Initial Report: Unity Software (NYSE:GPN), 154% 5-yr Potential Upside (EIP, Siva PALANIVELU)

Siva presents a "BUY" recommendation based on the company reinstating its subscription-based pricing model and focus on integrating its game engine and mediation platform

LinkedIn: Palanivelu Siva

Executive Summary

Unity Software (NYSE:U) is the market leader in game engines. Over the past year, U had made a few strategic missteps which has led to a ~39% drop in share price YTD. However, I believe that Unity is a turnaround story in the making due to...

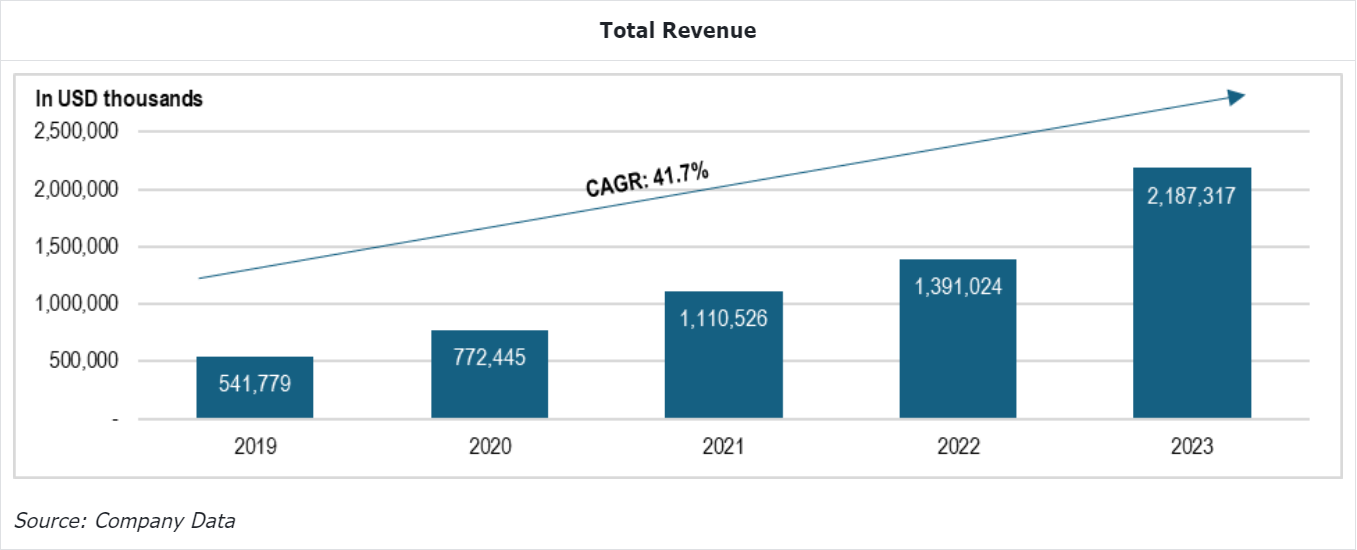

1) Runtime Woes - Running back to what works: The reinstated subscription-based pricing model (with a price hike) should revert consumer confidence leading to +14% CAGR in revenue

2) Fueling Growth in Growth Solutions: Unity’s focus on integrating its game engine (Unity Engine 6) and mediation platform (Unity LevelPlay), cross selling between both businesses and improving data infrastructure should lead to +8% CAGR in revenue

Total Returns (3-Year): +26.6% Annual IRR driven by TP of US$ 50.64 (+155.2% upside)

Share Price Movement

U’s share price is down 39.34% YTD due to the introduction of the run time fee which resulted in major backlash from game developers. Additionally, there was a negative sentiment to the acquisition of ironSource.

