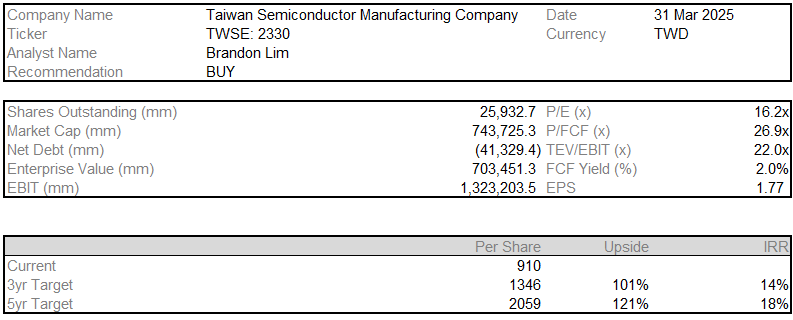

Initial Report: TSMC (TPE:2330), 121% 5-yr Potential Upside (Brandon LIM, SC VIP)

Brandon LIM presents a "BUY" recommendation for TSMC based on the company's established dominance allowing it to benefit from structural tailwinds and current fearful conditions leading to mispricing.

12M Target Price: TWD 1,369.61

Upside: +50.5%

I am initiating coverage on Taiwan Semiconductor Manufacturing company (TWSE: 2330) with a BUY recommendation based on a 12-month target price of TWD 1,369.61 implying a 50.5% upside from the current market price. This target price is derived from a blended average of my discounted cash flow and relative valuation analysis.

A Mission Essential Company

I think not many realize the importance of semiconductors in our lives, and how our lives are very much in the hands of a few semiconductor players. The term semiconductors may feel very abstract but think of them as merely tiny chips that power all your devices (basically like engines to your car). Semiconductors power the entire digital economy and therein lies TSMC, central to the entire value chain.

Founded in 1987 by Morris Chang, TSMC is the world’s largest semiconductor foundry/fab (semiconductor fabrication plant), accounting for 28% of global semiconductor market. Headquartered in Hsinchu, Taiwan, TSMC is known as the first pure-play foundry that exclusively focuses on manufacturing semiconductors according to the integrated circuit designs provided by its customers. This unique business model, as you would come to realize later, is a key reason that built TSMC’s moat in the industry.

I quote Morris,” I had been in the semiconductor business for three decades before I came to Taiwan. And I learned at close quarters how competitive the industry was, and how good some of the players were—companies like Intel, Texas Instruments. Even then the Japanese companies were very fierce also. I knew how competitive it was, and how difficult it would be to carve out a niche for a new Taiwan company. So that was the second thread of thought. The third thread of thought was I paused to try to examine what we have got in Taiwan. And my conclusion was that [we had] very little. What strengths have we got? The conclusion was very little. We had no strength in research and development, or very little anyway. We had no strength in circuit design, IC product design. We had little strength in sales and marketing, and we had almost no strength in intellectual property. The only possible strength that Taiwan had, and even that was a potential one, not an obvious one, was semiconductor manufacturing, wafer manufacturing. And so what kind of company would you create to fit that strength and avoid all the other weaknesses? The answer was pure-play foundry.”

Such a move showed how sharp Morris was to the industry landscape, which was a key driver for TSMC’s secular success. As a pure-play foundry, TSMC is uniquely positioned such that they do not compete with other players in the industry. They simply focus on honing their craft in refining leading edge nodes to manufacture tailored semiconductors for their customers.

TSMC manufactures products for 528 customers. Notably, their leading customers make up a significant portion of their revenue. Apple alone makes up ~25% of its revenue and its top 10 customers accounted for ~70% of its revenue. TSMC’s product segment is split across 6 business segments: High Performance Computing (HPC), Smartphone, Internet of Things, Automotive, Digital Consumer Electronics and Others. As of 4Q24, these categories represent 53%, 35%, 5%, 4%, 1% and 2% of net revenues respectively

The Semiconductor Value Chain

So before we dive into why TSMC is best-in-class and so uniquely positioned, allow me to explain the semiconductor value chain briefly. If you would like to skip ahead, you could but the important terms to familiarize with before moving on to the subsequent section is (explained in simple English):

Transistors: Tiny electrical switches inside a chip, the basic building blocks of computer processing

Integrated Circuits: Chips with millions of transistors

Wafer: A thin slice of silicon in which many integrated circuits (chips) are fabricated

