Initial Report: Tongwei Co., Ltd. (600438.SH), 208% 5-yr Potential Upside (EIP, Kenneth TEE)

What does photovoltaic energy and agriculture have in common? Let's examine how Tongwei ties it all together and generates revenue for itself.

LinkedIn | Kenneth TEE

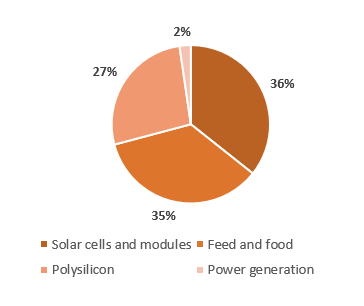

Tongwei Group Co. Ltd is a leading Chinese industrial company founded in 1982 that engages in 1) photovoltaic new energy businesses and 2) agricultural operations in animal feeds, aquaculture, and food manufacturing in China and globally.

90% of Tongwei’s revenues are derived from China via PV, feed, and food. This includes indirect exposure to global markets via polysilicon contracts with Chinese module manufacturers that sell worldwide. 10% of overseas revenue includes sales of cells, modules, and feedstock to Asia and Europe.

Figure 1: Tongwei’s Organisational Structure

Figure 2: Tongwei’s FY2022 Revenue by Geography

Photovoltaic

Tongwei entered its photovoltaic (PV) new energy business in 2008, starting with developing and manufacturing crystalline silicon. Currently, Tongwei is a vertically integrated PV enterprise with upstream high-purity crystalline silicon production, midstream high-efficiency solar cell production, and downstream terminal PV power station construction and operation.

For its upstream operations, Tongwei operates through its subsidiary Tongwei Yongxiang Co. Ltd which owns three high-purity crystalline silicon production bases in Leshan (Sichuan), Baotou (Inner Mongolia), and Baoshan (Yunnan). As of June 2023, Tongwei is the world’s largest manufacturer of polysilicon with an annual capacity of 280,000 metric tons (MT) and aims to reach 350,000 tons/year by 2023. Its major customers in 1H2023 for its polysilicon include solar module manufacturer JinkoSolar and semiconductor company TCL Zhonghuan.

For midstream, Tongwei’s subsidiary Tongwei Solar conducts R&D, manufacturing and selling of core solar power generation products. The company is currently the world’s largest crystalline silicon solar cell manufacturer, achieving 54 gigawatt (GW) annual capacity of solar cells from four bases in Hefei, Shuangliu, Meishan and Jintang. According to the company's production capacity planning, Tongwei Solar will have a production capacity of 80-100GW in 2023, further consolidating its status as the world's largest solar cell manufacturer. Tongwei Solar also offers solar modules to large customers in China such as power generation companies, with a 3GW deal struck in August 2022 with China Resources Power.

Agriculture

In the agricultural segment, Tongwei operates through Tongwei Feeds and Tongwei Foods, which serves the livestock feed and consumers food segments respectively. As of June 2023, Tongwei Feeds has an annual feed production capacity of more than 10 million tons. Its market share of aquafeed in China has been the largest for more than 20 consecutive years till 2022. It is also a major manufacturer of fresh, frozen, and processed food for consumers in China.

At the end of the industry chain, Tongwei integrates PV power generation with modern fishery, and pioneered the world's first development model of "fishing and light integration". Tongwei has constructed 51 "fishing and PV integration" bases across China to optimise solar energy generation that can be used for power aerators and pumps for fishery as well as preventing algae bloom by lowering water temperature. As the only leading enterprise involved in both agriculture and new energy PV industry in China and globally, Tongwei has achieved coordinated development of agriculture and PVs.

Figure 3: Tongwei’s FY2022 Revenue by Geography

Industry Overview

China’s growing demand for energy while committing to ESG

China has committed to a 2060 net zero target with 1200GW from renewables by 2030. Chinese companies are now required to transit to lower-carbon business models while being expected to include ESG into annual reports such as referencing the Task Force on Climate-related Financial Disclosures (TCFD) framework. With regulators and investors pushing for transparent ESG data, many companies are increasingly pressured to adopt renewables such as solar panels.

