Initial Report: Viscofan S.A, 41% 5-yr Potential Upside (VIP, Tianyu TAN)

Tianyu presents a "HOLD" recommendation based on steady growth projections but strong market positioning.

LinkedIn | Tianyu (Leslie) Tan

1. Company Overview

Founded in Spain in 1975, Viscofan is the global leader in artificial casing manufacturing with ~40% market share, and the only supplier with the four main technologies including cellulose, collagen, fibrous and plastic. The company has diversified global production facilities in EU (43%), North America (30%), South America (14%) and Asia (13%). The company achieved stable growth of 6.0% CAGR in revenue, 2.8% CAGR in net profit and an average ROIC of 15.7% in the last ten years. Revenue in 2023 was €1,266m with a net profit of €141m. Listed in BME, market value as of Apr 19, 2024, was €2,723m. The chairman has been José Domingo de Ampuero y Osma since 2009. Main shareholders are institutions (40.4%) and PE/VCs (14.4%).

2. Investment Thesis

Moderately growing artificial casing market globally with a high barrier to entry.

The market size of artificial casing stands at €4,000m, with expectations of a 2-4% CAGR in volume over the coming years. This growth is primarily driven by an increase in meat consumption and the ongoing shift from traditional animal guts to artificial casings. Factors such as global population growth, rising protein intake, and a diverse array of meat choices are driving meat consumption. This will result in a 0.5% annual growth in developed countries and 1.4% in developing countries until 2028, according to OECD data. Furthermore, the transition from animal guts to artificial casings is anticipated to accelerate, with Viscofan targeting a 5-7pp replacement of the current animal guts market by 2025—which constitutes 46% of the total casing market—just with collagen casings. The shift towards artificial casings supports automation in production processes, which is beneficial in contexts of wage inflation, and aligns better with ESG standards due to significantly lower water usage. A study by Devro highlighted that switching from gut to casing could cut meat processing costs by up to 50%. My call with a customer revealed a clear trend at the client's company towards more stable, automated, and intelligent meat processing over the last decade, which was facilitated by the adoption of artificial casings. The market for artificial casings has high entry barriers due to the heavy asset requirements and economies of scale, limiting the entry of new competitors. Consequently, smaller market players are either withdrawing or being acquired by larger entities, unable to reach the necessary scale for profitability.

Market share consolidation with competitive advantages.

