Initial Report: Yokohama Rubber Company (TYO: 5101), 62.7% 5-yr Potential Upside (Charmaine LIM, EIP)

Charmaine LIM presents a "BUY" recommendation for Yokohama Rubber Company based on the market recognising its shift towards the more resilient and higher-margin OTR segment.

Driving Growth Off-Road? Yokohama Rubber's Strategic Maneuver

1. Executive Summary

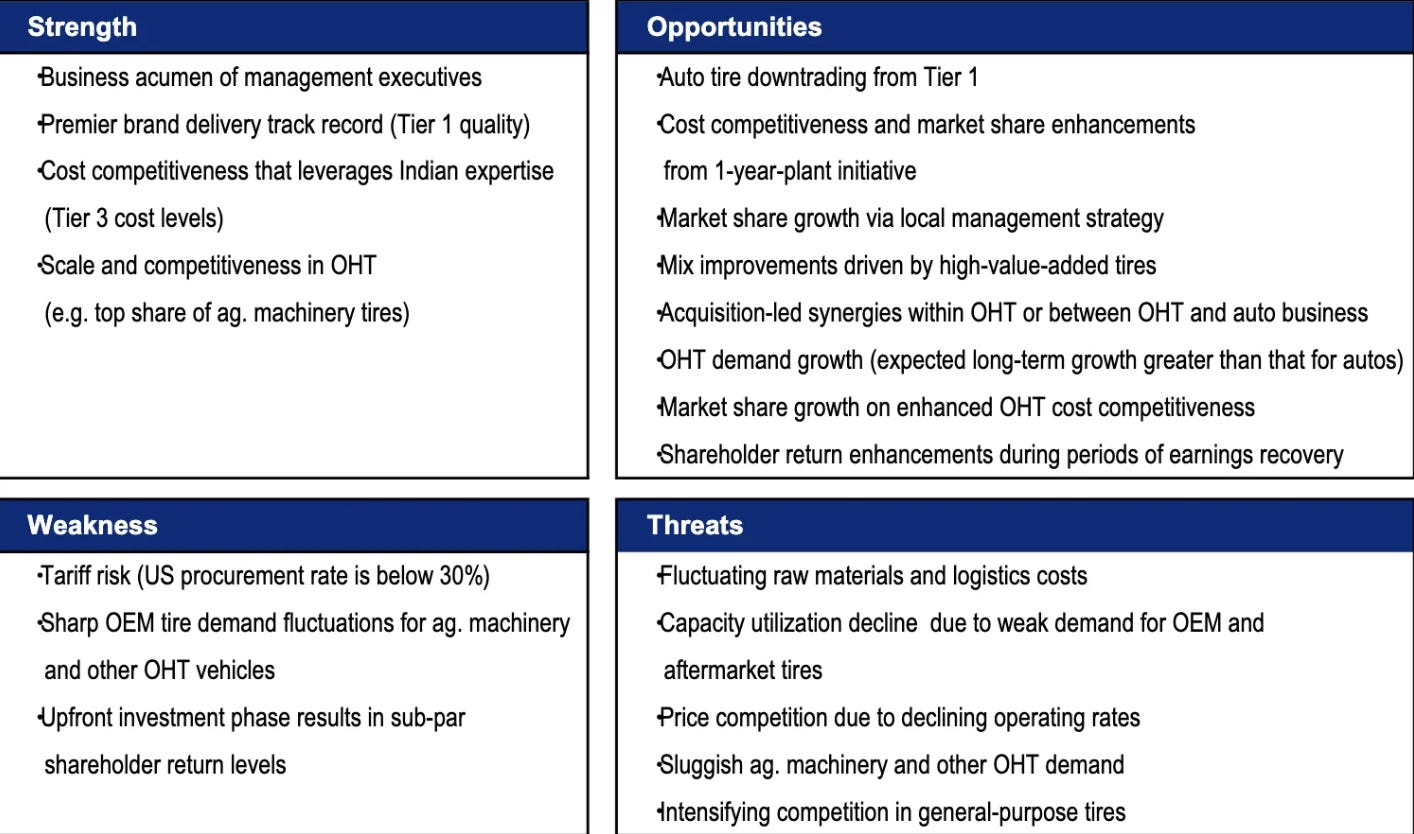

The transformative acquisitions of Trelleborg Wheel Systems and Goodyear's OTR tire business have established Yokohama Rubber as a formidable No. 3 global player in this specialized sector, offering significant revenue and margin expansion potential driven by increasing mechanization in agriculture, infrastructure development, and rising demand for resources. Coupled with a focus on premium consumer tire segments and ongoing cost efficiencies, this strategic repositioning is anticipated to drive substantial earnings growth. While acknowledging the potential headwinds from evolving global trade policies, particularly the risk of increased US tariffs on imported goods, which could impact profitability in a key market, we believe Yokohama Rubber's diversified global footprint and proactive cost management strategies will help mitigate these risks. Our analysis projects a 5-year target price of ¥5,600, predicated on the market recognizing the enhanced earnings power and strategic advantages derived from Yokohama Rubber's decisive shift towards the more resilient and higher-margin OTR segment.

2. Yokohama Rubber Company Overview

2.1. Historical Background and Key Milestones

Established on October 13, 1917, in Yokohama, Japan, the Yokohama Rubber Company initially focused on manufacturing a diverse range of rubber products, including essential industrial components such as belts and hoses. In 1921, the company expanded its production to include pneumatic tires for both trucks and passenger cars, marking its entry into the core business that would define its future. Following World War II, Yokohama Rubber strategically shifted its focus towards the rapidly expanding automobile industry, recognizing the immense growth potential of this sector. The company demonstrated a commitment to innovation early in its history, pioneering the development of Japan's first wire radial tire for trucks and buses in 1956. This technological advancement was followed by the introduction of the first radial tire specifically designed for passenger cars in 1966.

In 1978, Yokohama Rubber launched the ADVAN series of tires, which, due to its superior performance and technological sophistication, became the company's global strategic brand in 2005. Beyond its tire operations, Yokohama Rubber diversified into Multiple Business (MB) operations starting in 1952. This segment has played a crucial role in contributing to social infrastructure and various industrial fields through the development and production of products such as industrial and automotive hoses, as well as conveyor belts. The company's initial production facility was established in Hiranuma in 1920, followed by the commencement of operations at the Hiratsuka Plant in 1952, which remains one of its core manufacturing hubs. Yokohama Rubber's international expansion began in the 1960s, with a significant step being the establishment of the Yokohama Tire Corporation in the United States in 1969, marking its formal entry into the global market. Continuing its tradition of innovation, the company has more recently introduced the "BluEarth" brand of tires, emphasizing environmentally friendly designs with low rolling resistance. Yokohama Rubber's extensive history, spanning over a century, underscores its ability to adapt and thrive in a dynamic market. Its early emphasis on technological advancement, particularly in the radial tire segment, laid a strong foundation for its current standing in the industry. Furthermore, the diversification into MB operations provides a degree of stability that complements the cyclical nature of the tire business.

