Initial Report: XPeng Inc. (09868.HK), 86% 5-yr Potential Upside (EIP, Mian XIA)

Who says lawyers cannot do finance? Our one and only in-house lawyer is also an analyst! Let's look at the intricate analysis that Mian XIA conducts in this Smart EV company.

LinkedIn | Mian XIA

Executive Summary

XPeng is a leading Chinese Smart EV company that designs, develops, manufactures, and markets Smart EVs that appeal to the large and growing base of middle-class consumers in China. Since its inception in 2015, XPeng has become one of the leading Smart EV companies in China, with leading software and hardware technology at its core and bringing innovation in advanced driver assistance, smart connectivity and core vehicle systems. It develops full stack advanced driver assistance systems, or ADAS, software in house and has deployed such software on mass-produced vehicles.

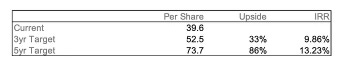

This report issues a BUY recommendation on XPeng Inc (09868.HK) given the following theses: (a) Leading Technological Innovation and Smartification Solutions, (b) New Product Line (G9 and beyond) Boosts Profitability and Promotes Brand Name, and (c) Favourable Policies Towards the EV Industry in China and Other Countries. XPeng is also a ESG positive company given its support for EVs and strong attention to ESG compliant and supportive practices in the E, S, and G aspects. Ultimately, this report ascribes a target price of HK$52.5, and accordingly issues a BUY recommendation with an estimated upside of 13.39% for the next one to three years.

Company Overview

Business segments

XPeng is a leading Chinese Smart EV company that designs, develops, manufactures, and markets Smart EVs that appeal to the large and growing base of middle-class consumers in China. XPeng intends to empower consumers with its differentiated Smart EVs that can offer disruptive mobility experiences. This is achieved by fast iteration of software and seamless integration with hardware, which enable XPeng to lead the innovation of Smart EV technologies and provide differentiated Smart EV products to consumers.

Since its inception in 2015, XPeng has become one of the leading Smart EV companies in China, with leading software and hardware technology at its core and bringing innovation in advanced driver assistance, smart connectivity and core vehicle systems. It develops full stack advanced driver assistance systems, or ADAS, software in house and has deployed such software on mass-produced vehicles. In September 2022, XPeng rolled out City NGP in Guangzhou, which can perform a wide range of driving tasks when activated with a set destination, for complex urban driving scenarios.

Its Smart EVs appeal to the large growing base of middle-class consumers in China. It primarily targets the mid- to high-end segment in China’s passenger vehicle market, with prices ranging from RMB150,000 to RMB400,000. Consumers choose its products primarily because of attractive design, industry-leading electrification and smart technologies, interactive smart mobility experience and long driving range.

XPeng currently offers the following models, together with their specifications: (1)

G3i (compact SUV), launched in 2021, a mid-cycle facelift of the G3 model originally launched in 2018, with a wheelbase of 2,625 mm and NEDC range between 460 km and 520 km;

P7 (sports sedan), launched in 2020, with a wheelbase of 2,998 mm and NEDC/CLTC range between 480 km (NEDC) and 625 km (CLTC);

P5 (family sedan), launched in 2021, with a wheelbase of 2,768 mm and NEDC range between 450 km and 550 km;

G9 (flagship SUV), launched in 2022, with a wheelbase of 2,998 mm and CLTC range between 570 km and 702 km; and

P7i (sports sedan), launched in 2023, a mid-cycle facelift of the P7 model originally launched in 2020, with a wheelbase of 2,998 mm and CLTC range between 610 km and 702 km.

(1) XPeng 2022 Annual Report, p. 70, online: <https://ir.xiaopeng.com/static-files/7a939e90-fa41-4dff-9746-56798e8338d4>

Revenue drivers

Growth in the Smart EV market

The global auto industry is moving in two long-term structural directors: greener (e.g. Neighbourhood Electric Vehicle, “NEVs”) and smarter (autonomous and connectivity). These two concepts will ultimately merge into one – Smart EVs – in future products and this move is particularly fast in China, involving EV start-ups such as XPeng. Analysts expect XPeng’s market share in the NEV segment in China to top ~ 11% by 2025, rising from 1% in 2019. (2)

(2) Nick Lai, Ryan Brinkman, Jiajie Shen, Rebecca Wen, and Anqi Hu (J.P.Morgan) “XPeng – Riding on and leading China’s multi-year Smart EV trend; initiate at OW” (22 September 2020)

The rise of Tesla in China is driving two important structural trends: 1) from “B” customers to “C” customers, and 2) a rising concentration among the top 10 Original Equipment Manufacturers, “OEMs”, and batter suppliers.

