Initial Report: The Walt Disney Company (DIS), 119% 5-yr Potential Upside (EIP, Joseph CHONG)

Everyone knows Disney. But Joseph is confident of Disney's continuous climb and discusses NFT expansion. Let's dive into his memo for more!

Disney is a media entertainment giant with diverse revenue streams across media outlets, theme parks and merchandise

Disney's content flywheel underpinned by strategic acquisitions cements brand loyalty

Localised APAC strategy of Disney+ helps to sustain subscriber growth

Recovery in theme park admissions and guest spending, bolstering parks and experiences revenue

SOTP-backed fair value of $96.11 represents a possible upside of 8.0% - without factoring in significant optionality from NFTs and an ARPU surprise of its streaming services

Company Overview

Disney is a media entertainment giant with diverse global operations in linear TV, streaming, theme parks and merchandise.

Founded in 1923, it has enjoyed a rich history of successful pivots over the last century: It produced its first animated film in 1937, launched Disneyland in 1955, acquired ABC in 1995, steadied a series of content acquisitions in the 2000s to 2010s (Pixar in 2004, Marvel Entertainment in 2009, Lucasfilm Entertainment in 2012, 21st Century Fox in 2019), before diving into streaming through Hulu in 2009, ESPN+ in 2018 and Disney+ in 2019.

After a strategic reshuffling in 2020, Disney now comprises 2 revenue segments:

Disney Media & Entertainment (DMED) - contains 13 TV channels and 3 streaming services, which profits from affiliate fees, advertisements, and subscriptions

Disney Parks, Experiences and Products (DPEP) - offers 6 theme parks/resorts and 1 cruise line, which profits from admission fees, merchandise, and food & beverage (F&B)

These segments are contingent on Disney’s 3 content groups, ranging from:

Walt Disney Studios - film division with 6 live-action and 3 animation studios

Disney General Entertainment Content (DGE) - US TV division centering on ABC and Disney Channels

ESPN and Sports Content - live sports division with 2 cable channels, including ESPN+ and ABC

Given its vast content library, Disney’s competitive moat lies in its a) quality original productions, b) distinctive branding, and c) unmatched customer loyalty fuelled by its content flywheel between 2 interconnected revenue segments. This has been stewarded by a widely lauded management team, notably with former CEO Bob Iger pioneering Disney’s aggressive acquisitions and foray into streaming in the last decade.

Business Segments

As mentioned in the company overview, Disney classifies its revenue into 2 segments – Disney Media & Entertainment (DMED) and Disney Parks, Experiences and Products (DPEP).

1. Disney Media & Entertainment (DMED)

Under DMED, Disney generates revenue through 3 main sources – 1) Linear Networks, 2) Direct-to-Consumer and 3) Content Sales/Licensing.

Linear networks

Linear networks refer to Disney’s domestic and international channels (i.e. ABC Television Network (ABC), Disney, ESPN, Fox, National Geographic), as well as its 50% equity investment in A+E Television Networks (A+E) which operates cable channels (A&E, HISTORY and Lifetime). Within this division, Disney generates > 60% of revenue through affiliate fees earned by charging multi-channel video programming distributors (cable and satellite service providers) and ABC-affiliated television stations for the right to deliver programming to their customers. In addition, Disney earns advertising revenue through its linear networks.

Direct-to-Consumer (D2C)

D2C consists of Disney+, Disney+ Hotstar, ESPN+, Hulu and Star+ DTC streaming services.

On these streaming services, Disney charges a subscription fee and sells advertising space to generate revenue which we will elaborate upon in Thesis 2.

Content Sales/Licensing

The main revenue drivers of this segment are:

a) Sales/licensing of film and television content to third-party television and subscription video-on-demand (TV/SVOD) services

b) Theatrical distribution – rentals from licensing our film productions to theatres

c) Home entertainment distribution – sale of film and television content to retailers and distributors in home video formats

d) Others – includes music licensing revenue and fees from licensing intellectual properties (IP) for use in stage plays

2. Disney Parks, Experiences and Products (DPEP)

Disney operates 5 theme parks and resorts and licenses its IP to a third party, Oriental Land Company (OLC), to operate the Tokyo Disney Resort. In addition, Disney also operates a cruise line, vacation club and a resort & spa (Aulani). Under this segment, Disney generates revenue through:

a) Theme Parks and Resorts

Theme park admissions – collected from the 5 theme parks it operates

Merchandise, food and beverage – sold at theme parks, resorts and cruise ships

Resorts and vacations – accommodation fees including sales from hotel rooms, its cruise line and rental of vacation club properties.

b) Others

Merchandise licensing and retail – merchandise licensing comprises royalties from licensing its IP for consumer goods while retail consists of merchandise sales at Disney stores, branded internet sites and wholesalers.

