Initial Report: Xvivo Perfusion AB (XVIVO.ST), 19% 5-yr Potential Upside (Pyae Phyo SHUN, EIP)

Pyae Phyo SHUN presents a "BUY" recommendation for XVIVO.ST based on its strong market position with scalable technology addressing organ shortages.

Why Hold?

XVIVO Perfusion holds a strong market position with scalable technology addressing organ shortages. However, high valuation, regulatory complexities, and reliance on organ availability pose risks. While DCF analysis suggests upside, near-term volatility and execution risks remain key considerations.

Company Description

Xvivo Perfusion AB (publ), a medical technology company, develops and markets machines and perfusion solutions for assessing usable organs and maintains in optimal condition pending transplantation in Sweden, the United States, the Netherlands, Italy, North and South America, Europe, the Middle East, Africa, the Asia Pacific, and Oceania.

The company was incorporated in 1998 and is headquartered in Mölndal, Sweden. Its customers mainly include hospitals, transplant centers, and healthcare providers operating in the field of organ transplantation as well as Healthcare institutions worldwide facilitating their transplantation endeavors through a comprehensive range of innovative products and services.

The company offers:

Products:

Kidney Assist Transport, a portable device that allows hypothermic pulsatile perfusion of donor kidneys with oxygenated solution for up to 24 hours;

Liver Assist that provides clinicians a choice of perfusion protocols whether hypothermic, normothermic, sub-normothermic, or a combination;

XVIVO System (XPS), a comprehensive ex vivo lung perfusion (EVLP) platform that offers an overview of the entire process;

STEEN Solution, a buffered extracellular solution intended for the assessment of isolated lungs after removal from the donor in preparation for eventual transplantation into a recipient.

Perfadex Plus, an extracellular, low potassium, dextran-based electrolyte preservation solution;

XPS Disposable Lung Kit that contains all the necessary devices and tubing to run a normothermic EVLP procedure on the XPS;

XVIVO Organ Chamber, a sterile single-use container intended to be used as a temporary receptacle for isolated donor lungs;

XVIVO Lung Cannula Set, a sterile single-use set that connects isolated donor lungs to an extracorporeal perfusion system for ex-vivo assessment.

Kidney Assist that provides clinicians with a choice of perfusion protocols from hypothermic to normothermic perfusion;

Gisto, an integrated system for organ transportation.

Services:

FlowHawk™: Organ intake workflow software. (US only)

XVIVO Organ Recovery Service (Italy only)

XVIVO Perfusion Service (US only)

Business Segments

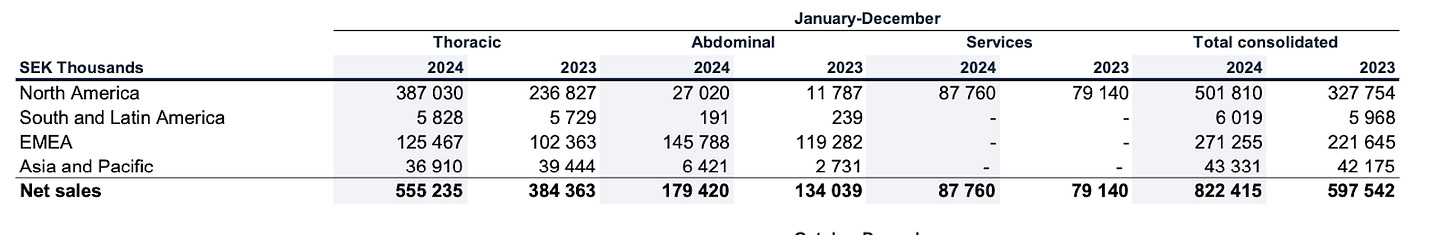

The company operates through three segments: Thoracic, Abdominal, and Services. Commercial and R&D activities take place within each business area.

Thoracic (products for lung and heart transplantation)

Focusing on delivering consumables essential for preserving and recovering thoracic organs, the thoracic contributes the most out of the three business segments to the company’s overall revenue by supplying advanced technologies that enhance surgical outcomes. In lung transplantation, the company’s product Perfadex® Plus has a market share of approximately 90 percent in traditional static preservation of lungs. However, XVIVO’s products are in a clinical study phase for heart transplantation.

