Initial Report: Visa Inc. (NYSE: V), 76% 5-yr Potential Upside (EIP, Gabriel Koh)

Gabriel presents a "BUY" recommendation based on the company's low-risk business model, strong financials, and wide economic moat.

Company overview

Visa Inc. (Visa) operates as a global payments technology company. The company facilitates global commerce and money movement across more than 200 countries and territories. Visa operates one of the world’s largest electronic payments networks — VisaNet — which provides transaction processing services, primarily authorization, clearing and settlement. The company offers products, solutions and services that facilitate secure, reliable and efficient money movement for participants in the ecosystem.

Business segments

Visa's core business is in facilitating secure, reliable and efficient money movement among consumers, issuing and acquiring financial institutions and merchants. The company has traditionally referred to this structure as the four-party model.

In a typical C2B payment transaction, the consumer purchases goods or services from a merchant using a Visa card or payment product. The merchant presents the transaction data to an acquirer, usually a bank or third party processing firm that supports acceptance of Visa cards or payment products, for verification and processing. Through VisaNet, the acquirer presents the transaction data to Visa, which in turn sends the transaction data to the issuer to check the account holder’s account balance or credit line for authorization. After the transaction is authorized, the issuer posts the transaction to the consumer’s account and effectively pays the acquirer an amount equal to the value of the transaction, minus the interchange reimbursement fee. The acquirer pays the amount of the purchase, minus the merchant discount rate (MDR), to the merchant.

Generally, interchange reimbursement fees are paid by acquirers to issuers. Visa establishes default interchange reimbursement fees that apply absent other established settlement terms. These default interchange reimbursement fees are set independently from the revenue Visa receives from issuers and acquirers. Visa's acquiring clients are responsible for setting the fees they charge to merchants for the MDR and for soliciting merchants. Visa sets fees to acquirers independently from any fees that acquirers may charge merchants. Therefore, the fees Visa receives from issuers and acquirers are not derived from interchange reimbursement fees or MDRs.

Visa provides payment processing for both non-Visa-branded and Visa-branded card transactions. In the context of non-Visa-branded card transactions, Visa facilitates payment processing by providing gateway routing services to other payment networks. At the client’s request, Visa may provide authorization, clearing or settlement services on their network before or after they route the transaction to the other payments network. In those instances, Visa may earn data processing revenue for the specific services provided. In the context of Visa-branded card transactions on their network, Visa provides authorization, clearing and settlement services and may earn service, data processing, international transaction or other revenue. Depending on applicable regulations, some payment processors may or may not use Visa's network to process Visa-branded card transactions. If they use Visa's network, Visa may earn service revenue and data processing revenue. If they do not use Visa's network, Visa earns only service revenue.

Revenue drivers

Consumer Payments

On an annual basis, Visa sees more than $20 trillion of opportunity globally, excluding Russia and China, to convert cash, check, Automated Clearing House (ACH), domestic schemes, and other forms of electronic payment into cards and digital accounts on Visa’s network. E-commerce plays a major role as more consumers and merchants shift to digital platforms for goods and services. Visa aims to grow consumer payments through expansion of credentials and acceptance points and deepening engagement with consumers through key enablers such as Tap to Pay, Tokenization and Click to Pay.

New Flows

Visa's new flows business is focused on driving digitization and improving the payments and money movement experience across all payment flows, beyond C2B, through Visa's network of networks. These include P2P, B2C, B2B and G2C payments, which provide some of the largest payment opportunities in the world. Representing a total addressable opportunity of approximately $200 trillion of payment flows annually, excluding Russia and China, this pillar of Visa's business aims to make payments and money movement easier for businesses, consumers, and governments, using both Visa’s global network and connectivity to other networks around the world.

Value-Added Services

Value-added services represent an opportunity for Visa to diversify their revenue with products and solutions that help their clients and partners optimize their performance, differentiate their offerings and create better experiences for their customers. Visa's comprehensive suite of value-added services spans five categories — Issuing Solutions, Acceptance Solutions, Risk and Identity Solutions, Open Banking Solutions and Advisory Services. Visa's value-added services strategy has three areas of focus: (1) provide services for Visa transactions; (2) deliver network-agnostic services for non-Visa transactions; and (3) provide services that go beyond payments.