Yields: The percentage of good, working chips produced from a silicon wafer

Node: Generation of chip-making technology, measured in nanometers – basically the instruction manual the determines the size of your chip components

Moore’s Law: The number of transistors on a microchip doubles roughly every two years (companies aim to follow this law to push their progress, Moore’s Law acts as a predictable roadmap for the future of technology)

Figure 1: Semiconductor Wafer

Source: Wafer World

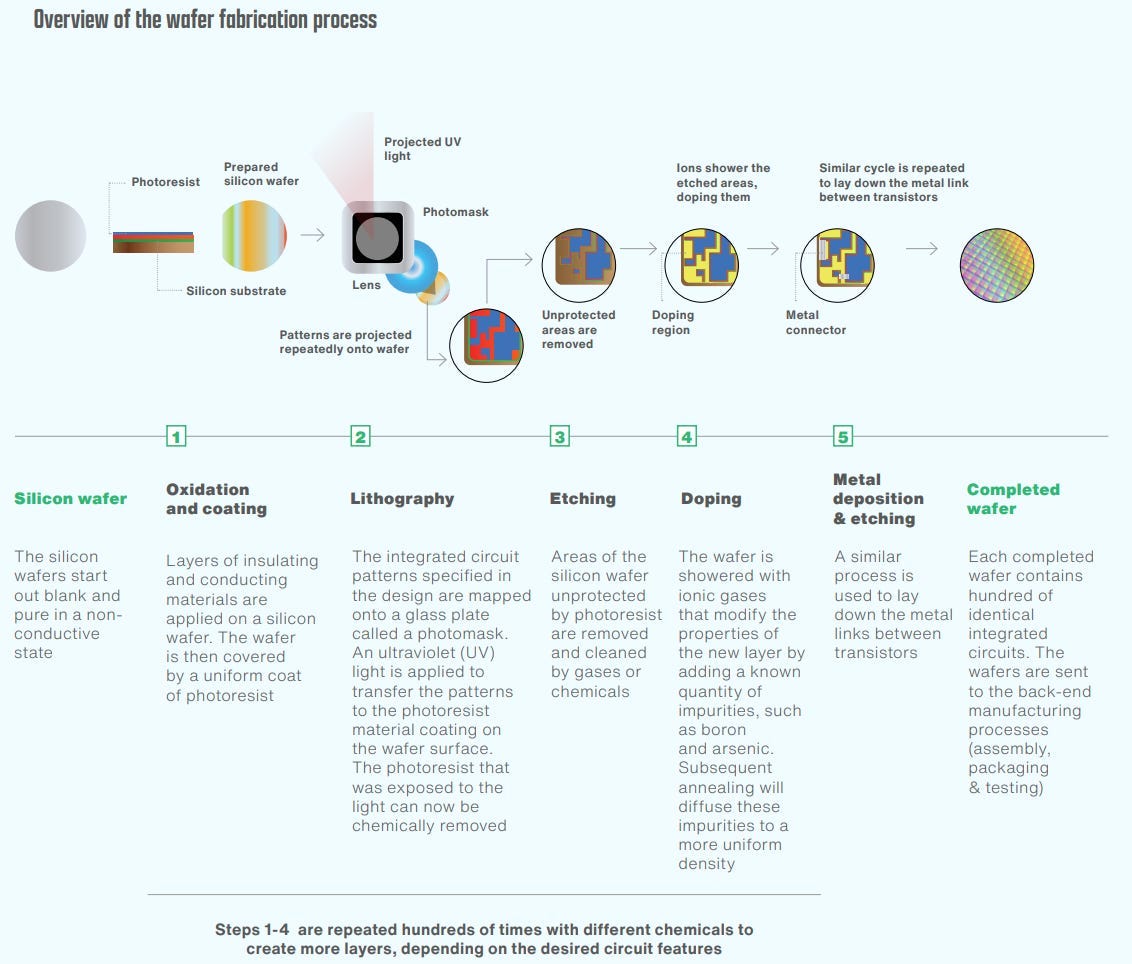

TSMC specializes in wafer manufacturing. The flowchart below shows a brief overview of the steps of wafer manufacturing. I am no semiconductor expert and would not explain the technical steps in full detail but TSMC basically oversees the entire manufacturing process apart from the production of raw wafers.