Figure 5: Forecast for PV installation, China (in red). Source: Bloomberg

Previous record prices for traditional energy sources will accelerate solar demand going forward

Record fossil fuel prices as a result of lower CAPEX post-pandemic and supply disruption from Russia-Ukraine war has made countries recognise the need for long-term, clean and secured energy sources. According to BloombergNEF, the base case scenario for 2023 solar PV build worldwide is 236GW, with China dominating installation capacity through 2030. In the long-run, US$4 trillion of clean energy investment is needed per year to achieve the net zero goal, kicking off a strong secular growth for renewables with solar being the main beneficiary.

China’s dominance of the PV industry

Currently, China dominates the entire PV value chain, from polysilicon (material source for PV) to manufacturing of solar cells and modules. China’s share of the global solar panel manufacturing rose from 55% in 2010 to 84% in 2021. With continued investment into renewable energy and the growing demand worldwide, China will continue to dominate the PV value chain from upstream to downstream. The China Photovoltaic Industry Association (CPIA) reported that newly installed PV cells have grown 31%, reaching a high of 170GW, with China leading at 54.88GW ahead of United States with 26.8GW. Meanwhile, exports from China are valued at US$28.43b, a y-o-y growth of 43.9%. These statistics indicate rapid growing demand, and China’s PV industry’s ability to expand its capacity.

Figure 6: Market share in PV value chain by geographies in 2022. Source: Visual Capitalist

Cheaper renewable prices will continue to drive solar demand

With China’s large manufacturing capacity and increasing investments globally, the prices of producing solar energy and wind energy have come down 87% and 66% respectively from 2009 to 2021, and prices will continue a downward trend with solar cells expected to fall 15-20% by 2030. This will continue to drive demand for solar energy in the long-run in China and globally.

Figure 7: PV and Wind production prices are becoming competitive. Source: GSAM

Steady growth in Feed and Food Industry in China and regionally

Spurred by the rapid recovery of pig herd production from African Swine Fever (ASF), the Chinese feed industry continued its growth in 2021. Global demand for feed from China strengthened as well. According to USDA, China’s total feed consumption for 2022 would increase by 2.9% y-o-y to 301.6 million MT. Aquafeed is the fastest growing segment with a 10.4% CAGR from 2020-2026 due to rise in seafood consumption. Meanwhile, with prices of imported grains such as soybeans used for feedstock rising, China has targeted for grain self-sufficiency to increase to 88.1% by 2031. More stable supply and price for grains in future will benefit feed producers’ margins. For the food industry, China’s domestic consumption will continue to rise as the Chinese middle-class population continues to grow and China’s government continues to emphasise on “common prosperity” policy.

Figure 8: Global aquafeed market size. Source: Expert Market Research

Thesis for Tongwei

Thesis 1: Tongwei is expected to further expand capacity upstream and maintain dominance

Polysilicon demand around the globe has been increasing substantially as the demand for solar energy worldwide surges. The global polysilicon market is expected to grow at a steady 5.6% CAGR (2022 -2028) with China taking the forefront in the key manufacturing stages of solar PV that exceeds 80% of global production and is expected to rise to 95% given the current expansion of the industry.

There is concern that Tongwei’s market share will be threatened by the major and upcoming players in the PV market as polysilicon is a commodity rather than a differentiated product. This concern is substantiated as the robust demand in the PV market calls for continuous expansion of a firm’s capacity and more competitors. However, Tongwei is well-positioned as the market leader in the polysilicon industry, securing six major contracts in 2022 which has led to a 231.9% y-o-y increase in 2Q2022 net profit. This will expedite their aggressive expansion plan of 800k - 1million tons capacity by 2026, way ahead of their competitors, effectively gaining market share from them. Hence, given the existing market condition, Tongwei’s aggressive expansion plan moving forward will allow them to gain market share.

