Dear Sponsors, Board of Advisors and Members,

Happy Fall everyone!

It is my absolute pleasure to be writing to you again this fall! We are happy to officially welcome the six newest additions to the International Chapter! They are: Olivia Zhang, Joshua Sng, Javier Chan, Wong Gene-Han, Mouli Raj, and Cheng You-Gin. We are so proud of you for making it through the grueling selection process, for showing us so much passion, courage and commitment. Going forward, as official members of the Club, you will be each other’s greatest supporters, allies, teachers and most importantly friends. What you reap from Z Club is a multiple of what you sow, so take every chance you get to invest in yourself and see where it leads you.

Over the past three months, the global economic outlook and the bear market that we have been facing has given us lots of opportunities to dig deeper into the flurry of information we’ve been presented, evaluate our approach and beliefs, practice what we know and have learnt, and to continue to learn from each other as always.

We know that rising interest rates, persistently higher inflation, and slowing economies are likely here to stay for a considerable amount of time. This is a good place to relook at the long-term trends or outlooks we believe in, re-examine some of the core assumptions we’ve held regarding the trajectory of industries and companies within the next five to ten years.

As value investors, we understand that the way we play the game is to exercise conviction in our judgements as irrationality unfolds through the booms and busts in financial markets. But staying level-minded wasn’t just being immune to noise, or a psychological state you will yourself into for extended periods of time. It should be the result of a long, arduous process: digesting the flurry of information and varying (often conflicting) opinions, trying to identify which ones are worth paying more attention to, determining just how to take something into consideration, evaluating the different scenarios of our assumptions and arguments, and making investment decisions on the day-to-day.

We can definitely feel the time pressure that volatile conditions brings and its ability to turn an already difficult-to-make decisions into ones that might be made too hurriedly (or, if we slip into decision paralysis, ones we might not make at all!). Perhaps more than any doubts or struggles we face specific to a particular stock or industry analysis, the struggle to process information systematically and make decisions based on a clear set of principles might be the more critical thing to work on in the long-term for us.

I remember being particularly struck by the simple yet genius idea brought up by Ray Dalio in ‘Principles’, of going through life making every experience count, seeing each one as a chance to hone your own set of principles by doing, reflecting, and doing with more purpose and gumption than before. Faced with a blizzard of information, without these principles we’ll have to deal with each problem we face as if it’s the first time we (or the Club) have ever faced it. Being able to make better, faster decisions being fully aware of why and why not you’re making them a certain way is something I feel is crucial to being more seasoned, self-aware, and unique investors.

I was excited to see this idea again recently when I saw the following excerpt from an interview with venture capitalist Ann Miura Ko:

“Increasingly, I’ve realized that it’s important to be explicit about how you’ve come to a decision and its impact. What made you take one path over another? What worked well and what didn’t? When we make a mistake, we discuss how we came to our judgment and where we can improve our process. It’s not always a fun process, but it’s fundamental, like a pianist practicing scales. You do it again and again and see if you can get better.”

I am very much intrigued by this idea, that as a team we can continually build on a playbook that you keep going back to pick at until you’ve hit new territory, something new to try out and learn from not just for ourselves but for anyone who comes across our records. Especially with the bear markets that we’re currently facing I think that the work we produce now can be really useful for not only ourselves but also future batches of members. We have got to work thinking about how to best write our investment memos and organize our readings, models, and written records into a more effective system that we can continually look back and improve on.

Before I delve into some of the recent research and conclusions that we’ve come to in the recent quarter, I’d like to share some of our thoughts on China after looking at the 20th Party Congress held in October. I believe what has been unveiled by the CCP there holds several insights that will shape our outlook on investing in China.

