Initial Report: Tuhu Car Inc (HKG: 9690), 83% 5yr Potential Upside (EIP, Louis TEE)

Louis presents a "BUY" recommendation based on its strong expansion, margin growth, and cost efficiency, leveraging China's consumption trends.

LinkedIn: Louis Tee 郑俊杰

Why invest in Tuhu now?

Tuhu is a net benefitor of the China consumption downgrade trend due to its private-label and exclusive products offered at competitive pricing but high GPM.

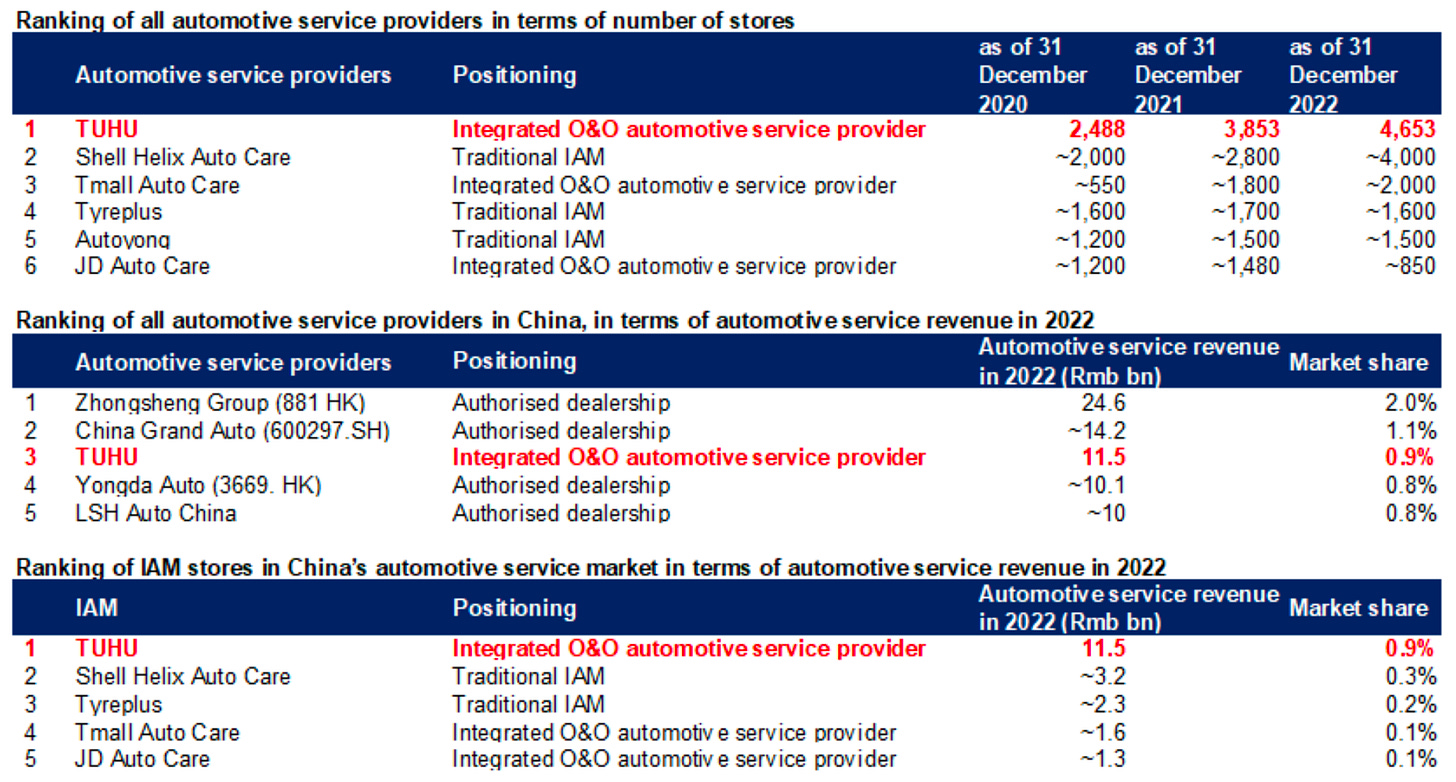

Tuhu Car Inc. (9690.HK) is China’s largest independent automotive aftermarket (IAM) provider by revenue with 0.9% revenue share in 2022, higher than No.2-5 IAMs combined. Having started as an O2O (Online-to-Offline) tire replacement platform in 2011, Tuhu has grown to become the largest integrated online and offline auto service platform in China, connecting 18mn annual transacting users to 5.1k+ Tuhu workshops/20k partner stores as of Jun.