Figure 2: Wafer Manufacturing Process

Source: Worldly Partners, TSMC Multi-Decade Study

The complicated value chain of semiconductors can result in a way longer memo. If you would like to dive deeper, do refer to Appendix 1. Anyway, I can briefly summarize the industry outlook in a few sentences.

(1) There is an insatiable demand for leading-edge chips and semiconductor demand is in a secular uptrend. (2) It is more expensive to produce leading edge chips, as a result...

(3) the number of companies producing these chips has drastically consolidated over the years

(4) TSMC holds a dominant oligopolistic position in the value chain, with other foundry players even relying on them for leading edge processes.

The world can never get enough of leading-edge chips and TSMC is right in the middle of it. Currently, the long-term semiconductor demand is driven by the large, nascent trend of 5G and HPC-related applications. This demand is placing immense pressure on foundries like TSMC, whose advanced chips are crucial components in products from major customers such as Apple, Nvidia, AMD, and Qualcomm. Apple's A-series and M-series chips, powering iPhones and MacBooks, rely on TSMC's advanced 3nm and 5nm process nodes, as do Nvidia's GPUs, the workhorses of AI and data centers, which are also increasingly utilizing TSMC's 5nm technology and are expected to move to 3nm. Similarly, AMD's CPUs and GPUs, used in servers and gaming, and Qualcomm's Snapdragon processors for mobile devices all leverage TSMC's advanced manufacturing, including 5nm and increasingly 3nm processes.

There are two main types of business models seen in the industry – Integrated Device Manufacturers (IDMs) and Fabless semiconductor companies. IDMs design and manufacture their chips while fabless companies design and outsource manufacturing to foundries (like TSMC). We see a shift towards the foundry model as…

It is more expensive to produce leading edge chips

Figure 3: Design Cost of Leading-Edge Nodes ($ million)

Source: IBS

As chips become more complex to cope with the demand for faster processes and computational power (so that Apple can always claim their next AXX bionic chip is the fastest in the market), the manufacturing processes also become increasingly expensive. Companies prefer to outsource manufacturing to reduce capex burdens and focus on design.

Figure 4: Why Companies Prefer the Fabless Model

Source: TSMC

As a result, the industry is going through massive consolidation

Figure 5: Consolidating Industry, decreasing number of players at each process node

Source: BofA

So yes, because it is so expensive to manufacture leading-edge chips, the effects are two-fold.

Companies are increasingly adopting a fabless model in which they do not produce these chips but outsource production to a manufacturer like TSMC. An example would be NVIDIA outsourcing its GPUs and Apple using TSMC’s 3nm chips for its latest iPhones.

The industry is consolidating into the hands of a few players. While 26 players manufactured leading edge chips in 2002, this number has dwindled to the remaining 3 firms: TSMC, Samsung and Intel. Frankly, TSMC and Samsung are the only two options for fabless semiconductors to produce chips at the leading edge as Intel produces them internally.

TSMC is miles above their competitors in the leading edge

TSMC’s only competitors in the leading edge are Intel and Samsung. TSMC is way ahead of its competitors having launched its 3nm node in 2023, with plans to begin volume production of their 2nm node in the second half of 2025. Meanwhile, Intel is struggling to catch up as most of their flagship chips are still produced at the 7nm node, with the company reportedly set to outsource their 3nm chips to TSMC.

Additionally, TSMC’s yields are far better than Samsung. By Q3 2024, TSMC’s 3nm process reportedly achieved a yield rate of 90% while Samsung struggles with lower yields at 50-60% for their first generation 3nm chips and 20% for their second-generation processes. Samsung is also reportedly considering outsourcing its processors to TSMC.

At this point you may be wondering how TSMC is so far ahead of its peers. This can be summarized by (1) First mover in identifying the gaps of the market (2) Management’s customer-first philosophy and (3) Prioritizing and investing in talent. I will elaborate on these in Appendix 2 if you would like to find out more.

Investment Theses

I have 3 core theses on TSMC, (1) the company's established dominance (2) allowing it to benefit from structural tailwinds. Furthermore, (3) the market's mispricing due to current fearful conditions serve as a compelling opportunity for entry.

TSMC is best-in-class: TSMC is dominant in an oligopolistic market. Being an essential player in the semiconductor value chain, TSMC is able to not only scale its topline massively but also leverage on its dominant position for increasing margins. In the foundry market, TSMC commands a dominant 64% market share based on total revenues.