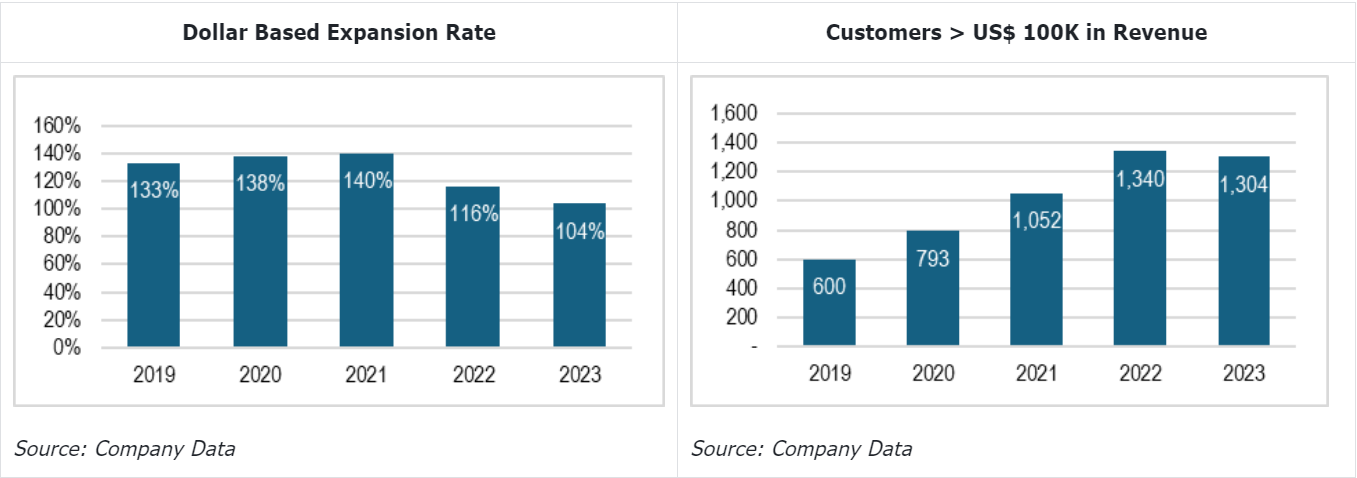

Key Metrics

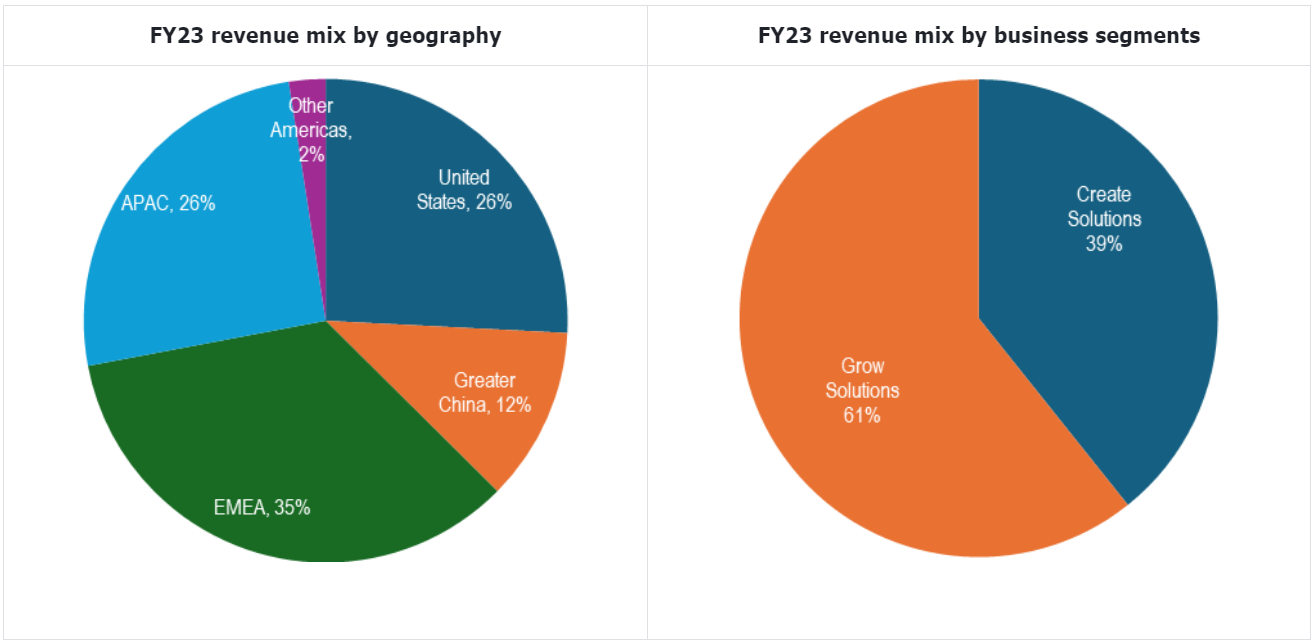

Revenue Segments

Create Solutions (39% of revenue)

Under Create Solutions, the key product is Unity’s game engine which is the Unity Engine 6.

A game engine is primarily a one stop shop that offers essential systems and tools such as physics simulations, graphics rendering, AI functionality, networking system, audio system etc.

Some of the biggest games developed on the Unity Engine are Pokémon GO, Temple Run, Hearthstone, Subway Surfers, Among Us and Top Eleven

Currently, the biggest players in the game engine industry are Unity, Unreal Engine (by Epic Games), Godot and Cry Engine. However, Unity and Unreal Engine have the biggest market share

Pricing model is based on a subscription basis

In a nutshell, Unity Engine is targeted for mobile game developers / Indie developers while Unreal Engine is targeted for AAA game developers (developers of games such as Fortnite, Final Fantasy 7)

Grow Solutions (61% of revenue)

Grow solutions is mobile advertising business of the company with key products such as LevelPlay and ironSource which serve different purposes across the mobile advertising value chain

Industry is fragmented with different players. Google and Facebook are the tier 1 mobile advertisers. Unity and AppLovin are the biggest competitors in the tier 2 space.

Different types of ads include Static in-game advertising, Interstital Ads, Native banners, Contextual ads, Rewarded video ads, Playable ads and Advergaming

Different players of the advertising value chain:

