Initial Report: The Hershey Company (HSY), 32% 5-yr Potential Upside (EIP, Trinsy NEOH)

Trinsy believes that Hershey stock is currently mispriced by the market and is a sweet opportunity she doesn't want to miss.

1. Introduction

Hershey’s. A company that I’m sure many of us already know. for some, this tasty treat transports us back to our childhood, while for others, it's a delight reserved for festive occasions. Allow me to dive deeper into this case to determine why this could be a sweet opportunity.

It all started in 1894 when Milton S Hershey chanced upon a chocolate processing machine at a convention. Taking a leap of faith, he sold his business, Lancaster Caramel Company, to venture into the manufacturing and sale of milk chocolate bars. Today, Hershey’s (NYSE: HSY) operates one of the largest and finest chocolate businesses in North America, boasting over 19,000 employees across 100 brand names. It dominates 45% of the chocolate segment in the US and generated $10 million in revenues in 2022. The company markets, sells, and distributes its products across 80 countries worldwide. Through acquisitions and new brand portfolios, Hershey has expanded its product offerings, catering to individuals of all ages. Some of its notable products include Dots Pretzels, Lily sweets, and the iconic Kit Kat chocolate under a licensed agreement with Nestle.

Michele Buck assumed the positions of Chairman of Board and CEO position in March 2017. At Hershey’s she served as Chief Operating Officer, President, and Chief Growth Officer. Prior to joining Hershey’s in 2005, Buck took on senior positions at Kraft and Frito Lay. With Buck’s extensive experience within the consumer-packaged goods industry, she accelerated the company’s growth by expanding into new snack offerings. She has proven herself to be the right person for the position, showcasing her strength in understanding consumer consumption patterns and shopping habits.

2. Business Overview

Over 55% of chocolate & candy bar consumers in the US indulge in Hershey’s. Beyond its traditional chocolate and candies, the company has diversified its portfolio to cater to more snacking occasions. The company revenue is mainly from three segments:

(1) North America Confectionary – Business in chocolate and non-chocolate confectionery, gum and refreshment products, protein bars, spreads, snack bites and mixes, as well as pantry and food service lines. Renowned brands such as Hershey’s, Reese’s, Kisses, and Twizzlers fall under this category.

(2) North America Salty Snacks – Ready to eat popcorn, baked and trans fat free snacks, pretzels and more. Great brands acquired such as SkinnyPop, Pirate’s Booty and Dot’s. Retail sales 3 Year CAGR for the salty snacks segment grew 10.6%. This growth was supported by Ready-to-Eat Popcorn and Pretzels, which grew by 11.4% and 11.5%, respectively.

(3) International – Sell the same brands and other segments that are not individually material outside of North America

Hershey’s Product Portfolio – Sweet and Savoury

The business is mainly involved in 5 major product segments:

(1) Chocolate: This includes the iconic classics such as the Hershey’s® bar, Hershey’s® with almonds, Special Dark and Kisses.

(2) Reese’s: Peanut butter meets Hershey’s chocolate, comes in cups, pieces and sticks

(3) Candy: Mints and chewing gum from brands such as Jolly Rancher and Breath Savers. Caramel and toffee delights such as Werther’s Original. Other candies like gummies, Twizzlers.

(4) Snacks: Started recently in late 2017, includes salty munchies such as SkinnyPop and other indulgences like the barkTHINS and REBA protein bars.

(5) Better-for-You Focus: As consumers become more health conscious, Hershey’s started this segment to include snacks that are organic, plant-based or reduced in sugar. An example is the acquisition of Lily’s in 2021 bringing in no added sugar chocolate bars and stevia sweetened gummies.

Images from: Hershey’s Investor Day 2023

Financial Results

Business Model – Leading Snacking Powerhouse

Aspiring to be a leader in the snacking industry, Hershey’s is broadening its participation by innovating consumer-centric products and expanding the boundaries of its core confection brands to capture new snacking categories through acquisitions, such as Dot’s Pretzels. A prime example of this strategy is the Reese’s Camel Big Cup, which was released in November of this year. This innovation is coupled with augmented reality and image recognition to gather data, boosting future sales.

The image recognition technology identifies the merchandise and the exact in-store location of the display. This capability allows Hershey’s to track and collect data, helping them make better decisions regarding the placement and ways to improve their future products.