Source: Company Report

Yokohama Rubber has undertaken significant strategic acquisitions to bolster its presence in the Off-Highway Tire (OHT) market. The 2016 acquisition of Alliance Tire Group (ATG), a specialist in agricultural and construction machinery tires, for $1.18 billion , and the 2022 acquisition of Trelleborg Wheel Systems (TWS), a leader in agricultural and industrial tires, for €2.1 billion , represent substantial investments aimed at capturing a larger share of this high-growth sector. These acquisitions signify a clear strategic direction towards diversifying its revenue streams and capitalizing on the increasing demand for OHT driven by global trends.

The company's headquarters remain in Hiratsuka, Japan. Yokohama Rubber operates under a well-defined corporate governance structure. As of March 28, 2024, the Board of Directors comprised a total of ten members, including six internal directors and four external directors, ensuring a balance of knowledge and experience. The company transitioned its governance structure to a "Company with an Audit & Supervisory Committee" on March 30, 2023, to enhance the supervisory function of the Board. Key personnel leading the company include Masataka Yamaishi, who serves as Chairman & CEO and Chairman of the Board, and Shinji Seimiya, the President & COO. Nitin Mantri holds the position of Member of the Board and Senior Managing Officer & Co-COO, with specific responsibility for the OHT Business and the India Business. This dedicated leadership for the OHT segment underscores its strategic importance to the company's future growth.

Yokohama Rubber is also focused on enhancing its R&D capabilities, as highlighted by its "HAICoLab" AI-powered data utilization framework. This initiative demonstrates the company's commitment to innovation and leveraging technology to drive efficiency and product development.

Source: Company Report

2.2. Corporate Structure and Leadership

The leadership of Yokohama Rubber Company is spearheaded by Masataka Yamaishi, who serves as the Chairman & CEO. The operational aspects of the company are overseen by Shinji Seimiya, the President & COO. The company's strategic direction and governance are managed by a Board of Directors that includes both internal executives and external, independent members.

In a move aimed at enhancing its corporate governance and streamlining decision-making processes, Yokohama Rubber transitioned from a company with an Audit & Supervisory Board to one with an Audit & Supervisory Committee. This structural change is intended to further enhance corporate value by promoting efficiency and transparency. As of March 2024, the company's commitment to diverse perspectives and international standards was evident in the composition of its Board of Directors, which included a total of ten members, comprising six internal directors (including female and foreign national representation) and four external directors. The presence of a board member specifically dedicated to the OHT business signifies the strategic priority the company places on this high-growth segment. The inclusion of external directors and the adoption of an Audit & Supervisory Committee framework reflect a strong commitment to sound corporate governance principles and enhanced transparency, which are vital for building and maintaining investor confidence.

2.3. Analysis of Business Segments: Tires, Multiple Business (MB), and Other Business

Source: Company Report

The Yokohama Rubber Company operates through three primary business segments: Tires, Multiple Business (MB), and Other Business. The Tires segment constitutes the core of the company's operations, generating approximately 90% of its total sales. This segment encompasses a comprehensive range of tire products, including those manufactured and sold by YOHT (formerly Alliance Tire Group=ATG) and Y-TWS (Yokohama-TWS, formerly Trelleborg Wheel Systems Holding AB), both of which specialize in off-highway tires.( )Yokohama Rubber develops, manufactures, and markets tires across all product categories, from general-use tires for passenger cars and winter tires designed for icy and snowy conditions to robust tires for trucks and buses. The company also produces a wide array of off-highway tires (OHT) tailored for agricultural, construction, industrial, and forestry machinery. Key brands within the passenger car tire segment include the globally recognized ADVAN (high-performance), BluEarth (environmentally friendly), GEOLANDAR (SUV/crossover), and iceGUARD (winter). The Tires segment includes the production of tires for the truck and bus sector, as well as specialized tires used in various motorsports events.

Source: Bloomberg Intelligence

The Multiple Business (MB) segment represents a significant diversification for Yokohama Rubber, with a long history of developing technologies and products that contribute to social infrastructure and industrial fields. This segment is involved in the manufacture and sale of a wide range of industrial products, including high-pressure hoses used in automobiles, construction machinery, machine tools, and metal joints. It also produces industrial materials such as marine hoses and pneumatic fenders for marine applications, conveyor belts used in various industries, and even aerospace products like lavatory modules and drinking water tanks for airplanes.

The Other Business segment is primarily focused on the manufacturing and sale of golf equipment under the PRGR brand, including golf clubs and related accessories.( )

3. Strategic Expansion in the Off-Highway Tire (OHT) Market

3.1. Analysis of the Off-Highway Tire (OHT) Business

Source: Company Report

Yokohama Rubber's Off-Highway Tire (OHT) business is a key strategic segment, encompassing tires designed for specialized machinery used in agriculture, forestry, construction, and industrial applications. This sector is of growing importance to the company, as it provides a high-value opportunity for expansion and profitability. Yokohama Rubber has built a strong presence in the OHT market, particularly within the global agricultural and forestry machinery tire segments, which make up approximately 40% of the total OHT market. The company also holds the second-largest market share in the industrial and port vehicle tire segment, which constitutes about 25% of the global OHT market. In addition, Yokohama Rubber is actively focusing on expanding its presence in the construction and mining machinery tire markets, where it previously had a smaller share.

The global OHT market is valued at USD 4.8 billion in 2024, with a projected compound annual growth rate (CAGR) of 6.1% from 2025 to 2034, potentially reaching USD 8.4 billion by 2034. Within this broader market, the North American OTR tire market is also notable, valued at USD 3.48 billion in 2024 and expected to grow at a CAGR of 5.22%, reaching USD 5.23 billion by 2033. This growth rate outpaces the 3.4% CAGR projected for the overall global tire market from 2025 to 2030, highlighting the OHT segment as an area of strong strategic interest.

Several factors contribute to the attractiveness of the OHT market. The specialized nature of OHT products, the stringent performance requirements, and the established relationships between tire manufacturers and original equipment manufacturers (OEMs) in key sectors create high barriers to entry. These barriers protect profitability within the OHT segment compared to the more commoditized consumer tire market. Furthermore, the OHT market's strong growth prospects are driven by key trends such as increasing construction and mining activity, infrastructure development, rising global demand for minerals and commodities, and the mechanization of agriculture, particularly in response to growing global food demands.

As the global population is expected to increase by 20% from 2025 to 2050, demand for food and, consequently, for agricultural machinery tires, is anticipated to rise. Specifically, agricultural and forestry machinery tires are expected to grow at a CAGR of 5.5%, providing a significant opportunity for Yokohama Rubber, which is well-positioned with its established expertise in this segment. Global logistics volumes are projected to double between 2023 and 2030, driven by growing port and warehouse transport operations, there will be a substantial demand for industrial and port-use machinery tires. These tires are forecasted to grow at a CAGR of 5.3%, and Yokohama Rubber is enhancing its portfolio to cater to this demand.

Infrastructure development is another major driver of growth in the OHT segment. With global construction output projected to increase by 85% from 2023 to 2030, the demand for construction machinery tires, which are expected to grow at a CAGR of 6.2%, will be significant.

The transition toward clean energy is also creating opportunities in the mining sector. As the demand for critical battery materials such as lithium, graphite, cobalt, and nickel increases, this will lead to an increase in the demand for mining machinery tires. These tires, expected to grow at a CAGR of 6.6%, represent the highest growth segment within OHT.