Cost drivers

General and administrative expenses

Consist mainly of card benefits such as costs associated with airport lounge access, extended cardholder protection and concierge services, facilities costs, travel and meeting costs, indirect taxes, foreign exchange gains and losses and other corporate expenses incurred in support of Visa's business, such as compliance costs to adhere to differing regulations across regions.

Personnel expenses

Salaries, employee benefits, incentive compensation and share-based compensation.

Marketing expenses

Expenses associated with advertising and marketing campaigns, sponsorships and other related promotions of the Visa brand and client marketing.

Competitor analysis

The global payments industry continues to undergo dynamic and rapid change. Existing and emerging competitors compete with Visa’s network and payment solutions for consumers and for participation by financial institutions and merchants. Technology and innovation are shifting consumer habits and driving growth opportunities in ecommerce, mobile payments, blockchain technology and digital currencies. These advances are enabling new entrants, many of which depart from traditional network payment models. In certain countries, the evolving regulatory landscape is creating local networks or enabling additional processing competition.

Visa's main competitors are fellow global or multi-regional networks. These networks typically offer a range of branded, general purpose card payment products that consumers can use at millions of merchant locations around the world. Examples include American Express, Diners Club/Discover, JCB, Mastercard and UnionPay. These competitors may be more concentrated in specific geographic regions, such as Discover in the U.S. and JCB in Japan, or have a leading position in certain countries, such as UnionPay in China. Government-imposed obligations and/or restrictions on international payments systems may prevent Visa from competing against providers in certain countries, including significant markets such as China and India. Based on available data, Visa is one of the largest retail electronic funds transfer networks used throughout the world.

Investment thesis

Low-risk business model with strong financials and wide economic moat

Visa is often considered a credit card company, but it doesn't issue any cards. It only operates a global payment network which charges merchants "swipe fees" to process their transactions. Banks and other financial institutions partner with Visa to issue cobranded cards, and they're responsible for handling all the debt. Visa's rival Mastercard uses the same low-risk business model, but American Express issues its own cards and takes on those liabilities. That's why Visa ended its latest quarter with a manageable debt-to-equity ratio of 1.3, compared to a ratio of 4.7 for Mastercard and a much higher ratio of 8.2 for American Express. This simpler business model makes Visa more appealing than its more leveraged financial peers.