Publishers: Publishers are website owners or content creators who offer ad space on their platforms to generate revenue

Supply Side Platforms (SSP): SSPs help publishers manage and sell their ad inventory for high CPMs on ad exchanges. They optimize the selling process by allowing publishers to set minimum price thresholds and control the ad placement process

Demand Side Platforms (DSP): Advertisers use DSPs to purchase ad inventory across multiple ad exchanges and publishers. DSPs helps advertisers find the highly value ad space at a low CPM

Ad Exchanges: Ad Exchanges are digital marketplaces that facilitate the buying and selling of ad inventory between advertisers and publishers. The use real time bidding technology to auction ad impressions

Ad Networks: Ad Networks act as an intermediary between advertisers and publishers that aggregates ad inventory from multiple publishers and resells. They help fill unsold inventory and can provide additional targeting options

Ad Servers: The purpose of the ad server is to serve ads on the website or an app after selecting the highest bid and track the performance of those ads

Data Management Platforms (DMP): The platform that serves as a source of data for publishers and advertisers is DMP. They collect first, second and third-party data and list wholesome user details to concerned parties for detailed targeting

What are mediation platforms?

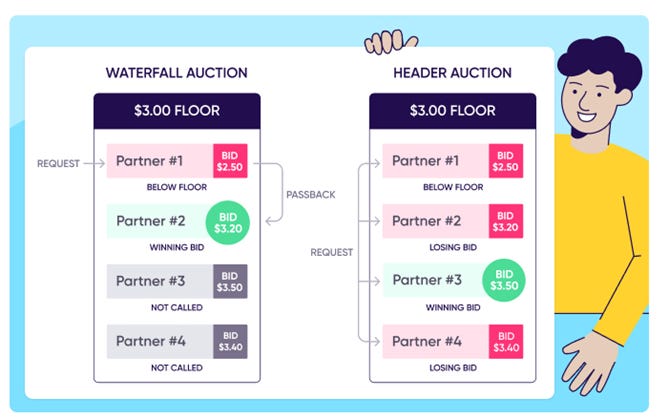

An ad mediation solution lets you manage multiple ad networks (and access more ad selling models) through a single software development kit (SDK)

