Meet the Investor - Amundi Asset Management - Mr. Allen Xiao

The Generation Z Investment Club extends our heartfelt gratitude to Allen for enriching our learning journey with his invaluable expertise.

Z Club Academy - Sustainable & Climate Investing Trends

The Generation Z Investment Club was honoured to invite Allen Xiao to share about sustainable and climate investing trends during our Z Club Academy session on 15 April 2024 evening. Allen Xiao is the Deputy Chief Risk Officer of Amundi Asset Management in the United States. Amundi is Europe’s largest asset management company. Allen is mainly responsible for investment risks, compliance and ESG Governance, and formulates risk management frameworks in compliance with the regulations of the Securities Regulatory Commission and the Federal Reserve.

Cheng You Gin, our host, set the stage by introducing Allen and sharing about Next Gen Investors Endowment Ltd. The introduction was followed by an Ask-Me-Anything (AMA) session, which provided a platform for attendees to delve into pertinent topics. Here are some highlights from the engaging dialogue:

Driving Forces and Trends in Climate, Sustainability, and ESG

Operational Transparency

Corporations are increasingly recognizing the value of disclosing ESG and sustainability information, not just as a compliance measure but as a strategic imperative. This transparency not only fosters trust among stakeholders but also unveils areas for operational enhancement. By focusing on sustainability and ESG issues, companies can identify opportunities for improvement, driving efficiency and resilience in their operations.

Focus On Market-Based Approaches

A significant trend in tackling carbon emissions involves the adoption of market-based mechanisms such as carbon pricing. Carbon tax and Emission Trading Systems (ETS) are leading examples of this approach. Carbon tax involves setting a price on greenhouse gas emissions, providing a financial incentive for companies to reduce their carbon footprint. The revenue generated can then be reinvested in initiatives to mitigate environmental impact or compensate affected parties. On the other hand, ETS operates through the trading of emission permits, creating a market where companies can buy and sell allowances based on their emission levels. This system encourages emission reductions to occur where they are most cost-effective, driving innovation and efficiency in emissions management.

Divergence Of Focus Across Geographical Regions

Allen offered intriguing insights into the varying emphasis on renewable energy across regions such as APAC, EMEA, and the Americas, highlighting the divergent paths taken by different geographical areas.

He explained this divergence using electric (EVs) and hydrogen-powered vehicles as examples. While electricity remains the mainstream renewable energy option, hydrogen is gaining prominence, particularly in sectors like aviation and maritime where decarbonization poses unique challenges. Allen attributed this regional focus shift to a combination of contemporary geopolitics and regulatory divergence. For instance, China has emerged as a dominant player in EVs, fueled in part by geopolitical tensions and favourable government policies such as EV subsidies. Conversely, Germany and Japan have taken the lead in hydrogen-powered vehicles, driven by their technological expertise and supportive regulatory environments.

From an investor's standpoint, Allen views these divergent focuses as investment opportunities. By understanding the nuanced drivers shaping renewable energy landscapes in different regions, investors can strategically position themselves to capitalize on emerging trends and market dynamics.

Perceived Growing Resistance To ESG Principles Within the USA And Its Implications

Allen shared that the USA is a vast and diverse landscape, with varying attitudes towards ESG principles across different sectors and regions. It is important not to paint the entire country with uniform resistance towards ESG. Allen underscored the potential consequences of resistance to ESG principles, highlighting the risk of diminishing competitiveness on a global scale. As other regions embrace sustainable investing practices, US asset managers risk lagging behind if they fail to adapt. However, Allen expressed optimism about the trajectory of ESG adoption in the United States. He noted that perceived resistance may stem, in part, from the historical lagging of ESG capabilities among US asset managers. Yet, as these professionals build on their expertise and become competitive, the barriers to ESG integration are likely to diminish.

Milestones of standardization of ESG standards

In exploring the milestones of standardizing ESG standards, Allen shared that it would be a global consensus among regulators to promote market transparency. Allen emphasized the critical role of regulators in recognizing the adverse effects of low transparency. By acknowledging the risks associated with insufficient or misleading disclosure of (ESG) information, regulators can drive efforts to establish clear and comprehensive standards that enhance transparency and accountability across industries.

The Q&A session was followed by a short sharing by Allen. Some key takeaways from the session include:

Regulatory Developments

Allen highlighted several key regulatory developments shaping the landscape of sustainable investing. Firstly, there has been a push towards clearer and more stringent labelling of funds across major jurisdictions including the EU, UK, and US, empowering investors with transparent information about the ESG characteristics of their investments. Additionally, the inclusion of nuclear energy and natural gas in the EU Taxonomy also creates greater global alignment in sustainable finance standards. The introduction of the EU's Carbon Border Adjustment Mechanism (C-BAM), imposing charges on embedded carbon content in certain imports like cement and aluminium, has also underscored a commitment to combat carbon leakage and promote carbon pricing consistency globally. Moreover, Allen shared that there has been a surge of support for climate action from governments, corporations, and investors in the wake of the COVID-19 pandemic, demonstrating a collective determination to address environmental challenges and build a more resilient future.