Meanwhile, as Tongwei’s main polysilicon contracts are with domestic midstream players, Tongwei has not been on the global stage enough as their direct export only accounts a small portion. However, we see this as Tongwei playing to its core competitiveness in fulfilling the large polysilicon demand in the domestic market. Furthermore, Tongwei’s partners’ overseas sales of solar modules will result in an increase in polysilicon order from Tongwei. Thus, Tongwei is well positioned to benefit from both domestic and global PV market.

Therefore, we see that Tongwei is in a pole position on 2 counts (1) It leverages on their strategic partners to benefit from overseas demand and (2) profit boost from securing the six major contracts will in turn expedite their aggressive expansion plan to boost their capacity and continue to gain majority of the market share in the polysilicon market.

Figure 9: Tongwei’s expected polysilicon production capacity growth (‘000 MT). Source: Tongwei’s FY2022 report

Thesis 2: We expect Tongwei to accelerate its downstream manufacturing and become the first vertically integrated PV company to lead module supplies within this decade (GW)

Since 2016, Tongwei has been expanding aggressively down the PV value chain as the market for solar cells and modules continues to grow rapidly. We believe that Tongwei’s advantage will become more prominent going forward as it controls a large supply of polysilicon. This translates to ability to outbid competitors and weather through polysilicon price rises as they are able to use the polysilicon for cells and modules directly unlike downstream players who will face margin compression should input costs rise. This advantage is starting to show as Tongwei managed to outbid the longstanding manufacturer LONGi Green in August 2022. This signals a huge potential for it to become the largest in coming years should it receive more orders due to cost advantage. Analysts are currently concerned that Tongwei expansion downstream will eat into their partners’ market share, which in turn will deter partners such as LONGi from purchasing polysilicon from them. However, this concern is mitigated due to the tight supplies of polysilicon and Tongwei is one of the leading producers with aggressive expansion plans, so companies have to continue purchasing from Tongwei.

According to PVInfoLink, cells and modules sold in 2022 reached 38.93GW, a year-on-year growth of 57.61% and Tongwei maintained global number one for delivery of solar cells. Tongwei’s solar panels are best-in-class, continuous expansion allows Tongwei to lower cost and improve quality, further meeting the demand from downstream customers. This demonstrated Tongwei’s ability to expand and grow downstream as it strives for quality and quantity. By the end of this year, Tongwei will join the top 10 for wafer capacity and top 15 for module capacity, reflecting huge potential going forward.

On the R&D front, Tongwei continues to invest into the country’s green development strategy by focusing on the multiple processes of Aquaculture-Photovoltaic Integration projects. This innovation was created by combining its strength in agriculture and PV sectors by increasing the magnitude of key processes in these projects, catapulting it towards the status of a world-class clean energy operator. With greater developments, the economic benefits of these models will improve and drive transformations by making large contributions to the green development of China, giving Tongwei differentiated competitiveness which can help them secure more deals.

This upcoming competitive advantage has not been sufficiently priced in. For instance, its current P/E is 5.62 whereas LONGi Green P/E is 13.96, and it is priced more in line with pure-play polysilicon companies. Hence, shifting down the PV value chain to midstream operations will enhance Tongwei’s potential dominance in the entire PV value chain, increasing its profit margin as demand for PV modules grows and potentially become the leader in the module supplier market from 2025 onwards.

Figure 10: Tongwei’s annual capacity for solar cells. Source: PV Magazine

Thesis 3: China’s dual-circulation and self-sufficient policies will boost Tongwei’s agricultural segment

With China focusing on establishing a dual circulation and self-sufficient economy, the country sets its goals on improving social equality through boosting its domestic consumption and production. Thus, efforts by Tongwei to establish its presence in the agriculture industry will give the company a competitive advantage. China consumes close to 175m tonnes of animal feed every year and industrial farms are increasingly common. Following the upward recovery of ASF (Chinese production dropped by 55%) and the industrialisation of farms, the animal feed market in China is expected to grow with the projected growth rate at 4.06% CAGR. Additionally, with prices of grains such as soybeans (used for feedstock) increasing, China aims to solidify its domestic grain production to reduce dependence on imports going forward, which should stabilise input costs and margins for Tongwei.

