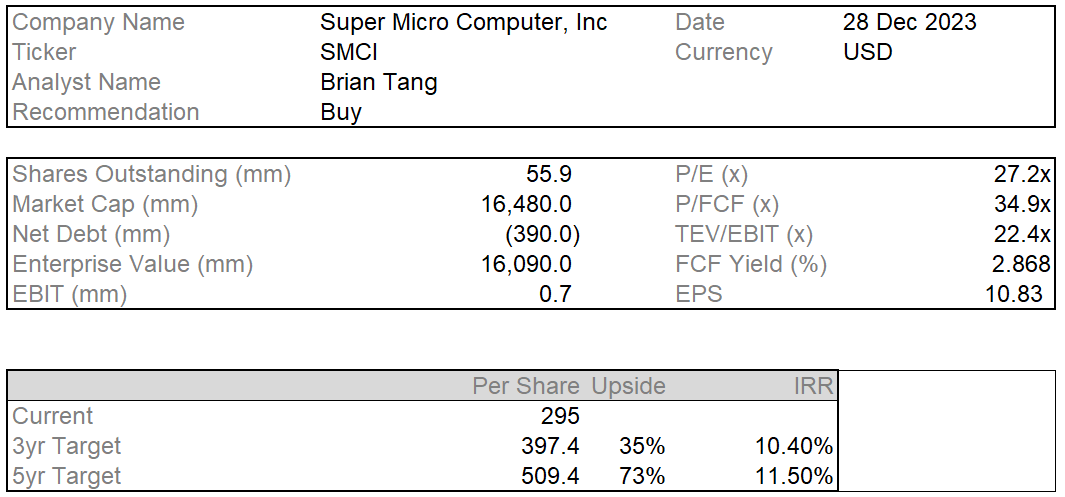

Initial Report: Super Micro Computer Inc. (NASDAQ: SMCI), 73% 5-yr Potential Upside (EIP, Brian TANG)

Brian is a believer that SMCI is actively leading the liquid cooling workgroup and it can manage its debt very well, with the possibility for improved shareholder returns owing to leverage.

SMCI Company Overview:

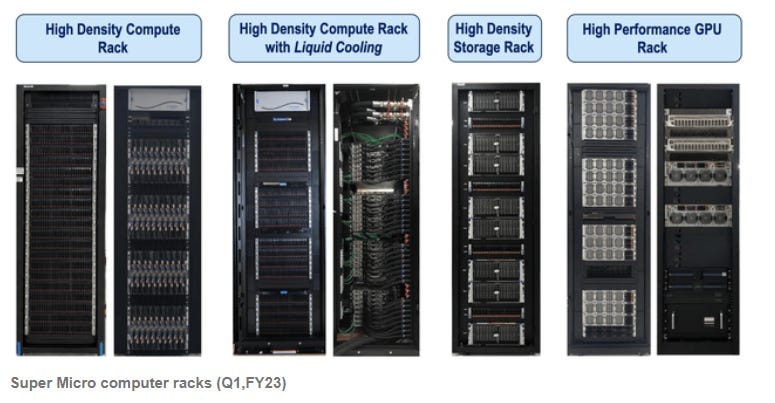

Supermicro, founded in 1993 and located in San Jose, California, is a global technology pioneer at the forefront of innovation in Enterprise, Cloud, HPC, AI, Accelerated Computing, and 5G Telco/Edge IT Infrastructure. The design philosophy of the organization follows a building blocks technique, resulting in first-to-market, best-in-class products. Supermicro, as a Total IT Solutions supplier, provides a comprehensive suite of environmentally friendly and energy-saving systems, including servers, storage, GPUs, networking, workstations, data center racks, cooling solutions, software, and professional services.

Beyond technology, Supermicro is actively leading the liquid cooling workgroup at The Green Grid, an industry alliance focusing on improving data center efficiency. In addition to their technological skills, the corporation adheres to strict anti-corruption, human rights, responsible mineral sourcing, and supplier practices rules. Supermicro's value statement, grounded in a mission to adhere to guiding principles, connects with the idea that "Green Computing can be free... with a big bonus," highlighting their commitment to sustainable and cost-effective IT solutions.

Business Model:

Taiwan Semiconductor Manufacturing Company Limited (TSM) and chip designers such as Nvidia (NVDA), Advanced Micro Devices (AMD), and Intel (INTC) are at the heart of the semiconductor supply chain. Companies like Super Micro, on the other end of the supply chain spectrum, play an important role by expertly building and configuring top-tier chips. They employ these components to build plug-and-play servers with integrated power, cooling, and storage.