3.2. Impact of the Trelleborg Wheel Systems Acquisition

Source: Company Report

On May 2, 2023, Yokohama Rubber Co., Ltd. completed a significant strategic acquisition with the purchase of all outstanding shares of Trelleborg Wheel Systems Holding AB (TWS) for a total consideration of EUR 2,074 million (approximately ¥307.2 billion). TWS is a prominent Swedish company engaged in the manufacture and sale of off-highway tires specifically designed for agricultural and industrial machinery. In fiscal year 2022, TWS reported net sales of approximately ¥172.5 billion and employed a workforce of 6,621 individuals. This acquisition was a key component of Yokohama Rubber's medium-term management plan, YX2023, which identified the expansion of the OHT business as a crucial driver for future growth within the company's commercial tire sector.

Yokohama Rubber anticipates that the integration of TWS will lead to a more balanced sales composition within its tire business, aligning the ratio of consumer to commercial tire sales with the global market average of 1:1. Previously, the company's sales were more heavily weighted towards consumer tires, with a ratio of 2:1.( )The acquisition is expected to generate significant synergies across various aspects of the business, including the development of new and innovative products and services, enhanced manufacturing capabilities, expanded sales networks, improved quality control processes, and strengthened sustainability initiatives. TWS brings to the Yokohama Rubber Group an extensive global footprint, with 14 production sites located in Europe, Asia, and the Americas, and a well-established network of 40 sales offices worldwide. Its key product brands, TRELLEBORG and Mitas, are highly regarded in the agricultural and industrial machinery sectors. While Y-TWS experienced some financial challenges in 2024, primarily due to its significant reliance on agricultural OEMs facing production reductions, Yokohama Rubber is actively implementing measures to optimize manufacturing efficiencies, increase focus on the more stable aftermarket segment, leverage the broader YRC platform for operational improvements, and expand the customer base.( )The acquisition of Trelleborg Wheel Systems represents a substantial strategic move that immediately bolsters Yokohama Rubber's scale, product portfolio, and global presence within the strategically important OHT market.

Source: Company Report

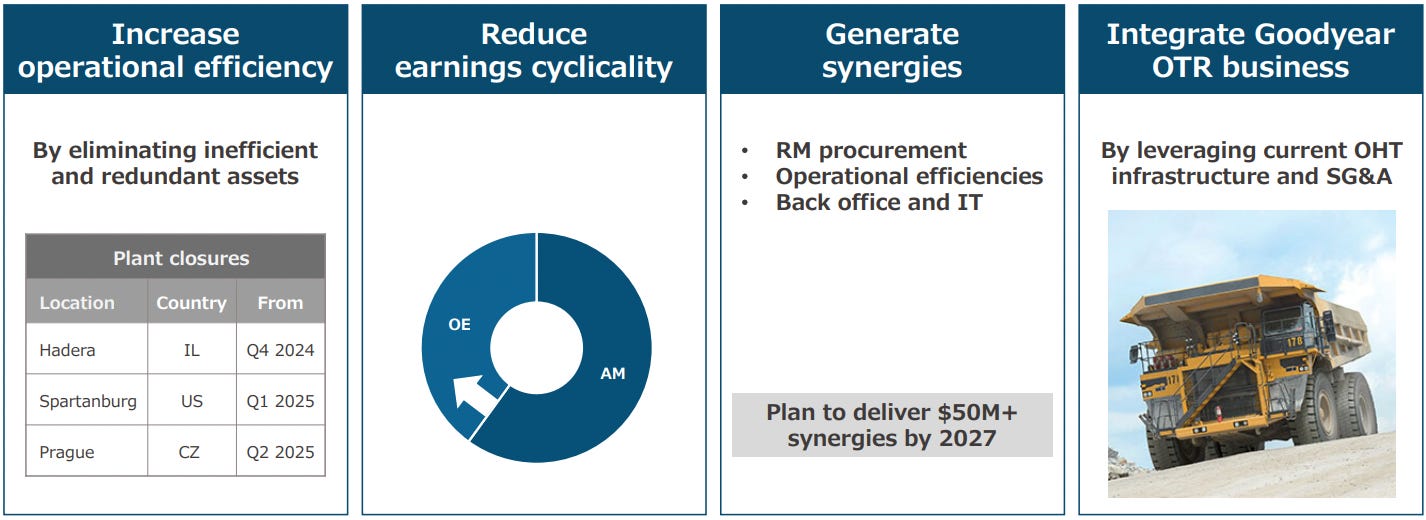

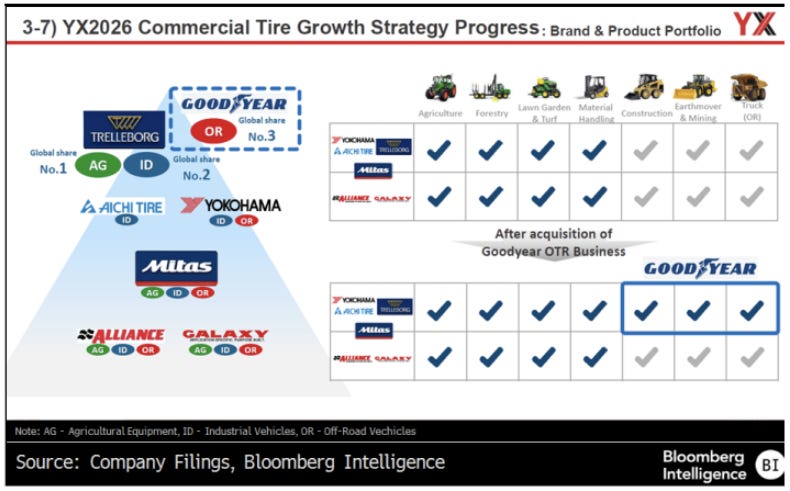

3.3. Strategic Implications of the Goodyear OTR Tire Business Merger

Yokohama Rubber further solidified its position in the Off-Highway Tire (OHT) market with the completion of the acquisition of Goodyear's OTR tire business on February 3, 2025, for a cash consideration of $905 million (approximately ¥129.4 billion)( )This acquisition includes the transfer of all shares of Nippon Giant Tire Co., Ltd., which operates a dedicated OTR tire plant in Japan, and Goodyear Earthmover Pty Limited in Australia, as well as other relevant global assets.( )This strategic move is a key component of Yokohama Rubber's medium-term management plan, Yokohama Transformation 2026 (YX2026), which aims to achieve significant growth by expanding the company's offerings in the off-highway tire segment.

Yokohama Rubber anticipates that this acquisition will significantly enhance its product lineup, particularly in the crucial segments of mining and construction machinery tires. It also brings advanced technologies, professional services capabilities, and the strong brand recognition associated with Goodyear's OTR business. In fiscal year 2023, Goodyear's OTR business reported sales of approximately US$678 million (approximately ¥95.4 billion) and an EBITDA of around US$129 million (approximately ¥18.1 billion), demonstrating a strong track record of stable financial performance.( )The successful completion of this acquisition elevates Yokohama Rubber to the position of the No. 3 player in the overall global OHT market.( )With the addition of Goodyear's OTR business, which has a strong presence in the market for mining machinery tires, Yokohama Rubber now boasts a comprehensive range of both premium and standard tire brands across all major OHT categories, from agriculture (AG) to industrial (ID) and off-road (OR) tires. This strategic acquisition is projected to contribute over ¥5 billion in incremental profit to Yokohama Rubber's financials in 2025, highlighting the immediate financial benefits and the strategic fit of this business with Yokohama Rubber's existing operations.