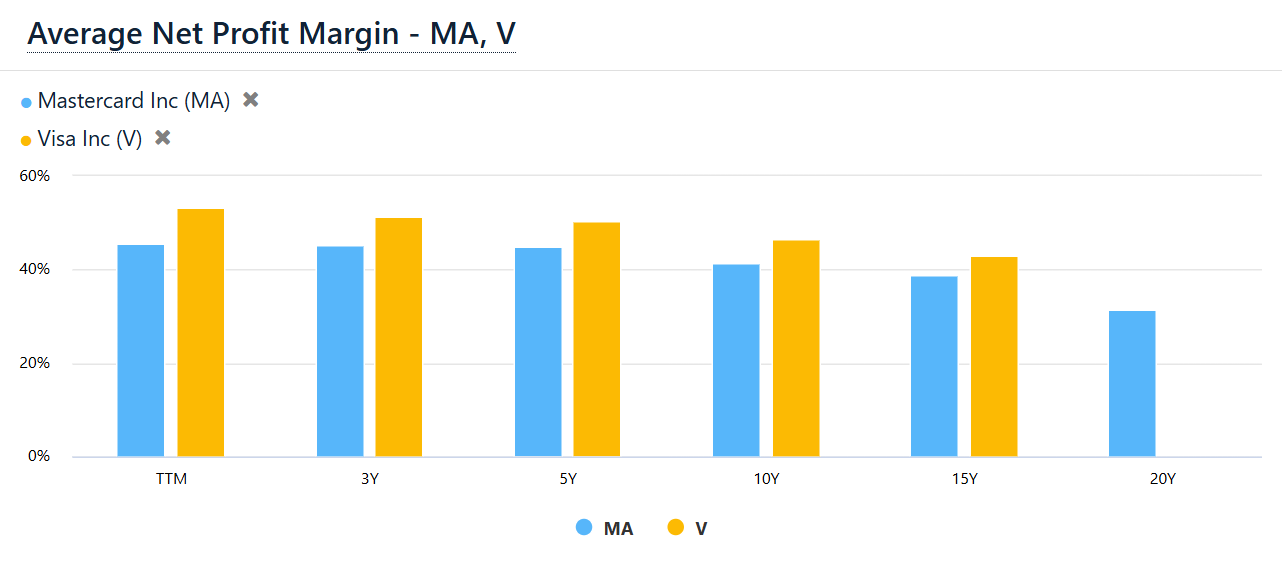

Visa also has a much higher average net profit margin at c.50% compared to Mastercards c.45% for the past five years. Albeit Mastercard has a slightly higher five-year revenue CAGR of 8.28%, surpassing Visa's 7.28%.

Visa also consistently had a higher FCF than Mastercard from 2019-2023. Visa’s FCF grew from $12.03 billion in 2019 to $19.70 billion in 2023, while Mastercard’s FCF increased from $7.47 billion to $11.33 billion in the same period. That means, Visa had a higher five-year CAGR of 10.37% compared to Mastercard’s 8.69%. Overall, Visa leads in FCF as well.

Furthermore, I believe Visa's fundamental value proposition of security, convenience, speed and reliability as well as the number of credentials and their acceptance footprint is Visa's wide economic moat. Visa connects more than 4.1 billion account holders to over 100 million merchants (the largest number of merchants in any payment system), ~15,000 financial institutions, and governments in more than 200 countries. These numbers show the strength and global reach of Visa’s network, which is one of Visa’s strongest competitive advantages since this scale of network is why there is a very low risk of emerging competitors and thus high barriers to entry. Both consumers and merchants benefit from having an option that is accepted worldwide, in offline retail stores and online. The more users the network has, the higher the benefit for every participant within the network. Visa can continue to utilize its network of networks strategy to facilitate the movement of money. A competitor would need to build a network as reliable and safe as Visa’s and replace Visa for 4.1 billion cardholders, 100 million merchants, and 15,000 financial institutions, which would be quite a challenge. This is why Visa-branded cards account for roughly half of all credit cards in circulation and half of all card-based payment volumes. Together, Visa and Mastercard control more than 90% of the global payment processing market outside of China. This near-duopoly drives most businesses to accept Visa and Mastercard and begrudgingly pay the swipe fees for those transactions. That flywheel constantly fuels Visa's growth, widens its moat, and locks in its customers and merchants. Albeit this raises Visa's biggest long-term challenge which is the threat of tighter regulations. For nearly two decades, Visa and Mastercard faced constant pressure from individual merchants, merchant groups, and antitrust regulators to reduce their swipe fees. However, I believe this legal risk is well mitigated, especially with the recent preliminary settlement in the U.S., which I further elaborate on under the risks and mitigation section.