China’s NEV industry is entering the acceleration stage. The development of China’s NEV industry can be classified into two stages:

the 2015-2019 development stage, when penetration (from 1% to 5% during the period) was led more by push factors such as government subsidiaries and emission requirements.

the 2020-2025 acceleration stage, when forecasted penetration should surge to 13-14%.

The forecasted penetration acceleration in the second stage is expected to be driven by:

Continued (battery) cost reduction (8-10% p.a.) through improving energy density, rising scale and production yields. One important factor for price reduction is OEMs continuing to push suppliers to lower prices, given that battery suppliers still enjoy rather healthy margins of ~25-30%. The production cost parity is expected to be reached in China by 2023 and in other regions (given the larger size of vehicles and higher battery prices) around 2025.

Fast growth of individual buyers and attractive Smart EV content/functionality vs traditional Internal Combustion Engine, “ICE” cars: Tesla’s entry into the Chinese market has led to an increasing trend of individual customers purchasing EVs – Battery EV, “BEV”, sales to individual buyers in January-July 2020 accounted for ~64% of total sales compared to less than 50% in 2019. In addition, Smart EV’s content and button-less design are attractive to customers.

The base case projection is that China’s total NEV demand (inclusive of EVs, Plug-In Hybrid EVs, “PHEVs” and Hybrid EVs, “HEVs”) will see a 26% CAGR over 2019-2015, or from 1.4mn units to 5.7mn units. Of this, it is expected that EVs and PHEVs collectively will top 3.9mn units by 2025, implying a ~13% penetration rate, more than double the 4.7% in 2019, but still below the China government’s expectation of 25%.

Cost drivers

Shortage of Chips for Smartification

XPeng’s unique smartification solutions relies heavily on a stable and affordable supply of chips. However, this aspect has seen much disruption and shortage in recent years. A couple of factors aggravated the chip shortage in China. With the rise of the AI age, China is already the world’s largest semiconductor market in terms of consumption. However, a large percentage of around 84% is dependent on import. Such import is severely hindered by the ongoing Sino-US trade war. Taiwan, being a major semi-conductor manufacturing base, with well-known names such as the TSMC, is caught in the middle of the Sino-US tension and put under the economic political spotlight as well. Further, the strict covid control policies that was only lifted in late 2022 severely disrupted supply chain and logistic infrastructures. In such a context, if XPeng is unable to secure stable and affordable sources of chips supply, it was be a significant cost driver for its R&D and product delivery going forward.

Competitor Analysis

Economic moat

The main economic moats surrounding XPeng constitute of its leading technological innovation and smartification solutions, as well as money-for-value affordable models coupled with the Chinese government and consumers’ preference for domestic brand names. Please refer to paragraphs 5(a) and (b) of this report for more details.

Investment Theses

Leading Technological Innovation and Smartification Solutions

XPeng provides leading smartification solutions, including its adapted Advanced Driver Assistance System, "ADAS", for China’s sophisticated road conditions and in-car app ecosystems. These smartification features are designed to capture China’s young customers, who account for one-third of new car buyers. Some of the most salient features of their technological innovations and smartification solutions are as set out below:

a. 800V Ultra-fast Charging

XPeng created industry-leading re-charging experience via its SiC+800V high-voltage platform first introduced and mass produced in its G9 flagship SUV model. EVs surpass ICE Cars in terms of power performance and smartification, but they still face the underlying problem of re-charging inefficiency. For illustration, the single fuelling time for ICE Cars is 5 minutes, while the current fast charging for EVs take at least 60 minutes, and this is further prolonged by the waiting time in the charging queue during peak hours. (3)

(3) Yin Xinchi, Li Jingtao, Li Zijun, Wang Shichen, and Wu Pinglu (CITIC Securities) “The Introduction of G9 is expected to boost revenue for XPeng (G9发布,有望助力小鹏提高盈利能力)” (23 September 2022).