Tongwei’s agricultural business model focuses on research, production and sales of aquatic feed, livestock, and poultry feed. According to Tongwei’s semi-annual report, total animal feed sales are up 49.31% y-o-y, contributed by 33.81% and 62.76% y-o-y increases in aquatic feed and livestock/poultry feed respectively. As compared to its competitors, Tongwei’s gross profit margin is one of the highest in the industry at 9.48% whilst New Hope Liuhe is 1.6% and Wens Foodstuff at -10.12% respectively.

Presently, the aquafeed market is seen to be the fastest growing segment with a growth rate of 10.4% CAGR. To capitalise on this growth, Tongwei has acquired Tiangbang’s aquafeed business. Tongwei is now the world’s leading aquatic feed manufacturer with aquatic feed being its core product and main profit driver in its agriculture and husbandry segment.

Additionally, Tongwei entered a 50% joint venture business with Danish fish feed manufacturer Biomar. The companies took over Haiwei, a Chinese fish feed manufacturer which was the market leader in Southern China. This will help Tongwei penetrate the China’s fish farming industry which farms nearly 30m tonnes of fish every year, the largest fish farming country in the world. Additionally, Tongwei has produced a premium quality ‘Kaikoule’ feed for fish fry, which greatly lowered the feed conversion ratio and enhanced their survival rate by over 25%, making it highly demanded by farmers. Tongwei’s long term plans for growth through acquisitions and joint-venture initiatives are effective for strengthening their competitive advantage, and well aligned with China’s own goals of prioritising domestic production and consumption.

Figure 11: Forecasted revenue in meat segments over time in China. Source: Statista

Key Catalysts

Being able to continue expanding capacity to keep up with demand and reduce costs to secure contracts consistently

The robust demand for green energy globally will provide a huge opportunity for the solar PV industry with a projected CAGR of 18.3% going forward. Furthermore, China is expecting to account for up to 95% of the global PV market, providing Tongwei with an extensive market to capture. High demand coupled with sufficient capacity will allow Tongwei to secure more future contracts and further propel their net profit, allowing them to accelerate the pace of their aggressive expansion plan and reduce their production cost.

Reopening and recovery of China economy leading to higher domestic consumption

With Covid-19 restriction being eased, domestic consumption is expected to gradually recover. This will increase the sales of the food-value-chain and Tongwei being a major player of the agriculture market will benefit substantially.

Despite the recent dip due to China’s Zero Covid-19 policy, China’s Consumer Confidence Index is expected to recover from the current level as the economy is expected to reopen. Consumers will be more optimistic about their financial situation and employment picks up. With higher consumer confidence, they tend to spend more which will benefit Tongwei’s agriculture business.

Furthermore, the reopening of China’s economy will lead to an increase in the industrial output in China. With increased industrial output, more energy is needed and will further accelerate the pace of the transition to green energy. Tongwei being the market leader in the solar PV value chain is in a very competitive position.

Financial Analysis

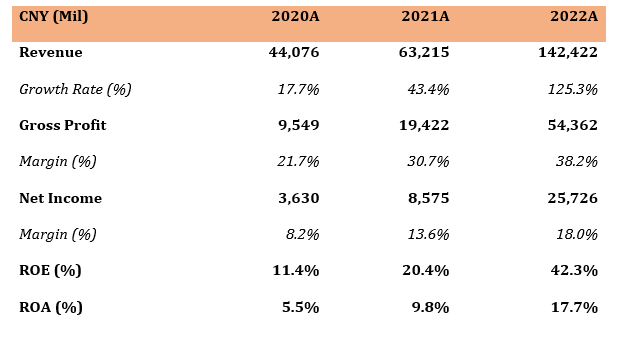

Revenue

FY2022 had a larger than usual revenue growth due to 6 contracts gained in upstream polysilicon and midstream solar cells and modules with its partners. Going forward, Tongwei is expected to continue outbidding pure-play polysilicon companies to secure more large-order contracts due to its leading capacity and lower costs. With polysilicon supplies, Tongwei will continue to secure contracts for solar cells and modules due to their cost advantage amid rising polysilicon prices. As for agriculture segment, feed sales will also have larger than usual revenue growth due to recovery from ASF. Going forward, growth is expected to moderate but stay strong.