Source: Company Report

Key trends shaping the OTR tire market include the rising demand for radial tires, which offer enhanced durability, improved comfort, and better fuel efficiency compared to traditional bias tires.( )There is also an increasing demand for OTR tires with longer lifespans and reduced maintenance requirements, particularly in demanding industries like mining and construction where equipment downtime can be costly.( )Furthermore, the need for operational versatility is driving demand for all-weather and multi-terrain OTR tires that can perform effectively in diverse environmental conditions.( )The increasing investment in infrastructure development and the growth in mining operations are significant drivers in various regional markets.( )The growing trend towards the electrification of heavy equipment is creating new demand for specialized OTR tires designed to handle the unique stress points and weight distribution of electric vehicles.( )Technological advancements, such as the integration of AI and ML for predictive maintenance and the development of smart tire technology with real-time condition analysis, are also transforming the OTR tire market. The aftermarket for OTR tires is expanding rapidly, driven by the continuous need for replacements, maintenance, and retreading services. Sustainability is another key focus, with companies investing in eco-friendly materials and retreading solutions to reduce their carbon footprint.

Geographically, the Asia Pacific region dominates the global tires market, accounting for the largest revenue share in 2024. This is primarily attributed to the rapid expansion of the automotive industry within the region, particularly in key markets such as China, India, Japan, and Southeast Asia.( )The automotive premium tires market is anticipated to grow at an even faster pace, with an expected CAGR of 10.89%, reaching a value of USD 19.46 billion by 2030.( )Furthermore, global sales of all automotive tires were valued at USD 240.9 billion in 2024 and are projected to reach USD 471.7 billion by 2035, indicating a robust CAGR of 6.3%.

4. Competitive Landscape: Key Players and Market Share Analysis

The global tire market is characterized by a competitive landscape dominated by several major international players. These key competitors include Michelin Group, Bridgestone Corporation, Continental AG, The Goodyear Tire and Rubber Company, Sumitomo Corporation, and Pirelli Tyre S.p.A. In 2022, Michelin held the largest share of the global tire market with 15.1%, followed closely by Bridgestone with a market share of 14.2%.( )Yokohama Tire Corporation is also recognized as a significant player in the global tire industry.

Within the Off-the-Road (OTR) tire market, competition includes companies such as BKT and Apollo Tyres, which are strengthening their global presence with cost-competitive solutions.( )Yokohama Rubber's recent strategic acquisition of Goodyear's OTR tire business marks a significant shift in the competitive dynamics of the OHT market, firmly establishing Yokohama Rubber as the No. 3 player in this segment.( )The global tire market's concentration among a few major players indicates a mature yet competitive industry. For Yokohama Rubber, understanding the market share and strategic initiatives of these key competitors is crucial for developing effective competitive strategies and achieving sustainable growth. The company's proactive approach through strategic acquisitions has notably enhanced its competitive positioning in the high-growth OHT market, elevating it to a top-tier contender.

4.1 Global Competitor Strategies

Each major competitor in the off-road tire market employs distinct strategies to maintain and expand their market share. Michelin focuses on leveraging advanced rubber compounds and reinforced casings specifically designed for construction, mining, and agricultural applications and has recently launched sustainable OTR tires incorporating a significant percentage of recycled materials. Bridgestone emphasizes the use of high-durability rubber and steel-belted radial tire technology for heavy equipment and industrial vehicles, and has introduced smart tire technology with real-time tracking capabilities, alongside substantial investments in expanding its radial earthmover tire production.( )Goodyear, prior to its divestiture of the OTR business to Yokohama, concentrated on heat-resistant rubber and deep-tread designs tailored for earthmoving, forestry, and port operations. Continental AG offers a comprehensive range of both radial and bias-ply OTR tires, including smart tire technology solutions for mining, agriculture, and material handling sectors.Titan International specializes in developing unique rubber formulations and reinforced sidewalls primarily for agricultural and forestry machinery. BKT (Balkrishna Industries) distinguishes itself by focusing on all-terrain rubber compounds and impact-resistant tire structures for construction, mining, and heavy-duty transport applications, with a strong emphasis on providing cost-competitive solutions. Apollo Tyres strategically focuses on high-performance rubber compounds for industrial and agricultural machinery, actively expanding its global footprint by offering cost-competitive products.( )

4.2 Analysis on Japan Tire Companies

Japan Tire Companies: Strategy on premium tire shift

Source: Company Data, Citi Research

The strategic shift towards premium tires is a crucial element of Yokohama Rubber's growth strategy, aligning with a broader trend among Japanese tire manufacturers to enhance profitability and capture greater market share. In 2024, Yokohama Rubber reported an AGW (ADVAN, GEOLANDAR, Winter) ratio of 43%, a notable increase from 41% in 2021. Furthermore, the sales ratio of AGW tires with a diameter of 18 inches or more reached 51% in 2024. The company has set a long-term target to achieve an AGW ratio of 50% or higher, indicating a sustained focus on higher-value products.( )

This emphasis on premium tires is driven by increasing consumer demand for high-performance and durable tires, the growth of the electric vehicle market which requires advanced tire technology, and the higher profit margins associated with premium offerings.( )Yokohama Rubber's strategy to increase the sales ratio of its premium ADVAN, GEOLANDAR, and Winter tires to 50% by focusing on product and regional strategies, including strong sales of 18-inch and larger tires in Europe and Asia, demonstrates its commitment to this profitable segment.( )

Japan Tire Companies: Strategy on Cost Reduction Plans

Cost efficiency remains a critical priority for Japanese tire companies, as they seek to optimize operations and sustain profitability in a competitive market. Yokohama has undertaken strategic initiatives, including the establishment of new plants in China and Mexico under a "1-year factory" concept, which aims to accelerate production timelines and enhance supply chain agility. The company is also leveraging synergies with OHT (Off-the-Highway Tires) to streamline production and reduce costs.

Source: Company Data, Citi Research

Sales volumes for automotive tires and Sales by final destination

Source: Company Data, Citi Research

Sales volumes for Japanese tire manufacturers, including Yokohama, Toyo, Bridgestone, and Sumitomo, have shown a positive trajectory, aligning with increasing global demand. Data trends indicate that these companies have successfully rebounded from the downturn, with notable growth observed in recent years.

While the domestic Japanese market remains important, a significant portion of sales is directed toward Asia, North America, and Europe. As global mobility trends continue to evolve, Japanese tire manufacturers are expected to maintain a balanced focus on both domestic and international markets, capitalizing on growth opportunities while managing regional risks. This strategic approach will enable them to sustain their market position and drive long-term profitability in the highly competitive tire industry.

5. Financial Performance and Valuation Metrics

5.1. Historical Revenue and Profitability Analysis

Yokohama Rubber Company demonstrated exceptional financial performance in fiscal year 2024 (January to December 2024), achieving record highs in both sales and earnings. The company's sales revenue increased by 11.1% compared to the previous year, reaching ¥1,094.7 billion (approximately USD 7.18 billion). This marked the first time in the company's history that its annual sales exceeded the ¥1 trillion mark. Alongside this significant revenue milestone, Yokohama Rubber also reported record profits across all key categories. Business profit saw a substantial increase of 35.6% year-on-year, reaching ¥134.4 billion (approximately USD 881 million). Operating profit also grew strongly, up by 18.7% to ¥119.2 billion (approximately USD 782 million). Profit attributable to owners of the parent company increased by 11.4% to ¥74.9 billion (approximately USD 491 million). The company's business profit margin also reached a record high of 12.3%.