As it stands, there are two major technology pathways for EV fast-charging: 1) 400V+ High Current fast charging led by Tesla, and 2) 800V High Voltage fast charging led by Porsche. Among them, the former poses a huge challenge to copper wire specifications, thermal management, and construction of high-current charging facilities. Therefore, in order to be compatible with the fast charging function of all levels of models, 800V electrical architecture is gradually becoming the mainstream choice of fast charging solutions for EV manufacturers other than Tesla. Among them, in 2019, luxury car brand Porsche launched the world's first 800V model Taycan; in September 2022, XPeng launched the G9 model to achieve the first mass produced configuration of silicon carbide chip 800V (SiC+800V) high-voltage platform; Li Auto and NIO's new models in 2023, 2024 are expected to carry high-voltage fast charging platform as well.

XPeng's G9 model relies on its own "4S" 480kW charging station to provide 200km worth of re-charging in 5 minutes and has a better experience at ordinary third-party fast charging stations. In 2021, XPeng started its own research on the “three central electric hardware”, as a result, G9 is the first model in China to be equipped with SiC+800V platform; specifically, G9 is divided into two configurations by charging multiplier, 4C and 3C, corresponding to 10%~90% charging time of 1/4 hour and 1/3 hour respectively, and the two configurations have a peak charging power of 430kW/300kW respectively. In addition, XPeng also independently developed the "S4 Super Fast Charging Station", which uses liquid-cooling technology for the charging gun and has a through-flow capacity of 670A. On XPeng’s self-developed S4 charging station, G9 can get 200km worth of power in 5 minutes of re-charging; in contrast, a regular 400V EV can only get 50-60km worth of power in 5 minutes of re-charging at a regular charging station with a 250A limit. Even on ordinary third-party charging station, due to charging efficiency in models relying on the 800V platforms, XPeng G9 can be charged for 40 minutes continuously at the 120kW power limit, while its comparative product can only maintain 90kW power for about 30 minutes.

On a related note, as of the end of August 2022, XPeng has rolled out 1,000 self-operated charging stations, including 799 self-operated super-charging stations and 201 self-operated destination stations.

b. XPILOT

XPILOT is customised for driving behaviour and road conditions in China. XPILOT 2.5 is currently deployed on both the G3 and P7 models. The key capabilities of XPILOT 2.5 deliver essential autonomous driving features, including adaptive cruise control, lane centering control, automated parking, active safety features, etc. XPILOT 3.0, rolled out in 2021, takes autonomous driving to the next level and features new functions such as navigation-guided pilot and automated parking for memorized parking plots. The current version, XPILOT 3.5, is designed to deliver maximum driver assistance and convenience, helping to navigate through complex and challenging city driving scenarios with comprehensive coverage of urban roads through innovative algorithms catered to positioning, perception fusion, motion prediction and behaviour planning.

c. Xmart OS

Xmart OS is the in-car intelligent operating system, developed by XPeng, that enabes customers to enjoy an easy-to-use and smart experience on XPeng cars. The AI voice assistant makes voice control with continuous dialogue possible and its capability of receiving and executing ~10 requests within 25 seconds is efficient and welcomed by customers. In its G9 model, the Xmart OS is further enhanced and incorporates MIMO communication technology into in-car voice system for the first time in the industry, enabling as many as four passengers in the car to command voice-control simultaneously, while the response time of the AI is kept within milliseconds.

Figure.1: A visual illustration of Xmart OS

Source: XPeng website

d. “Xopera” – XPeng’s Proprietary Media System

The G9 series provides 28 acoustic units to create the "Xopera" XPeng Concert Hall, equipped with the original Dana Confidence premium audio system, with a total power of 2250w, using Dolby Atmos technology, providing 7.1.4 channel high quality sound, and combined with audio and video content to realize unique functions such as film plot linkage, hardware synchronisation, thus providing an immersive 5D sensory experience.