Margins

Due to Tongwei’s rapid expansion in upstream polysilicon capacity, they have been able to raise GPM and NIM rapidly from FY2020 through FY2022. They will also be able to reduce costs of producing solar cells and modules which should continue to boost margins. For agriculture segment, we expect margins to be more stable as it is a more mature industry. Going forward, we view that it will maintain GPM and NIM albeit at a slower rate as production costs of polysilicon and solar cells/modules will eventually reach a terminal rate due to scientific reasons.

Returns

Going forward, we expect ROA and ROE to stabilise after rapid growth due to the small equity and asset base. Substantial retained earnings and capacity build up (CAPEX) should lead to increase in shareholder’s equity and assets, which will moderate the rapid rise in ROA and ROE.

Solvency Ratios

In FY2022, Tongwei had heavy financing activities, issuing CNY¥12b in convertible bonds. This is likely done to finance its future CAPEX and to lock in currently lower PBOC 1-year Loan Prime Rate as China engages in dovish monetary policy. However, Debt/Equity (D/E) ratio decreased from 0.72x in FY2021 to 0.52x in FY2022. This is due to the disproportional rise in retained earnings FY2022 and revenue is expected to continue to outrun their debt build up. In addition, after this round of debt raising, short-term debts declined almost 50% from FY2021 to 1H2022, signalling efforts to reduce debt.

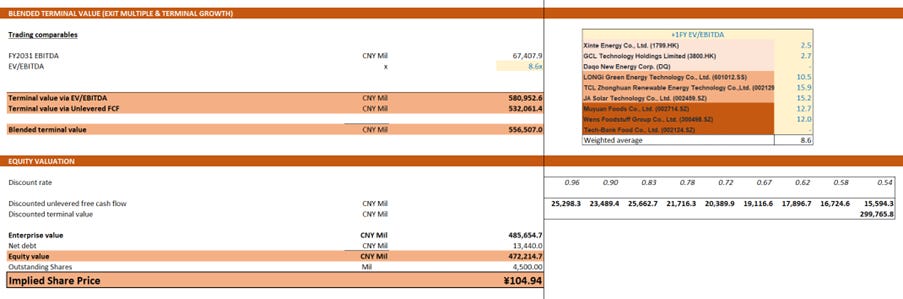

Valuation

Weighted Average Cost of Capital (WACC)

CAPM was used for cost of equity, with risk-free rate based off 10-year CGB yield, market risk premium of China from Damodaran, Beta was relevered using peers’ weighted average unlevered beta. For cost of debt, marginal debt cost was China 1-year LPR + spread, Tongwei FY2022 effective tax rate.

Revenue Model

For the PV business segment, Tongwei’s FY2023 is expected to increase by 8.2% y-o-y due to the high base effect from 2022 with the large-sized contracts obtained. Going forward, multiple midstream players such as LONGi and Jinko Solar is expected to continue to expand module capacity to meet the greater demand from both domestic infrastructure as well as overseas demand such as from Europe which seeks to replace Russia’s natural gas as well as due to rising prices.

However, global recession risks are rising throughout 2023 and we expect 2023 to face slowdown in economic growth globally, coupled with persistent inflation. This will translate to greater political pressure to increase fossil fuel output in the short-run at the expense of ESG risks and compliance to attempt to reduce cost-push inflation. This may also reduce feed demand globally as consumers demand will fall and cut back on spending due to inflation.

Meanwhile, long-term outlook is still bright, and continued strong growth is expected from Tongwei especially in the PV segment.

Cost Build

According to the thesis, costs of solar cells and modules in midstream should continue to fall. In FY2022, non-silicon cost of Passivated Emitter and Rear Cell (PERC) Cell fell by 20% y-o-y. Meanwhile, we expect polysilicon manufacturing costs to also be more efficient. In FY2022, power consumption fell by 13% y-o-y. These factors will contribute to a rise in GPM for Tongwei from 30.7% in FY2021 to 35.0% in FY2022, but moderation is foreseeable going forward.