Images from: Hershey’s

Hershey’s distributes its products to customers both online and in-store. In the disruptive retail world, the consumer shopping experience has influenced the company to adopt a commerce strategy, addressing the space as an ecosystem with the consumer at the center of every decision. The company operates eight Hershey’s Chocolate World Stores (in the US and one in Singapore) and distributes its products to customers who run chain grocery stores, merchandisers, wholesale clubs, and wholesale distributors. These customers typically resell the products to end customers in retail outlets. In 2022, 28% of their net sales were made to McLane Company (a wholesale supply chain services company and a primary distributor to Walmart Stores Inc).

Images from: Hershey’s Website

More recently, Hershey’s has adopted an omnichannel strategy, which has grown to constitute over 5% of its business today. With slowed growth in the merchandising sector due to a retail partner pivoting to its eCommerce initiatives announced in the recent quarter (Q3 2023), Hershey’s direction through omnichannel and digital business is expected to place them in an advantageous position, enabling growth in the long run.

In addition to having an efficient product distribution channel, Hershey’s unique occasion-based marketing and innovation have played a vital role in driving strong brand equity. Focused on creating emotional connections with consumers and ensuring product quality, Hershey creates market campaigns associated with the feelings of togetherness and memorable moments. These pop-up events and brand experiences help Hershey stay on top of the minds of consumers, encouraging repeated purchases and driving brand equity.

The company views the supply chain as a growth enabler instead of a cost center. Today, Hershey’s operates 16 chocolate plants, mostly in the US, with other locations in Brazil, Canada, Mexico, etc. Constant upgrading of Hershey’s supply chain capabilities is crucial for efficiency and margin expansion. The team invests in advanced technology, eliminating bottlenecks and complexity through modularity, which reduces the time for changeovers and cleanings between product runs. Kit Kat was a prime example where they found opportunities in schedule and item changes, bringing in an additional $35 million in capacity. Additionally, investing in automation has eliminated Payday capacity growth by over 25%, constituting about 1/5 of their overall retail sales growth last year.

Agile fulfillment is another approach used by Hershey’s to bring brands together onto one display unit, allowing precision merchandising. This strategic approach provides better distribution based on the consumer’s preferences for different products (e.g., Texas preferring Payday over York). This reduces waste and increases sell-through.

Images from: Hershey’s Investor Day 2023

Value Chain

Annually, Hershey’s sells 3 billion of its iconic chocolate bars. The product mainly uses 2 ingredients; 70% cocoa and 30% sugar.

1. Extraction of Raw Ingredients

Hershey’s sources its cocoa beans from Theobroma Cacao, mainly found in the central and southern parts of America, West Africa, and Asia. A kilogram of quality cacao beans costs approximately $3.50, and 2.3 kilograms of sugar cost around $4 (purchased from US suppliers). In recent years, Hershey’s removed PGPR and vanillin from their ingredient list and replaced them with natural vanilla, which is more expensive.

2. Manufacturing process

After the ripened beans are transported to the plants, they are processed into cocoa butter and chocolate. The beans undergo cleaning, winnowing, and crushing to form liquid cocoa butter. This process concludes with conching, which involves rotating the chocolate to remove its bitter taste and mold it. The full cost of farmer operations is approximately $25 per kilogram, inclusive of packaging, labor, and facilities.

3. Purchase

Final product transported to distributors and retailers for sale.

The entire process would cost Hershey’s approximately $1.39 for a 50g Hershey’s chocolate bar (ignoring the ability for scale, which would bring down costs drastically – quick research suggests it costs around $0.15 to make a 50g chocolate bar). Based on these numbers, it seems like the majority of the costs are coming from the plant facility. With 7 out of 16 plants located in the US and Pennsylvania being the largest factory, electricity and labor costs are a concern for Hershey’s.

Economic Moat

(1) Cost advantage

Having a large scale in production and a strong distribution network, Hershey’s benefits from negotiating better terms to increase volume and margins. The company would be able to replicate competitive products and ultimately offer it to retailers at a lower cost compared to its smaller peers. Limiting its competitors and new entrants shelf space. Operating income margins in 2022 21.7% and expected to be 24% in 2023.