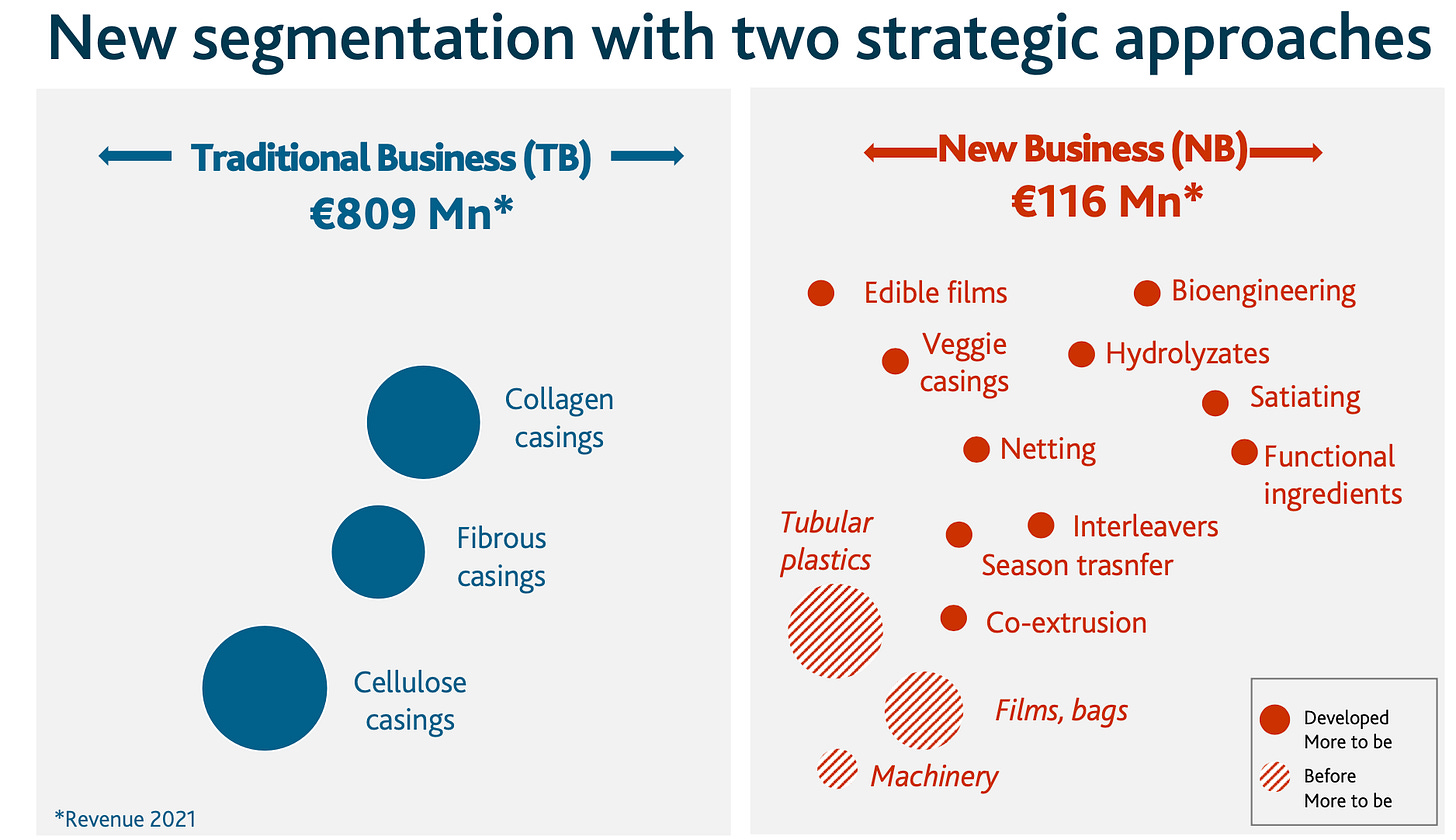

Viscofan is the clear leader with a 41% market share, 2.7x than the second player Viskase, and has consolidated 4pp market share in volume since 2016. The company has competitive advantages to continue gaining market share with the most diversified product portfolio, the most distributed production, reliable supplying capability and leading industry technology. Revenue of traditional business will grow with a CAGR of 2.3% to €1,103m in 2028.

The most diversified product portfolio: Viscofan is the sole company in the industry with the four main technologies and is developing new technologies to meet market trends This positions the company as a single point of contact for all types of materials, simplifying client interactions. The high capital investment and saturated market make it difficult for competitors to replicate Viscofan's comprehensive capabilities.

The most distributed production: Viscofan operates production facilities in 11 countries, providing it with a broader geographical footprint than its competitors. This extensive presence enables Viscofan to serve clients more effectively in their local markets and to tap into structural growth opportunities in new regions. For instance, in 2023, the company established a center in Thailand to capitalize on growth in Southeast Asia. Additionally, having a diversified production network helps Viscofan mitigate geopolitical risks and sourcing challenges.

Reliable supplying capabilities: Vicofan has strong operational capabilities and continuously expands its capacity with caution to secure supply to clients. Viscofan also has much lower leverage (0.7x net debt/ EBITDA) for future expansion to meet growing demands, compared with the second largest player Viskase (4x) and the fourth largest player Kalle (>50x). Furthermore, a staff of Viscofan China in Suzhou stated that the company’s more reliable production and governance secured Viscofan’s client loyalty compared to Shenguan, which is the third largest competitor located in China.