An ad mediation SDK in turn is a standardized set of development tools for incorporating several ad serving options through one connector embedded into your app

Game developers can essentially improve their mobile app game monetization as mediation platforms route requests to multiple ad networks to connect you with the highest bidder

There are 2 primary ways in which ad mediation platforms maximize revenue: waterfall bidding and in-app header bidding

Investment Theses

Create Solutions- +14% CAGR in gaming revenue driven by revamped pricing structure

As of 1(st) Jan 2025, Unity will reinstate its old subscription model with an 8% price hike on Unity Pro and a 25% price hike on Unity Enterprise. While bears believe that the runtime fees have shaken industry goodwill and may have longer term implications, I believe that these fears are overblown.

According to industry insiders, when the cancellation was announced, most of the paid subscribers just downgraded to the Unity Personal plan which resulted in a decrease in paid subscribers but not usage.

Unity Engine’s biggest moat is that there high switching costs to shifting game engines. Switching game engines often involve redeveloping many of the assets, scripts or systems which would take up a lot of time. There is also a learning curve to understanding the new engines. It is also complex to port your old projects to a new engine.

Secondly, if you are a mobile game developer there is no good alternative. Unreal engine focused mainly on console games (had some 2D features but not as advanced as Unity) and commission-based pricing system (so it is equally as expensive but for lesser features). Cry Engine and Go Dot were the alternatives, but they have lesser features than Unity

So, it is unlikely that game developers managed to completely transfer to other game engines in the span of 9 months when the run time fee was active

Additionally, the price hikes that will be implemented for 1(st) Jan 2025 are pegged to the upgrade of Unity Engine 6. Management has reported that Unity 6 has already seen 500k downloads which compares favorably vs prior releases following strong customer feedback at the Unite Conference after the elimination of the Runtime fee

Changes in pricing plans

Grow Solutions - +8% CAGR in revenue driven by integration of the monetization and game engine business, cross-selling and improving data infrastructures

For a successful mobile advertising business, there are 3 main key areas that Unity needs to focus on – integration of unity’s monetization tools with game engine, cross- selling and improving data infrastructures. Management has initiated healthy steps towards working on all 3 segments

#1 – Integration of unity’s monetization tools with its game engine

At the Unite Conference in September 2024, Unity announced that it will integrate Unity Level Play with the Unity Editor (with the release of Unity Engine 6) which will allow game developers to not only access Unity Ads and Iron Source Ads. This would allow developers access to 25 ad networks (AppLovin has 25+ Ad networks as well). Unity also announced that Google demand (Google Ads, Display and Video 360) will soon bid into Unity LevelPlay via Google’s partner bidding program

I believe this is a step in the right direction as the main advantage of integration is convenience of using the same platform for everything (game development, optimization and monetization)

According to industry insiders, if AppLovin and Unity were able to bring in the same ad revenue, about 70-80% of game developers will switch to Unity. Of course, this is conditional on Unity being able to bring in the same ad revenue as Applovin for game developers. I believe that Unity will be able to catch up to AppLovin as 1) Unity, Applovin and Google roughly have the same take rate (20%-30%) 2) Unity has roughly the same number of Ad networks as App lovin (reducing the competitive advantage that Applovin has over Unity)

#2 – Cross selling will drive growth

In the past, leaders of Create and Grow were not compensated based on cross-selling thus they had no incentive to do that. Additionally, with the ironSource acquisition they lost traction on making sales and making it more of a one business model with 2 revenue streams. Instead, Unity remained as a company with 2 business models

During 3Q24, earnings call management guided that they “merged the sales teams that are going to be selling those- our core engine and editor with these game services. We used to sort of have it spread out in all sorts of different ways”

Given that the sales team and products have been integrated, it will easier for the sales team to cross sell both products, leverage on individual customer bases and drive revenue growth

#3 – Improving Data Infrastructures

Game development is a very data driven process, with developers closely analyzing prototype data to understand player behavior and game design effectiveness.