Tuhu is a B2C company focused on solving consumer pain points including information asymmetry on pricing, quality, transparency and standardization, and leverages internet/software to acquire users and monitor offline stores nationwide.

Business Segments & Revenue Drivers

Revenue & Gross Profit breakdown by segment

Channel revenue breakdown

Company's interests categorized by online/offline/franchisees

Over 80% of gross profit comes from products and services, from supply chain, while franchise and management fees are almost pure profit, albeit not large in scale.

Tuhu has been focusing on its franchising business model while having strong control of the quality of workshops and capacities. This is different from its peers where they have notably decelerated franchised/partner store expansions over recent years.

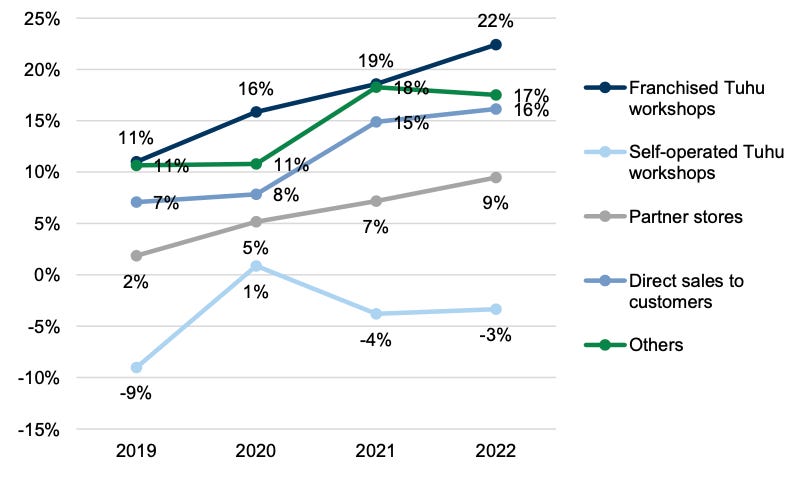

Store-type Revenue breakdown

Store-type Gross Profit Margin breakdown

Tuhu's franchise model

Franchisees: of Tuhu are mainly automotive service providers and investors in the industry.

Capital investments: to open a Tuhu workshop is ~ RMB 650k, which includes upfront franchise fees (~RMB 100k), fixtures , equipment (~RMB 150k), decorations (~RMB 150k), annual rental costs (~RMB 200k) and other expenses. Tuhu grants its franchisees access to online traffic, with online orders contributing to >70% of total revenues from individuals.

Payback period: is about 2-3 years. In lower-tier cities, the payback period could be much faster.

Profitability: It requires at least 5-6 months for a franchised Tuhu workshop to reach operational breakeven, vs 15-18 months for a self operated Tuhu workshop due to high initial capital investments & operational costs.

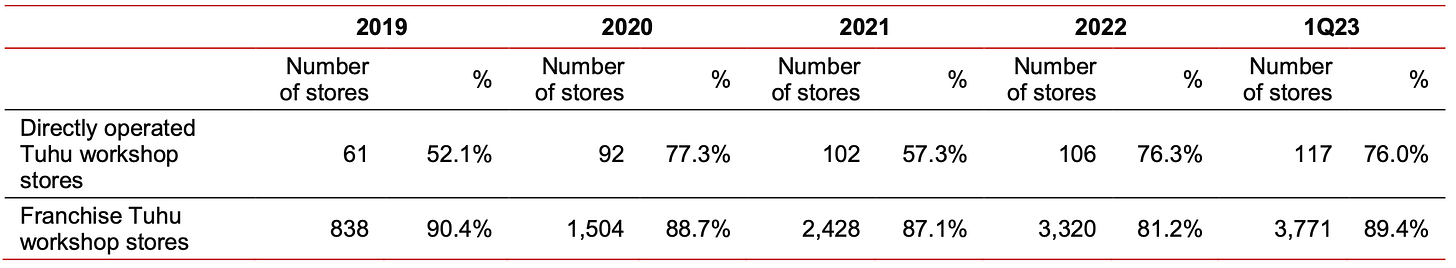

As of March 2023, 89% of franchised Tuhu workshops with >6 months of operations were profitable, and 87%/81% in 2021/2022.