Figure 6: TSMC's Dominant Market Share in the Foundry Industry

Source: Company Filings

I believe:

There is no better alternative for customers. As aforementioned, it is difficult to manufacture leading edge chips. With TSMC’s dominance far ahead of its competitors, we see customer loyalty and stickiness as TSMC’s 9 out of 15 top customers have stayed since 2000. TSMC is also essential in the value chain, serving 528 customers and manufacturing 11,895 products across a wide range of applications.

As TSMC is best in class, I expect to see a greater increase in ASP of their chips stemming from their high bargaining power in the market allowing for inelastic demand as TSMC has pricing power. Reportedly, their 3nm wafers can go up to $20,000 with their 2nm wafers expected to sell at $30,000. Hence, I projected a moderate uplift in wafer ASP with larger growth in the next two years given the high-volume manufacturing of 5nm and 3nm processes. The 2nm process is similarly expected to enter volume production in the second half of 2025. Conservatively, I assumed low growth in wafer prices in 2028 and 2029 due to maturity of older nodes and the uncertainty in predicting the roll out of 2nm and 1.4nm processes.

Figure 7: Blended Wafer ASP Projections and Estimates

Source: My Estimates, Company Filings, Tom's Hardware

Leading edge demand has never been stronger, TSMC is set to leverage on structural industry tailwinds with most of their leading edge entering high volume manufacturing. There are several potential near-term catalysts signalling the demand ahead.

Increasing AI Capex driving demand for the leading-edge. In the recent GTC 2025, Jensen (Nvidia) announced that computing is at an inflection point. He forecasts a US$1Tn AI Capex on Data Centres in 2028 (an ambitious target!), signalling an exponential demand in AI infrastructure.

Figure 8: GTC 2025, Jensen's Bullish Projections

Source: Nvidia GTC 2025

Similarly, cloud computing remains a high growth segment with its TAM outpacing enterprise data centres (basically high-performance computing which drives demand for the advanced nodes that TSMC manufactures). This reflects the industry’s growing investment in the sector which is why I believe that while it is hard to predict how lofty of a target this is, the base case persists that we still have at least a few years of sustained AI growth before we reach a certain peak.

LHS Figure 8: Cloud vs Enterprise Data Center Infrastructure TAM

RHS Figure 9: Market Segments and their Current Cycle Trend

Source: BofA, Chip Stock Investor

The race for the leading edge causes the need for countries to manufacture chips domestically. The US CHIPS Act is one of the initiatives targeted at catalysing this demand. Currently, the US CHIPS ACT has already brought about up to US$6.6Bn in proposed funding to build a third fab at TSMC Arizona. More recently, TSMC has committed to building five new factories in the US, announcing its intention to expand its investment in semiconductor manufacturing in the USA by an additional $100Bn. With the first Arizona fab already in volume production as well as the second fab targeted to finish in 2H26 (management forecasts), TSMC is far ahead of its peers in manufacturing the leading edge.

Nvidia's breakthrough in its computational lithography platform - CuLitho brings forth COGS savings, and yield enhancements in the leading edge. As if TSMC’s gross margins and yields are not already industry leading compared to their peers, Nvidia’s breakthrough in their computational lithography platform (cuLitho) will significantly accelerate chip fabrication. A brief overview on what computational lithography is – a highly complex and time-consuming stage that uses algorithms to generate the patterns which will be etched (printed) on the chips. CuLitho basically reduces the time needed to generate these patterns, reportedly speeding up the process by 40x. To visualize this impact on the flowchart, cuLitho improves the efficiency of stage 2 and 3. For TSMC, adopting cuLitho would drive (1) R&D expenses down as R&D teams can iterate on new design rules and process technologies much quickly and (2) improve yields as cuLitho ensures more precise and optimized photomask designs, reducing manufacturing defects. Hence, I have projected a 0.2% and 0.5% reduction of R&D and COGS as a % of revenue in the years of 2nm production.

Figure 10: Detailed Wafer Fabrication Process

Source: MBI Deep Dives, WhiteHouseReport

Market Mispricing amidst Strong Secular Outlook Presents an Opportunity. So if TSMC is such a market leader, you may ask why has the stock dropped 10% for the month and 15% YTD (as of the time of writing)? Well, I believe that the market is significantly underestimating TSMC’s growth potential as (1) while Deepseek shook the AI market, it is merely a red herring and (2) Geopolitical Concerns, while valid, are overblown.