Parks licensing and other – sponsorship fees, co-branding, and royalties on Tokyo Disney Resort’s revenue.

Revenue Drivers

Disney Media & Entertainment (DMED)

A) Linear Networks

Revenue drivers include:

1. Affiliate fees, which is dependent on:

Contractual rates (per subscriber)

Number of subscribers (of distributor)

2. Advertising revenue, which comprises of:

Advertising rates

Impressions (number of times ad is shown)

B) Direct to Consumer (D2C)

1. Subscription fees

2. Advertising fees

Both are underpinned by Disney's subscriber base and Average Revenue per Subscriber (ARPU), which have enjoyed Y/y increases in the latest quarter:

1. Subscriber increase – this was mostly contributed by Disney+ and Hulu. We segmented subscribers based on:

Retail customers – either subscribed to Disney+ individually or via the Disney, Hulu and ESPN+ bundle

Wholesale customers (existing content distributors), which have lower ARPU than retail customers

2. ARPU expansion – ARPU hikes are pivotal in driving profitability:

Hulu – driven by a lower mix of wholesale customers

Disney+ – monthly subscription prices

C) Content Sales/Licensing

Revenue is mostly derived from selling and licensing Disney content, both film and television, to:

1. Third-party TV and SVOD providers

2. Theatres (c. 8%) and home entertainment services

Parks, Experiences & Products

Revenue Segments

A. Theme parks– admission fees, merchandise and food & beverage

B. Resorts and vacations – accommodation in hotel rooms, cruise ships, vacation club properties

C. Merchandise licensing & retail - royalties from licensing IP on consumer goods, sales from merchandise at retail stores

Overall, revenue is heavily dependent on theme park admissions, and is likely highly correlated to spending on other revenue streams.

Management

Disney is led by Bob Chapek, CEO, and Robert A. Iger, Chairman. Bob Chapek has been with Disney for 28 years and has held key roles across a variety of revenue segments, including serving as Chairman of DPEP, President of Distribution for The Walt Disney Studios and head of Disney Consumer Products. We believe this breadth of experience gives him a good understanding of the overall business, priming Disney for more cross-monetisation and synergistic opportunities across revenue segments.

We also have confidence in his ability to successfully digitalize Disney given his track record in bringing Disney's home entertainment division into the digital age. He was even praised by then-CEO, Michael Eisner, as knowing how “to grow the business while adjusting to the changing marketplace, which was intense”. We are already starting to see glimpses of this digitalization starting with the restructuring of its media and entertainment divisions in October 2020 to make streaming the priority.

Industry Overview/Competitor Analysis

Disney competes in 2 highly cyclical industries: the media entertainment and amusement park space.

Media Entertainment

The media entertainment industry can be broadly segmented into content producers and distributors, which rely on cinemas, pay-per-view TV, video games/e-sports and/or the rising over-the-top video (OTT) to reach consumers.

The overall entertainment industry is expected to grow at 13% CAGR from 2021 to 2026, fuelled by the disruption of 5G and OTT which is forecasted to expand at a 6-year CAGR of 10%, where content is streamed non-linearly through the internet instead of via traditional cable or broadcast channels.

Specifically for Disney, its distribution channels include:

Broadcast TV - ABC Network and 8 domestic TV stations

Cable TV – Disney Channel, ESPN, National Geographic, FX, Freeform, A+E (50% ownership)

Streaming service – Disney+, Hulu, ESPN+, Disney+ Hotstar

Broadcast and Cable TV

Disney is a market leader in the slow-growth pay-TV market, which is expected to expand at a mere CAGR of c. 3% from 2020 to 2027. Since the media value chain has high fixed costs and favours consolidation for greater economies of scale, most media conglomerates simultaneously engage in 2 business models:

Aggregators – network channels that acquire content rights from third parties, before packaging them into different channels for scheduled broadcasting. They typically profit from affiliate fees, advertising fees and direct content sales to consumers.

Distributors – TV operators or telecommunication companies that acquire content from aggregators. They typically profit from bundled channels to consumers.