Revenues and profits from Franchisees to Tuhu:

Upfront franchise fees of ~RMB 100-400k for a 3-year franchise agreement

Monthly fixed management fees of ~RMB 4.7k

Recurring profit-based royalty fees based on 10% of operating profits of franchised stores.

The revenues from franchisees accounted for 3.4%/4.0%/4.8% in 2020/2021/2022 and 5%+ in 1H2023 of Tuhu's overall revenues.

Store count and outlook

Tuhu had 2.3k franchisees as of 1Q2020, with franchisees opening ~2x workshops, and 40% opening 2 or more workshops.

The number of franchisees is expected to increase to 4.1k by 2026E, driven by business development and offline store support by Tuhu.

Industry & Competitor Analysis

Passenger Vehicles Growth Trajectory

Strong vehicle ownership growth in China

The market for passenger vehicle ownership is about RMB 1.42 trn (~USD 200 bn) in 2023, with a CAGR of 4.7% over the next 4 years.

Business segment breakdown in 2023 based on market size:

Maintenance/repair and care: RMB 820 bn

Bodywork painting: RMB 280 bn

Beauty and washing: RMB 310 b

There is strong growth potential for China passenger vehicles, with an expected scale of 427mn units by 2030. Ownership of fuel vehicles will continue to grow over the next 4 years, reaching 427mn in 2027. After 2027, the ownership of fuel vehicles should remain high with 311mn units by 2030.

Passenger Vehicle Ownership Growth (ICE, Hybrid, EV) (100m units)

Annual repair & care costs for different price ranges of fuel vehicles vs new energy vehicles (RMB)

Ageing vehicles over time in China, driving demand

The passenger car population in China grew at 13% CAGR over the past 10 years, and the average vehicle age of passenger cars reached 6.2 years in 2022, and expected to reach 8 years by 2027E, driving higher demand for automotive services. Meanwhile, in the US, the average vehicle age of passenger cars was 12.2 years in 2022.

Vehicle ownership per person in China presents an upside potential

China's passenger car ownership per person remains low at 194 per 1000 persons in 2022, while US is 769 per 1000 persons.

Competitive Landscape

Fragmented automotive service market in China

The automotive service market is highly fragmented in China. With 680k automotive service providers, the top 5 players accounts for only ~5.6% GMV share. Market players can be categorized into 2 categories:

Authorized dealership stores, IAM providers (including O&O platforms/eCommerce), traditional IAMs, upstream suppliers

Automotive OEMs, especially NEV players such as Tesla or NiO

Rise of the O2O automotive service model in China

IAMs have been gaining share from authorized dealership stores over the past few years and accounted for 46% of overall GMV share, with this trend expected to continue over the next few years.

Traditionally, consumers would either choose 4S/authorized dealerships or IAMs for automotive services such as maintenance and repair. As the warranty period from OEMs normally covers 3 years, car owners usually go to authorized dealerships during the warranty period. After the warranty period, car owners may choose to stick with authorized dealerships, which tend to provide better services from trained and qualified technicians at higher prices, or otherwise resort to IAMs due to more convenient locations and affordable services, as per CIC.

In response to consumer demand for more standardized service, reasonable pricing, and omni-channel services, the integrated O2O automotive service model combines the best of both the online platforms and offline stores to deliver service to car owners, as per CIC.