Deepseek Worries - Overreaction in the short-term but merely a red herring. AI-linked stocks suffered a crash following the news of Deepseek back in January as claims of developing powerful AI models at a fraction of the current cost triggered a selloff. Investors were wary of potential budget cuts in AI which could translate to lower demand for high-end semiconductor chips – particularly those manufactured by TSMC. However, such fears are overblown, as while shocking in the short term, the long-term trend remains unaffected. Having read industry reports on Deepseek, there are a few salient factors that allow me to have conviction that this secular demand for semiconductors is largely unaffected.

Despite DeepSeek’s advancements, semiconductor investment plans are not expected to change immediately. Feedback from industry sources suggest that the current GPU buildout plans remain unaffected from Meta’s increasing GPU demand to Microsoft’s capex plans. I believe the industry was already aware of the possibility of Deepseek’s progress.

Lower training compute requirements driven by advancements like DeepSeek’s is not expected to significantly impact long-term growth in GPU demand. Historically, algorithmic improvements and lower costs tend to accelerate usage across the industry and consequently, increase overall demand. DeepSeek’s advancements could lead to more AI applications and broader adoption, increasing the demand for TSMC’s services.

Overblown Geopolitical worries. While I shall not discuss the risk of China invading Taiwan in this section (perhaps explained under the risks segment), I acknowledge the threat of US-China relations acting has headwinds that TSMC must navigate. Notably, Trump tariffs have been notoriously causing the rise of investor caution as TSMC is no exception as Trump’s “made in America” mandate comes into effect. However, TSMC’s decision to invest US$100bn in Arizona aligns with Trump’s mandate, possibly shielding the company slightly from tariffs. Furthermore, although Trump poses export restrictions to China in order to curb their access to leading edge chips, China only accounts for 10% of TSMC’s net revenue, limiting this downside.

Financial Analysis and Valuation

I calculated a price target of 1,369.61, implying a 50.5% upside from the current price, derived using a blended average of intrinsic valuation (DCF) and relative valuation (comparables). I assigned a higher weightage to DCF considering the vastly different market capitalization of TSMC ahead of its competitors.

Revenue Build: I segmented TSMC’s overall revenue into their different process node technologies from 1.4nm to >16nm. Industry estimates of each process node’s average selling price (ASP) were used to derive the implied quantity of nodes sold. I further tapered the quantity and ASPs of older nodes over time while adjusting the growth for newer process nodes to account for the increase in demand for the latest leading-edge technologies. Overall, I believe my 5Y revenue CAGR of 23% is fair and conservative given that it is slightly below the 25% historical 5Y CAGR.

Gross Margins: TSMC has seen an increase in gross margins from 46% in 2019 to 56% in 2024. This is mainly driven by strong pricing power in their advanced nodes and high-capacity utilization of their fabs. Management has guided a 57-59% gross margin for the 1Q25, with a long-term target of 53%, citing uncertainty in the macro environment. In this aspect, I remain more bullish than management given their track record of beating gross margin estimates as they initially guided 52-54% for 2024. While management has cited a 1-2% dilution in gross margins because of their overseas fab and how they do not want to raise exorbitant prices for their customers, I remain convinced that they are able to maintain a 58-60% gross margins from 2025-2029.

Figure 11: TSMC's Gross Margins Fares Well Among Peers (LTM GM)

Source: Company Filings, CapitalIQ

CAPEX: Management has guided USD 38-42 billion of which 70-80% will be invested in advanced process technologies, 10-20% will be used for specialty technologies (mature nodes with specific applications) and 10-20% will be on advanced packaging, testing and other areas. I have projected Capex in line with management and forecasted at 33% of revenues.

WACC: The cost of equity of 8.95% was calculated using the CAPM method. To derive a suitable risk free rate, I used a weighted average of each region’s risk-free rate according to their weight in TSMC’s revenues and an adjusted levered beta of 0.97. Taiwan’s equity risk premium was calculated using Damodaran’s country risk premium of 5.48%. Along with an after-tax cost of debt of 3.49%, I obtained a WACC of 8.76%.

