com/news/home/20201130005970/en/Stride-Identifies-a-Cyberattack-on-Its-Systems-and-Network

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.