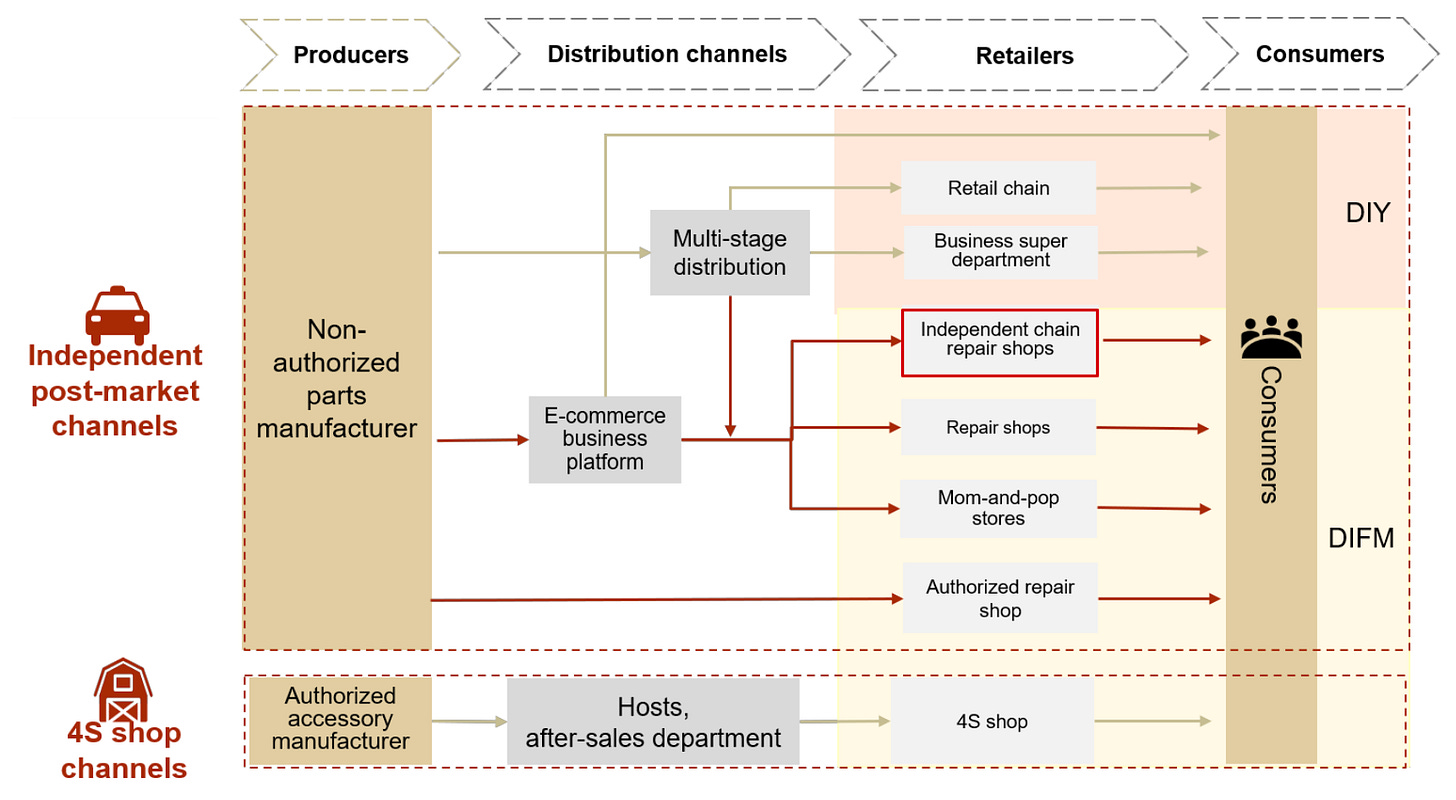

Distribution Channels for autoparts

(DIY = Do it yourself, DIFM = Do it for me (which means professional stores will provide car repair services)

Key players in O&O automotive service include these top 3 companies: Tuhu, Tmall Auto Care and JD Auto Care, which provides online matching and ordering of auto parts and perform service in nearby offline stores. The leading O&O automotive service platforms are set for market consolidation in the industry in the mid term, thanks to their stronger brand awareness among young consumers, scale advantages in front of upstream suppliers, and more standardized operations and higher operating efficiency than individual IAM stores.

Intense price competition but limited impact on Tuhu

There exists intense price competition from other O2O players and especially from JD Auto Care.