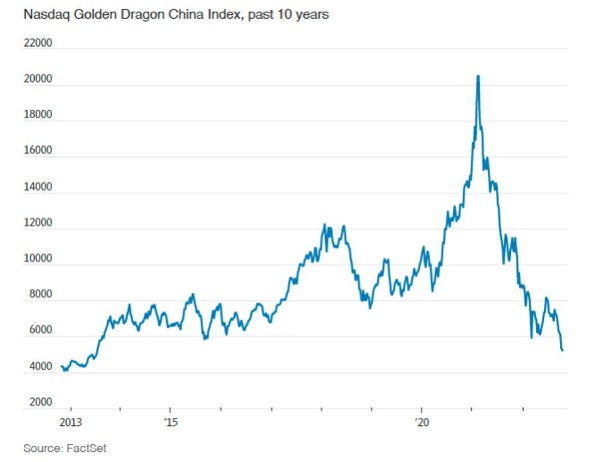

Frustrations over the persistent Covid control policy, as well as concerns over intervention in the private sector and geopolitics have led to a significant decline in investor confidence: The Nasdaq Golden China Index composed of US listed Chinese stocks plunged to their lowest level in almost 10 years. China’s strict zero-Covid policy has emphasized stamping out transmission through mass testing, stringent quarantine requirements, travel restrictions and lockdowns, keeping Chinese citizens from spending and producing at usual levels, disrupting global supply chains, and causing China to lose favour with foreign investors who are increasingly turning their attention to other emerging markets.

All this is happening amidst the backdrop of an aging population, a mountain of real estate debt, rising labour costs, increasing regulatory scrutiny and government intervention, trade wars, and other geopolitical tensions that China already experienced prior to the pandemic.

So is China still a market that we should explore? We wanted to go deeper to understand the full story of what exactly has been happening in China’s story up till this point in time. If we can identify some themes that play a key role in China’s narrative, they will serve us well in helping us think about the future of investments in China, and what decisions to make now to capitalize on those future scenarios.

Zeroing on the contents of this year’s Party Congress, a key part of this year’s Work Report included China’s overall development targets for 2035:

· Achieve a per capita GDP level of a moderately developed country

· Achieve high-level scientific and technological self-reliance and be at the forefront of innovative countries

· Build a modern economic system, form a new development pattern, and basically realize new industrialization, informatization, urbanization, and agricultural modernization

· Build a strong country in education, science and technology, talent, culture, sports, and healthy China, and significantly enhance China’s soft power

· Increase the per capita disposable income of residents, significantly increase the proportion of middle-income groups, make basic public services equal, and ensure rural areas have access to modern living conditions

· Form green production and lifestyles, stabilize and decrease carbon emissions after reaching peak emissions (in 2030), and fundamentally improve the ecological environment

In the more immediate future, the Party also outlined the following steps for the next 5 years, designed to achieve the 2035 goals:

· Improving self-reliance in science and technology

· Matching the growth of residents’ income with economic growth

· Matching the increase in labor remuneration with the increase in labor productivity

· Making basic public services more equal

· Taking a step toward completing the multi-level social system

· Significantly improving the urban and rural living environment

We can see that economic development remains a top priority for China, even though many may see the strict adherence to strict Covid control policies as an indication that economic development will continue to be sacrificed no matter what. Although it is true that China’s stance hasn’t budged despite the astounding amount of external pressure and widespread, downright painful economic, political and social costs that its caused, these measures cannot last forever. Dynamic clearing (动态清零) is likely going to remain as a reliable tool for the government to protect itself from major outbreaks, but the costs of strict pandemic control will only continue to weigh down further on the benefits.

We are already seeing some signs of reopening: the relaxation of international travel rules, (including reducing mandatory quarantine requirements and loosening testing measures), easing of domestic travel rules and removal of flags on digital-travel passes for past visits to hot spots, a targeted campaign to increase inoculation rates among the elderly (August 2022 vaccination data below), the possibility of wider availability of domestic Covid treatment pills by year-end, and updated pandemic guidelines for containment and surveillance to ease overly aggressive local restrictions.

