Dear Sponsors, Board of Advisors and Members,

It has been yet another year full of memorable discussions, collaborations, breakthrough learning, and personal discovery for all of us at the Club, much thanks to the extraordinary support we have received from all of you, our friends and advisors.

I have been very fortunate to fly back home to Singapore for Chinese New Year and meet up with a lot of members from our community. It has been an absolute delight to finally be able to get to know each one of you so much more deeply than before. If I’ve been enthusiastic in my past letters about how much I believe writing your thoughts down helps you think through them better, I have been pleasantly surprised by how much inspiration and clarity regarding my investing views I have gained just by talking through them with all of you face-to-face. I am also now more determined than ever to build these relationships with you, and most importantly grateful that you have all left me more encouraged and knowledgeable after our conversations.

Looking back on 2022, we’ve witnessed the rise of inflation and interest rates to 40-year and 13-year highs respectively, and the accompanying unprecedented series of rate hikes by the Fed in the States. However, in November as US stocks started to show significant growth, investors began to balance their ongoing apprehension given the Federal Reserve's cautious approach with signals that the pace of policy tightening would decrease and inflation may be coming down.

In China, a hard-hit property sector as well as what seemed like an endless, tumultuous battle against Covid-19 has sent the MSCI China Index on a 23% decline and marked 2022 as its most difficult year since 2008. The electric vehicle and tech hardware sectors suffered from lockdowns and weak consumer confidence, although sentiment has improved with the help of a pivotal change in China’s pandemic policy. As Sino-US tensions continue to escalate, many more assumptions about the direction of China’s growth are being called back into question even as investors start turning their attention back to this emerging market.

We are aware that this moment is a very critical time for our portfolio: even if many names we’ve familiarised ourselves began falling to very attractive valuations, we knew we would need to determine what uncertainties have been priced in, which aspects of a business’s merits may have been exaggerated and which business risks have been undermined.

Someone recently asked me about what has changed in my view of investing, all the way back to a few years ago when I first approached it. My answer was a long list of things, but one big thing was this: a shift in my understanding that investing in stocks, for the long-term, was not solely about cranking out numbers for what we think is the true value of a company, then buying stock and holding onto it till our prophecies came true. I soon realized that, when Mr. Market knocks on our door daily, the prices we see have been determined by a range of factors, not all of which reflect fundamental, lasting and significant changes to the earning potential of companies. And it took actually holding stocks to realise that thinking about price versus value over long periods of time was really hard to do yet incredibly rewarding.

Howard Marks once wrote, “Whereas events in the real world fluctuate between ‘pretty good’ and ‘not so hot’, investor sentiment often careens from ‘flawless’ to ‘hopeless’ as events that were previously viewed as benign come to be interpreted as catastrophic.” Recognizing the sometimes manic, irrational behaviour that may to certain prices helps us analyze our companies in the wider context, letting us decide whether something is a distraction or whether an event warrants a re-evaluation of our opinions.

In many of our Meet-The-Investor sessions over the years, many of us have asked the professional investors that we’ve been lucky enough to meet the question of what it really means to be contrarian. And the responses I’ve heard tend to focus on a much deeper level understanding of what a contrarian approach really means: not just holding an opposing view from the majority for the sake of doing so, but looking at the markets, all the publicly-available information and facts it presents, and intentionally thinking: What seems right and what seems off about this interpretation and the subsequent reaction? What can we do to build our own opinion and can we back it up strongly enough to build a position?

If we want to stick to our goal to never overpay for businesses, ensure our purchases are protected by margins of safety, and to buy stocks for owning, not trading, we’ll have to look at the different interpretations of the same, publicly-available information, and figure out what exactly it is about a company that has been misjudged and why, not to try and time markets precisely but to uncover truly value buys.

So we’ve decided that this is what we want to keep doing. But how exactly should we think about macro given the future we now face? Oaktree’s ‘Sea Change’ memo offered me a lot of insight into the trends that have driven these radical changes in markets and investor attitudes. The idea that we might ‘never know where we’re going, but we ought to know where we are’ also helped me in my thinking on how we can try to look at macro trends for our portfolio.

2022 has forced us to remember that our companies don’t exist in a vacuum; they are living, breathing people-run businesses navigating their way through the ups and downs of the economic cycle. The reminder that macro conditions can make or break many of our investment theses have called for us to exercise more caution in factoring macro conditions into projecting the trajectory of the companies we are analysing. Understanding that changes in the prices of securities are not solely reflected by whether a piece of news is positive or negative, but of how far they exceed or fall short of expectations formed in the context of macroeconomic conditions, has also helped us understand the price movements of securities and see more clearly when they may be under or overpriced.

Inflation and interest rates are undoubtedly going to stay as the dominant considerations for investors for perhaps many more years, but our fund’s philosophy, strategy and the themes that we will be bullish on will determine the investment decisions we make in the coming year. This is of course much easier said than done, but being repeatedly challenged to stick to a disciplined method is an integral part of being a member of the Value Investing program.