JD Auto Care has 1.4k stores and 30k+ 3rd party connected stores. It announced a price reduction program in Sept 2023 where their product prices are cut to 5% lower than peers. However, this impact on Tuhu is limited because:

Majority of Tuhu's revenues and GP is contributed by private label/exclusive products which contributes to ~58% of revenues, 63% of autoproducts/services, and ~75% of GP from autoproducts/services.

JD Auto Care's price reduction program only covers certain SKUs and Tuhu's price reaction to it covers a certain portion of such SKUs.

Tmall Auto Care has 2k+ stores and adopts a loose franchise model that focuses on cooperating with regional IAMs (30+ brands) under a joint operation model, but with limited SKUs and lesser integration with Taobao/Tmall.

Douyin, on the other hand, operates differently as a 3P eCommerce traffic platform. Its GMV of auto aftermarket products grew 129% yoy in 2022 vs -12% at other major eCommerce platforms, with top categories in internal decoration, washing, detailing, maintenance, and auto electronics. IAMs seem to be interested in Douyin for online traffic and customer acquisiton, given that offline vehicle volumes in China's auto aftermarket came under pressure.

Store count & locations

Tuhu is ranked No.1 among automotive services in China based on number of stores, and No.1 among independent automotive aftermarket providers (IAM) based on annual revenues.

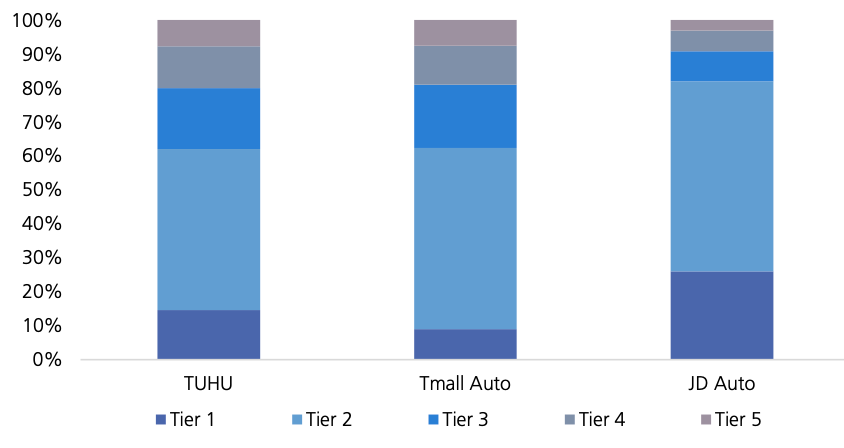

Tuhu is focused on high-tier cities, similar to its competitors.

Tuhu has significant market lead with >6,400 stores, while Tmall Auto and JD Auto had ~2,100 and ~1,700 stores respectively.

In terms of cities of focus, tier 1 and tier 2 cities are the main focus of the trio, with tier 1 and 2 cities accounting for 60%/60%/80% for Tuhu/Tmall Auto/JD Auto. JD Auto's store locations are more focused on tier 1 and 2 cities.

For net new store additions, more than 50% of the trio's new stores were opened in tier 2 cities in Q324. For store additions in tier 3 and below cities, there are less than 40% of net new store additions among the trip, suggesting that penetrating into lower-tier cities is slower than market expectations.

Store Numbers (As of 3Q24)

China Cities Footprint based on Tiers (As of 3Q24)

Location Densities (Q324)

Demographics of customers

Tuhu has a customer base of the lowest per capita purchasing power (RMB per capita), compared to its peers.

This is attributed to JD Auto's high-tier-centric geographical store exposure, with Tuhu operating outside city centres with customers that can afford less.

Per capita purchasing power (RMB per capita), 15-minute drive

Cannibalisation

There exists notable cannibalisation of stores that compete with their own stores.

>85% of Tuhu and JD Auto stores compete with themselves. The cannibalisation share of Tmall Auto was slightly smaller at 80%.

Cannibalisation Share (%) by 15-minute drive

Cannibalisation Share (%) by 15-minute drive, Q2 vs Q3

Investment Thesis

Thesis 1: Topline growth - A net beneficiary of China's consumption downgrade, I expect store expansions to drive revenue, accelerating presence in lower-tier markets.