Super Micro's solutions include Artificial Intelligence (AI) and High-Performance Computing (HPC), as well as 5G, IoT, and Hyperscale infrastructure. The company distinguishes itself not only for its hardware knowledge, but also as a certified partner and reseller of enterprise application software, including relationships with well-known platforms such as Redhat by IBM. This strategic partnership expands Super Micro's capabilities by providing customers with completely integrated hardware and software solutions to meet their changing technological needs.

Market Share:

Competitor Analysis:

Economic Moat Analysis using SWOT:

Strengths:

In comparison to competitors, SMCI is known for their cutting-edge technology and unique solutions.

SMCI has a high emphasis on research and development, allowing it to seek product expansion and stay ahead of competition in technical breakthroughs.

SMCI has a strong global presence with operations in many countries, enabling it to access a larger consumer base and respond to changing market situations.

Customer pleasure is prioritized at SMCI, and great customer service is provided, resulting in significant client loyalty.

Weaknesses:

SMCI relies largely on third-party sources for components and parts. This has the potential to disrupt supply chains and cause quality control concerns.

SMCi has significant debt, which may jeopardize its financial stability and capacity to invest in research.

SMCI's global presence is also a problem, as it is relatively modest in comparison to its competitors. This inhibits its ability to enter new markets.

The technology industry is prone to quick regulatory changes and legal challenges, which could have an influence on SMCI's operations and profitability.

Opportunities:

Expansion into emerging markets, as SMCI can look for prospects in Asia, Latin America, and Africa. Such areas have greater growth potential, and SMCI can diversify its customer base and income stream by creating a strong global presence.

Strategic partnerships and alliances enable SMCI to engage with other technology firms. SMCI can acquire additional resources at low prices by utilizing the strengths of its partners.

Cloud computing and data center solutions are in high demand, and SMCI can profit on this trend by providing tailored goods and services to these markets. This allows SMCI to carve out its own niche.

Threats:

Strong market competitors, both huge and little. SMCI is up against stiff competition, particularly in this narrow technology industry. This is not an exception for newcomers.

Changes in government rules concerning data security and privacy can have an impact on business operations. Furthermore, when rules are imposed, it can affect the cost of their investment.

Key Ratios and Margins: All values updated annually at fiscal year end

Valuation:

Liquidity

Solvency (Annual data as of 30 June 2023) - Debt Ratio)

Investment Theses:

Anticipated growth in Artificial Intelligence hardware presents a favorable outlook for Super Micro (SMCI) owing to its distinctive business model.

Artificial intelligence (AI) equities have seen tremendous increase, driven by genuine revenue and earnings growth, as AI applications become increasingly important for businesses in the 2020s. Advanced Micro Devices (AMD) CEO Lisa Su, known for her track record of success, forecasts a significant increase in the AI chip market. Initially expecting growth from $30 billion in 2023 to $150 billion by 2027, she changed her forecast to a $45 billion market in 2023, with a projected increase to $400 billion by 2027.

With the immediate adoption of tighter US trade restrictions on China, it is possible that Nvidia's (NVDA) AI processors would flood both the US and global markets in the coming months. This is projected to exacerbate SMCI's short-term positive conditions. This optimistic prediction creates a great opportunity for Super Micro, a server maker, as AI servers are likely to contribute significantly to market growth. While some consider server manufacturers to be essentially assemblers of proprietary chips, the intricacy of AI necessitates innovation in server design, which aligns with Super Micro's strengths. Super Micro began as a motherboard maker in the 1990s and has now evolved into a vertically integrated system manufacturer, creating and optimizing all components in-house. This technique permits customized models for varied purposes and assures a quick time-to-market, giving OEMs and ODMs a competitive advantage over more conventional alternatives.

In essence, Super Micro's distinct business strategy, based on in-house component Super Micro Computer's earnings over the next few years are expected to increase by 82%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.development and a modular "building block" architecture, puts the company favorably in the rapidly changing world of AI-driven server technology. Competitors would encounter difficulties in modifying their existing business models to match Super Micro's vertically integrated approach, making it difficult for them to reconfigure and compete effectively in this dynamic market.

SMCI’s high growth potential at a cheap price

Super Micro Computer is well-positioned for a bright future, with an expected 82% increase in earnings over the next three years. This optimistic forecast is projected to result in higher cash flows, which will contribute to higher share value.

SMCI’s forward-looking investment plans, allowing them to stay ahead of competitors in the IT services market

Super Micro Computer Inc (SMCI) announced better-than-expected earnings for the fiscal fourth quarter and received an upgraded outlook earlier this month from Susquehanna analyst Mehdi Hosseini. Wedbush analyst Matt Bryson raised Super Micro Computer from Underperform to Neutral, with a $250 price target. The company's bullish fiscal 2024 outlook is attributable to a fundamental shift, specifically investments in generative AI training for customers other than large cloud service providers (CSPs), such as developing cloud, enterprise, and sovereign entities. Bryson's upgrade comment revealed evidence of further significant orders outside of CSPs, with increased demand reported in the United Kingdom and some Middle Eastern countries looking for GPUs.