Relative Valuation: I benchmarked TSMC with comparable companies in the semiconductor industry. To ensure consistency, I categorized these companies into two tiers based on the similarity of their business models with Tier 1 being foundries (Global Foundries, United Microelectronics Corporation, SMIC) and Tier 2 being Integrated Device Manufacturers (IDMs) (Samsung, Texas Instruments, Intel). Despite TSMC’s market leadership, I have been conservative in using median equally blended NTM EV/EBITDA of 8.36x and P/E ratio of 25.6x, with the blended average still resulting in an upside.

Figure 12: TSMC Trades at or Below its Peers

Source: Company Filings, CapitalIQ, My Analysis

Final Target Price: Along with a blended average of Gordon Growth and Exit Multiple DCF, I arrived at a target price of TWD 1,369.61 implying a 50.5% upside from the current price. I assigned a slightly higher weightage to DCF (60%) given the lack of good comparables in an oligopolistic foundry market and TSMC’s significantly larger market cap to its peers.

Risks

Of course with any business, no matter its dominance comes key risks. There are two key risks to look out for (1) the black swan event of China invading Taiwan and (2) The semiconductor downturn.

China invasion of Taiwan: Of course, this issue has been on everyone’s mind the past few decades as China has always expressed its desire for reunification of Taiwan. Should China invade Taiwan and take over TSMC’s IP, the most cutting-edge technologies (which are in Taiwan currently) would fall into the hands of China. There are a few mitigations to this namely (1) TSMC is diversifying away from Taiwan with more overseas fabs in US, Japan and Germany and (2) it is reported that TSMC has a way to disable their IP and manufacturing capabilities in the event of Chinese invasion. Ultimately, I recognize that there is no real mitigation against a black swan event like a hostile reunification, but I believe that there are more pressing issues we have to deal with if such an event were to happen.

Semiconductor downturn, lower than expected AI infrastructure spending: The market has seen a surge in share prices for all AI stocks and the AI boom seems to be never-ending. Given the nascent nature of AI infrastructure and high-performance computing, we have been cognizant that a slowdown is bound to occur. Well as I have mentioned, capex in the industry is still healthy, with further runway for growth in the foreseeable future. Perhaps if you asked me if TSMC is worth an entry two years later…maybe my answer would be different depending on the climate.

Concluding Thoughts

TSMC is a remarkable example of a company which has trailblazed an entirely new segment and disrupted the market. Morris’ founding story of TSMC is nothing short of amazing and you should definitely check out his podcasts linked in the references below.

Finally, if I were to tell you that there was a business out there which

is dominating an oligopolistic market with products so good that its competitors have to rely on them

is set to benefit greatly from the secular AI boom with its essential mission services and

is at an attractive with further runway for growth, wouldn’t you want to invest in it?

And that business is none other than TSMC.