(2) Intangible assets – Branding

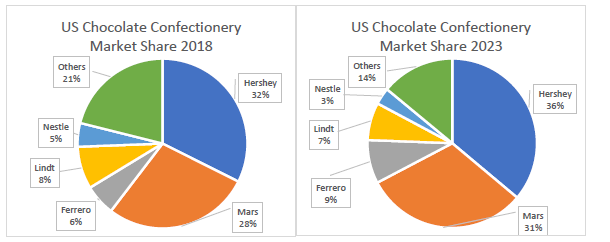

Hershey’s dominates the US chocolate confectionery industry, accounting for over 45% compared to Mars' approximately 30%. Over the years, Hershey’s has continued to strengthen its market-leading position. Since 2018, Hershey’s market share has grown from 32.4% to 36.1%, while Mars lost market share from 28% to 27.1% in 2021 before gradually regaining market share to 31.2% this year.

3. Industry Overview

US Confectionery market

Mars and Hershey’s accounts for half of the total market share. Mars is leading US confectionery market with 25% followed closely by Hershey’s at 23.9%. The remaining players such as Ferrero and Mondelez accounts for 9.7% and 5% respectively. Based on Euromonitor, the top three snacks by brand shares are Reese’s, M&M’s and Hershey’s Chocolate Bar.

US Snacks Market

In 2017, the CEO embarked on a journey to transition Hershey into a snacking powerhouse through their savoury and better-for-you product categories. The business diversified out of confections looking into acquiring brands at least $100 million in revenue which people love but needed to leverage on Hershey’s branding to gain more customers. The company owns three of the six faster growing snack brands in the US and the savoury and better for you segment accounts for 10% of their portfolio.

Hershey’s has been growing faster over the past five years and is expected to catch up to Mars' market share. The company has experienced better growth potential than chocolate, with annual sales of savory snacks rising 5-7%, compared to 1-3% for the former.

Global Ingredients Market

(1) Cocoa

The price of cocoa has hit its all-time high in the last 45 years, trading at ~$4,500 a ton on December 31, marking a >60% year-over-year jump, and is expected to remain elevated in 2024. The main driver behind this surge is the El Niño weather pattern and pests, which could potentially dwell on the shortfall. Moreover, the shortfall is further exacerbated by the high prices for pesticides and fertilizers. Analysts are expecting a third consecutive deficit in 2023-2024 as Ivory Coast farmers sent 34% fewer beans this season. Ivory Coast and Ghana, which produce almost 60% of cocoa beans, mostly export to the EU and US for processing. According to the ICCO, this suggests a potential deficit of more than 100,000 tonnes for the 2022-23 season. The lower supply and resilient demand will keep cocoa prices high. Hershey’s is highly sensitive to the prices of cocoa and sugar, as the confectionery segment accounts for 81% of the business

Image from: Markets Insider, Cocoa Commodity

(2) Sugar

Global sugar supply is affected by the extreme weather and volatile oil prices. Raw-sugar futures rose to 27.6 cents a pound in November, a 12-year high. India, the second-largest exporter of sugar, has cut back on exports after dry weather decimated cane crops. Thailand's sugar production has also been affected due to El Niño. The lower rainfall during the sugarcane growth stages contributed to smaller production. With lower production and high demand, sugar prices are expected to stay elevated in 2024.

Image from: Trading economics, Raw Sugar

In order to cope with the rising prices of ingredients, Hershey’s implemented a 9.8% increase in organic product prices, while volumes increased by 0.9% in Q3 2023. The company had a candy price hike in 2022 when they were grappling with the rising inflation rate and supply chain issues arising from the war. Consumers were expected to pay about 17% more for a standard Hershey bar.

Industry Trend: Healthier Options – Better-For-You Snacks (BFY)

IRI data reported that 49% of consumers are snacking more than three times a day, with the younger generations fueling the snacking lifestyle. The acceleration in snack consumption was driven by the pandemic as consumers turned to snacks for familiarity and comfort. In addition to frequent snacking, there has been a stronger emphasis on a healthy lifestyle. Recently, weight loss drugs like Ozempic have gained popularity, suggesting that consumers are more conscious about their weight and diet. A study from Innova Market Insights found that "60% of consumers look for healthier snack options, with half choosing healthier options over indulgent ones." Brands are more focused on functional health and no/low sugar products as they continue to realize strong growth. Moreover, companies are integrating BFY benefits into traditional snack categories, such as grain-free chips. The BFY market is expected to expand at a 6.7% CAGR, reaching $54 billion by 2030."