For Q4, machine perfusion accounted for 58 percent (53) of net sales. Growth was primarily driven by strong momentum for EVLP on the US market. Static preservation and other sales accounted for the remainder of net sales. Compared to 2023, sales of disposables increased by 45 percent and amounted to SEK 539.2 million (372.5). Organic growth amounted to 46 percent in local currencies. Machine perfusion accounted for 59 percent (50) of net sales. Static preservation and other sales accounted for the remainder of net sales.

Abdominal (products and perfusion services for liver and kidney transplantation)

XVIVO offers oxygenated machine perfusion products for both these organs. Products for liver and kidney transplants are primarily sold in selected markets in Europe, but also in other smaller markets. The launch of the company’s kidney preservation product, Kidney Assist Transport, gradually accelerated during 2024. Product encompasses a range of protective solutions and consumables that facilitate the effective preservation and transplant of abdominal organs while ensuring that clinicians have access to the latest tools designed to optimize organ viability during the surgical process.The revenue was primarily generated in Europe, and approximately 71 percent related to liver perfusion.

Services (services within organ transplantation in the US)

Services include consulting and training services for healthcare facilities engaged in organ recovery procedures. This service-oriented approach complements the product offerings, ensuring that healthcare providers can maximize their use of this segment’s technologies through expert guidance and support. Sales increased by 11 percent year-on-year, of which 4 percent related to acquired growth relating to FlowHawk. Organ recovery’s sales grew organically by 7 percent in year-on-year terms. The gross margin amounted to 40 percent (44). Margins are expected to improve gradually as activity increases and new customer contracts are signed.

Revenue drivers (in different geographical regions)

XVIVO ended the year strongly with 44% organic growth. The Thorax was once again the primary driver, particularly lung, which grew by 55% in Q4. Abdominal also showed solid performance with 30% growth, returning from a weak Q3. While easy comps somewhat boosted growth in Q4, it’s important to note that organic growth for FY’24 reached 39%. Looking forward, growth drivers in 2025 can be similar to those in 2024. Once approved, the heart sub-segment will provide a boost, though we anticipate a more limited contribution from the kidney in the US. 2024 has been a standout year for growth, but maintaining this pace will be challenging. Services segments are also set to bring in more revenues

Key markets include:

Sweden: The company’s home base, where it has built an extensive network within the healthcare sector.

The United States: A significant market in the field of organ transplantation due to its advanced healthcare infrastructure and a high rate of organ transplants.

The Netherlands and Italy: These countries represent growing markets for the company’s innovative products and services.

Other regions include North and South America, as well as parts of the Europe, the Middle East, and Africa; and the Asia/Pacific, contributing to a diverse and expanding clientele.

Business outlook

The company focuses on establishing and maintaining leadership in organ transplantation through innovation, quality, and strategic growth. By investing heavily in R&D, it continuously develops solutions to improve preservation and recovery processes. Collaboration with medical professionals, research institutions, and healthcare organizations drives innovation and ensures alignment with evolving clinical needs. Additionally, the company pursues global expansion, targeting high-potential markets to advance organ transplantation worldwide.

According to their CEO, “In 2025, we will sharpen our focus on our two core markets: North America and Europe. In Europe, the primary focus will be the launch of our heart technology together with growing our current business. In North America, the emphasis will be on further expanding our EVLP business and continuing to grow and strengthen our digital and organ recovery service offering. In 2025 we will continue to invest for the future. Our commercial and clinical organization will be built out and equipped to handle a broader product portfolio and we will invest further in building a tailored service offering that addresses evolving customer needs.”Moreover, the company has a solid cash position of 450 million SEK, providing a strong financial foundation for future investments.

Positive outlook for Thoracic (heart and lung) with a strong position in the Ex vivo lung perfusion (EVLP) business

As seen in Q2, Q3 and Q4 earnings, XVIVO's lung business continues to drive growth within the thoracic segment, with EVLP showing solid momentum in the US market indicating that XVIVO is a leading provider for lung perfusion.