Source: NHC CEIC, Morgan Stanley Research

We do need to take note of the price movements that are reactions to news of reopening or sustained control measures, I believe the bigger story here is still the realization of China’s goals as part of its larger narrative. Yes, near-term concerns will determine what approaches and the difficulty of which the goals will be pursued, but when it comes to China the goals tend to truly be relatively longer-term commitments, because they are driven by a steadfast loyalty to the Party and the nation’s values.

There has been a clear shift in the standards that China holds its economic development to. It has become increasingly reluctant to compromise the way it might have in the past decades, achieving rapid economic growth at the expense of gaping social inequality, environmental pollution, lack of innovation, weak rule of law and weaker voice on the global political stage. China refuses to accept the kind of capitalism and the problems that come along with a whole-sale adoption of Western systems. Its willing to blaze a new trail with the benefit of hindsight after observing the history of developed economies, to try and achieve the kind of economic development that is tailored to China’s existing conditions and ideals.

Reaching this goal is far from easy, taking into account the external challenges that come running as a consequence of China’s achievement. Its economic and political rise poses serious threats to the unipolar American hegemony, and the isolated path it has chosen to take in its governance directly challenges established governance ideals. To make up for the unpopularity of its ideals and what China has done to achieve what it has, China has to rally as many supporters as possible through initiatives like the BRI and GDI, reduce its reliance on hostile countries to reduce risk in critical pillars of its own economy, and fight tooth and nail to weather trade conflicts, bolster its soft power, improve its image and prove itself to a global audience.

With that said, I believe China is at a turning point where its biggest weaknesses can be turned on their heads to become its greatest opportunities. In early October, President Biden signed an executive order to ban the export of certain graphic processing units (GPUs) from Nvidia and AMD to China (GPUs are essential in high demand computations and for the development of artificial intelligence). These new export bans build upon pre-existing bans that aim to prevent China from developing their own high-tech industries. The U.S. has long been attempting to deny China the ability to produce their own semiconductor chips and GPUs that would be essential to compete technologically with the U.S. in the future. These controls are expected to expand further as the U.S. and China continue their strained, competitive relationship.

A combative approach to the heightened geopolitical risks brought on by US sanctions and the Russia-Ukraine conflict was reflected in the 20th Party Congress as well, with the report calling for a strengthening of national security on all fronts, particularly those involving food, energy, and supply chains. The dual-circulation strategy, a two-pronged development approach that seeks to boost China’s domestic demand (“internal circulation”) as well as cater to export markets (“international circulation”), was also reiterated during the Congress. This means that China remains committed to attracting foreign investment, especially at a time when companies face incremental pressure to relocate or diversify their supply chains out of China or adopt ‘China-Plus-One’ strategies. We expect that there will be a decline of foreign capital flowing into China but recognize that there is a need to continue to monitor the effectiveness of the Chinese government’s efforts in encouraging foreign investment.

Back on the home front, China has its fair share of socioeconomic problems to tackle. With an aging population and rising youth unemployment on their hands, the CCP’s report sheds new light on the next steps to achieve ‘Common Prosperity’, a flagship campaign launched by Xi Jinping in August 2021, aiming to reduce wealth inequality and balance the level of social and economic development across different regions of the country. Efforts to provide fairer labor remuneration, better economic opportunities, and targeted tax policies, among other strategies will be bolstered in the coming years to ensure better wealth distribution in the long term. However, it is important to note that neither the Work Report nor any previous information released by the government on the matter, indicating that China will not implement a wide-ranging welfare system, and will continue to encourage hard work on an individual basis.

To protect the wealth that China has already built so far, the Chinese government will also need to address threats of mortgage payment boycotts and rising bank loan losses by strengthening the weak links in the financial system and incorporating and effectively implementing more risk-management methods in reforming high-leverage, unsustainably developed industries.