New Product Line (G9 and beyond) Boosts Profitability and Promotes Brand Name

XPeng’s fourth car model, G9 flagship SUV large five seater is expected to boost revenue and further promotes brand name. G9 is priced at RMB 0.31-0.47 million, the highest priced model in the current lineup of XPeng EVs. The previous three XPeng models were generally priced below RMB 0.30 million (G3 is a compact SUV priced at RMB 0.17-0.20 million; P5 is a compact sedan priced at RMB 0.18-0.25 million; and P7 is a mid-size sedan priced at RMB 0.24-0.43 million). Therefore, the G9 model brings the brand upwards in terms of its pricing range and is expected to improve revenue generation. Analysts are of the view that G9 can be expected to capture the share of BBA and second-tier luxury brands in the mid-size SUV market, achieving a breakthrough in the pricing range and boosting brand power while further improving gross margins. (4) On the media conference that took place on 21 September 2022, the chairman He Xiaopeng expressed the confident view that the sale volume of G9 is projected to exceed Audi Q5 and reach more than 10,000 sales per month.

(4) Supra note 3.

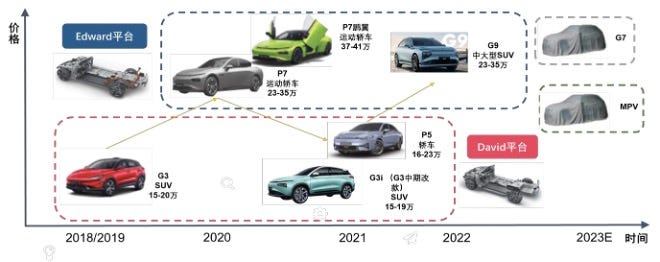

Figure.2: A diagram of XPeng’s product matrix (in Chinese)

Source: XPeng website

The price difference between XPeng’s G9 and Tesla’s Model Y is clearly reduced compared to the difference between XPeng’s P7 and Tesla’s Model 3. The product lineup of XPeng is pretty close to that of Tesla, and both focuses on smartification in terms of their technological pathway. In the sedan sector, XPeng’s sports sedan P7 (RMB 0.24-0.35 million), which is around RMB 50 thousand less to Tesla’s Model 3 (RMB 0.29-0.37 million), even though P7 has comparatively larger internal space. In contrast, in the SUV sector, while G9 also has larger internal space compared to Tesla’s Model Y, it has reduced the price difference to around RMB 10 thousand. This points towards improved revenue generating ability of XPeng. There is also plans to introduce a B grade SUV next year and it is expected to be priced around RMB 0.27-0.35 million, in between P7 and G9.

