Dear Sponsors, Board of Advisors and Members,

I write this letter to you in the midst of a sweltering summer here in Beijing, which despite the unbearable heat, has had a surprising number of days with beautiful blue skies like the one here.

Still, 2022 has been far from smooth-sailing. The Russia-Ukraine conflict rages on while we continue to live with Covid-19. Interest rate hikes and a pessimistic economic outlook continue to cast uncertainty over markets. For our generation this is the first time we’ve reckoned with what slowing economies and tightening monetary policies mean for financial markets. We came on for the ride at the very start of the pandemic, and we remain in our front-row seats, day-by-day experiencing just how powerful macro forces may be. Buying equities now is probably the best way for us to learn how idiosyncratic risk from our selection of companies stands against systemic risk in the new era we now live in.

The perpetual comparison we make between value and price has taken on some interesting conditions as a result. The decline in the market that we’ve seen so far this year has made us ponder whether equities have already discounted an eventual economic slowdown. Looking forward, further discounting may occur for two reasons. Bond yields don’t typically peak until the Fed’s last rate hike is imminent, so P/E stand to fall further. Time lag in the economy’s reaction to higher rates also point to further impact on earnings. Understanding the business cycle will be very useful for us when deciding on what to look at and how we formulate an investment strategy around it.

On the macro front, as opposed to only moving forward we will be paying close attention to whether tightening monetary policies around the globe are able to lower inflation over the next two to three months. In the meantime, as we see more companies reporting their second quarter earnings, we will adjust our views of how well-positioned companies are to grow moving forward based on what we hear on calls and see on reports.

We’ve also recognized the importance of laying solid foundations in how we form our teams. Making it clear to everyone on the team how we make decisions, handle impasses and disagreements, and outlining a general working style can help to save time and help everyone work better together. At the same time, as a student-run club, maintaining transparency and accountability to supporters outside our internal team is crucial.

Establishing a systematic investment process to force us to think through our investment ideas more carefully. Recording it all down can help to serve not only as a way to account for the decisions we’ve made, but also help us avoid repeating the same investment mistakes. Formalizing a list of questions that must be covered for every idea can help us obtain interesting new information and insights. To help us stay objective and adopt more balanced view of our investments, we also aim to incorporate a practice of looking into a company before the analyst is scheduled to deliver his/her analysis, to come up with a list of more customized questions that must challenge the analyst aggressively. We believe this will help to make our investment committee meetings not only more exciting but also lead to a lot more meaningful and necessary discussion.

This quarter, Xinhui from Team Spring initiated coverage on Mercado Libre (NASDAQ: MELI), the largest online commerce and payments ecosystem in Latin America, a region with a population of over 650 million people and one of the fastest-growing Internet penetration rates in the world.

Our thesis is that the continued expansion of their logistics network, advertisement revenues and a maintained Take Rate power will drive MELI’s marketplace top & bottom line.

We also believe that greater services offerings such as insurance, investment products and credit offerings like Buy Now, Pay Later (BNPL), coupled with strong growth in user base & GMV, will also drive Meli’s Fintech top & bottom line. Based on our initial analysis, we arrived at a 5-year price target of $1,071. Given the current price of $988.18 (as of 18 August 2022), we will be keeping our eyes peeled for the second quarter results released in early August to monitor the position the company is currently in and improve upon our analysis to prepare for a time when the price falls to a range we are comfortable with as we are still very interested in the business.

Xingyu of Team Viva initiated coverage on Chinese domestic service robot company, Ecovacs Robotics. The company is best known for developing in-home robotic appliances. Ecovacs Robotics (SHA: 603486) is at the forefront of innovation in smart home robotics, exploring new ways for robots to transform homeowners’ lives. Its products include Deebot, Winbot, and Airbot, shown below.

The market demand for domestic service robots in China shows a trend of rapid growth, driven by the fast-paced lifestyle brought on by urbanization. This has led to a reduction of the time people spend on housework and has resulted in a large demand for housework robots. According to data from Chinese market research company Guanyan Tianxia, the size of China's home service robot industry increased from 5.57 billion yuan in 2017 to 11.46 billion yuan in 2020. High smartphone penetration has also led development of these domestic robots to use smartphones as a mobile terminal. The smartphones then allow remote control of the AI hardware, resulting in an improved intelligent product experience.

The most prominent and established product type in the realm of domestic service robots would be robot vacuums, popularized by iRobot’s Roomba back in 2002. Cut to the present and we see that the product has taken off tremendously: according to data from GfK, the size of the global market for robot vacuums in 2021 was US $5.3 billion, with a year-on-year increase of 18%, and the development momentum is quite good. Shifting our focus to China, we see that China's robot vacuums has become the largest worldwide after exceeding that of the United States last year to account for 32% of the global market. By the end of 2021, the sales volume of China's robot vacuums nearly tripled from that of 2016. Despite a year-on-year decline in 2020 due to the impact of the pandemic, over the past five years the sector has maintained a grown at 20% on average. Chinese manufacturers such as Ecovacs, Stone Technology, Xiaomi and Midea have entered the mainstream market.