In the heart front, XVIVO’s heart preservation technology, utilizing Hypothermic Oxygenated Perfusion (HOPE), is gaining strong momentum. In the U.S., the PRESERVE clinical trial completed patient enrollment five months ahead of schedule, reflecting high interest from transplant centers. The next milestone is a one-year follow-up, after which data will be analyzed for FDA Pre-Market Approval (PMA). If approved, HOPE could significantly expand the donor pool by making higher-risk hearts viable and improving patient safety during long-distance transport and surgical delays, strengthening XVIVO’s position in the U.S. heart transplant market.

In Europe, while CE-mark approval has been slightly delayed, confidence remains high following the publication of XVIVO’s heart trial in The Lancet in August 2024. The study demonstrated a 44% reduction in severe complications and a 61% decrease in primary graft dysfunction (PGD) compared to traditional ice storage. These findings, along with strong clinical evidence and growing regulatory interest, position HOPE as a transformative innovation in heart transplantation. Once approved, it is expected to drive hospital adoption, market expansion, and long-term growth in Europe. Moreover, positive research results using XVIVO’s heart technology in Australia/New Zealand, expands the donor pool in Australia/New Zealand. With strong clinical results and growing adoption, it has high potential for regulatory approval and global expansion.

Abdominal (liver and kidney)

The company has become a clear market leader in kidney perfusion in the Europe.

For liver products, XVIVO’s Liver Assist technology, utilizing Dual Hypothermic Oxygenated Perfusion (DHOPE), has demonstrated the ability to extend liver preservation up to 20 hours, significantly improving transplant logistics. A clinical trial at UMCG (Netherlands) confirmed that prolonged perfusion had no negative impact on patient outcomes while enabling daytime surgeries, reducing strain on medical teams, and improving surgical efficiency. With most liver transplants at UMCG now performed during the day, this technology enhances planning flexibility and facilitates multi-organ transplants. These findings support broader adoption, positioning XVIVO’s Liver Assist as a key innovation in liver transplantation while positioning XVIVO as a market leader in kidney perfusion products in Europe.

However, Liver Assist is an unapproved device limited by Federal (or United States) Law to non-clinical research use only and is not commercially available for sale within the United States. But as of September 2022, XVIVO's Liver Assist device has been granted Breakthrough Device Designation by the U.S. Food and Drug Administration (FDA). This designation is intended to expedite the development and review of medical devices that offer significant advantages over existing alternatives for treating life-threatening or irreversibly debilitating conditions. The IDE application, which requires approval from the FDA to initiate a clinical trial, has also been submitted.

Once approved for commercial sales in the US, XVIVO claims that margins are expected to improve at a pace with increased sales in the US and as we achieve economies of scale from new production facilities.

XVIVO's Kidney Assist Transport has overcome previous production constraints and is now expanding its European presence, with installations in over 15 high-volume hospitals. Strong clinical evidence supports the benefits of Hypothermic Oxygenated Perfusion (HOPE) for DCD kidneys, and in 2025, XVIVO will explore its potential for DBD kidneys. This data will be crucial for positioning Kidney Assist Transport to address the full kidney transplant market in both the US and Europe, driving broader adoption and long-term growth.

Services:

In the US, XVIVO’s FlowHawk™ and organ recovery services provide end-to-end support during organ retrieval and transportation, ensuring optimal preservation and reducing the risk of post-transplant complications. These services are highly valued by transplant surgeons and payers, as they enable continuous organ monitoring and provide surgeons with critical pre-transplant insights, allowing for better preparation and improved outcomes. By integrating these services with its existing product portfolio, XVIVO not only drives revenue growth but also strengthens its competitive advantage by increasing customer reliance and reducing switching incentives.

In Italy, XVIVO’s perfusionists accompany retrieved organs to the transplant surgeon’s operating theater, ensuring optimal preservation throughout transport. This hands-on service minimizes the risk of organ rejection and post-transplant complications while providing surgeons with real-time organ monitoring. Surgeons can assess the organ remotely before transplantation, allowing for better preparation and improved surgical outcomes. By offering this alongside its perfusion technology, XVIVO enhances its value proposition, increases customer dependence, and strengthens its competitive edge through higher switching costs and long-term customer relationships.