Tight availability of H100/A100s and longer lead times were also noticed into at least the first quarter of next year, and in some cases, through the first half of 2024. Bryson believes that this setup reduces the possibility of SMCI experiencing a downturn in the coming quarters. Super Micro Computer's stock had gained by 6.38% to $274.55 as of the most recent release.

ESG understanding

Environmental

The Innovative Resource-Saving Architecture™, at the heart of Supermicro's commitment, achieves a remarkable 40-45% reduction in hardware refresh costs, contributing to a significant reduction in e-waste and up to 50% reduction in electricity and carbon footprint. Recognized as a pioneer in energy-efficient computing, the firm is committed to achieving Energy Star certification for all solutions by the end of fiscal year 2023, emphasizing environmental, social, and governance (ESG) best practices. Supermicro implements green manufacturing standards in its operations in the United States, Taiwan, and the Netherlands, including factory automation and alternative energy sources like solar.

Supermicro places sustainability at the heart of their business processes. The company actively releases GHG emissions data for Scope 1, 2, and 3, exhibiting transparency and responsibility. The Nominating & Governance Committee's facilitation of board oversight on ESG-related issues demonstrates a commitment to environmental responsibility. Supermicro promotes carbon-free electricity by purchasing wind renewable energy certificates (RECs). The company is a responsible mineral source, and its engagement in The Green Grid Consortium, where it heads the Liquid Cooling Group, demonstrates leadership in promoting industry-wide data center efficiency improvements. Supermicro's commitment to adopting sustainable practices into company operations is exemplified by the incorporation of solar panels into the Taiwan Campus, with ongoing investigations for additional Green investments.

Social

Supermicro prioritizes the inclusion of veterans and underrepresented ethnicities in its focused recruitment campaigns, creating diversity throughout their workforce. The fact that more than 60% of employees have access to restricted stock pay demonstrates the company's dedication to recognizing and rewarding its workforce. Supermicro not only improves its corporate culture by fostering an inclusive atmosphere, but it also assures that employees are vital to its success. This emphasis on human capital is consistent with the company's overall commitment to ethical and responsible business practices, which contributes to a positive and sustainable workplace culture.

Governance

The governance principles of Supermicro stress transparency, independence, and accountability. With 71% independence, the Board of Directors demonstrates a commitment to unbiased decision-making. The board's over 30% female presence stresses diversity and inclusivity. The "One Share, One Vote" structure maintains shareholder equity, and an annual Say-on-Pay Proposal reinforces CEO salary accountability. Supermicro's dedication to responsible governance is further demonstrated by robust risk mitigation tools, such as the power to take back executive salary. Collectively, these activities contribute to a governance framework that promotes justice, openness, and ethical behavior.

Risk Analysis

Super Micro Computer, Inc. (SMCI) has conducted a risk assessment, with a focus on its debt profile and general financial health. The following are essential points that summarize the risk analysis:

Overview of Debt:

Over a year, SMCI's total debt climbed dramatically, rising from US$98.2 million to US$596.8 million. Net debt is roughly US$329.4 million after deducting the cash reserve of $267.4 million.

Balance Sheet Stability:

The total liabilities due within a year are $1.47 billion, with additional liabilities of $309.3 million due after that. These debts are offset by $267.4 million in cash and US$972.6 million in receivables due in the next 12 months. The company's liabilities are $539.4 million greater than its cash and short-term receivables.

Concerns about free cash flow:

Super Micro Computer spent a lot of money over the last three years, showing a reliance on free cash flow to pay off debt. The ability of the corporation to reverse this cash burn is a critical aspect in analyzing its debt risk.

Overall Evaluation:

Despite significant liabilities, the company's market capitalization of US$2.83 billion appears to provide a cushion against large debt problems. The company's capacity to cover interest expenses and achieve excellent EBIT growth are both favorable indicators of its debt management capabilities. However, prudence is urged, and the balance sheet should be monitored on an ongoing basis.

Investment Risk:

According to the above, SMCI can manage its debt very well, with the possibility for improved shareholder returns owing to leverage. The negative risk includes the necessity for diligent balance sheet monitoring and the company's capacity to reverse its history of burning cash.

References: Yahoo Finance. (© 2023). SMCI - Super Micro Computer Inc. (SMCI) Stock Price, Quote, History & News. Yahoo Finance. https://finance.yahoo.com/quote/SMCI/

Simply Wall St. (© 2023). Super Micro Computer Inc. (NASDAQ:SMCI) - Share price, News & Analysis. Simply Wall St. https://simplywall.st/stocks/us/tech/nasdaq-smci/super-micro-computer

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

this is very good!