In Ecovac’s case, we believe the high efficiency of R&D capability, high quality and cost-effectiveness products due to full in-house production, and the construction of a one-stop platform for controlling all its in-home electric cleaning appliances confers Ecovacs a strong competitive advantage. Further expansion into the 2B cleaning market, as well as going into the cleaning product business through investing in subsidiaries is likely to drive growth in the coming years. Using the historical P/E multiples for comparable companies like Stone Tech (石头科技), we arrived at a target price of 150 CNY. The stock is currently trading at 90.40 CNY (as of 18 August 2022).

The above sums up the most updated actions that the fund has taken up till this point in time. Please see the past track record of VIP International Portfolio below:

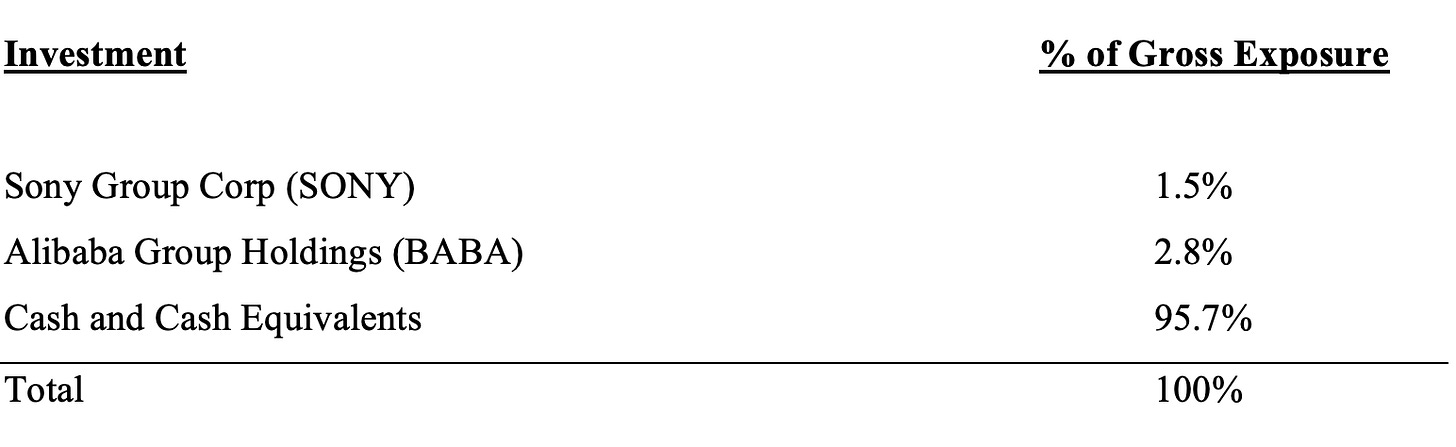

The endowment’s current investments are accounted for in the table below:

We are in the process of reviewing our current positions as well as working together to define a clearer view on the consumer tech sector as well as the other sectors we are looking to expand our coverage on.

Since June we’ve also started our recruitment process, which was one of the most exciting and rewarding periods for me personally as CIO. In every moment that I have spoken and made recruitment decisions on behalf of the members I go back to the principles of what our Club is all about. Most analysts and PMs dream of being able to call the shots one day after rising to the top of their firms or setting up their own shop, but this usually occurs years and years after they’ve learned the ropes and proven themselves consistently over time.

On the other hand, we’re given an astonishing amount of freedom and room to make big decisions very early on in our investor journeys. At the gates of Z Club, we ask only that you come in with an open mind, endless curiosity and passion, and the courage to challenge yourself to be a better investor than you were yesterday. While the burden of professional managers lies in generating significant upside and growing their AUM, our burden is to monitor our own growth and pursue the things that will challenge and train us the most. This is what I believe to be the greater value that Z Club should create. We are given so many opportunities, be it valuable resources, a massive network of investors, funds to deploy and manage that we don’t have to worry will disappear, and a chance to model the operations of a real fund with people who want nothing more than to see us push ourselves and change every day.

One of my favorite quotes from the Green Brothers is one from Hank:

“You might never know what you’re doing. But do me this favor, get out of bed every morning knowing that no one changes the world alone, and no one doesn’t change it at all. We are exceptional, and none of us are, and we are all lost sometimes. So follow a path, any path, until you get to a place that you feel like you don’t like, and then change directions.

Because there is one thing that you are making every day, and that is yourself. That is your job, and you must do it well. ”

So, to current and future members, “Do or do not, there is no try.” Z Club is a wonderful place for testing your boldest most exciting ideas. Most of us are lucky that our wandering has led us to this place, but even within the world of investing don’t be afraid to explore just what kind of investor you wish to become.

Looking ahead, words cannot express how excited we are to keep you updated on how we are growing and what we’ve learnt as we proceed to conduct further research on our watchlist companies, rigorously testing our ideas and reflecting on what we’ve learned during the process. Just as value and capital can compound with time, I believe the knowledge we gain every day also helps us to learn and invest better day by day.

Thank you for your continued support that’s made all of this possible, we look forward to writing to you again in the fall.

With Best Wishes,

Rebecca Yang

on behalf of the Value Investing Program’s International Chapter Team