Industry Analysis

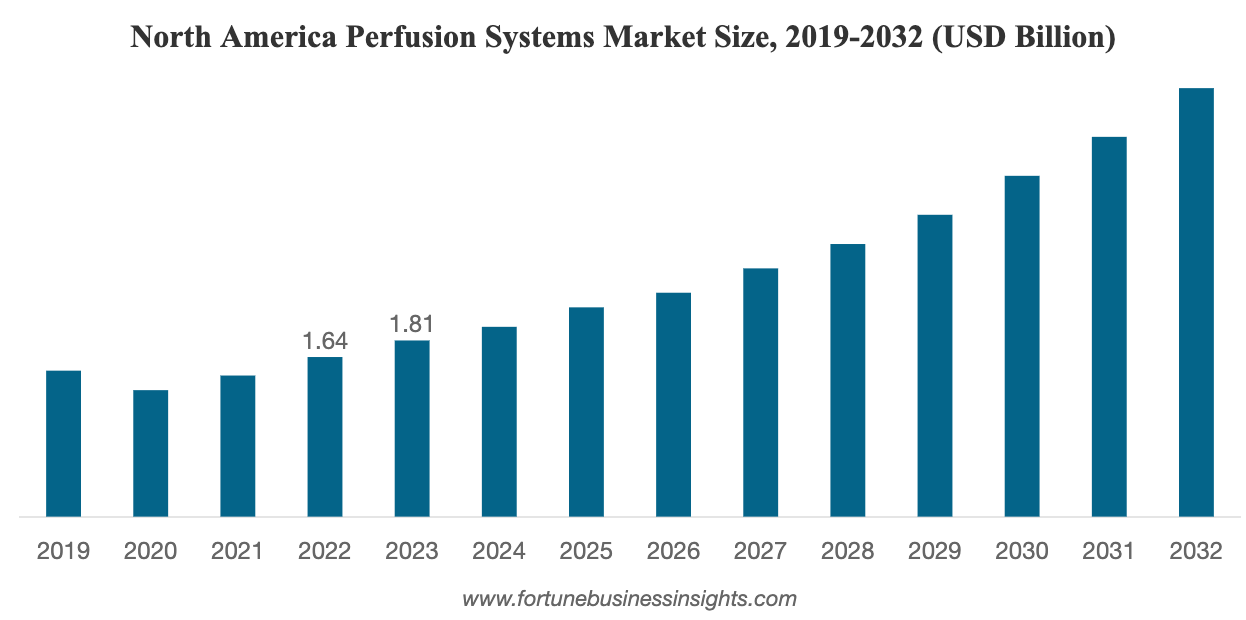

The perfusion systems market size was valued at USD 4.62 billion in 2023. The market is projected to grow from USD 5.00 billion in 2024 to USD 11.55 billion by 2032, exhibiting a CAGR of 11.0% during the forecast period. North America dominated the perfusion systems market with a market share of 39.18% in 2023.

Support from government and healthcare organizations

Governments and healthcare organizations in key markets like the U.S., Japan, and China are promoting machine perfusion to improve organ preservation and reduce transplant rejection, particularly for donation after circulatory death (DCD) organs. The trend is reinforced by a surge in DCD liver transplants using hypothermic oxygenated perfusion (HOPE) or normothermic machine perfusion (NMP), rising from 1.2% in early 2023 to 60% by mid-2023, according to the Scientific Registry of Transplant Recipients (SRTR). Increased investment in perfusion technologies for multiple organs further accelerates adoption, positioning machine perfusion as the new standard in transplantation. The support from government and healthcare organizations could speed up the commercialization of solutions/machines in trial periods, allowing XVIVO to enter US markets more easily especially with its liver and kidney products.

Increasing prevalence of chronic diseases

Chronic diseases, including CKD, liver disease, and heart failure, progressively damage organs, driving demand for transplants. 1 in 10 people worldwide suffer from CKD, with 88,901 patients on the U.S. kidney waiting list (2022). Hepatitis C affects 50M globally, causing ~242,000 deaths in 2022. In the U.S., 17,000 patients await liver transplants, but only 5,000 procedures occur annually. Heart transplants have risen, with 3,668 adult and 494 pediatric procedures in 2022. THere is a strong demand for organ transplants and there is a huge demand that XVIVO could fulfil with its perfusion machines and solutions.

