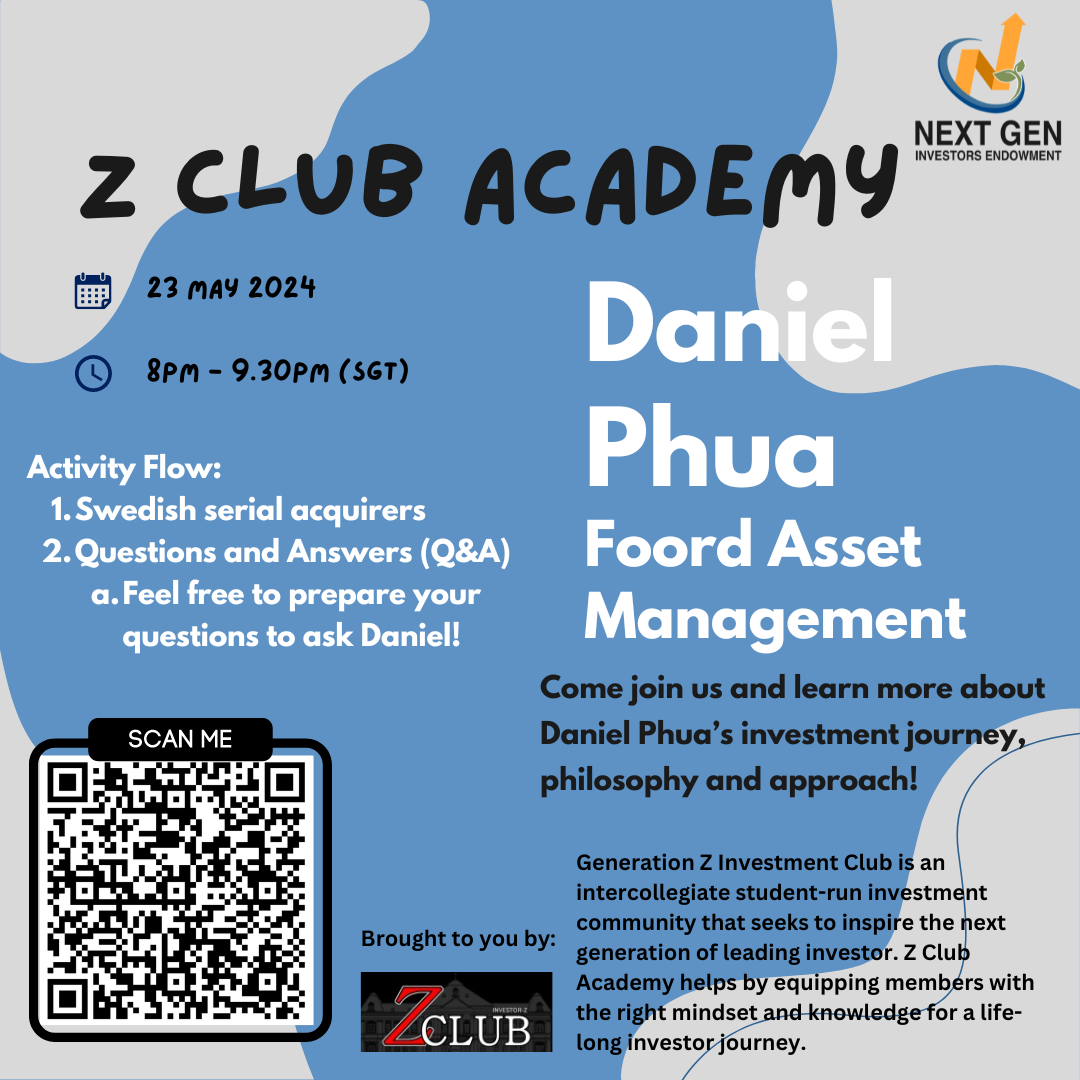

Meet the Investor - Foord Asset Management - Mr. Daniel Phua

Starting from humble beginnings, Daniel made his way to where he is today through passion, determination, and openness to exploring new opportunities. He also shared about Swedish serial acquirers!

Daniel's passion, determination, and openness to exploring new opportunities are truly inspiring and offer valuable lessons for all of us. Throughout his career, Daniel has been entrusted with a diverse array of roles and responsibilities. Despite the challenges, he has consistently managed to excel and create substantial value for the organizations he has been a part of.