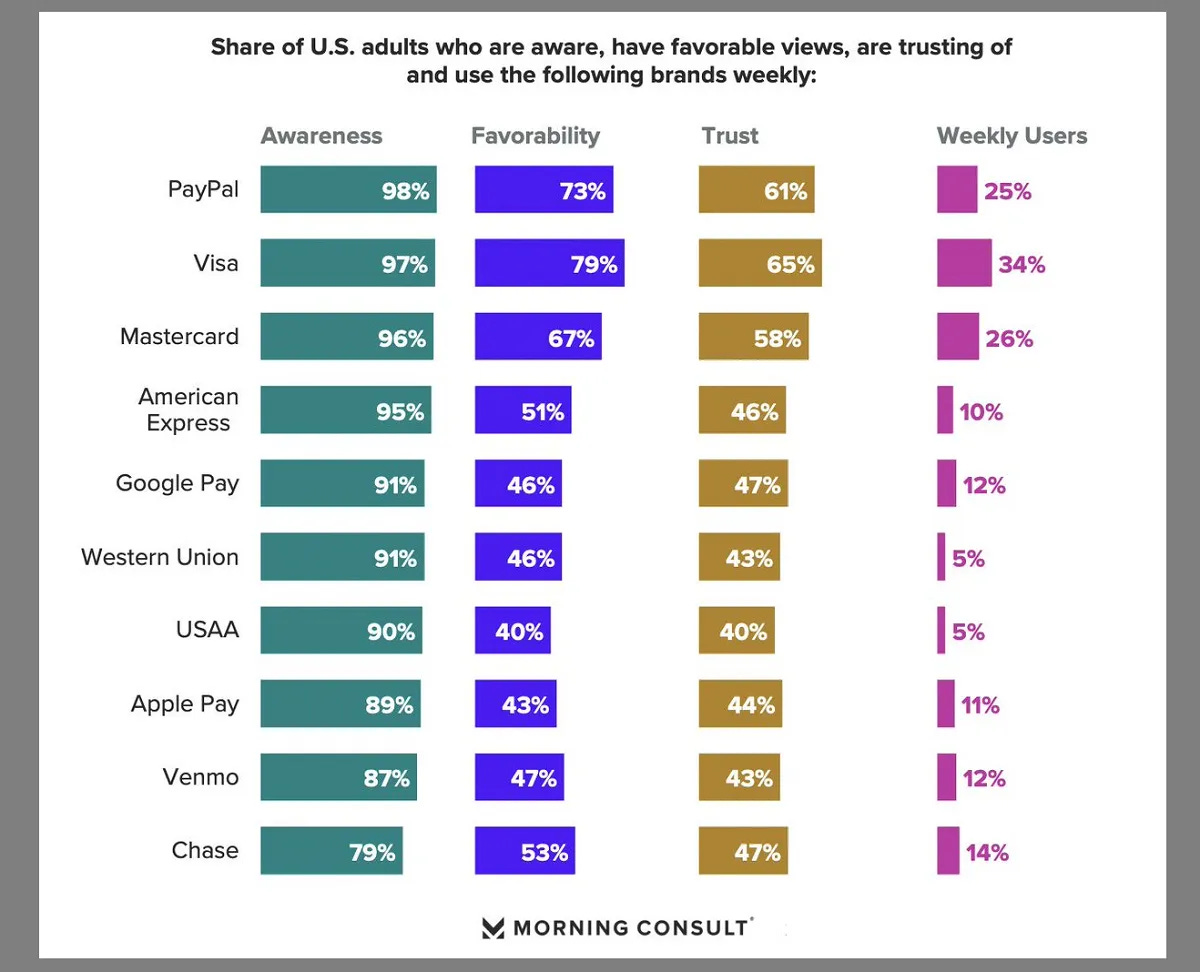

Additionally, Visa's global brand recognition which creates trust as a Visa-led study from 2017 showed that Visa is by far the most trusted brand in the payments sector and can also benefit from that financially. The study found that consumers are 2.6x more likely to think a merchant is reputable when they accept Visa and 1.9x more likely to enter an unfamiliar store. A Morning Consult Report from 2023 still has Visa as the most trusted brand in banking, investment, and payments for the third consecutive year. Morning Consult is one of the leading online survey companies, and their rankings are based on global surveys with thousands of consumers to gather their opinions of brands.

Valuation

I will use PE ratio to value Visa given its high net margin business model.

Visa's PE ratio has been consistent in the range of 32-35x and thus I will use a conservative TTM average PE ratio for Visa of 33.42 which is relatively similar to the 3 year average PE ratio of 33.17.

Using FY2027 net income estimates of USD26,513M, the 3Y target price is USD451.84, a 45% 3Y upside.

Using FY2029 net income estimates of USD32,212M, the 5Y target price is USD548.97, a 76% 5Y upside.

Risks and mitigation

Increased scrutiny and regulation of the global payments industry, including with respect to interchange reimbursement fees, merchant discount rates, operating rules, risk management protocols and other related practices, could harm Visa's business. In April 2024, to settle a major part of a long-running class action lawsuit, Visa (and Mastercard) agreed to reduce the interchange fee rates U.S. merchants pay on credit card transactions, cap those rates for at least five years, and give merchants more flexibility to steer payments and impose surcharges. When Visa cannot set default interchange reimbursement rates at optimal levels, issuers and acquirers may find Visa's payments system less attractive. This may increase the attractiveness of other payments systems, such as competitors’ closed-loop payments systems like Paypal or Alibaba with direct connections to both merchants and consumers. Some issuers may react to such regulations by charging new or higher fees, or reducing certain benefits to consumers, which make Visa products less appealing to consumers. Some acquirers may elect to charge higher MDR regardless of the Visa interchange reimbursement rate, causing merchants not to accept Visa products or to steer customers to alternative payments systems or forms of payment.