Looking back at the previous fiscal year, 2023, Yokohama Rubber recorded sales revenue of ¥985.3 billion (approximately USD 6.46 billion), representing a 14.5% increase compared to 2022. In 2022, the company's revenue stood at ¥860.5 billion (approximately USD 5.64 billion). The strong financial performance in 2024 was attributed to successful efforts in increasing sales volume, implementing more optimal product pricing strategies, and expanding sales of consumer tires with sizes of 18 inches or larger. These factors were further supported by a full-year contribution from Y-TWS (Yokohama-TWS) and a positive impact from the depreciation of the Japanese Yen.( )Management is optimistic about the company's future financial prospects and projects that both sales and earnings will reach even higher record levels in fiscal year 2025.( )Yokohama Rubber's consistent growth in revenue and significant improvements in profitability in recent years highlight the successful execution of its strategic initiatives and its ability to capitalize on market opportunities. The projected continued growth in 2025 further underscores the positive momentum in the company's financial performance.

5.2. Key Financial Ratios

This growth was accompanied by a solid business profit margin of 12.3%, indicating effective cost management despite challenges such as rising raw material prices. Its P/E ratio, ranging from 6.0x to 7.4x, continues to reflect an undervaluation when compared to major industry peers like Bridgestone (9-14x) and Michelin (9-13x), positioning the company as a potential value investment. This relatively low valuation is also visible in its Price-to-Free Cash Flow (P/FCF) ratio, reported at 24.8x, which, although high, aligns with the company’s ongoing investments in capacity expansion and its strategic focus on the growing electric vehicle (EV) tire market.

Yokohama’s free cash flow yield of 4.03% supports the notion that the company is generating solid cash, although this is tempered by capital expenditures tied to the expansion of manufacturing capabilities in India and a heightened focus on the EV market. Recent announcements and reports confirm the company's proactive approach in these areas. Yokohama India, a subsidiary, has outlined plans to significantly boost its production capacity to 4.5 million tires by 2025, backed by investments in its Visakhapatnam plant. These initiatives are expected to drive future growth, particularly as the market for larger, EV-compatible tires continues to develop. Despite some volatility in raw material costs, including natural and synthetic rubber, Yokohama has been able to mitigate some of these pressures through operational efficiency, as evidenced by its gross margin of 35.0% in FY 2024.

The company’s financial leverage is relatively conservative, with a net debt-to-EBITDA ratio of 1.72x, indicating that debt levels are manageable compared to some of its peers in the sector. The interest coverage ratio of 4.7x is slightly below industry averages but still suggests sufficient coverage for debt obligations. The company’s ability to manage its debt is further reflected in its net debt of ¥340.2 billion, providing room for future investments.

Yokohama Rubber has revised its timeframe for achieving its long-term total returns ratio target of 30% to FY12/26. The company is prioritizing growth over shareholder returns at this time. We believe that a dividend payout ratio of 30% and a total returns ratio of 40% from FY12/27 onward are achievable goals. As the company begins to recoup its investments, we anticipate a substantial increase in dividends over the medium term. These developments have not been fully reflected in sector share prices.

Dividend Yield Comparison

Source: Company Data, Citi Research

5.3 Current Valuation Based on PER

We apply a fair P/E multiple grounded in a comprehensive assessment of profit growth potential, profitability metrics (such as RoIC and the RoIC-WACC spread), historical valuation levels, sector and market benchmarks, and global peer comparisons. Our target P/E multiple of 7x sits at the midpoint of this range. While we view the company’s growing exposure to the off-highway tyre segment where long-term growth is expected to outpace that of auto tyres as a positive, this is balanced by headwinds such as US tariff risks, stagnant demand for new agricultural tyres, and a relatively low dividend yield, which we consider as discount factors.

The three-year target price of ¥4,109 is derived from our EPS forecast of ¥587 and a PER of 7x.

The foundation of our valuation rests on mid- to high-single-digit annual EPS growth, supported by three key drivers. First, margin expansion from an increasing mix of higher-margin off-highway and industrial products. Second, cost efficiencies from global operations, particularly in North America and Europe. Third, stable FCF generation, which reinforces the sustainability of earnings growth without excessive leverage.

6. Growth Strategy and Competitive Advantages

6.1. Focus on Premium and Off-Highway Tire Segments

Yokohama Rubber's growth strategy is strategically centered on expanding its presence and profitability in the premium consumer tire segment and the high-growth Off-Highway Tire (OHT) market. Under its medium-term management plan, YX2026, the company's commercial tire business is actively promoting an OHT growth strategy aimed at significantly strengthening its position in this attractive market.( )In the consumer tire business, Yokohama Rubber is focused on increasing the sales ratio of its premium brands, ADVAN, GEOLANDAR, and Winter tires, to 50% of the total consumer tire sales.( )A pivotal aspect of the company's strategic transformation has been the series of acquisitions in the OHT sector, including ATG in 2016, TWS in 2023, and Goodyear's OTR business in early 2025.

The company aims to achieve a significant increase in profit from its OHT division in 2025, primarily fueled by the restructuring of TWS and the successful integration of the recently acquired Goodyear OTR business. Looking ahead, Yokohama Rubber has set ambitious financial targets, projecting revenue of ¥1,150 billion and an operating income of ¥1,300 billion for fiscal year 2026.( )

The OHT segment benefits from relatively high barriers to entry, primarily due to the specialized nature of the products, the stringent performance requirements, and the established relationships with OEMs in the agricultural, construction, and mining industries. These high barriers to entry contribute to better profit margins within the OHT segment compared to the more competitive consumer tire market.( )Yokohama Rubber's strategic emphasis on the OHT market and premium consumer tires positions the company to capitalize on these favorable market dynamics, potentially leading to improved profitability and sustainable revenue growth. The achievement of a balanced 1:1 ratio between consumer and commercial tire sales also provides a more diversified and stable revenue base, reducing the company's reliance on the highly competitive consumer tire segment.

6.2. Plans for Production Capacity Expansion in China and Mexico

Source: Company Report

To further enhance its cost competitiveness, particularly in the Yokohama brand standard tire segment within the consumer tire market, Yokohama Rubber has initiated plans for significant production capacity expansion in key regions. The company has started the construction of new manufacturing plants in both Mexico and China, operating under the ambitious concept of a "1-year plant" challenge.( )

This initiative aims to drastically reduce the product costs associated with its standard tire offerings by establishing efficient and rapidly operational production facilities in these strategic locations. In addition to these new plants, Yokohama Rubber is also undertaking investments to expand both the production capacity and product mix at its existing facilities in the Philippines and Mishima.These strategic expansions in production capacity are a clear indication of Yokohama Rubber's commitment to meeting anticipated future demand across its various tire segments. By establishing new plants in Mexico and China, the company aims to improve its cost structure, particularly in the competitive standard tire market, potentially through lower labor costs, reduced transportation expenses, and enhanced responsiveness to regional market demands. The "1-year plant" concept suggests a strong focus on efficiency and speed in bringing this new capacity online. Furthermore, the concurrent investments in the Philippines and Mishima indicate a broader strategy to optimize and expand the company's global manufacturing footprint to support its overall growth objectives.