Recently, Daniel shared his insights on Swedish Serial Acquirers in a session that was both captivating and enlightening. His deep understanding of the subject matter was evident, and the session left a lasting impression on everyone in attendance. One of the highlights was Daniel's mental model for analyzing these companies. He outlined four key principles that guide his approach:

Discipline when undertaking M&A

Focus on Organic Growth and Internal Reinvestment

Attention to a Few Simple Financial Metrics

Decentralized Organizational Structure

Moreover, Daniel provided a breakdown of how using EBITDA/WC and EBITDA growth can create healthy competition among subsidiaries acquired by the parent company. This method not only drives performance improvements but also fosters a competitive spirit that can lead to greater overall success.

Daniel’s session equipped us with new tools and ideas to apply in our journey as an investor.

Generation Z Investment Club, EIP

Trinsy NEOH

Daniel's sharing was a strong affirmation that anyone has the capability and potential to become a good investor, regardless of whether it comes in their personal capacity or as a profession. His investor journey highlighted the traits of perseverance, grit and most important of all, flexibility. Despite feeling disadvantaged from his background, he was not one to shy away from adversity and that yielded dividends for him through the people he met that eventually led to his career. A trait which I believe all of us at Z Club should emulate.

Beyond his investor journey, he brought out a clear picture of the investment philosophy and mental models adopted by Swedish acquirers and how they sought for companies which were at a relatively attractive price, have good management and financial resources. By following a disciplined mandate in their acquisition strategy, good acquirers are able to develop a wide portfolio of companies that gives them exposure across different sectors. In many ways, this philosophy is not so different from long-term value investing which Z Club has imparted on me. Much like a Swedish acquirer, a value-investor seeks companies that are priced relatively cheaply, with a strong management that understands their business well and also has financial resources to back up their goals.

Most certainly Daniel's sharing has provided a wider introspection into the philosophy behind investing and shed light on how certain principals do not defer regardless of the type of investor.

Generation Z Investment Club, EIP

Jon Lon YIONG

I attended Daniel Phua’s sharing session on the 23rd of May 2024, and I couldn't be more thankful for his insights! I learned so many new things from the session, especially about investment opportunities in serial acquirers, which is Daniel's current focus. Here are my key takeaways from this fruitful session:

Don’t be shy—knock on doors and reach out!

Daniel began by sharing his experiences and the story of how he got into investments. He recounted his journey through various internships and roles in renowned firms, and one of the key messages he shared was the importance of taking initiative. He emphasized that reaching out to people and seeking opportunities, even though it might seem daunting at first, can open many doors. Daniel’s story highlighted the significance of perseverance and the willingness to put oneself out there, which resonated deeply with me, as I was a person who was hesitant to reach out first when I began my university journey. His sharing served as a gentle reminder to all of us that sometimes, the most valuable opportunities come from being proactive and not being afraid to ask people the right questions!

Investment opportunities in serial acquirers!

A major part of Daniel’s session focused on the concept of investing in serial acquirers. This was particularly intriguing as it was an area I was previously unaware of. Daniel explained how he began exploring investment opportunities in this niche, providing a detailed look into his approach. He shared his method of filtering investment prospects, which involves a thorough analysis of companies he fundamentally likes and those that are trading at reasonable valuations.

Daniel also delved into the importance of a company's M&A (Mergers and Acquisitions) philosophy. He emphasized the importance of looking for companies that acquire well-managed businesses where the existing management remains post-acquisition. Additionally, he highlighted the advantage of focusing on smaller businesses to reduce competition and the benefit of paying low acquisition multiples. This detailed approach to evaluating serial acquirers was eye-opening and provided a clear framework for assessing potential investments in this space!

Characteristics of a good serial acquirer

Towards the end of his session, Daniel outlined the characteristics of a successful serial acquirer. He pointed out that discipline in M&A practices is crucial. Good serial acquirers are methodical and strategic about their acquisitions, ensuring that each acquisition adds value and aligns with their long-term goals. He also stressed the importance of the organization having organic growth and internal reinvestment. These insights were particularly valuable as they provided a practical checklist for identifying strong candidates for investment in the serial acquirer space.

In conclusion, Daniel’s sharing session was very informative and inspiring to us students. His insights into the world of investments, particularly in serial acquirers, opened my eyes to new opportunities and strategies. Thank you so much, Daniel, for all your insights and for sharing your knowledge with us!

Generation Z Investment Club, EIP

Khadijah PINARDI