I do not expect the settlement to directly and materially affect the card networks' profitability, largely because the card issuers, rather than the networks, earn the interchange fees that Visa and Mastercard set for most merchants. I think the relatively small reduction should be manageable for credit card issuing banks, though a separate proposal from the Federal Reserve to lower debit card interchange fees may add to interchange pressures in general. Overall, I view this settlement as a positive development for Visa because it should (with court approval) resolve a large remaining part of the long-running merchant litigation and prevent merchants from filing similar lawsuits while the cap is in place. Even if Visa is forced to reduce its swipe fees by more basis points in the U.S., that would only represent a sliver of their total fees. Visa could also offset that pressure by raising its swipe fees in other markets.

Many countries or regions are developing or promoting domestic networks, switches and RTP systems (e.g., U.S., Brazil, India and Europe) and in some countries the government itself owns and operates these RTP systems (e.g., Brazil). These governments could, to an extent, mandate local banks and merchants to use and accept these systems for domestic or other transactions, prohibit international payments networks, like Visa, from participating in those systems, and/or impose restrictions or prohibitions on international payments networks from offering payment services on such transactions. Visa could face the risk of their business being disintermediated in those countries.

The expansion of real-time payment networks could revolutionize cross-border payments, but we need interoperable global RTP networks, with mechanisms to process payments in multiple currencies, not siloed, domestic networks that can’t talk to each other. Visa's domestic transaction volume may be affected adversely, but international transaction volume, which is the main revenue driver of new flows and has higher margins due to foreign exchange and cross-border fees, is unaffected. In fact, this further proves the importance of Visa as one of the two main international payment network to exist in the world. Visa Direct is a great example of a global network for real-time payments that is interoperable, and enables faster, more cost-effective cross-border capabilities. More efficient and cost-effective cross-border payment solutions will enable businesses and consumers to transact across borders without traditional delays and fees while simplifying currency conversions and compliance with local regulations. These domestic RTP networks can even be revenue drivers for the value-added services business segment of Visa such as risk management.

ESG assessment

The material ESG risks affecting Visa's operations include:

Emissions from its offices and data centres

Visa is actively greening through obtaining the U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED), Building Research Establishment Environmental Assessment Method (BREEAM), Green Mark or equivalent certifications for the design, construction and build-out of Visa's office facilities. As of September 30, 2023, Visa owned or leased 144 office locations in 82 countries, including four global processing centers, 80 percent of which had achieved or was pending green building certification. In FY23, Visa’s data centers accounted for 66 percent of their total electricity consumption and remain an important focus of their sustainable operations efforts. In 2023, Visa achieved year-over-year improvements in our data center energy efficiency, measured by power usage effectiveness (PUE). Globally, the PUE in our data centers has improved by 21 percent since 2017.

Cyber Threats

Visa's cybersecurity organization protects its information and technology assets by operationalizing zero-trust architecture and deploying defense-in-depth principles. Visa uses an established risk framework and assessment methodology to identify cybersecurity risks and associated business impacts. In 2023, Visa’s security program once again achieved the highest capability maturity rating within its category from Gartner Consulting, outperforming peer organizations within the highly-regulated financial services sector. Visa deploys multiple redundant layers of preventive and detective technologies across their network and data layers to help mitigate risks. This layered defense-in-depth strategy is supported by robust governance processes that involve regular oversight by and reporting to the Board and management.

Data Privacy

Visa has a Global Privacy Program to support the appropriate collection, use and sharing of personal information. It's Privacy Program is centered on key privacy principles that allow the Privacy Program to adapt alongside Visa’s global footprint, taking into account industry benchmarks and best practices in addition to evolving laws and regulations. Visa’s Chief Privacy Officer leads Visa’s Global Privacy Office, comprising dozens of privacy professionals around the world. The Global Privacy Office works closely with several cross-functional teams and internal governance bodies, including the Cybersecurity team and Global Data Office.

Conclusion

With a low-risk business model that has strong financials and a wide economic moat, Visa is an attractive short-medium-term investment opportunity with a target price of USD548.97 and a 76% upside from the current share price of USD312.56.