As Benjamin Graham famously stated, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." We won’t try to accurately predict specific events and participate in short-term speculation; that is beyond the scope of our mandate and a detraction from the Club’s founding purpose and our member’s intentions. What we will continue to do is to monitor macro conditions and how they will shape the decisions companies make now, to see the extent they will be beneficial to the long-term growth of these businesses.

Quarterly Updates

Our past track record of VIP International Portfolio below:

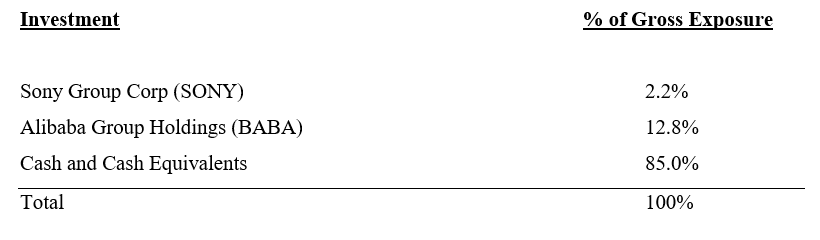

The endowment’s current investments are accounted for in the table below:

We’ve been building our research database, particularly in new industries so we can have a bird’s-eye view of what drives demand and supply and how the eco-systems’ players are creating value for the industry. We believe that by training ourselves to become specialists in certain markets that are perhaps going through a period of lower valuations but in our view will become increasingly profitable, we can: 1) exercise our judgement on how much industry-wide sentiment is driving valuations of individual firms, 2) compare different companies on a broader level first and spot the characteristics of stand-out companies that separate the wheat from the chaff, and 3) begin prioritising various considerations and asking the right questions that stem from a specialised understanding of the unique characteristics of companies within the industry.

This quarter, in addition to continued monitoring of companies we’ve previously analysed and determined target entry prices for, we’ve re-examined our holdings and begun building our knowledge of several industries, including China’s Cloud and EV industry as well as the global additive manufacturing industry.

We have substantially increased our stakes in Alibaba after expanding our understanding of China’s cloud market and conducting a re-evaluation of Alibaba’s valuation, an effort led by Chen Jingxiang and Olivia Zhang from the class of 2023 and 2024 respectively. As brought up in our previous letter, the digital transformation of China’s economy is driven by factors such as an urgently intensifying need for self-reliance, more equitable distributions of wealth and improved social mobility, and now more than ever, a breakthrough for a sluggish economy that’s rode out the booms of its manufacturing and consumer internet sectors. Investing heavily to support the Cloud industry has a huge ripple effect for the entire economy, improving productivity and re-positioning Chinese industries to shift from a lagging, reactionary state to global leaders setting standards for innovation.

In 2009, Ali Cloud began to develop its own cloud computing operating system "Feitian". Ali Cloud's Feitian is the first independently developed operating system in China, and only Amazon, Microsoft and Google have mastered this technology in the world, which has established Ali Cloud’s position in the industry and bolstered its core competitiveness.

It also has had a major breakthrough in computing power. The self-developed CPU "Yitian 710" has been put into large-scale application. Ali Cloud released a self-developed CPU, marking that Ali Cloud has carried out the independent innovation of full-stack cloud infrastructure. The “Yitian 710” ultra-high computing performance and low power consumption is expected to reduce the operating cost of data centres, thus lowering the threshold for enterprises to access the cloud.

Why is this significant? Self-developed operating systems and the self-developed chips (with a high degree of internal customization) effectively reduce energy consumption and operating costs. Ali Cloud provides IAAS+PAAS+SAAS services, computing, storage, big data, artificial intelligence and other service products. There are 400-500 kinds of Ali Cloud PaaS products, with the most complete range of subdivided categories that we have seen, which we believe will help them better meet customer’s customization needs.

Alibaba Cloud’s first mover advantage, having set up their cloud computing segment in 2009, has allowed them to research and develop many industry-leading technologies that will boost their services to 2B customers. For instance, polarDB, their cloud-native database, is the only large-scale global database management system cloud provider in the Leaders Quadrant of Gartner Magic Quadrant. Dingtalk, a digital collaboration workplace and application development platform, is also China’s largest business efficiency mobile app in MAU in March 2022. With better technology than their competitors, as well as a growing market, exponential growth for Alibaba Cloud is expected in the next few years.

Our full report on Alibaba delves into many other points, but in summary, Alibaba is an internet giant that is in a stage of transformation. Facing strong competition in the e-commerce segment, it has shifted its focus to cloud computing, a budding industry with massive potential and incredible tailwinds from the ideologically-driven push for digitization from the central government. Given its early mover advantage and heavy investment in AliCloud, Alibaba is very likely to emerge as a winner in the Cloud Computing industry in China. At the same time, its existing network effect and cash generation ability in the e-commerce space cannot be underestimated. In our view, Alibaba is severely under-priced by the market, mainly due to regulatory risks, which as mentioned in our previous letter, is more nuanced than we think it’s being seen as. We have hence decided that it was an opportune time to increase our stake in Alibaba.