Confident on store expansions in lower-tier markets to capture growing demand from aging cars

Expansion Plans: Tuhu plans to open over 1,000 new stores each year in 2024 and 2025.

Focus on Lower-Tier Markets: This expansion will be focused on lower-tier markets to strengthen their presence there.

Store Count: As of the end of 2022, Tuhu had 4,653 directly operated and franchised workshop stores.

Target for 2025: By the end of 2025, Tuhu aims to have around 8,000 stores.

Network Densification: Emerging first-tier and second-tier cities will be the core focus for densifying their network.

Higher store traffic and lower ASP: The company has noticed a consumption downgrade trend despite growing store traffic. For the tyre industry, high-end tyres saw 10%-30% yoy decline in 1H24, while domestic tyre brands still saw 10%-20% yoy growth. Tuhu’s private-label and exclusive products benefit from the trend at competitive pricing, as per the company. Tuhu expects gross margin to reach c.30% in 2026.

driven by more favorable product mix.

Attractive franchise incentives to drive new workshop openings

Franchise incentives for Upper-Tier Markets:

Management Fee Waiver: New workshop stores in designated upper-tier markets can have their management fees waived for nine months, up to a maximum of RMB 72,000.

Franchise Fee Rebate: Existing merchants in certain upper-tier cities can receive a 25% rebate on franchise fees, ranging from RMB 50,000 to RMB 100,000.

Franchise incentives for Lower-Tier Markets:

Franchise Fee Exemption: Existing merchants opening new stores (limited to one) in lower-tier markets can be exempted from paying the franchise fee (up to RMB 100,000).

Management Fee Waiver: In single-store cities, existing local stores can receive an additional six-month management fee waiver.

Franchise Fee Rebates: New stores in untapped markets can enjoy a 25% franchise fee rebate, with key provinces in untapped markets receiving up to a 75% rebate.

Tuhu is actively using franchise incentives to expand its network, particularly in lower-tier markets.

The incentives are designed to attract new franchisees and incentivize existing ones to open additional stores.

The focus on lower-tier markets suggests a strategy to penetrate areas with less competition and tap into untapped potential.

Profitability of current franchise stores is healthy

Average Profit of Profitable Stores:

In 2019, the average profit of profitable franchise stores was RMB 394,800.

This increased to RMB 430,200 in 2020.

However, it dropped to RMB 345,200 in 2022.

By Q1 2023, the average profit had already reached RMB 109,400.

Outlook for 2023:

I project that the average profit of franchise stores for 2023 will increase compared to 2022.

No. of profitable workshops and proportions

Thesis 2: Margins - I expect gross margins to expand driven by exclusive & private label brands, and cost reductions to benefit bottom line.

Increasing Profit Margins Through Exclusive and Private Label Brands

Tuhu is boosting its profit margins by offering more exclusive and private label products.

Exclusive Supply Brands are products Tuhu purchases from brands that are different in specifications and models from those sold through other channels. For example, Continental tires exclusively supplied to Tuhu. These products have higher profit margins compared to standard products in the market.

Private Label Brands are products directly produced by manufacturers for Tuhu's own brands. Since Tuhu doesn't share profits with brand owners, these products offer even better profit margins.

As of March 31, 2023:

Tuhu's platform offered 51 private label products covering 7,429 SKUs.

It also offered 54 exclusive products covering 2,239 SKUs.

Revenue Contribution:

The revenue contribution from exclusive supply brands increased from 17.5% in 2019 to 37.4% in the first half of 2023.

The revenue contribution from private label brands increased from 4.7% to 28.9% over the same period.

Improved Gross Profit Margins:

As a result of these strategies, Tuhu's gross profit margin improved from 7.4% in 2019 to 24.2% in the first quarter of 2023.

Revenue breakdown by private label, exclusive, standard products

Cost Reduction and Model Convergence

Tuhu is making progress in reducing costs and improving its business model.

Single-Store Costs: The cost per store has started to decrease.

Expense Ratios:

The combined expense ratios increased from RMB 1.678 billion in 2019 to RMB 3.306 billion in 2021.