Revenue is mainly derived from advertising and affiliate fees, which in turn makes competition among TV networks highly dependent on:

Top channels – whether channels were the 10 most highly viewed in the U.S. in 2020 (based on internal estimates)

Number of viewers/subscribers – total viewership from each network’s “top channels”

Content acquisition – quality, exclusivity, and regularity of content additions

Content distribution – carriage by multichannel video programming distributors (MVPDs)

Disney’s massive popularity is likely because each of its flagship channels strategically targets different segments of the cable TV industry and has cemented their positions as a market leader:

ABC and Fox – all-in-one network which offers in-house movies, TV shows and theatrical productions

Fox News – professional cable news channel that was most highly rated and viewed by US citizens in 2020

ESPN – 24 hours sports news channels that were most highly rated by US men in 2020

The universal appeal of Disney’s channels is further corroborated by its strong pricing power, as evident from its recent price hikes even amidst the pandemic. For instance, despite the general decline in viewership among traditional channels due to the rise of OTT, Disney hiked its affiliate and advertising fees (per viewer) by 8% and 35% Y/y respectively in 3QFY9/21. Despite the shrinking pay-TV industry, the quintessential popularity of Disney’s flagship channels, fuelled by strategic content acquisitions by management (ie. Disney acquired Fox in 2018), may possibly offset viewers’ general shift to online streaming.

Streaming Services

Notably, pay-TV giants like Comcast, ViacomCBS and Warner Bros Discovery have also steadily pivoted towards online streaming through the respective platforms Xfinity, Paramount+ and HBO. However, they have been growing at a slower pace, as evidenced by their meagre subscriber count.

Overall, while Netflix is the clear market leader in terms of its subscriber count, existing content library and future content production, Disney is poised to ride on the tailwinds of online streaming, both domestically and abroad, for 2 reasons:

Fundamentally, its competitive advantage lies in its superior brand recognition, underpinned by a strong emotional affinity and brand loyalty among customers (elaborated in thesis 2).

Furthermore, unlike Netflix’s flailing performance in APAC, where revenues have consistently dipped by c. 1% Y/y from 2018 to 2020, Disney was estimated to amass a mighty fleet of 32.4m subscribers in 2020, just 8 months after its launch through the HotStar merger in India. This has been boosted by a highly localised content strategy, affordable mobile plan and tight network with local distributors. The large TAM in developing APAC countries, fuelled by the under-penetration of SVOD and rapidly increasing digitisation rates, are likely to sustain Disney’s high subscriber growth.

Theme Parks

Besides Disney’s media outlets, it also derives c. 35% of revenue from its Parks, Experiences and Products segment (as at FY22), which in turn is highly contingent on-demand from amusement parks. The global amusement park space is expected to grow at a 5-year CAGR of c. 8% to reach $82b in 2026. The market is also highly concentrated, with its top 10 players comprising a substantial c. 56% of global revenue. Notably, revenues have recovered beyond that of pre-pandemic levels as the masses revenge travel in full force.

Disney holds a comfortable position as the clear market leader, with Disney parks consistently dominating 9 out of the 10 most highly visited amusement parks worldwide till FY19 (before COVID-19 skewed revenues). Universal Studios Japan, on the other hand, took 5th position with a yearly attendance of 14.5m.

Since amusement parks are highly differentiated by the quality of their customer experience, Disney’s success has been broadly driven by its rigorous digital innovations, which elevates its already popular franchises and creates an immersive experience for park-goers. This is especially so for Disney since theme parks form a cornerstone of its unique marketing flywheel and aids in building an entire universe around its original storyline.

Investment Thesis

Thesis 1: Disney’s strong intellectual property creates a sustainable moat

Disney has cultivated a strong suite of IP through a mix of in-house development as well as acquisitions as seen from the table above.

Out of the top 5 all-time best-selling franchises, Disney owns 3 – Marvel Cinematic Universe (MCU) (excluding ‘The Incredible Hulk’ and ‘Spiderman’), Star Wars and Avengers. Its standout IP is MCU with its total gross of c. 2.2x that of the next highest-grossing franchise which it also owns. Disney’s strength in IP is further emphasized by the breadth of its content suite as it owns a total of 19 of the top 50 highest-grossing film franchises. We believe that the success of the franchises stems from the following factors:

A) Nostalgia Effect

With reference to MCU, many of its films are based on the original Marvel comics which began featuring modern superheroes in 1961. In addition, the MCU film franchise has been running for 13 years, and thus, we believe that Disney’s characters have been a part of the audience’s childhood regardless of their generations. As a result, we opine that strong emotional affinity and nostalgia has been built into the audience, which keeps them attracted to the Disney characters and locked into the Disney ecosystem of products.