Rising need for organ transplantation

The rising prevalence of chronic diseases, including kidney failure, liver cirrhosis, and heart disease, is driving demand for organ transplants. In 2023, the U.S. performed 46,000 transplants (an 8.7% increase from 2022), with 27,000 kidney transplants, while Europe saw 39,000 transplants. Growing transplant eligibility and advancements in preservation solutions are crucial to maintaining organ viability and improving outcomes. As end-stage organ failure cases rise, the need for effective organ preservation solutions continues to expand, fueling market growth.

In 2023, North America led the market with a substantial revenue share, followed by Europe and APAC. Asia Pacific is expected to register the highest CAGR during the forecast period.

Competitor Landscape

XVIVO Perfusion operates in a niche but rapidly growing market driven by the increasing demand for organ transplants due to aging populations and the rising prevalence of chronic diseases. The company has established itself as a market leader, particularly in lung transplantation, and is expanding its presence in heart, liver, and kidney transplants. Its deep expertise, strong clinical data, and broad regulatory approvals provide a competitive edge. The barriers to entry in XVIVO Perfusion’s markets are substantial. The company’s patented technologies, with protection spanning 18 to 20 years, create a significant hurdle for new entrants. Any competing technology would require extensive R&D investment, followed by multi-year clinical trials and complex regulatory approvals. Even after clearing these stages, new players would face the challenge of convincing surgeons, hospitals, and payers—who are accustomed to XVIVO’s highly regarded products—to adopt an alternative solution. Additionally, XVIVO’s expansion into organ retrieval services strengthens its competitive advantage by embedding itself deeper into the transplant ecosystem. The data collected from these retrievals enables continuous process optimization, further solidifying its market leadership. Our ongoing assessments indicate no imminent threat from new market entrants in the foreseeable future.

However, XVIVO faces challenges from a complex, time-sensitive supply chain and evolving regulatory environments that could impact approvals and operational efficiency. The competitive landscape remains dynamic, with emerging players and potential disruptive technologies posing threats to market share. XVIVO’s ability to strategically expand into emerging markets, diversify its product portfolio, and form strategic alliances with research institutions and healthcare providers positions it well for sustained growth. Nonetheless, macroeconomic factors such as healthcare budget constraints and supply chain disruptions remain risks that could affect pricing, sales cycles, and overall market penetration.

Key Competitors:

TransMedics, Inc. (US): Developed the Organ Care System (OCS), a portable device that maintains donor organs in a near-physiologic state, enabling real-time monitoring and assessment. The OCS Heart System received FDA approval in 2021 for use with organs from donors after brain death.

Paragonix Technologies (US): Specializes in organ preservation and transport devices, including the LIVERguard Donor Liver Preservation System. Paragonix has expanded its product offerings in the US and Europe to strengthen its geographic presence.

OrganOx Limited (UK): Focuses on normothermic machine perfusion technology, particularly for liver preservation. Their Metra device maintains donor livers at body temperature, improving preservation quality.

Dr. Franz Köhler Chemie GmbH (Germany): Provides Custodiol HTK, a widely used organ preservation solution. The company expanded its presence in the Chinese and Asia Pacific markets through a joint venture in 2020.

Bridge to Life Ltd. (US): Offers organ preservation solutions and has collaborated with medical institutions to enhance liver preservation techniques. In October 2024, they partnered with ULS Coimbra to advance liver transplant procedures.

XVIVO differentiates itself through its focus on ex vivo perfusion technology, particularly in lung transplantation. It has made significant advancements in normothermic perfusion, a process that keeps donor lungs in a functioning state before transplantation, enhancing transplant success rates. It faces stiff competition from TransMedics, which has a much larger revenue base and a broader portfolio covering multiple organ types with its Organ Care System (OCS). Additionally, market consolidation and continuous innovation from competitors like Paragonix present ongoing challenges. However, XVIVO is the most specialized in organ perfusion and preservation and has strong cash flows to focus on organ perfusion and preservation innovation. Thus, if XVIVO could expand into US markets successfully with liver and kidney products and scale up its production properly, XVIVO has no worries about its competitors.