Unity has a much better data stack compared to AppLovin as Unity is the game engine behind 60% of mobile games (~268,000 games) compared to AppLovin which only gets its 1P data from ~200 mobile games

However, during 3Q24 earnings call, management guided that they are making progress on rebuilding their machine learning stack and data infrastructure, with early testing on live data showing encouraging results

Management Analysis

The new management led by Matthew Bromberg should help boost investor confidence. Given that, Unity Software is in the current state because of a series of bad decisions made by the previous management led by John Riccitiello, it is important to assess what were the wrong decision undertaken by previous management and to assess whether the new management is any different (Conclusion, yes, they are)

The new management is led by Matthew Bromberg, who was the prior COO of Zynga and held multiple leadership roles in Electronic Arts.

Bromberg led a dramatic turnaround at Zynga, achieving 24% compounded revenue growth and expanding EBITDA margins by 1600 bps

During 2Q24, Bromberg announced the hiring of Jim Payne as the new chief product officer and Alex Bum as the new SVP of corporate development

Jim Payne co-founded MoPub in 2010, which became the largest in app mobile ad server and exchange (acquired by Twitter in 2013) and founded MAX which is a mobile advertising header bidding solution (acquired by AppLovin). I believe that Jim Payne will be crucial to the growth of Grow Solutions given his extensive experience in the AdTech business

Valuation

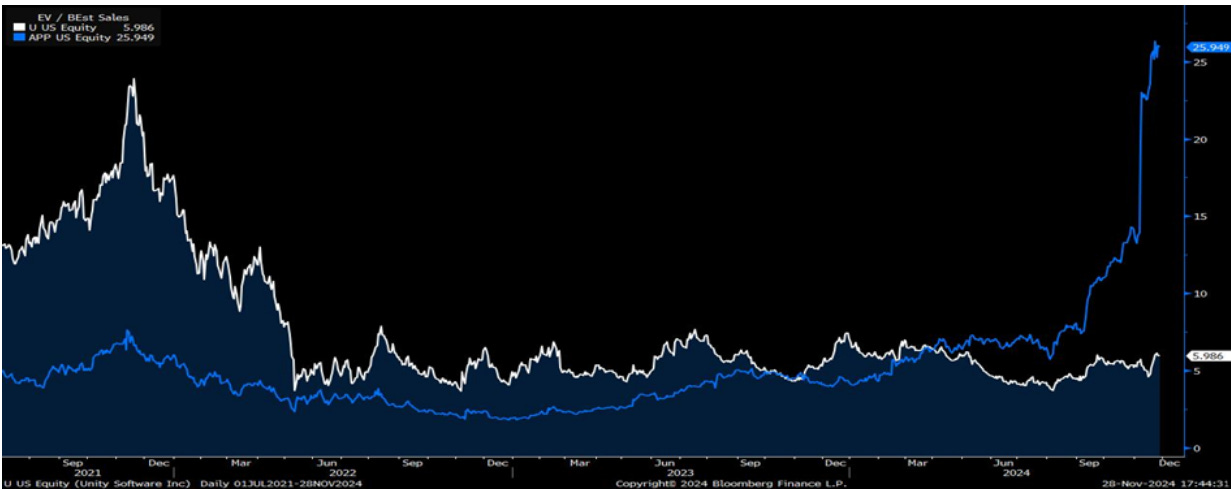

Currently, Unity is trading at a 5.9x EV/Sales multiple compared to AppLovin which is trading at a 25.9x Multiple

Revenue Build

Cost Build

Investment Risks

Delay in improving data infrastructure

According to management, data infrastructure and machine learning should improve by 1H25. Management is already on track to improving machine learning capabilities with live testing done in 3Q24. A delay is less likely.

Game Developers are still scarred by runtime fee implementation

Game developers felt betrayed by the implementation of the runtime fee which led to severe backlash. However, it is unlikely that developers completely ditch Unity Engine as their game engine given its moats

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.