7. Research and Development Efforts in Off-Road Tire Technology and Innovation by Yokohama Rubber

7.1 Focus on Tire Compound and Construction Technology

Yokohama Rubber places a strong emphasis on continuous innovation in both tire compound and construction technologies as crucial elements in delivering tires that offer exceptional durability, superior grip, and a smooth driving experience across various terrains.( )The company utilizes advanced rubber compounds, including silica-infused compounds, which are specifically engineered to enhance wet traction and improve fuel efficiency. Furthermore, Yokohama employs state-of-the-art construction techniques, such as steel belt reinforcement and optimized ply design, to ensure the structural strength and overall durability of its tires, enabling them to effectively withstand the rigors of diverse driving conditions, including challenging off-road environments. This ongoing investment in advancing tire technology is considered essential for Yokohama to maintain a competitive edge in the market and to meet the evolving performance demands of modern off-road vehicles.

7.2 Utilizing Motorsports for Technology Development

A key component of Yokohama Rubber's research and development strategy involves actively utilizing its participation in motorsports activities as a vital platform for the development of new and innovative tire technologies, particularly for its ADVAN and GEOLANDAR brands. The demanding conditions encountered in real-world off-road racing events provide an invaluable testing ground for GEOLANDAR tires, generating crucial data and insights that directly inform the product development process.(3) This strategic approach allows Yokohama to push the boundaries of its tire technology under extreme conditions and to efficiently translate the knowledge gained into tangible improvements in its consumer tire product lines.

7.3 Global R&D Network

Yokohama Rubber operates a sophisticated global research and development network, strategically strengthening its R&D activities in regions that are close to major consumer markets. This includes facilities such as the Yokohama Development Center America, located in North Carolina.The company also leverages a network of global testing facilities, including the Tire Test Center of Asia in Thailand and the Nürburgring Test Center in Germany. This comprehensive global R&D infrastructure enables Yokohama to effectively tailor its tire development efforts to meet the specific needs and preferences of different regional markets, while also benefiting from a diverse pool of expertise and access to a wide range of testing environments and conditions.

7.4 Focus on Sustainability in Tire Technology

Yokohama Rubber is increasingly prioritizing the integration of sustainability principles into its tire technology research and development efforts. This includes a dedicated focus on the research and application of sustainable materials in tire production, the development of technologies aimed at reducing tire weight to conserve resources and improve fuel efficiency, and the exploration of innovative recycling technologies for end-of-life tires. Furthermore, the company is actively involved in the development of biomass-derived synthetic rubber as a more sustainable alternative to traditional petroleum-based materials.( )These initiatives reflect Yokohama's commitment to aligning its technological advancements with global trends and the growing consumer demand for more environmentally friendly and sustainable tire products.

8. Risk Factors and Mitigation Strategies

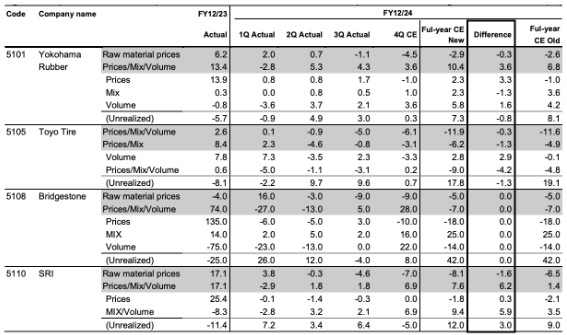

Spreads in tire makers (actual results and estimates) as of the 3Q earnings releases (¥b)

Source: Mizuho Securities

8.1. Analysis of Raw Material Price Volatility (Natural Rubber, Crude Oil)

Yokohama Rubber's financial performance is subject to the volatility of raw material prices, particularly natural rubber and crude oil derivatives, which are essential components in tire manufacturing. Fiscal year 2024 presented a challenging operating environment, marked by rising raw material costs.( )The OTR tire market, in particular, is sensitive to fluctuations in the prices of natural rubber and synthetic rubber, which can directly impact the profit margins of manufacturers. Interestingly, a factor analysis of Yokohama Rubber's business profit for FY2024 indicated a positive impact of +5.2 billion yen from raw material prices within the Tires total segment.( )This positive impact could potentially be attributed to the company's ability to pass on some of the increased costs to customers through price adjustments or due to inventory valuation effects. However, the overall rubber tire market generally faces the ongoing challenge of raw material price volatility, which can exert pressure on profitability.( )Effective management of these price fluctuations through strategic sourcing, hedging activities, or the ability to adjust product pricing in response to cost changes will be crucial for Yokohama Rubber to maintain its profitability.

8.2. Exposure to Currency Exchange Rate Fluctuations (Yen)

As a global company, Yokohama Rubber's financial results are influenced by fluctuations in currency exchange rates, particularly the relationship between the Japanese Yen and other major currencies such as the US Dollar and the Euro. In fiscal year 2024, the company's financial performance benefited from the depreciation of the Yen against these major currencies.( )Specifically, the exchange rate impact of the US Dollar strengthening against the Yen contributed a positive ¥1.4 billion to the Tires total business profit in FY2024, while the impact of the Euro and other currencies against the US Dollar had a negative effect of ¥1.4 billion.( )For the Y-TWS business, the strengthening of the Euro against the Yen resulted in a positive exchange rate impact of ¥0.4 billion. The Yen has shown signs of firming, which has led to some downward pressure on Japanese stock prices as investors consider the potential implications, including the risk of new US tariffs. The company will need to continue to monitor and manage its currency exposures to mitigate potential adverse effects on its earnings.

8.3. Sensitivity to Global and Agricultural Tire Demand

Tariff rates of major countries

Source: METI,J.P.Morgan

Source: Bloomberg, J.P. Morgan

Yokohama Rubber's performance in its core tire business is closely linked to the overall demand for tires in both the global automotive and agricultural sectors. Global tire demand is primarily driven by the expansion of the automotive industry, particularly in emerging economies where vehicle ownership is on the rise. In fiscal year 2024, Yokohama Rubber faced challenges due to a significant reduction in production by agricultural machinery manufacturers, which negatively impacted original equipment (OE) sales for agricultural tires.( )However, this decline in OE sales was offset by strong performance in the replacement (REP) market for agricultural tires under the YOHT brand. Looking ahead, the agricultural tires market is projected to experience growth, driven by the increasing global demand for food production and the ongoing mechanization of agricultural practices.( )Yokohama Rubber's ability to navigate fluctuations in demand across different sectors and its presence in both the OE and replacement markets will be important factors in maintaining stable and growing sales volumes. The resilience demonstrated by the YOHT brand in the face of OE market challenges underscores the value of a diversified market approach.