Source: CFGR

Fig: Peer Group comparison

Source: DNB Markets

From first look, XVIVO seems overvalued despite its strong business and market positioning.

Investment thesis:

The Razor/Razorblade Business Model Supports High EBITDA Margins and Creates a Strong Economic Moat

XVIVO employs a razor/razorblade business model, where its capital equipment (perfusion machines) acts as the "razor," while single-use consumables and solutions serve as the "razorblades." Notably, more than 80% of XVIVO’s sales come from disposables, ensuring a recurring revenue stream and high-margin business. This model not only stabilizes cash flow but also enhances pricing power, as customers must continuously purchase XVIVO’s proprietary solutions and accessories to maintain operations.

Moreover, the organ perfusion and transplantation industry has high barriers to entry, stemming from stringent regulatory approvals, proprietary technology, and the need for extensive clinical validation. This has historically deterred new entrants, although the sector has seen increasing investor interest. For example, recent IPOs in the medical device and organ transplant space—such as TransMedics’ successful market debut—highlight the industry's long-term growth potential. XVIVO's niche position and robust intellectual property portfolio give it a strong competitive moat in this expanding market.

The U.S. Liver Transplant Market Represents a Key Growth Opportunity for XVIVO

The United States is the largest liver transplant market in the world, with more than 8,600 liver transplants performed in 2021. This figure exceeds the combined total of the next three largest markets—China, Brazil, and Italy—underscoring the U.S. as the primary driver of global transplant demand. Looking ahead, the U.S. liver transplant market is expected to grow at an annual rate of 6% until 2030, while the donation after circulatory death (DCD) segment—a key area for XVIVO—is projected to expand at an even faster pace of 15% per year.

A 2023 study published in The New England Journal of Medicine demonstrated that oxygenated hypothermic perfusion significantly improves post-transplant clinical outcomes for DCD donor livers. This presents a major opportunity for XVIVO to penetrate the U.S. liver and kidney transplant markets, as its oxygenated perfusion solutions are well-suited for this application. However, XVIVO has yet to establish a strong foothold in the U.S., making successful market entry a key determinant of its future growth. If the company can expand its liver and kidney preservation technologies in the U.S., it could capture significant market share and drive long-term profitability. Given the well-received support during clinical trials in the US, I remain optmistic towards XVIVO’s entry into the US market.

Sustainable Margin Expansion Through Proprietary Technology and Operational Efficiency

XVIVO is well-positioned to expand its gross margins through a combination of proprietary consumables, exclusive product offerings, and operational efficiencies. The company’s perfusion solutions and disposable products generate high-margin, recurring revenue, as transplant centers must rely on XVIVO’s specialized solutions for organ preservation. Additionally, its exclusive regulatory approvals and distribution agreements create barriers to entry, allowing for premium pricing and reduced competition. On the cost side, increased production scale is expected to lower per-unit manufacturing costs, while expansion into high-growth markets like the U.S. liver and kidney transplant sector will provide access to higher reimbursement rates. Furthermore, ongoing supply chain optimization and operational efficiencies will help reduce overall costs, further driving EBITDA margin expansion. By leveraging its proprietary technology, securing exclusive partnerships, and optimizing costs, XVIVO is positioned to achieve sustainable long-term margin growth.

Valuation

The valuation is based entirely on a Discounted Cash Flow (DCF) model, with peer multiples used as a reference due to the limited number of comparable listed companies. A Weighted Average Cost of Capital (WACC) of 9.5%, a terminal growth rate of 2%, and a terminal EBITDA margin of 34% have been applied, with explicit forecasts extending until 2033.