Price Target: ¥104.94

The target price was derived from the base case scenario in the Discounted cash flow (DCF) valuation. FCFF was achieved by blending the EV/EBITDA exit multiple approach and terminal growth rate approach.

Risks

R1 – Political motivation to keep inflation low by ramping up output of fossil fuels

The high inflation from goods and services have led to some countries such as China to step up traditional energy sources like coal, which can affect Tongwei in the short run. However, long-run transition to renewable energy will benefit Tongwei in the longer run.

R2 - Political Risk: Government intervention

US-China tension and Chinese government’s control over prices and sourcing of polysilicon may affect Tongwei’s revenue. However, demand in the long run will stay resilient as China controls the majority of polysilicon resources and processing capabilities.

R3 - Investment Risk: Resurgence of diseases

This may result in disruption of food and agriculture value chain, labour shortages due to restriction on movements and the production of staple crops. As the risk of Covid-19 remains, Tongwei could only try to take the necessary pandemic protection measures accordingly.

ESG Evaluation

Environment

Tongwei is dedicated to the development of low carbon emission products. Firstly, through extensive technological innovations such as the aquaculture-photovoltaic integration, a green driver that provides clean and high quality power is created. Additionally, the company uses its own high-purity silicon in the construction and operation of PV plants which cuts carbon emissions by 50m tons. Furthermore, the company reduces its greenhouse gas emissions through green electricity certificate trading, attaining product carbon footprint and green factory certifications. It continuously pushes to be the pioneer in setting industry standards and forming best practices. An example of this is the “Booster” that was unveiled in COP26, an innovation in the production process of high-purity silicon production process minimising carbon emission. Tongwei allocated a proportion of resources to ensure proper environmental mitigation is put in place.

Due to its position in the agriculture industry, Tongwei’s performance is susceptible to negative environmental impact on corn and soybean yield, which could disrupt the supply for feed production. As such, there are environmental risks absorbed by Tongwei due to its presence in the agriculture industry.

Social

The company has partnered with nearly 30 local universities and research institutes to provide business education, form fruitful partnerships and brainstorm high-level technological achievements. Tongwei also has extensive volunteering efforts with 70 employees clocking in a total of 140 hours.

With employee health and safety being paramount in its industry, Tongwei spends considerable resources towards employee development and even has its own Tongwei learning centre to upskill its employees. It puts great effort to protect its employees’ rights and consider their interests whilst also putting in time towards employee safety training and drills. For the year 2021, Tongwei dedicated 84,546.5 hours towards work safety training for 182,455 of its employees. The company was able to achieve four zero targets (ie- zero accidents, zero work injuries, zero wrong operations and zero unplanned downtime). It was given a high rating by the Ministry of Emergency Management following a work safety audit.

Governance

The Company attaches high importance to the development of an anti-corruption workplace

by providing anti-corruption training to enhance employee awareness in this regard. Additionally, 31 full-time employees have been given anti-corruption roles in order to curb the corruption risk among employees.

Tongwei advocates clear two-way communication with investors through the creation of Tongwei Information Disclosure Management Procedures, a total of 105 announcements were made. Shanghai Stock Exchange rated Tongwei grade A for information disclosure between 2020 to 2021. On the internal management, an Insider Register was formed to monitor inside information management, resulting in the prevention of insider trading and illegal acquisition.

With regard to ESG matters, Tongwei has put in place three working groups that will be in charge of different functions under the Energy Management Committee. Tongwei’s Sustainable Development Management Group is responsible for information disclosure, execution and implementation of ESG initiatives.

Tongwei has put emphasis on ensuring that both genders are well represented in its company. As of 2021, Tongwei had 32,224 employees worldwide with 73.2% males and 26.8% female employees. This is an improvement from the previous reporting year which saw only 25.6% of female employees in its total workforce. However, Tongwei still falls behind ILO standards on gender equality at work which indicates a need for improvement on this front.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.