With regards to unequal development across regions, the CCP emphasised that China will “promote coordinated regional development” through investing in the development of the western regions, “comprehensive revitalization” of the northeastern regions, accelerating the rise of the central regions, and encouraging the eastern regions to accelerate modernization. It also explicitly calls for the continued development of China’s mega-city clusters, in particular the Xiongan New Area of the Beijing-Tianjin-Hebei economic cluster, and the Chengdu-Chongqing economic circle. These indications will further guide us in understanding the regions that may become important targets for the Chinese companies that we will be looking into.

Another key component of this year’s report is in the realm of technological innovation, which may help to solve many of the pressing problems mentioned above can provide long-term growth opportunities. Compared to his report five years ago, Xi dedicated a whole section to technological development and talent management.

Compared to the 2017 Party Congress report, two key words in the tech context stand out in this year’s report: technology (科技 or 技术) and talents (人才). There are 55 mentions of the word “technology” and 34 mentions of “talents” in the technology context, dramatically increasing from 25 and 5 mentions of each word in the 19th Party Congress report, respectively. Other tech-related words such as innovation (创新), information (信息), internet (网络), digital (数字), smart/intelligent (智能), and originality (原创) have all appeared more frequently in the 20th Party Congress report than previously

Source: The Diplomat

China has also announced policy goals that will build a better innovation environment, such as promoting the construction of international science and technology innovation centers, increasing investment in “diversified science and technology”, strengthening intellectual property rights, and expanding international science and technology cooperation and exchange.

I believe that the near-term focus for technological development in China will be on achieving self-sufficiency in the core technologies like semiconductors, artificial intelligence, new energy, biotech, automation and agri-tech. However, I think the Chinese government is still actively looking for tech solutions to its social and governance problems, personally from observing the unrelenting push for such innovations in national and regional innovation challenges for Chinese university students, as well as the widespread efforts to educate and encourage Chinese youth to take up greater social responsibility and dedicate their brains and efforts towards addressing domestic social issues.

Lastly, on the environmental front, to achieve China’s “dual carbon” targets, the CCP also recognises the need for systemic change in how the country’s economy is run. However, at the same time it also emphasises China’s need to maintain energy stability, meaning that China will draw upon non-renewable energy sources – including coal and other fossil fuels – to meet its growing energy demand. Thereafter, China will begin take a step-by-step approach to reduce reliance on these sources. Hence, we think it will also be important to keep in mind that the government will continue to work towards goals such as the “strengthening the clean and efficient utilization of coal, intensifying the exploration and development of oil and gas resources, and increasing reserves and production”. We think this is helpful for us to adjust our expectations of the kind of balancing act a country like China compared to both its more developed peers and less developed emerging market peers.

In summary, in the short-term, even though there has been a lack of indication of when reopening will begin or in what way it will be conducted, the question has been when, not if, China will ease its pandemic control measures. The impact of zero-Covid restrictions ending in a population of 1.4 billion people on China and other markets is bound to be something significant that we can and should try and form expectations around now.

In the longer term, China makes a fascinating case study of a market where the government’s authority is stable and ideologically motivated to consistently advance their set economic goals. This however doesn’t shield companies and investors from unpredictable, drastic regulatory moves. This volatility may be undesirable and justifiably so, but I believe that the 20th Party Congress represents a departure from the sudden, shocking policy moves these past few years. One of the key takeaways from the 20th Party Congress report is that China will seek to stabilize its economy and development before embarking on any new major policy developments. China’s current economic state warrants more of the ‘building back up’ than the initial ‘knocking down’, so I think even as we gain a deeper understanding of how far regulatory crackdowns can go, it is irrational to assume the levels we are seeing now to be sustained for many years into the future.