Leading technology: Besides, as the industry leader, the company has unparalleled industry know-how and protected technology in production. In addition to patent protection, the company has taken extensive security measures to safeguard the technology in its new facilities.

Additional growth opportunities in new businesses underpinned by Beyond25 Strategy Plan.

Viscofan has launched the Beyond25 Strategy Plan aimed at growth and expansion in the New Business segment, targeting a 15-20% CAGR in revenue growth by 2025. The company has been proactive in introducing innovative products like collagen hydrolyzates, veggie casing, special plastics, wider collagen casing, and longer casing. Notably, Viscofan is focusing on the collagen hydrolyzates market, projected by the FDA to grow into a $7bn market, aiming to increase its market share from less than 1% to 3% by 2025, translating to over €40mn. The veggie casing, catering to sustainable demands, particularly from Indian customers, is expected to constitute 3% of Viscofan’s total revenue. Under the leadership of Chairman José Domingo de Ampuero y Osma, the management team has a strong track record through the successful Be More (2012-2015) and More to Be plans (2016-2021), making them well-positioned to execute the Beyond25 Strategy. Revenue of new business will grow with a CAGR of 5.7% to $199.4m in 2028.

Stable industry-leading margin profile and high ROIC, with the potential to increase.

Viscofan's prudent capital investment and economies of scale have yielded a high EBIT margin of 17.3% a net margin of 14.3% and an ROIC of 15.7% in the past ten years. Insights from a Tegus interview with a former Viscofan US employee reveal the company's robust pricing power, often leading the market in price increases and effectively passing costs to clients without sacrificing demand, thus the cost increase by rising energy and raw materials have been passing on in the final sausage pricing. The diversified global footprint also helps Viscofan to access cheaper raw materials compared to other competitors. There is also potential in margin expansion due to product mix improvement and new capacity or upgrade ramp-up. The collagen segment is highly profitable compared to other technologies with faster growth, leading to a more profitable product mix. And the ramping up of US capacity and a focus on labor efficiency can also increase the region’s profitability, which is 30% of total revenue. Additionally, the company's strong cash flow supports its M&A activity on cheap targets, with its foresight in entering new regions, underscores its long-term strategic margin improvement.

3. Valuation

DCF method showing 19.4% upside, aligning with CCA method

DCF: €3,250.5mn. From 2023 to 2028, revenue from €1,226m to €1,451m, EBIT margin from 15.1% to 18.1%, NOPAT margin from 12.8% to 13.8%, ROIC from 14.1% to 16.5%, FCF from €177.1m to €255.4m, WACC of 8.3% and terminal growth 2%.

CCA: $3,256.5mn. €167m net profit at the end of 2024, historical forward P/E of the last ten years is 19.5x.

DCF analysis suggests a “Hold” opportunity with mere 19.4% potential upside. The discount reflects investors’ low expectations after 24Q2 results. The stock price would rebound with the recovery of casing demand and sustained earnings growth. The shift towards artificial casings, particularly in the U.S., and a turning demand in China, positions the company at an advantageous point. With successful cost pass-through strategies and a decline in energy costs, Viscofan is poised for margin improvement as the industry approaches the end of a restocking phase.

CCA method also suggests a similar upside potential. The current forward P/E ratio is 16.5x, below the historical average. It’s also trading lower than comparable companies such as Shenguan (28.1x P/E).

4. Risks and Mitigation

Currency risk:

A significant portion of Viscofan's EBITDA is earned in U.S. dollars, making the company susceptible to fluctuations in currency exchange rates which can impact profitability.

Environmental regulation risk:

The casing industry is subject to stringent environmental regulations that can increase production costs and affect operational flexibility.

Volatility in energy prices and raw materials:

Fluctuations in the costs of energy and raw materials can affect operating margins, as these are significant components of production costs.

Legal risk:

According to an expert call, the company employed undocumented workers in the US, which is illegal under U.S. law and exposes the company to potential legal actions, fines, and penalties.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.