In 2022, despite a slight revenue decline of 1.42%, the total cost dropped to RMB 3.19 billion (a decrease of 3.5%).

By the first quarter of 2023, the combined expense ratios had returned to pre-pandemic levels, reaching 24.8% (compared to 23.8% in 2019).

The decrease in cost per store and the return of expense ratios to pre-pandemic levels indicate a positive trend in Tuhu's cost management and operational efficiency.

Expense Ratios of Tuhu

Valuation

Buy-rated on Tuhu with a 12m target price of HK$25.30 (upside of 10%) based on a 18x 2026E P/E.

5Y target price of HK$42.00 (upside of 83%) based on a 18x 2030E P/E.

Key downside risks (summarized):

1) Worse-than-expected consumer demand shifts with technology advances

2) Slower network expansion

3) Intensifying competition

4) Worse-than-expected NEV strategy execution

ESG assessment

Quantitative Assessment

ESG Risk Rating: Tuhu holds a “low risk” ESG score of 19.96 (source: HKEX), which reflects proactive risk management in areas like supply chain oversight, customer satisfaction, and sustainable expansion

Operational Efficiency and Reach: In 2023, Tuhu significantly expanded its network, adding 1,256 workshops across China, especially in underserved lower-tier cities and remote regions. This enhances accessibility but also requires careful environmental and social impact management as they extend into more regions.

Qualitative Assessment

Environmental (E): Tuhu demonstrates an awareness of environmental impact but lacks extensive data on carbon emissions reduction and energy-efficient initiatives. However, the company has shown strides in supply chain transparency and operational efficiency, such as implementing an AI-driven task allocation system that reduces unnecessary travel, indirectly lowering emissions.

Social (S): Tuhu excels in customer satisfaction, achieving a 94.2% satisfaction rate in 2023, up from previous years. The company’s focus on customer service is backed by ongoing training for employees and improved operational practices in workshops. Their growth in diverse regions also includes partnerships, such as with PetroChina, allowing Tuhu to meet localized needs, yet bringing challenges in labor and service standardization.

Governance (G): Tuhu’s governance structure adheres to Hong Kong Stock Exchange guidelines, ensuring accountability and transparency, especially in financial and operational reporting. While corporate governance practices are robust, greater transparency on board diversity and executive compensation alignment with ESG targets could enhance investor confidence.

Sources

Goldman Sachs Research, UBS, CICC, CITIC Securities

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

The strongest point of this article revolves around the proposition of the investment thesis. This is not a question of whether this business is positioned with an extremely good moat, but rather, whether industry trends can carry this business until a point where consolidation leaves it the only player.

1) There are many businesses here, it is very fragmented. TUHU only has 0.9% of market share. There is no question that it is a very competitive business. But for a store that only opened in 2011, this is a very interesting proposition to have captured so much of market share so soon

2) haggling for bargains is a key trait of the Chinese consumer and car-owners are no different in that respect.(LEK consulting). This applies for tier 1 and 2 cities. Hence, the only way a manufacturer can win is through margins. Given such an impressive turnaround in margins, 7.4% in 2019 to 24.2% in the first quarter of 2023, I think there is something this is doing right

3) as industry consolidation happens with big brands coming in (JD, tmall, tuhu) which are all very new but have steadily gotten market share, I am inclined to think that the industry will conolisdate and competition will get tighter—given time.

4) This positions TUHU as a unique economic moat, eventually. And what TUHU will have when it comes to that is the sheer number of stores it already has (see location densities)

5) Given consumer downgrade, TUHU will win against these larger corporations.

This is my take on it, but key to this thesis will be consolidation.

1) How will consolidation fare given the bigger players wanting such as JD if they choose to play? What if they choose to acquire given their wider balance sheet?

2) Do you see car ownership increasing given consumer downgrade in china?

Hello, thanks for the insightful and well-researched article! I'm curious about your perspective on potential headwinds surrounding the increasingly higher share of BEV vehicles in China, and how that may impact their biggest revenue source of repair and maintenance, since BEVs require lower maintenance costs based on my understanding. I also really liked your distribution channel diagram.