I believe that investors looking at China should be learning to expect the unexpected when it comes to the government’s plans to develop industries into maturity in a more rigorous and sustainable way using both regulations and investments as a way to set standards for more robust growth. Be it abuse of market power, industries that feed into the cycle of inequality, lowering standards of living and lowering birth rates, or excessive leverage and improper risk management, I think it is fair to say that the government will continue to employ policy tools to achieve course correction in industries that require greater regulatory scrutiny. The aim will be to weed out lower quality companies that are unable to comply with the requirements of sustainable industry growth, something China must successfully transition into before the failures of current systems reveal themselves further.

In light of the above, we remain bullish on China, especially since our interests and companies under analysis mostly fall under tech. It is perhaps our generation’s natural inclination to find tech themes exciting, but we draw from evidence and a fundamental understanding of the power that technology holds in solving the key problems countries face, the paradigm shifts that key innovations can lead to, and the bettering of industries, businesses and

But tech is hard to invest in, with its tendency to attract too much capital and promise more than it may deliver, intensifying competition, regulatory uncertainty, politically inflammatory nature, and uncertainty during the R&D process. But we believe that these points of contention provide opportunities to discover companies trading with superior business models, underestimated intangible resources, and resilient, capable and passionate management at significant bargains.

We currently have plans to round out our existing research on companies such as Xpeng Inc. (NYSE: XPEV) in China, as well as Velo3D (NYSE:VLD) in the U.S, hailing from the EV sector and additive manufacturing sector respectively. We are currently optimistic about these two companies but we will be rigorously comparing them to their industry peers to flesh out what exactly constitutes their competitive advantages and over time, their economic moats. We have placed Mercado Libre (NYSE: MELI) and Ecovacs Robotics (SSE:603486) in our pipeline of investments to enter once their prices enter a window that will offer us sufficient margins of safety. In the meantime, we are enriching our analyses of these companies and updating the assumptions used in our valuations.

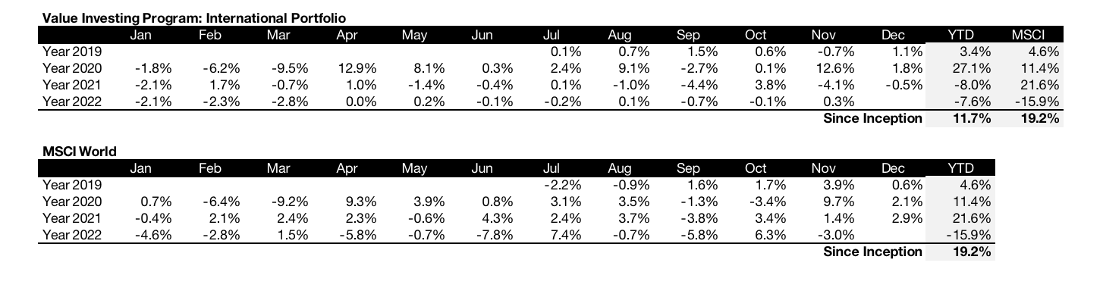

Please see the past track record of VIP International Portfolio below:

The endowment’s current investments are accounted for in the table below:

We will likely be making changes to our portfolio allocations during the last quarter of this year especially since both our current holdings have become cheaper. We are working on re-examinations of our investment theses for these companies, and our updated analyses and other changes to the portfolio will be presented in the upcoming letter early next year. As mentioned above, we will be making use of each potential investment we study or actual investment we make as an opportunity to learn, hence we will be leaving a trail of records that we can access for reviewing and referencing for these investments. We are currently exploring ways to make these available for sharing to showcase more of our members and engage more investment professionals that will be incredibly valuable to our community, such as through setting up a platform/online forum.

I believe every investor is a student for life. With this parting thought, I wish each and every individual that every night you go to bed and every morning you wake up, the thrill of learning new things about our world and the companies that are set on bettering it will drive you to seize each day.

Wishing everyone a happy holiday season ahead, and we look forward to writing to you again in the new year.

With Best Wishes,

Rebecca Yang

on behalf of the Value Investing Program’s International Chapter Team