8.4. Assessment of Competitive Risks

The tire market is characterized by a high degree of competition, with numerous global and regional players vying for market share. Key competitors in the industry are constantly focusing on product innovation, technological advancements, and the establishment of strategic partnerships to gain a competitive edge.( )

Yokohama Rubber faces increasing competition from new market entrants, particularly from manufacturers in emerging economies who often offer products at lower price points. Specifically, Chinese tire manufacturers are projected to significantly increase their share of global passenger car tire production, intensifying the competitive pressures in this segment. To address this growing competition, Yokohama Rubber is strategically focused on enhancing the cost competitiveness of its Yokohama brand standard tires. This includes initiatives such as the construction of new, efficient "1-year plants" in Mexico and China aimed at reducing production costs.( )In the highly competitive tire market, continuous innovation in product development, efficient cost management across the supply chain and manufacturing processes, and effective brand differentiation will be crucial for Yokohama Rubber to sustain and grow its market share and maintain healthy profitability. The company's proactive steps to improve cost competitiveness in the face of rising competition demonstrate a strategic awareness of the evolving market dynamics.

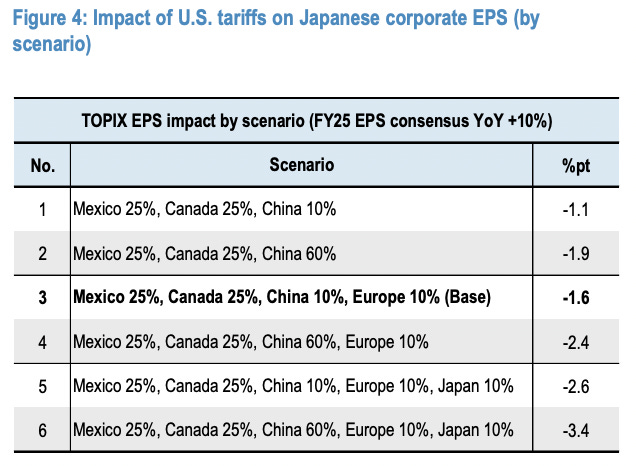

8.5. Potential Impact of US Tariffs

Breakdown of the impact of US tariffs on Japanese corporate EPS

Source: JETRO, US BEA statistics, J.P. Morgan

The imposition of tariffs by the United States on various imported goods, including those relevant to the automotive sector, presents a potential risk to Yokohama Rubber's performance in the US market. There have been past instances of duties being levied on tires imported from China and Thailand, which have impacted pricing within the US market.( )Furthermore, there are plans for the US to potentially implement new tariffs on imports from China, Mexico, and Canada in 2025, which could lead to increased prices for consumers and disruptions in existing supply chains.( )While some of these tariffs have initially impacted related industries such as wheel manufacturing through increased costs of raw materials like steel and aluminum, there is a broader risk that tariffs on auto parts and finished tires could negatively affect Yokohama Rubber's sales and profitability in the US. This could occur either through increased costs of imported tires or raw materials used in their production, or through a reduction in demand due to higher prices for consumers. The global nature of the tire industry's supply chain also means that tariffs could potentially cause disruptions and increase overall production costs for manufacturers who rely on imported materials. Yokohama Rubber will need to closely monitor the evolving trade policies and assess the potential impact on its US operations and sales.

8.6. Global Tire Demand Cyclicality and Potential Slowdown in the OHT Market: The automotive and tire industries are inherently cyclical, and a slowdown in global economic growth could lead to decreased demand for tires, including OHT.

The global economic outlook for 2025 suggests a moderate growth trajectory, with projections ranging from 2.5% to 3.3%. Japan's economy is expected to grow at around 0.7% to 1.5% in fiscal year 2025 , driven by factors such as wage growth and strong corporate profits. However, potential risks include global trade uncertainties, geopolitical tensions, and fluctuations in commodity prices. Consumer sentiment in Japan remains somewhat depressed due to rising food and energy prices. Interest rates in Japan are gradually rising, which could impact borrowing costs.

The tire industry is inherently cyclical, with demand closely linked to automobile sales and overall economic activity . Demand in the OEM segment is particularly sensitive to economic cycles, while the replacement market provides a more stable demand base . Fluctuations in raw material prices, such as natural and synthetic rubber and oil, also contribute to the cyclical nature of the industry, impacting profitability .

Factors such as changes in government policies or economic downturns could also decelerate infrastructure spending and agricultural mechanization. Yokohama Rubber can mitigate this risk by focusing on high-value-added segments, maintaining a diverse geographic presence, and adapting its production capacity to market conditions.

Currently, Yokohama Rubber employs several strategies to mitigate these risks. Diversifying raw material sources and exploring sustainable alternatives can reduce reliance on traditional commodities. Implementing hedging programs can help manage currency and commodity price volatility. Focusing on high-value-added segments allows for better margin resilience. A broad global footprint reduces dependence on any single market. Continuous investment in R&D ensures product differentiation and technological leadership.

9. Environmental, Social, and Governance (ESG) Initiatives

The company has consistently demonstrated a strong focus on environmental, social, and governance (ESG) factors. Yokohama Rubber has received "Prime" status in ESG corporate ratings by ISS ESG, a leading global provider of environmental, social, and governance research and ratings.( )This prestigious status reflects the company's particularly high evaluation in environmental management and social-related areas such as human capital, supply chain management, and human rights. Yokohama Rubber has been included in the FTSE4Good Index Series, a globally recognized ESG stock index, for 20 consecutive years.( )The company was also named to CDP's A List on Climate Change, recognizing its leadership in environmental transparency and performance.( )This strong ESG profile can be attractive to a growing number of investors who consider sustainability factors in their investment decisions.

9.1 Targets for Reducing CO2 Emissions

Yokohama Rubber Company has established ambitious targets for reducing its carbon dioxide (CO2) emissions, reflecting a strong commitment to environmental sustainability. The company's long-term goal is to achieve net zero CO2 emissions across its activities by the year 2050. As an interim step towards this long-term vision, Yokohama Rubber has set a mid-term target to reduce CO2 emissions from its company activities by 40% by the year 2030, using fiscal year 2019 as the baseline. Notably, in fiscal year 2024, the company reported achieving a 16% reduction in greenhouse gas emissions compared to 2019 levels, indicating significant progress towards its 2030 goal.( )Yokohama Rubber's commitment to addressing climate change has been recognized externally, as the company was named to the 2023 Climate Change A list by CDP, a global non-profit organization that evaluates environmental impact. To achieve its emissions reduction targets, Yokohama Rubber is implementing various measures, including energy management initiatives in its production facilities, promoting the use of renewable energy sources, and pursuing a modal shift in its logistics operations to more energy-efficient transportation methods. These efforts demonstrate a comprehensive approach to minimizing the company's environmental footprint and contributing to a decarbonized society.

9.2. Use of Sustainable Raw Materials

Yokohama Rubber is also strongly focused on increasing the use of sustainable raw materials in its products, with ambitious long-term and mid-term targets. The company's long-term aspiration is to achieve 100% sustainable raw material usage by the year 2050. In the medium term, Yokohama Rubber aimed to utilize at least 30% renewable and recycled raw materials by 2030. Impressively, the company achieved this 30% target in fiscal year 2024, six years ahead of schedule, and has since raised its 2030 target to 40%, demonstrating its strong progress and commitment in this area.( )To increase its use of sustainable materials, Yokohama Rubber is expanding its utilization of recycled rubber, wires made from scrap iron, silica derived from plant-based rice husks, and resins sourced from natural origins. Furthermore, the company has entered into a joint initiative with ZEON Corporation to develop manufacturing technology for key synthetic rubber chemicals using carbon resource recycling, aiming to further enhance the sustainability of its raw material supply chain. These initiatives highlight Yokohama Rubber's proactive approach to reducing its reliance on finite resources and minimizing the environmental impact of its products through the adoption of circular economy principles.