In December, Javier Chan and Cheng You Gin from Team Spring have also expanded on their research into China’s EV sector, yet another sector that has benefitted significantly from government subsidies in an effort to drive mass adoption of greener vehicles across Chinese cities and tackle China’s pressing environmental challenges.

Improving EV technologies in light of current cost trends facing automakers has further propelled the value-to-cost proposition of EVs, as opposed to ICE vehicles, to new levels.

The team has found that the stabler multiples of Chinese EV makers warrants a greater look into high-growth Chinese firms, and that a potential industry consolidation may shape the narrative for the industry, especially in the face of Tesla’s lowered prices to compete more aggressively in the Chinese market. With this in mind, next steps for this sector will be to zero in on some of the names covered in our initial research.

As mentioned previously, I have also started more research into the additive manufacturing industry. Additive manufacturing, also known as 3D printing, is a process of creating a three-dimensional object by building it up layer by layer. This process is in contrast to traditional manufacturing methods, such as subtractive manufacturing (machining) or formative manufacturing (casting or injection molding), which involve removing or reshaping material to create an object.

The global additive manufacturing market comprises 3D printers, printing materials, and service providers. The global 3D printing market size is expected to reach $42.8 billion by 2026, growing at a CAGR of 21.94% from 2020 to 2025. Even more ambitious predictions expect it to reach $350 billion by 2035.

AM is actually much broader than most of us knew! Additive technologies can use a wide range of materials, including plastics, metals, ceramics, and even living cells, and can create objects with highly complex geometries that would be difficult or impossible to produce using traditional manufacturing methods. Its applications also span a wide variety of industries, from aerospace, automobiles and industrials to healthcare and even footwear.

For a technology that’s actually been around since the 1980’s, I thought it was very interesting how certain news-worthy applications have driven different levels of interest in the technology, especially moving into the APAC region which is set for high growth rates in the coming years.

The core issues surrounding manufacturing, such as lowering cost-per-part without compromising quality, as well as quicker production times and innovations in product design and materials all hold massive potential for the industry looking ahead. But even further into the future, if we think about taking on the hard-to-tackle problems that we’ve met hurdles in using traditional methods, 3D printing may embark on even more interesting developments. Moving forward, we intend on looking deeper into how 3D printing will be able to leverage the capabilities it has already achieved at this early stage of its developmental cycle, to change how EVs are made, how energy is generated, stored and distributed, and how our global supply chains can be managed more intelligently. Sustainability is yet another important challenge or potential opportunity for greater innovation using additive: in creating greener materials, reducing manufacturing waste, and exploring new ways to manufacture a more sustainable world. We will continue to zero in on these themes as well as identify companies that are currently being overlooked or underestimated in this field to analyse the sustainability of their technological edge and how they plan on achieving the potential that we see 3D printing holding.

Parting Thoughts

Recently, I have been reflecting on the purpose of the Club once again, but more deeply about what we might do differently here than elsewhere this time round. There are several things that some organizations may do that we don’t.

For one, we’re not specifically grooming young people for the investing profession. While many of the members have aspirations to do so, and we do provide plentiful opportunities to connect with professional investors and even land jobs in the industry, we ultimately see investing as a tool to empower young people in their journey to think more critically about their world, themselves and their futures. Given that professional investors face a very different set of rules from us makes it all the more important that everyone should understand what kind of investor they are and what kind of investing they would like to pursue. What we share, however, is that regardless of whether we become professional investors, once we start we become investors for life.

We’re also not a get-rich-quick course. As mentioned in the beginning of this memo, the chaos of the past year has also proven that short-term performance of many managers can be a very bad measure of their quality. We want to drive high returns, but making a lot of money in a very short period of time will never be the incentive that will keep us motivated on the day-to-day. Our knowledge in the long-term fundamentals-driven investing that we try to compound over time, and what we learn along the way are perhaps the things that is harder to achieve quickly yet the more rewarding benefit of doing what we do.

Having had the chance to speak to more mentors of the Club in Singapore, I’ve gained some wonderful insight into the professional realm of investing, and just how different its incentives and requirements can be from the freedoms we enjoy running our Club fund. Our funds are secured through donations and sponsorships, from generous people who believe in the cause of teaching college students how to invest, as well as our commitment to working hard so we can really pick up as much as we can. We are able to deploy capital not worrying about whether the NTM performance is going to lead to a withdrawal of funds, and this gives us the freedom to learn from the process of investing for the long-term. And that’s what we will try our best to do.

Writing this letter to you every quarter is also an incredibly fun and rewarding experience for me, because I get to reflect so much on markets and how our philosophy should direct our research and analysis. Before I end off, I’d like to wish every member of our community another year of seizing opportunities, overcoming obstacles and honing your craft, in investing and in life, and I look forward to writing to you again very soon.

With Best Wishes,

Rebecca Yang

on behalf of the Value Investing Program’s International Chapter Team