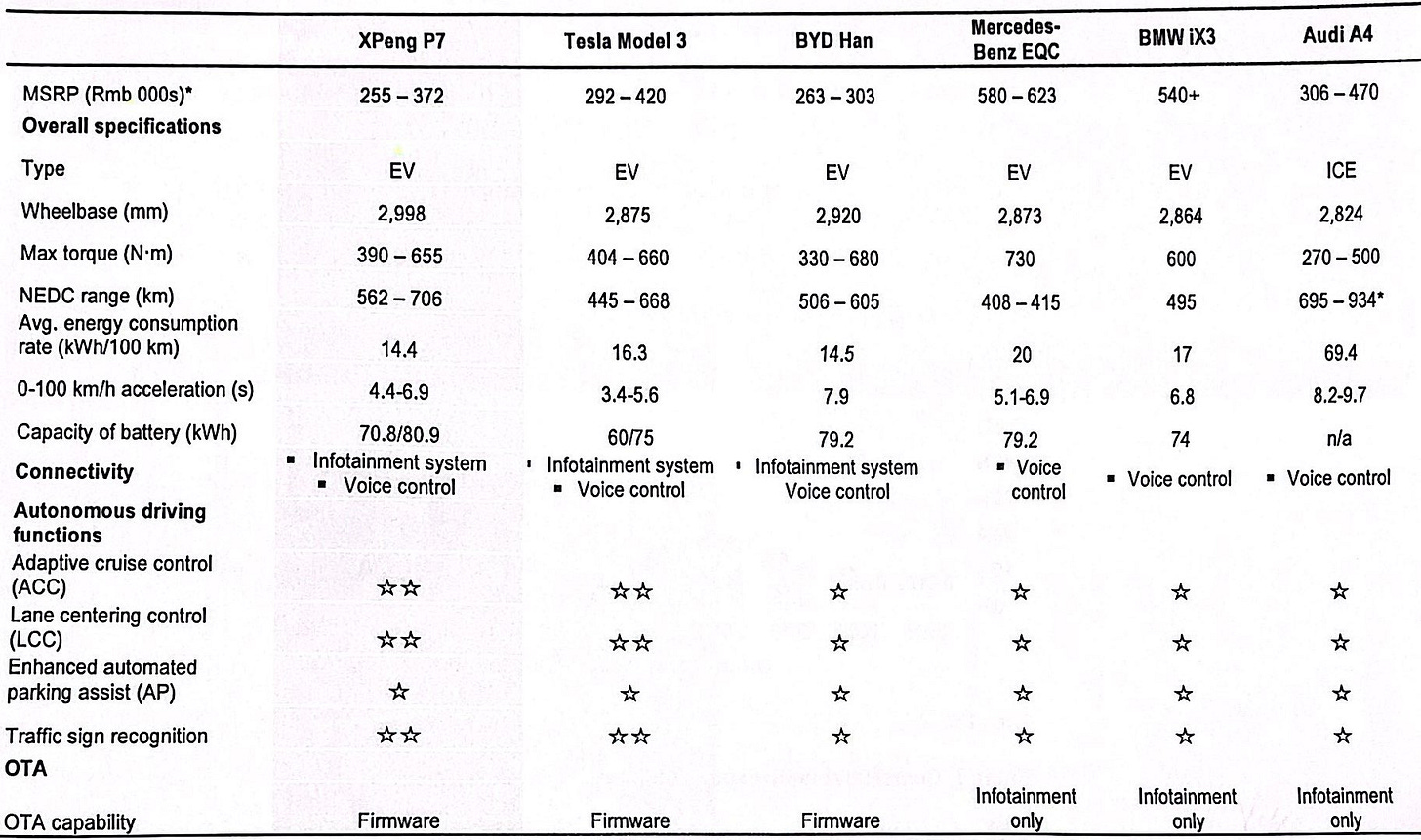

Table.1: Comparison of P7 and similar models

Source: supra note 2, which cited company data, IHS Markit Report. ** means that the feature comes with all vehicle versions, whereas * means that the feature comes in some versions and not in others. MSRP is pre-subsidy. For ICE vehicles, the NEDC standard is not applicable and instead refers to the driving range on a single tank of gasoline.

Table.2: Comparison of G9 and similar models

Source: supra note 3, which cited the official websites of the companies cited in this table, autohome.com.cn, and CITIC Securities Research Team.

As such, G9 is expected to help boost gross margin of XPeng. The pricing range of G9 allows it to exceed the company’s current revenue per car, which is RMB 0.22 million for Q2, 2022. The gross margin of G9 is expected to match that of P7, and a lot higher than the current average gross margin which stands at RMB 24 thousand per car. (5) In addition, the contribution of the G9 to gross margin is expected to be reflected in more flexible pricing policy measures for other models following its delivery.

(5) Supra note 3.

Favourable Policies Towards the EV Industry in China and Other Countries

China has put in place a myriad of supportive policies towards promoting the rapid growth of the EV industry, in line with its drive towards sustainability. In the New Energy Vehicle Industry Development Plan (2021-2035) issued by the State Council on 20 October 2020, (6) it is stated that the development of new energy vehicles is China’s way to move from a large automotive country to a strong automotive country and is a strategic initiative to address climate change and promote green development. It is aimed that by 2025, the competitiveness of China's new energy vehicle market will be significantly enhanced, major breakthroughs will be made in key technologies such as power batteries, drive motors and vehicle operating systems, and safety levels will see overall improvement.

(6) State Council, China, New Energy Vehicle Industry Development Plan (2021-2035) [新能源汽车产业发展规划 (2021-2035年)] (20 October 2020), online: <https://www.gov.cn/zhengce/content/2020-11/02/content_5556716.htm>

In addition, the policy goals are also for the average electricity consumption of new pure electric passenger cars to drop to 12.0 kWh/100 km, new energy vehicle sales to reach about 20% of total new vehicle sales, highly self-driving cars to achieve limited regional and scenario-specific commercial applications, and the convenience of charging and switching services to be significantly improved.