B) Constant Innovation

Within the past 13 years, 25 MCU films have been released, representing an average of c. 2 films per year. This constant refresh and sequel releases keep the audience locked in and ensures the franchise does not become stale or irrelevant. This is demonstrated through the consistent uptrend of box office numbers for the above MCU sub-franchisees as new films are being released (except for Avengers: Age of Ultron), indicating the audience is still eager for more MCU movies which ensure the sustainability of future theatrical release revenue.

C) Top Talent

Through acquisitions of film companies, Disney not only adds valuable franchises to its collection but also gains the talented animation and film crew behind these best-selling films. For example, LucasFilm, the film studio behind Star Wars and Indiana Jones, was acquired by Disney in 2012. The film studio is highly recognised for its leadership in developing special effects, sound and computer animation for the film. As a result, it gives Disney the ability to continue producing top-quality animation films that will go beyond the Star Wars and Indiana Jones franchises.

Furthermore, talented animators in the film industry may become more attracted to join Disney to learn and work under them which gives Disney a competitive advantage in hiring top talent to continue producing good films.

Overall, the strong IP Disney holds allows it to fill its pipeline with sequels and enables a flywheel effect for its consumer products, theme parks, experiences and other segments.

Thesis 3: Parks and experiences revenue is resilient through cycles

Our 2nd thesis is framed around the central idea that Disney’s theme park admissions will remain firm through economic cycles, ensuring its parks and experiences revenue remains resilient.

What could Disney’s parks and experiences revenue road to recovery look like?

We believe that an uplift in domestic and international tourism activity will affect Disney’s parks and experiences revenue through an increase in a) theme park admissions and b) total per capita guest spending.

A) Theme Park admissions

U.S.

Looking at Walt Disney World Magic Kingdom (Florida) Attendance as a proxy for overall U.S. admissions numbers, we can see that in spite of the global financial crisis and numerous macro crises in the 2010s, theme park admissions have remained strong and mostly growing.

Given that international visitors typically make up 18 to 22% of theme park attendance, we opine that U.S. theme park admissions will continue increasing as Disney adds capacity and revenge travel trend persists.

Ex-U.S.

Even though the ex-U.S. theme parks tend to have greater ebbs and flows in admissions numbers, it is still largely resilient across macro cycles. In addition, certain ex-U.S. theme parks such as Disneyland Paris have significantly higher than average proportion of international tourists and thus, should continue seeing an uptick in admissions as travel picks up.

B) Total per capita guest spending

We believe that total per capita guest spend will continue rising due to the 1) release of the Disney Genie service and 2) higher savings rates through the pandemic.

1) Disney Genie

Disney will be launching its Disney Genie service, a complimentary digital service that will help Disney theme park visitors build a personalised itinerary, in October 2021. This should improve the personalisation of the Disney theme park experience and maximise the time spent in the park. For example, it could suggest going on a particular ride at a certain time of day when the waiting time is shorter, and then suggest a nearby restaurant to have lunch at when the ride is over.

As a result, visitors will spend less time waiting at rides which opens time to spend at the gift shop or more restaurants and food stands. In addition, Disney will be rolling out a paid Disney Genie+ service which allows visitors to skip the queues at rides for a $15 to $20 fee. This replaces the outgoing FASTPASS and FASTPASS+ which were complimentary and thus, represents a potential hike in total per capita guest spend should there be an uptake of the paid service.

2) Higher savings rates through the pandemic

Given that personal savings rates in the U.S. were elevated from March 2020 to April 2021, U.S. residents would have higher than pre-pandemic purchasing power. As such, should they choose to spend more, the total per capita guest spending should increase. Given our belief that both theme park admissions and total per capita guest spend will continue to increase in the following quarters, we have the conviction that the total parks and experiences revenue will improve as we progress through the pandemic.

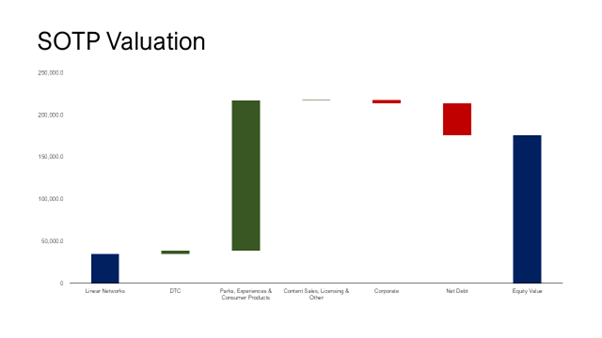

Valuation

Based on our excel financial model, we derived a fair value/share of $96.11 for Disney using a SOTP valuation. This represents an upside of 8.0% from the last closing price of $88.95.