9.3. Corporate Governance Structure and Practices

Yokohama Rubber Company has established a robust corporate governance structure designed to ensure transparency, fairness, and accountability in its operations. In a move to enhance corporate value and expedite management decision-making, the company transitioned from a structure with an Audit & Supervisory Board to one with an Audit & Supervisory Committee. The company's Board of Directors is composed of both internal executive members and a significant number of external, independent directors, providing a balance of expertise and oversight. Matters related to the appointment and remuneration of officers are carefully considered by a dedicated Personnel and Remuneration Committee, which includes a majority of Outside Officers, ensuring an independent and fair process. Yokohama Rubber has established clear standards for its business processes and is committed to the timely and appropriate disclosure of relevant information to its stakeholders. To further promote ethical conduct and provide channels for reporting potential issues, the company operates a comprehensive whistle-blowing system. Yokohama Rubber is also committed to upholding the rights and ensuring the equality of its shareholders. These corporate governance practices reflect the company's dedication to maintaining high standards of corporate behavior and fostering trust among its investors and other stakeholders.

10. Scenario Analysis

Yokohama Rubber is undergoing a transformative shift that lays the foundation for sustainable, long-term profit growth that is not yet fully reflected in its current valuation. At the heart of this transformation is a business restructuring strategy catalyzed by recent acquisitions, most notably in the OHT segment and a move toward decentralized, local management.

These changes are already driving operational efficiencies, cost synergies, and strategic alignment across segments. The integration of the Goodyear OTR business is expected to yield tangible benefits from FY12/26, as one-off costs taper and production and sales networks are optimized. The company is also consolidating facilities and modernizing its operating structure, which is projected to generate meaningful cost savings of approximately ¥10bn by 2030.

The strategic emphasis on local management empowers regional teams to make faster, market-specific decisions, enabling the company to better respond to demand shifts and competitive dynamics. This structural transformation enhances both agility and profitability, positioning the company to outperform over the long term.

While these structural shifts lay the groundwork for future value creation, Yokohama is also showing encouraging near- and mid-term performance that underscores the strength and adaptability of its current business model. Despite softness in OHT demand, particularly in the new agricultural equipment segment, the company is expected to post resilient results in FY12/25. Our business profit projection of ¥143bn (+6% YoY) comes even as we forecast Yokohama absorbing the ¥4.5bn in acquisition-related costs. This reflects a business increasingly capable of navigating short-term challenges, supported by a 3% increase in auto tire volumes and a robust 20% growth in aftermarket OHT sales. While first-quarter profit is expected to decline on the surface, adjusting for one-time costs reveals stable core performance, suggesting underlying momentum in key segments. Auto tire market share continues to rise, aided by successful winter tire sales in Japan and competitive positioning in overseas markets. The company’s ongoing procurement initiatives and restructuring in the OHT and MB segments are helping to contain raw material costs and create operating leverage. We believe Yokohama’s earnings guidance embeds conservative assumptions, particularly in fixed costs and pricing, and see upside risk to current estimates. This operational resilience and prudent cost control provide a cushion to earnings, enhancing the credibility of management’s near-term targets.

Looking beyond FY12/25, we see meaningful upside to earnings and shareholder returns as Yokohama transitions into an investment recovery phase starting in FY12/26. We forecast business profit to grow to ¥165bn in FY12/26 (+15% YoY) and to ¥185bn in FY12/27 (+12%), supported by continued gains in auto tire market share and significant expansion in the OHT business. Importantly, Yokohama is poised to exceed its medium-term plan target of ¥150bn in business profit by a wide margin, suggesting that the company is executing ahead of expectations. Production capacity constraints are expected to ease as new plants in China and Mexico come online in 2026 and 2027, supporting further sales growth. Marketing strategies that emphasize local leadership in key regions like Europe, the U.S., and China will continue to strengthen brand positioning and market access. The OHT business, currently stabilizing after a decline in new vehicle demand, is forecast to accelerate sharply from FY12/26 as the aftermarket segment grows and synergies with existing businesses begin to materialize. With capital investments peaking, Yokohama is set to increase its shareholder distributions. We project the total payout ratio will rise to 40% by FY12/27, up from 26% in 2024, with dividends per share more than doubling to ¥220.

10.1 Factors Considered in the Base Case Scenario

The base case scenario underpinning the ¥4109 (3-year) and ¥5600 (5-year) target price for Yokohama Rubber considers several key factors. It assumes a continuation of steady growth in the global tire market, with the Off-the-Road (OTR) segment experiencing stronger growth rates compared to the overall market. A successful integration of both the Trelleborg and Goodyear OTR businesses is also central to this scenario, with the expectation that the anticipated synergies and profit contributions from these acquisitions will materialize as projected. The base case assumes that Yokohama Rubber will achieve its stated sales and earnings targets for fiscal year 2025, demonstrating the effectiveness of its current strategies. It also factors in relatively stable raw material prices and manageable fluctuations in currency exchange rates, avoiding significant adverse impacts on profitability. This scenario anticipates the successful execution of the company's strategy to increase the sales ratio of premium tires within its consumer segment, contributing to improved margins.

10.2 Upside Potential in the Bull Case Scenario

Beyond the base case, several factors could contribute to an even more favorable outcome for Yokohama Rubber, representing the bull case scenario. Stronger-than-anticipated growth in global infrastructure spending would significantly boost the demand for construction and mining OTR tires, directly benefiting Yokohama Rubber's expanded OHT business. A faster realization of synergies from the recent acquisitions of Trelleborg and Goodyear's OTR business could lead to higher profit margins than currently projected. Significant technological advancements in sustainable tire materials and production processes could provide Yokohama Rubber with a competitive advantage, potentially increasing its market share and profitability. A further weakening of the Japanese Yen against major currencies would provide an additional boost to the company's overseas earnings when translated back into Yen. A market re-rating of Yokohama Rubber's stock, resulting in a higher PER multiple due to increased investor confidence in its OHT-focused growth strategy and demonstrated execution, could push the stock price beyond the base case target. These potential catalysts highlight the significant upside opportunities that exist for Yokohama Rubber.

10.3 Downside Risks in the Bear Case Scenario

Conversely, several downside risks could hinder Yokohama Rubber's performance and prevent it from reaching the target price, representing the bear case scenario. A sharp and sustained increase in the prices of key raw materials, such as natural rubber and crude oil, could significantly erode the company's profit margins. A substantial slowdown in global economic growth could negatively impact the demand for tires across all segments, leading to lower sales volumes and increased competitive pricing pressures. The integration of the acquired businesses, particularly Trelleborg and Goodyear OTR, might not be as smooth or as successful as anticipated, resulting in lower-than-expected synergies and profit contributions. Increased competition within the OHT market could put pressure on pricing and potentially reduce Yokohama Rubber's market share. A significant strengthening of the Japanese Yen would negatively impact the company's earnings from overseas operations when translated back into Yen. The imposition of substantial US tariffs on imported tires or related materials could adversely affect Yokohama Rubber's sales and profitability in the important US market. These potential risks need to be considered when evaluating the investment thesis.