Grid Investment Landscape

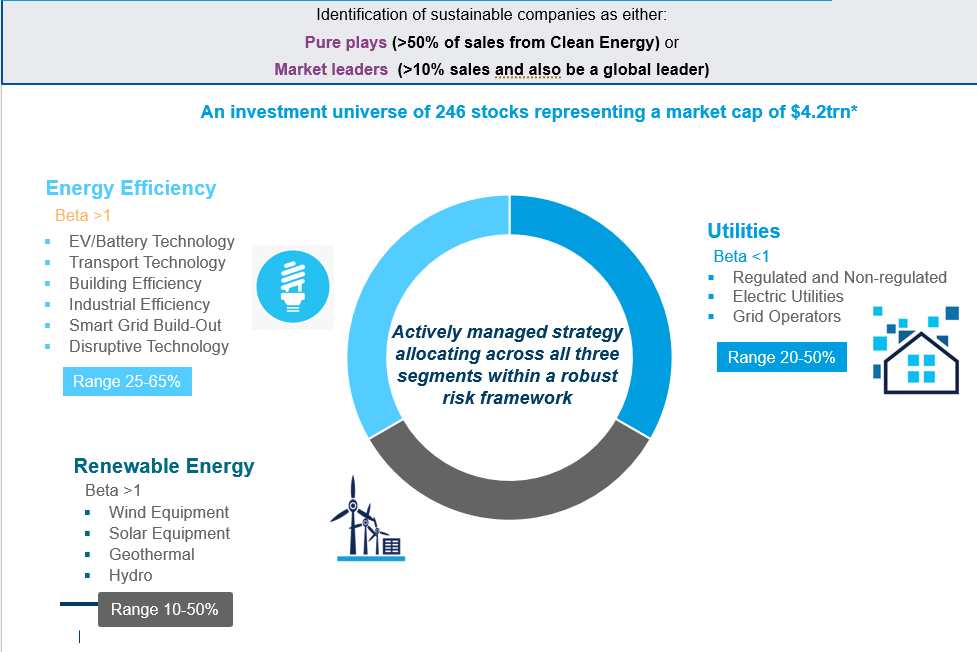

Allen describes the evolution of renewable energy investment through three distinct phases. Initially, the focus was on enhancing power generation efficiency, followed by advancements in energy storage technologies, and improvements to power transmission infrastructure. In the current (third) phase, he identified three key bottlenecks in grid investment that present unique investment opportunities. These bottlenecks include physical infrastructure, grid mechanics and services.

Investor Asset Valuation Evolution

Allen introduced the MIT Economic Projection and Policy Analysis (EPPA) Model as a comprehensive tool for asset valuation. While short-term asset valuation often incorporates ESG-related events such as scandals, long-term valuation considers broader risks, including physical and transition risks associated with climate change and sustainability challenges. The EPPA Model integrates key assumptions, such as labour productivity growth, technology costs, energy efficiency improvements, and urbanization trends to project a range of economic variables including GDP, energy use, consumption, as well as greenhouse gas emissions and pollutants from different activities. The EPPA Model thus serves as a vital tool in navigating the evolving landscape of sustainable investing, empowering investors to make informed decisions that align with their financial objectives and ESG priorities.

Sustainable and Climate Investing Examples

In addition, Allen shared with the attendees some examples of sustainable and climate investing in the area of clean energy and water, as shown in the slides below:

Following the short sharing session, Allen also addressed specific queries from attendees.

What is an area to consider/explore for ESG investing?

Allen suggests delving into the fundamentals of carbon emissions measurement. He cited the example of gas and oil, which claimed natural gas is less potent than oil when the time horizon is 100 years. While gas emissions may appear favourable within this timeframe, the imperative of achieving net-zero targets by the 2030s and 2050s necessitates a more nuanced assessment. By challenging prevailing assumptions and scrutinizing the implicit scientific underpinnings, investors can gain deeper insights into the true impact of carbon emissions.

In addition to technological considerations, Allen underscores the importance of geopolitical factors in shaping carbon emission trends. Geopolitics exert a significant influence on emission patterns and investment landscapes. By integrating geopolitical analysis into investment strategies, investors can better anticipate market shifts and identify opportunities arising from geopolitical developments.

Why are stocks of water companies mispriced?

