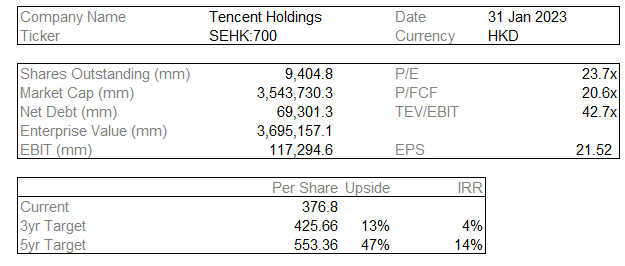

Initial Report: Tencent Holdings (SEHK:700), 47% 5-yr Potential Upside (China Tech Fund)

10/10 for Tencent

Introduction to the Next Gen China Tech Fund

About

The inception of China Tech Fund was the shared idea between Shinya and Max while having a discussion about the exciting opportunity of the Chinese listed shares in the United States and Hong Kong. During these past two years, the Chinese government executed a total crackdown into the technology and real estate sector causing a hard deleveraging and share liquidation by foreign investors all around the world. The Hang Seng Index (HSI) fell approximately 50% and foreign investors totally lost confidence investing in the Chinese market. With the tightening of financial markets all around the world due to persistent high inflation, China remains firm on the decision to lower interest rate; however financial and psychological repercussions remain and market participation is fearful of allocating capital. With the previous successful execution of the inception of China 101010 Fund during the severe bear market during 2011-2012 period in China, China Tech Fund’s goal is to also replicate the success by capitalizing on the rare contrarian opportunity to buy into the highest quality internet technology companies in China and hopefully with a long term perspective (10 years) and patience to successfully compound capital by beating the benchmark indexes.

LinkedIn | Max Tai

Company Description

Tencent is a Chinese technology juggernaut with four business segments: Value-added Services (VAS); FinTech and Business Services; Online advertising; and Others. In the first quarter of 2022, Tencent generated $22.62 billion in revenue.

Tencent is the world’s largest online gaming company by revenue. It develops original games in-house and also publishes third-party games. In China, Tencent is the clear market leader in both the smartphone games market (54% share in the first half of 2020) and the PC games market (60% share in 2019), according to Analysys and iResearch.

In the Social Networks subsegment, Tencent’s crown jewel is WeChat (known in China as Weixin), which boasted 1.225 billion monthly active users at the end of 2020. WeChat is a super app with functions that include peer-to-peer messaging, video calls, business communications, digital payments, e-commerce, and more. Users conduct nearly all their daily digital activities without ever having to leave WeChat.

Tencent’s fintech arm consists of Weixin/WeChat Pay, where the company earns a small cut of each payment transaction that the service processes. Weixin/WeChat Pay also generates revenue from fees for cash withdrawals and credit card repayment charges.

The Online Advertising segment encompasses digital advertising revenues that Tencent earns from selling advertising space on its digital properties. Some examples of these properties include Weixin Moments, Tencent Video, and Tencent News.

Investment Thesis

Strong future growth potential despite its already large size

Tencent’s business operations – not including its investments in other companies – span a wide array of different markets. The company is involved with online gaming, social networks, digital payments, insurance, online lending services, video streaming, digital advertising, cloud infrastructure services, and more. With its fingers in so many pies, Tencent is not fishing in a small pond. But Tencent’s revenue of RMB482.1 billion (around US$72 billion) in 2020 is also massive, so is there still room for significant growth for the company? Turns out there is. Let’s touch on three of Tecent’s core businesses – online gaming, mobile payments, and digital advertising – as well as the company’s optionality.

China’s gaming market is expected to grow at a compounded annual rate of 14% from 2021 to 2026, with mobile games and cloud gaming being two of the key drivers. For perspective, Statista pegged China’s online gaming market to be RMB288 billion in 2019 and Tencent’s Online Games subsegment had revenue of ‘merely’ RMB156.1 billion in 2020. We think Tencent is in a prime position to capitalise on the gaming market’s growth. The ubiquity of WeChat in China means that Tencent has very strong game-distribution capabilities. The company also has an incredible long-term track record of growing its Online Games business (more on this later) and it had a list of at least 22 games at the end of 2020 that are slated for release in the future.

Meanwhile, China’s mobile payments market is expected to surge from RMB468 trillion in 2018 to RMB1,800 trillion in 2025, according to Research in China. Based on data from iResearch, WeChat Pay’s share of China’s mobile payments market had increased from just 10% in the third quarter of 2014 to 38.8% in June 2020 (Ant Group’s Alipay had the largest share at 55.6%). In the fourth quarter of 2019, WeChat Pay exceeded more than 1 billion daily average transactions, had more than 800 million monthly active users, and had more than 50 million monthly active merchants. With WeChat Pay’s current market position – and the service’s ability to leverage the WeChat network – we think it’s likely that Tencent will continue to benefit from the growth of China’s mobile payments market.

Great management team

The 49-year old Ma Huateng, who’s also known as Pony Ma, is the most important leader in Tencent. He is not only a co-founder of the company, but he has also been its Chairman and CEO since its listing, at least. We appreciate the fact that Pony Ma is relatively young and yet already has at least 17 years of experience leading Tencent as CEO. Two of his most important lieutenants are Martin Lau Chi Ping and Allen Zhang Xiao Long, who both joined in 2005. Martin Lau, who’s 47, is Tencent’s president and has been a primary figure in the company’s investment process for many years. Allen Zhang is 51 and he was the leader of the internal Tencent team that created WeChat in 2011; he is currently the head of the entire WeChat business. All three of them have had over a decade of experience leading Tencent and have proven their leadership success at almost all stages of Tencent’s expansion.

High likelihood to generate strong stream of cash flow in the future

First, there’s still significant room to grow for the company as we had discussed earlier. The company’s core markets of online gaming, mobile payments, and digital advertising are all poised for growth and we think it is well-positioned to capture these opportunities. There are many more markets Tencent is involved with, which means the company could have many possible paths to grow in the future.

Second, Tencent has excelled at generating free cash flow for a long time. We already shared that the company’s average free cash flow margins were 30.8% for 2010-2020 and 26.9% for 2015-2020 – these are excellent margins. Even in the face of COVID-19 in 2020, Tencent’s free cash flow margin was 25.6%. We don’t see why Tencent’s free cash flow margins would weaken in the years ahead, especially when we consider that the company is operating in the high-margin technology space.

Regulatory tightening over

Tencent’s gaming segment relies heavily upon the awarding of game licenses. In 2021, a freeze on game licenses began and Tencent was unable to publish any new games. However, there are now signs of loosening regulations. Tencent was awarded its new game license in 2022, signifying a positive outlook on its gaming segment. Anti-monopoly regulations were another cause of concern for internet companies in China. However, there are signs showing that the Chinese government’s crackdown on internet companies is slowly ending. Moreover, even if regulations are to continue, Tencent has shown that it is able to align with the Party’s overall aim of ‘common prosperity’. It is also unlikely for Wechat, Tencent’s main moat, to be subjected to regulations. Thus, we see this as an opportunity for Tencent to focus on its core growth.

Overall Assessment

Tencent is a clear buy based on our analysis. It has huge growth opportunities because of its exposure to many different markets. Pony Ma is a leader who has not only demonstrated integrity, but also a wonderful long-term track record of execution and innovation. Tencent has high levels of recurring revenue due to the nature of its various businesses, and an excellent history of growing its revenue, profit, and free cash flow.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.