In achieving such goals, it’s highly likely for the Chinese government, regulators and market players to favour local Chinese players over foreign brands, as it is also clearly stated in the above plan that after 15 years of sustained efforts, China's new energy vehicle core technology is to reach the international advanced level, quality brand with strong international competitiveness. XPeng stands to benefit from this wave of policy and market supports.

Valuation

Based on a survey of analyst reports, the consensus estimate is in the range of HK$48 to 59. (7) Taking a conservative end of the range, this report suggests a modest valuation of HK$52.50. Given the last closing price of HK$49.60 (24 June 2023), there is still an upside of 32.58%, which is expected to be achieved within the next one to three years. Accordingly, this report issues a BUY recommendation on XPeng Inc (09868.HK).

(7) See for example, Yin Xinchi, Li Jingtao, Li Zijun, Wu Pingyue, Jian Zhixin and Dong Juntao (CITIC Securities), “Q12023 Results under Pressure, G6 and XNGP Regaining Confidence (23Q1业绩承压,G6和XNGP将重聚信心)” (29 May 2023), giving a target price of HK$48; Huang Leping, Chen Xudong, Zhang Yu and Guo Chunxin (Huatai Securities), “Bullish on XPeng’s Second Quarter Earnings Rebound (看好小鹏二季度业绩反弹)” (21 March 2023), assigning a target price of HK$50; and Ray Kwok (CGSCIMB), “XPeng Inc – Market Share Recovery Likely Ahead” (20 March 2023), allocating a target price of HK$58.93.

Risk and Mitigation

Intensifying competition in the NEV market

Competition in China’s NEV market is intensifying, while OEMs are striving to offer electrification solutions to customers and comply with China’s strict fuel efficiency/emissions targets. NEV-focused OEMs such as NIO, Li Auto, etc, are actively launching models and offering competitive products at similar price points, besides Tesla’s localized Model 3. Tesla’s Gigafactory is Shanghai was launched at end-19, and the company has already gained a ~20% share in China’s EV PV market YTD, according to Bloomberg.

In addition, global and domestic traditional OEMs are playing active roles. VW’s launch of the MEB platform, BMW’s electric version of its existing models (iX3), and Great Wall Motor/BMW’s Spotlight etc, should further shape the competitive dynamics. Given the fierce competition, there is also increased risk for a race to the bottom in terms of a price war which would work against the interest of XPeng as a relatively young company.

Limited track record and execution challenges of the franchise model

XPeng was founded in 2015 and started vehicle delivery only from end-18. With only eight years of history and 5 years of mass delivery, XPeng’s track record is still limited compared to traditional OEMs. In addition, XPeng may face execution challenges for its franchise model, given that its brand recognition is contingent on the quality of services at its stores. Although XPeng’s sales and service network, applying the franchise model, enables an asset-light expansion solution, depending on franchised stores where approximately 70% of its stores are franchised could be relatively risky for a relatively new brand such as XPeng. Given that franchisees manage the stores and run the daily operations directly, XPeng has limited control over the franchised stores. As a result, execution risks arise, and brand image could be damaged if franchisees fail to comply with the agreement with XPeng or to deliver satisfying and qualified services to XPeng’s customers.

ESG assessment

Environmental (8)

(8) XPeng, 2022 Environmental, Social and Governance Report, online: <chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://ir.xiaopeng.com/system/files-encrypted/nasdaq_kms/assets/2023/04/12/5-18-25/%E5%B0%8F%E9%B9%8F%E6%B1%BD%E8%BD%A62022%E5%B9%B4ESG%E6%8A%A5%E5%91%8A-%E8%8B%B1%E6%96%87%E7%89%88.pdf>

Building low carbon products: compared to conventional ICE vehicles, the electric vehicles delivered by XPeng in 2022 will reduce carbon emissions by approximately 1.72 million tons over their entire life cycle, advancing green and low-carbon travel.