We opine that the fair value estimate captures Disney’s current state of organic growth, without pricing in possible further upside driven by an ARPU surprise in its D2C segment and a faster than expected recovery in theme park admissions.

Key Assumptions

Risks

1. Declining paid-TV viewership

With the advent of online streaming, the waning industry of traditional cable & satellite TV may significantly dampen DMED revenue for Disney.

This risk is exacerbated when placed in the context of the dynamics between Disney’s highly intertwined revenue segments since Disney’s distribution channels comprise both traditional TV (Linear Networks) and streaming (D2C) platforms. With more content being migrated to Disney+, this may further cannibalise revenue from the Linear Networks segment. Overall, given declining viewership coupled and waning content, we expect a further tapering of Disney’s affiliate and advertising fees.

However, we believe that the high-growth D2C segment would eventually become a mammoth of its own, outsizing revenue from traditional media segments and downplaying the risk of cannibalisation.

2. Unprecedented spike in COVID-19 hospitalisations and deaths

Should the new COVID-19 variants wane significantly or the widely lauded booster program fails to meet expectations, there could be a significant rise in COVID-19 hospitalisations and deaths. This could cause a retracement in recovery of theme park admissions.

However, this is unlikely given the proven efficacy of COVID-19 vaccines and that COVID-19 is no longer considered a pandemic by the World Health Organization (WHO).

Catalysts

1. Cash cow optionalities from plausible NFT expansion

Non-fungible tokens (NFTs) are unique digital assets represented on the blockchain, a digital ledger that religiously tracks the sale, ownership and validity of each NFT. These assets can come in the form of JPEGs or video clips and are commonly derived from highly popular characters from established franchises.

This is because digital collectables, unlike analogue items like merchandise and consumer goods, are software tracked on blockchain and are hence fundamentally unique. This digital scarcity enables creators like Disney to continuously profit from NFTs even as they are resold through royalties on the resale value, creating a reliable revenue stream without minimal marginal cost.

Furthermore, given Disney’s superior content IP fuelled by aggressive acquisitions in the last decade, we think it is well primed to leverage on its suite of franchises (Marvel, Star Wars, Disney Animation) to sell NFT collectables and create an additional revenue stream. Referencing precedent transactions, an NFT collage from a relatively unrecognised digital artist, titled “Everydays – the first 5000 days”, ended with a record-setting purchase price above $69M on Mar 21.

Extrapolating this transaction to Disney’s superior brand recognition and fleet of universally popular characters that each possess legions of fans, the NFT market represents significant monetisation opportunities for Disney.

2. Growing subscriber base for Disney+ fuels possible ARPU hikes

With the continued high sustained net additional subscribers of Disney+, even as more employees return to the office which should decrease average watch time, should quell worries over potential churn as we emerge through the pandemic.

Hence, as Disney+ gains traction in both domestic and overseas markets, its rapidly growing subscriber base coupled with high retention rates, may translate into higher pricing power and ARPU hikes.

ESG Assessment

Environment

Disney has a comprehensive plan to work towards its 2030 environmental goals. For one, it has plans to submit emissions targets to the Science Based Targets initiative in 2023. Additionally, it has commissioned or announced 200+ MW of solar capacity as of FY22. Furthermore, 58% of total company operational waste is diverted from landfill and incineration.

Social

Disney has strong stakeholder engagement with its community through signature social impact initiatives, campaigns (e.g., cause marketing, awareness campaigns), multi-stakeholder coalitions, charitable giving and employee volunteering and giving.

Governance

Disney has a strong emphasis on diversity amongst its employees. For one, 7 out of 11 Board of Director nominees at our 2023 Annual Meeting Are women and/or racially/ethnically diverse. Moreover, ~47% of its U.S. employees are people of colour and ~51% of its employees worldwide are women.

Conclusion

Overall, Disney’s content flywheel creates a durable moat against rival entertainment outlets, both in the traditional pay-TV and modern SVOD space. Disney’s core proposition is further bolstered by expanding revenues in the high-growth D2C and recovering theme park segments. However, we believe that this narrative has already been baked into Disney’s market valuation, given that it has been around since the start of the pandemic.

Despite this, we posit the possibility of an upside, largely depending on the execution and reception of its NFTs and a surprise in streaming service ARPU hikes.

Thanks for reading,

Joseph

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.