Allen sheds light on the mispricing of stocks in the water sector, attributing it to the unique regulatory landscape governing this essential resource. Water, being a highly regulated commodity due to its critical importance, often sees its market valuation influenced by political considerations. This regulatory oversight can distort the true market value of water stocks, presenting investors with an opportunity to capitalize on the dissonance between perceived and intrinsic value. By recognizing the underlying regulatory dynamics shaping the water industry, investors can navigate this sector with a keen eye for value and capitalize on untapped investment opportunities.

Summary

In summary, Allen's insights offer an in-depth understanding of sustainable and climate trends, the renewable energy market and regulatory dynamics.

The Generation Z Investment Club extends our heartfelt gratitude to Allen for enriching our learning journey with his invaluable expertise. His contributions have undoubtedly inspired us to navigate the complexities of sustainable investing with more confidence and foresight.

Z Club Academy, Generation Z Investment Club

Nicholas TAN

Allen’s sharing was very informative and interactive. During the session, Allen shared about the sustainable and climate investing trends - ranging from regulatory developments to specific developments in various sectors such as Renewables, Utilities and Automobiles (EV). Some of the key trends included ramping up decarbonisation efforts and forward-looking metrics being adopted on the ESG front with greater momentum and commitment. Additionally, he shared that there is greater convergence towards a market-based approach within the sustainability landscape.

It was interesting to hear Allen’s perspective on the multiple benefits that come with reporting scope 1-3 emissions – Emissions reporting not only provides transparency from a climate perspective but also from an operational perspective. Allen shared that although policy divergence may have its cons, it also paves the way for investment opportunities.

I used the session as an opportunity to ask Allen how EU Asset Management (AM) firms can be held accountable for their investments, considering that the EU ESG fund guidelines for articles 6,8,9 funds are not yet approved, and AM firms are downgrading their funds often. Allen shared that with the SFDR being rewritten, there are efforts currently being undertaken by other standards, such as the CFA Global ESG Disclosure Standards for Investment Products, to provide the clarity and methodologies to address the current gap.

.

The six EU taxonomy objectives also acted as a reminder that amid the overwhelming focus that is given to decarbonization, we should not forget about the other aspects of sustainability, such as biodiversity and the protection of water resources.

Through the breakout room session, we were able to discuss the potential investment opportunities that lie within the sustainability landscape. Additionally, with regulations playing such a big role in the landscape, it made us reflect on whether sustainable growth can be determined with certainty before deploying capital. Nevertheless, we agreed that it was a necessary step forward to bring about meaningful impact. Overall, the session allowed us to gain a deeper understanding of the opportunities and challenges that we face within this ever-changing landscape.

Generation Z Investment Club, EIP

C M R Sooria

1. Carbon Tax and Trading Mechanisms

- Carbon Tax: The consensus was that carbon tax should be imposed based on emissions levels, with the proceeds used to fund green initiatives or compensate those adversely affected by emissions.

- Carbon Trading: It was highlighted that carbon trading serves as a competitive mechanism that encourages companies lagging in environmental performance to catch up, ultimately fostering a drive towards decarbonization.

2. Impact of Geopolitical and Policy Factors on Business Policies:

- The role of geopolitical tensions was discussed, particularly in the context of strategy testing to ascertain the impact of geopolitical factors on business operations and policies.

- The discussion also covered how trade tensions influence the costs of technologies like hydrogen conversion, suggesting inflated costs which could otherwise be lower.

3. Opportunities in Hydrogen and Electric Vehicles (EV):

- The group explored the potential of hydrogen as a viable source for powering EVs, noting the currently high but potentially reducible costs of hydrogen conversion parts due to geopolitical tensions.

4. Intersection of ESG and Growth Companies:

- It was pointed out that growth companies in the ESG sector benefit significantly from technological advancements, with companies like Nvidia being prime examples.

- The importance of policy momentum in positioning companies within the market was discussed, emphasizing how policy can both bolster and challenge growth trajectories.

5. Energy Predictions and Renewables:

- Traditional methods focus on predicting the demand side (e.g., energy requirements during winter), while the renewable sector is more concerned with predicting supply capabilities.

6. Volatility and Investment in Great Companies:

- A noteworthy point was that top-performing companies might exhibit higher volatility (beta) going forward, an important consideration for investors.

7. Integration of ESG into Investment Strategies:

- Practical insights were shared on how to incorporate ESG considerations into investment pitches, particularly during the initiation memo phase, to craft compelling investment narratives that align with sustainable and ethical guidelines.

8. Importance of Transition Technologies:

- The necessity of transition technologies was emphasized, especially for regions like Southeast Asia (SEA), which may not be ready for an immediate switch to green energy. The gradual integration of green technologies was discussed as crucial for sustainable development.

Generation Z Investment Club, EIP

Elaine CHIA

Feedback

What did you learn from Mr. Allen Xiao?