The DCF-derived fair value is estimated at SEK 567 per share, suggesting approximately 19% upside to the current share price. Sensitivity analysis indicates that variations in perpetuity growth rates and EBITDA margins could significantly impact the valuation

Key risks

Investment Risks

XVIVO Perfusion faces multiple risks that investors should consider, spanning market, operational, regulatory, financial, and liability concerns. A key risk is the company’s high valuation, which makes the stock vulnerable to shifts in market sentiment, regulatory setbacks, or delays in product rollouts. The ongoing interest rate cycle also presents a risk—if rate cuts reverse or economic turbulence arises, XVIVO’s status as a high-growth stock could make it susceptible to investor pullbacks.

Operational Risks

XVIVO must continually innovate, produce, and commercialize products that meet strict industry standards for safety and efficacy. While supplier agreements and strategic partnerships help mitigate risks, product development failures remain a concern. Additionally, given its relatively small scale, XVIVO relies heavily on its existing human capital, making the retention of key experts crucial for sustained growth and operational stability.

Regulatory & Legal Risks

The regulatory landscape is constantly evolving, and any sudden legislative changes or political decisions could disrupt XVIVO’s operations. Market entry is contingent on regulatory clearances, adding complexity and potential delays. Meanwhile, increasing industry regulations aimed at ensuring patient safety are driving higher product development costs, raising barriers to entry but also adding financial pressure on established players like XVIVO.

Financial Risks

XVIVO faces currency exposure due to a mismatch between revenue and expenses. While a large portion of its sales are in USD and EUR, many of its costs are incurred in SEK and USD, leaving the company vulnerable to foreign exchange fluctuations. The lack of a robust hedging strategy increases this risk, which investors should monitor closely.

Liability Risks

As a medical technology provider, XVIVO is exposed to potential liability claims related to its products and services. While the company maintains insurance coverage for general and business-specific risks, the potential for substantial legal claims remains an ongoing concern.

ESG Assessment:

Assessment:

XVIVO Perfusion plays a crucial role in advancing global healthcare by offering life-saving solutions that improve health outcomes and enhance the efficiency of organ transplantation. The company adheres to a strict code of conduct and internal sustainability policies, ensuring compliance with ethical and environmental standards throughout its operations. To minimize environmental impact and enhance product safety, XVIVO integrates continuous monitoring and review processes across the entire product lifecycle.

Despite these positive attributes, XVIVO faces sustainability challenges. The company relies on third-party suppliers and partners, making it dependent on their ESG practices, which may pose risks in meeting its own sustainability commitments. Additionally, the medical technology industry is highly regulated, requiring processes such as animal testing and the use of specific materials, which raise ethical concerns. Furthermore, hospital equipment—especially disposable items—is subject to strict biohazard regulations, limiting recyclability and increasing medical waste, which can have a long-term environmental impact.

Commitment:

To reinforce its ESG commitment, XVIVO actively supports four key UN Sustainable Development Goals (SDGs): SDG 3 (Good Health and Well-being), SDG 5 (Gender Equality), SDG 8 (Decent Work and Economic Growth), and SDG 9 (Industry, Innovation, and Infrastructure). In 2022, the company conducted a materiality analysis to assess its sustainability impact across the value chain, ensuring that it meets high ESG standards. XVIVO has identified three core ESG focus areas: maintaining ethical and responsible business practices, fostering employee commitment and workplace diversity, and delivering innovative, high-quality, and accessible healthcare solutions. Additionally, the company actively works to raise awareness of organ donation shortages through strategic partnerships and financial support for research projects.

Key ESG Drivers:

In the short term, XVIVO’s technology directly addresses the global shortage of donated organs, contributing to SDG 3 by increasing organ availability for transplants. By improving organ preservation and transport efficiency, the company helps shorten patient wait times and reduces overall healthcare costs for both public and private providers. Furthermore, XVIVO collaborates closely with hospitals to provide training and technical support, ensuring the seamless adoption of its technologies in clinical settings.

Looking at the long-term impact, XVIVO’s strong sustainability policies help mitigate risks associated with unethical practices, such as corruption and involuntary organ donations, as demand for organ transplantation continues to grow. The company remains dedicated to investing in cutting-edge research and development, further enhancing the accessibility and effectiveness of transplantation technologies. Additionally, as regulatory pressure on medical waste management intensifies, XVIVO is expected to explore more sustainable product designs and recycling solutions to reduce environmental impact and align with global sustainability goals.