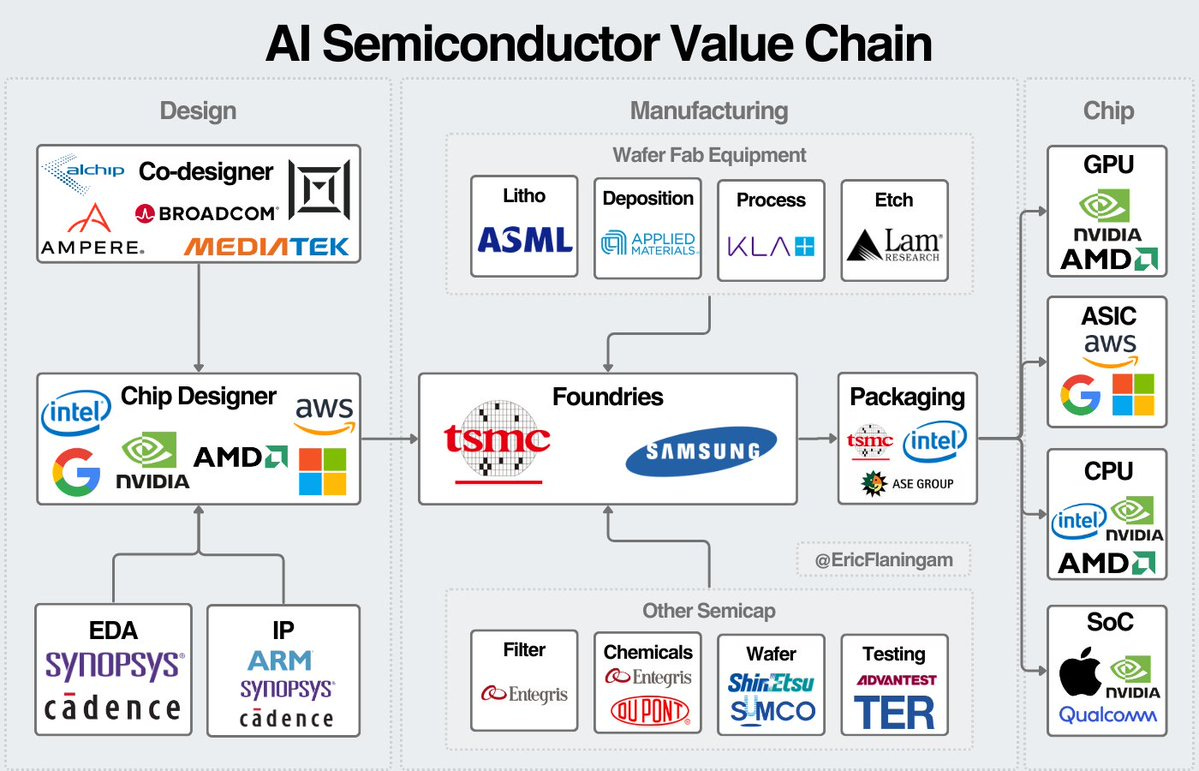

Appendix 1: Semiconductor Value Chain

Here’s the brief bigger picture of the whole value chain (upsteam, downstream what not as a wise man once emphasized to me). Disclaimer: I am not a semiconductor expert.

So, yes you can see TSMC is literally central to the entire process.

Appendix 2: What makes TSMC different

More on the quality of TSMC as a business and its management:

First mover in identifying the gaps of the market – as aforementioned, TSMC is the first to adopt a pure-play foundry model

Management’s customer-first philosophy: TSMC has built strong partnerships with its customers by adhering to its business philosophy of being a dedicated foundry and prioritizing customer feedback. To strengthen relationships with top customers and better understand their needs, Morris Chang visited the company's top customers at least once a year, and sometimes even more frequently.

Prioritizing and investing in talent: When TSMC started out, Taiwan had a huge supply of quality engineers, technicians and operators. I once asked my Taiwanese friend on what the locals thought of TSMC, and he remarked that it is highly respected to work at TSMC and the company is quite literally the pride of Taiwan – even having posters at a convenience store. Additionally, TSMC does not lay off employees to cut costs, even during industry downturns. The company views layoffs as a costly decision, not only due to severance packages but also because of the high costs associated with retraining new employees in the future. TSMC also continues to invest in research and development during downturns, recognizing these periods as opportunities to acquire top talent, as competitors often reduce hiring.

References:

Morris Chang Acquired Podcast: https://www.acquired.fm/episodes/tsmc-founder-morris-chang

TSMC Multi-Decade Study: https://worldlypartners.com/businesshistory/

NZS Semiconductor Whitepaper: https://www.nzscapital.com/news/semiconductors

Oral Interview with Morris Chang: https://www.semi.org/en/Oral-History-Interview-Morris-Chang

TSMC MIT Speech:

TSMC’s Customer Mix: https://www-statista-com.libproxy1.nus.edu.sg/statistics/1247996/tsmc-revenue-share-of-leading-customers/

MBI Deep Dives Semiconductor Primer: https://www.mbi-deepdives.com/semiconductors-to-see-a-world-in-a-grain-of-sand/

MBI Deep Dives TSMC: https://www.mbi-deepdives.com/tsm/

TSMC Annual Reports

Bloomberg, BofA Semiconductor Primer

Higher ASP as leading edge nodes progress: https://www.tomshardware.com/tech-industry/newer-chips-are-rapidly-becoming-far-more-expensive-tsmcs-average-wafer-price-jumped-22-in-one-year-and-nearly-all-semiconductor-industry-growth-now-comes-from-more-expensive-products

TSMC, Nvidia cuLitho: https://nvidianews.nvidia.com/news/nvidia-asml-tsmc-and-synopsys-set-foundation-for-next-generation-chip-manufacturing

Great job here.

Like to add that the core of a foundry business is trust and no one has done this better than TSMC has.

Trust that TSMC will not compete with you as Samsung did with Apple for the smartphone. Trust that TSMC will deliver on execution as Dr. Morris Chang always emphasized on promising what they can deliver. Trust that TSMC will not share your design with your competitor.