Reduce end-to-end carbon emissions: annual power generation from solar PV installed by the company reached 26.62 million kWh, which is equivalent to CO2 emission reduction of 14,188 tons, further promoting the clean energy adoption. In 2022, XPeng’s annual charging reached 322,602,875 kWh, with a cumulative carbon emission reduction of about 577,200 tons, which delivers low-carbon living.

Establish the carbon emission measurement system: the company carried out internal measurement of enterprise carbon emissions and lifecycle carbon emissions of each vehicle model to formulate the carbon emission measurement system. It has also established a carbon footprint assessment of its mass production models, and assigned Zhaoqing Plant as a pilot unit for carbon emission status measurements, setting emission reduction targets and breakdown tasks for emission reduction.

Green manufacturing: the Phase I distributed PV project located in the Zhaoqing Plant was connected to the grid in November 2021, with an installed capacity of 20.74 MW. Zhaoqing Plant was awarded the title of “Green Plant” from the Ministry of Industry and Information Technology of the People’s Republic of China, driving the green transformation of the manufacturing.

Green materials: XPeng carried out active R&D and utilization of green materials. And it established a VOC (Volatile Organic Compounds) evaluation standard system and process specification covering the whole vehicle, parts and materials.

Social (9)

(9) Ibid.

Product quality control: the company has been ISO 9001 certified, obtained the EU 2018/858 WVTA certificate for P5 and G3i models, and secured the first type certificate of UNECE R79 in China from TÜV SÜD for its P7 model. It has further developed the quality objective in the Supplier Quality Engineer (SQE) field, which is further divided into 30 objectives in 5 segments.

Product safety: the company obtained the UN R155 (UNECE Regulation No.155) certificate of compliance for its cybersecurity management system and 2 models were assigned C-NCAP 5-star rating in recognition of the products’ superb safety performance.

Responsible supply chain practices: the company has required suppliers to obtain third-party certification under IATF 16949, ISO 9001, environmental management system, production safety standardization, or equivalent certification. The company evaluated the ESG performance of its suppliers, and continuously track suppliers’ ESG performance in the compliance, business ethics, confidentiality infringement, product quality, production safety, environmental management and other dimensions. Furthermore, the Company has signed the Integrity Commitment Letter with 100% of suppliers to build a high quality partnership system.

Cybersecurity: the company has obtained the ISO 27001 Information Security Management System Certificate and ISO 27701 Privacy Information Management System Certificate to improve cybersecurity management.

Governance (10)

(10) Ibid.

Composition of the Board: the company’s Board of Directors is composed of 8 members, including 1 executive director, 4 non-executive directors and 3 independent non-executive directors, among which there is one female Director. Among the members of the board, the independent directors hold a majority in each of the 4 professional committees, all of which are chaired by an independent director. The company has established company-level ESG committee forming a 3-tier sustainability governance structure composed of the “Board of Directors-ESG Steering Committee-ESG Task Force”.

Risk control: the Company refers to the internal control framework of the COSO (the Committee of Sponsoring Organizations of the Treadway Commission) and the Sarbanes-Oxley Act Section 404 to establish a risk management framework and related risk management systems to comprehensively manage operational risks. The company manages the risks in accordance with the process of risk identification, risk assessment, risk response, problem solving, review and reflection, process improvement and additional control, and follow-up reviews, to carry out closed-loop risk management. In 2022, within the board, three independent non-executive directors and one non- executive director have risk management expertise. Additionally, one non-executive director and two independent non-executive directors constitute the audit committee of the company so as to ensure that risk management is carried out independently of the business lines. Moreover, we have established financial incentives for senior executives, direct managers, and others involved to develop risk management indicators, and strengthen the implementation of risk management measures.

Conclusion

In conclusion, positioned in a growth industry, and highly aligned with the tenets of the ESG movement, XPeng is a stock that derives value from a concerted effort in creating a more sustainable future. Granted it is still a young company, it has developed leading technology, delivered high quality products and seized considerable market share. Its current trading price is relatively low compared to its competitors with bigger brand names, leaving enough space for growth and value creation. Accordingly, this report issues a BUY recommendation on XPeng Inc (09868.HK), with a target price of HK$52.50 that could possibly be adjusted upwards if circumstances develop in a more positive direction.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.