Image from: Circana MULO+C 2022

4. Investment Thesis

(1) Salty Snacks Segment Positioned to Propel Top Line Growth

Hershey’s has long been known for its confections, accounting for 82% of its 2022 total revenues. As cocoa and sugar prices soared, North America's everyday chocolate sales slowed in the recent quarters. On the other hand, Hershey’s Salty Snacks segment is growing rapidly. The segment accounts for 10% of total revenues in 2022, up 5% from 2019. In the recent quarter, Hershey, experiencing strong headwinds with the all-time high commodity prices, announced its long-term plans to focus on the salty snack segment and innovation. The company acquired popular brands such as SkinnyPop, Dot’s, and Pirate's Booty. Under Hershey’s, SkinnyPop grew to become the second-best-selling brand by retail sales in the ready-to-eat popcorn segment. Dot’s took the third position in the pretzels segment, and Pirate’s Booty came in at second in BFY puffs.

Over the last 5 years, Mondelez, Kellogg, and Campbell have lost market share, causing a shift in the savory snacks market. Hershey’s has the potential to gain higher penetration in the salty snacks segment, having gained 2% in market share. To support future gains, Hershey’s has room to grow its household penetration rate. SkinnyPop is at 15%, Dot's is at 9%, while popcorn and pretzels overall generally range ~50-60% in terms of household penetration as categories. By investing more in the salty business through distribution and awareness, Hershey’s could expect low double-digit growth in the next three years and long-term high single-digit growth.

(2) Margin Expansion as Agriculture Prices Recover

With agricultural products at an all-time high, the gross profit margins have deviated from the average ~45%, standing at 43% in 2022. Under the cost of goods sold, raw materials and packaging contribute the bulk of the costs (60%), followed by manufacturing overhead (25%) and freight & logistics.

Cocoa futures (CJ:NMX) expect prices of cocoa to come down by 14% to $3,930 at the end of December 2024. Moreover, Hershey’s would be moving its salty business to their own platforms, which would grow margins by 300 basis points.

Image from: Barchart, Cocoa Futures

5. Valuation

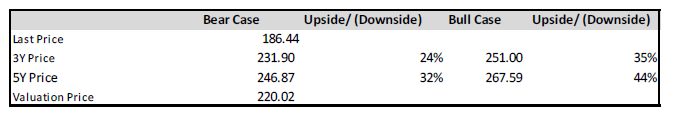

Hershey’s stock was beaten down to $186.44 (around 52 week lows) after the market had negative sentiments and strong uncertainty of cocoa and sugar prices. However, I see this as a potential market downdraft scenario where I would expect a mean reversion in its stock price fuelled by the decline in the prices of ingredients and diversified portfolio with high growth in its salty snacks segment.

My fair value estimate shows an intrinsic value of $219.89 per share. DCF model uses a 7.1% weighted average cost of capital. Estimating 3-year top line 5% CAGR and EBIT growing at 8.7% CAGR.

6. Risk and Mitigation

Climate change is a huge factor for Hershey’s as the business main ingredient is cocoa. Unpredictable weather such as El Nino is a prime example of how spikes in cocoa prices could affect Hershey’s operations. The business had to increase the price of its products and experience a pull back in the company sales volumes. Hershey’s tries to mitigate the high volatility through purchasing futures contracts. However, it is a double edge sword limiting their ability to benefit from possible price decreases.

7. ESG Assessment

In 2021, Hershey faced a child slavery lawsuit regarding eight children who allegedly claim they were used as slave labour on cocoa plantations in Ivory Coast. Although this case was dismissed, it emphasizes Hershey’s risk of promoting child labour in their materials sourcing process. Hershey’s has created a Child Labour Monitoring and Remediation System (CLMRS) which builds commitment to prevent and eliminate child labours. Supply chain partners and community-based groups engaged would help identify child labor and help remediate when cases are found.

Hershey’s Material Issues

Images from: SASB Industry

To conclude, Hershey’s focus on innovation, direction towards the sweet and salty space, strong branding and smart capital allocation makes it a fundamentally well managed company. I believe the stock is currently mispriced by the market and it’s a sweet opportunity I don’t want to miss.

Sources:

https://www.thehersheycompany.com/en_us/home/newsroom/blog/product-innovation-meets-tech-innovation-with-the-launch-of-reeses-caramel-big-cup.html

https://vendingproservice.com/how-much-does-it-cost-to-make-a-chocolate-bar/

https://www.foodbusinessnews.net/articles/24674-the-key-trends-driving-snack-segment-growth

https://www.barchart.com/futures/quotes/CC*0/futures-prices

https://sasb.org/standards/materiality-finder/find/?company[0]=US4278661081

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.